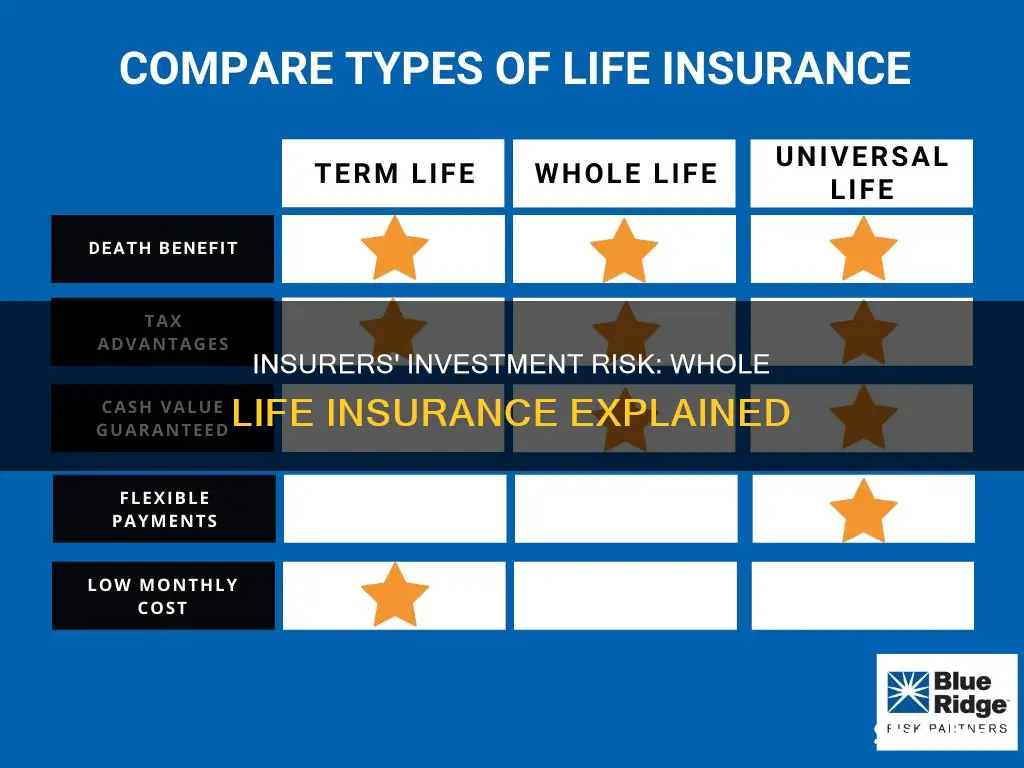

Whole life insurance is a type of permanent life insurance that provides coverage for the entire life of the insured. It is different from term life insurance, which only provides coverage for a specific number of years. Whole life insurance has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. The cash value of a whole life policy typically earns a fixed rate of interest. Whole life insurance is generally a bad investment unless you need permanent life insurance coverage.

| Characteristics | Values |

|---|---|

| Insurer assumes investment risk | Yes |

What You'll Learn

- Whole life insurance is a bad investment unless you need permanent life insurance coverage

- Whole life insurance is a hybrid of insurance and investment

- Whole life insurance is not the best way to invest—traditional investments are

- Whole life insurance is not an investment vehicle

- Whole life insurance is a terrible investment if you don't hold on to it to your death

Whole life insurance is a bad investment unless you need permanent life insurance coverage

Whole life insurance is a type of permanent life insurance that covers you for as long as you live, provided that the premiums are paid. When you pass away, the policy pays out a death benefit to your beneficiary. Whole life insurance also has a cash value component, which is where things can get complex.

Whole life insurance is generally a bad investment unless you need permanent life insurance coverage. It is quite expensive and often takes over a decade to earn reasonable investment returns. Therefore, it is typically only a good consideration if you are relatively young, have a high income, and want to pass money on to your family.

- You've maxed out your retirement accounts: If you've made all the allowable contributions to your tax-advantaged accounts, such as 401(k) plans or individual retirement accounts, you could use a whole life insurance policy to top up your tax-deferred savings.

- You have a lifelong dependent: If you're a parent caring for a child with a disability, whole life insurance can provide lifelong coverage, giving your family financial stability.

- You want to help your family pay estate taxes: Whole life insurance can give your loved ones the money they need to pay estate taxes without dipping into other accounts.

- You want to diversify your investment portfolio: The cash value on whole life insurance grows at a set rate, and the returns are not subject to market volatility.

However, there are several drawbacks to whole life insurance as an investment:

- The premiums are expensive: The cost of whole life insurance is much higher than term life insurance. For example, a healthy 40-year-old man can expect to pay an average annual premium of $7,440 for a $500,000 policy.

- The cash value is slow to grow: It can take 10 to 15 years or longer to build up enough cash value to borrow against.

- The cash value rate of return can be low: The average annual rate of return on the cash value is 1% to 3.5%, and you may earn higher returns with other investments.

- You can't control your portfolio: The insurance company declares the dividend or interest rate and manages the investments for policyholders.

- There can be tax implications if you withdraw cash from your policy: You may have to pay taxes on the amount that exceeds the policy basis.

In summary, whole life insurance is a bad investment unless you need permanent life insurance coverage. It is important to carefully consider your financial goals and circumstances before deciding whether to invest in whole life insurance.

Life Insurance and Grand Mal Seizures: What You Need to Know

You may want to see also

Whole life insurance is a hybrid of insurance and investment

Whole life insurance is a type of permanent life insurance that combines lifelong coverage with an investment component. While the primary purpose of a life insurance policy is to pay out a death benefit to beneficiaries when the insured passes away, whole life insurance also offers a cash value account that accumulates at a fixed rate over time. This makes it a hybrid of insurance and investment.

