Having a grand mal seizure can affect your life insurance. Life insurance companies consider the severity and frequency of your seizures when underwriting a client with epilepsy. They will also look at the date of diagnosis, the degree of severity of your condition, treatments received, neurological evaluations, seizure types, and the time since your last seizure. The cost of your life insurance coverage will depend on the type of epilepsy, the type of seizure, and the time since your last seizure. If you have had a seizure in the last 12 months, it will be difficult to get coverage. However, if your last seizure was over two years ago, you may be offered a standard rate by several insurance companies.

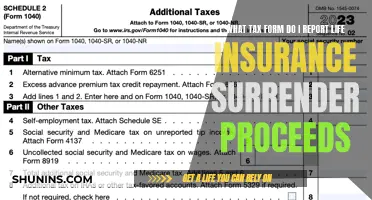

| Characteristics | Values |

|---|---|

| Type of seizure | Generalised tonic-clonic seizures (grand mal) |

| Symptoms | Loss of consciousness, muscle convulsions, body shakes, fall if standing or sitting upright, muscle stiffness, jerky movements, foaming at the mouth, biting the tongue, loss of bowel or bladder control, involuntary shouting or crying out |

| Risk factors | Family history, brain infections, drug use, conditions such as cerebral palsy and autism, sleep deprivation, exposure to flashing lights |

| Complications | Injury, brain damage due to lack of oxygen, Death |

| Diagnosis | Physical examination, checking for signs of seizure such as tongue bites, evaluating medical history, recollection of seizure, neurological evaluation |

| Treatment | Anti-epileptic medications, surgery to remove the part of the brain where seizures originate, stimulation therapy |

| Life insurance | Possible to get life insurance with epilepsy, insurers will consider date of diagnosis, severity, treatments received, neurological evaluations, seizure types, frequency, and time since last seizure |

What You'll Learn

- Tonic-clonic seizures can cause injury and even death

- The time since the last seizure impacts life insurance premiums

- The type of epilepsy and seizure affects the cost of life insurance

- The severity and frequency of seizures are considered by insurance companies

- Improving your health can lower life insurance rates

Tonic-clonic seizures can cause injury and even death

Tonic-clonic seizures, also known as grand mal seizures, are the most recognised type of seizure. They are also the most feared. This is because they can cause injury and, in rare cases, death.

During a tonic-clonic seizure, a person will lose consciousness and fall to the floor. They may bite their tongue or the inside of their cheek, causing blood to appear in their saliva. Their muscles will then begin to jerk rapidly and rhythmically, bending and relaxing at the elbows, hips, and knees. This phase usually lasts a few minutes, after which the person may lose control of their bladder or bowel.

As a result of these convulsions, people can suffer injuries such as broken bones, concussions, and head injuries with bleeding into the brain. They may also experience breathing problems.

If a tonic-clonic seizure lasts longer than five minutes, it is considered a medical emergency, and the person is at risk of permanent injury or death. This is known as status epilepticus. If seizures occur during sleep, the risk of sudden unexpected death in epilepsy (SUDEP) is higher. SUDEP is the most common disease-related cause of death in people with epilepsy, affecting 1 in 1,000 people with the condition. However, despite these risks, it is not common for people to die from seizures.

Esurance Life Insurance: What You Need to Know

You may want to see also

The time since the last seizure impacts life insurance premiums

The time that has passed since the last seizure is a significant factor in determining life insurance premiums. The longer it has been since the last seizure, the better the chances of securing a favourable premium.

Life insurance companies typically consider the time since the last seizure when assessing applications. If the last seizure occurred more than five years ago, applicants may be able to obtain life insurance at standard rates. However, if the seizure was within the last 12 months, obtaining coverage may be difficult.

The type of seizure also plays a role in determining premiums. For instance, if the seizures are myoclonic, Petit Mal, or absence seizures, and the last episode was over two years ago, several insurance companies will offer standard rates. On the other hand, if the seizures are more severe and recent (within two years), applicants may qualify for a higher premium, such as a standard table two or table four rating. Each increase in the table rating typically results in a 25% hike in the insurance premium.

The impact of the time since the last seizure on life insurance premiums is influenced by the overall management and control of epilepsy. Demonstrating effective seizure control and adhering to treatment plans can improve the chances of securing more favourable rates. Additionally, lifestyle changes, such as weight loss, regular exercise, and stress management, can positively impact overall health and, consequently, life insurance premiums.

Drug Use and Life Insurance: What's the Connection?

You may want to see also

The type of epilepsy and seizure affects the cost of life insurance

The cost of life insurance for people with epilepsy is determined by several factors, including the type of epilepsy and the nature and frequency of seizures. While it may be more challenging to obtain life insurance with epilepsy, it is not impossible, and there are still plenty of affordable options available.

Type of epilepsy

The type of epilepsy an individual has plays a role in the underwriting process for life insurance. Epilepsy can be classified into three main categories: symptomatic, cryptogenic, and idiopathic. Symptomatic epilepsy is