Here's how it works: when you pay your premium, the insurer invests a portion of it to give your policy a cash value. This cash value grows at a fixed rate that is guaranteed by the insurer. It accumulates on a tax-deferred basis, meaning any interest earned isn't taxed as long as the funds remain in the policy.

The cash value component of whole life insurance offers several benefits:

- Stable and guaranteed returns: The cash value grows at a fixed rate set by the insurer, providing guaranteed returns that aren't subject to market volatility.

- Tax advantages: The tax-deferred nature of the cash value account means you don't pay taxes on the interest earned as long as the funds remain in the policy.

- Access to funds: You can borrow against the cash value or withdraw funds from it. This can be useful for major expenses or to supplement retirement income.

- Dividends: If you purchase whole life insurance from a mutual insurance company, you may receive dividends as the cash value grows, which you can take as cash, use to pay premiums, or purchase additional insurance.

- Estate planning: The cash value component can help your heirs navigate federal estate taxes, ensuring they receive the full value of your assets.

However, there are also some drawbacks to consider:

- High cost: Whole life insurance tends to be much more expensive than term life insurance due to the built-in cash value component.

- Slow growth: In the initial years, a significant portion of your premiums goes towards fees, commissions, and administrative costs, resulting in slow growth of the cash value.

- Low rate of return: The average annual rate of return on the cash value is typically between 1% to 3.5%, which may be lower than what you could earn through other investments.

- Lack of investment control: The insurance company chooses where to invest the cash value portion, so you don't have control over the investment strategy.

- Tax implications on withdrawals: Withdrawing more than your policy basis (the total premiums paid minus any dividends received) may result in income tax liability.

- Reduced death benefit: If you borrow against the policy or make withdrawals, the death benefit paid out to your beneficiaries will be reduced.

In summary, whole life insurance can be a valuable hybrid of insurance and investment for individuals who want lifelong coverage and are comfortable with the trade-off between guaranteed returns and potentially higher returns from other investments. It's important to carefully consider the benefits and drawbacks before deciding if whole life insurance is the right choice for your financial goals and risk tolerance.

Fidelity Life Insurance: Physical Exam Requirements and Details

You may want to see also

Whole life insurance is not the best way to invest—traditional investments are

Whole life insurance is not considered an "investment" vehicle. It is better described as a tax-favoured, strategic allocation of cash flows. The bulk of what you pay in premiums goes toward funding the death benefit, with some of the amount allocated to administrative costs. What’s left goes into your cash value account.

Whole life insurance is not the best way to invest because it is expensive and often takes over a decade to earn reasonable investment returns. It is also inflexible and has low returns. Traditional investments, such as stocks, bonds and real estate, tend to have higher returns.

Diabetes and Life Insurance: Impact and Implications

You may want to see also

Whole life insurance is not an investment vehicle

Whole life insurance is generally a bad investment unless you need permanent life insurance coverage. It is quite expensive and often takes over a decade to earn reasonable investment returns. It is typically only a good consideration if you're relatively young, have a high income, and want to pass money on to your family.

The cost of whole life insurance tends to be much higher than term life insurance. For example, a healthy 40-year-old man can expect to pay an average annual premium of $7,440 for a $500,000 policy, while a woman of the same age might pay $6,512. In comparison, a term life policy for a healthy 40-year-old would cost $334 for a man and $282 for a woman, on average.

The cash value of a whole life insurance policy is quite small during the first 10 to 20 years of coverage due to fees and the cost of coverage. Therefore, whole life insurance is not a good investment if you're older, as you may not live long enough to see good returns. In this case, a guaranteed universal policy would be a better option.

The average annual rate of return on the cash value for whole life insurance is 1% to 3.5%, which is quite low compared to other investments. You may earn higher returns with stocks, bonds, and real estate.

Whole life insurance offers a fixed rate of return on cash value, with no investment choices. It does not provide the potential highs of the stock market and may underperform compared to other investments. If you are looking for a higher rate of return or short-term liquidity, there are better savings and investment options available.

Exercise and Life Insurance: Is There a Catch?

You may want to see also

Whole life insurance is a terrible investment if you don't hold on to it to your death

Whole life insurance is a type of permanent life insurance that can cover you for as long as you live. It combines lifelong coverage with a cash value component. The cash value accumulates at a fixed rate, so you know exactly how much cash value you’ll build over time. Whole life insurance is not a good investment for everyone. It is generally a bad investment unless you need permanent life insurance coverage. It is expensive and often takes over a decade to earn reasonable investment returns. Therefore, it is typically only a good consideration if you're relatively young, have a high income, and want to pass on money to your family.

Whole life insurance is a terrible investment if you don't hold on to it until your death. Since the vast majority of people surrender their policies before death, it is a terrible investment for most people who purchase it. Whole life insurance is a product designed to be sold, not bought.

Civil Service Life Insurance: Cash Value and Benefits Explained

You may want to see also

Frequently asked questions

Yes, the insurer assumes investment risk in whole life insurance. The insurer invests a portion of the premium to give the policy a cash value. The cash value grows over time at a fixed rate guaranteed by the insurer.

Whole life insurance provides coverage throughout the life of the insured person. In addition to paying a tax-free death benefit, whole life insurance also contains a savings component in which cash value may accumulate. Term life insurance, on the other hand, only provides coverage for a certain number of years, rather than a lifetime.

Whole life insurance has a cash savings component, known as the cash value, which the policy owner can draw on or borrow from. The cash value of a whole life policy typically earns a fixed rate of interest. Withdrawals and outstanding loan balances reduce death benefits. Whole life insurance is more expensive than term life insurance.

On average, whole life insurance policies are significantly more expensive than term life insurance. The cost of whole life insurance varies based on several factors, such as age, occupation, and health history.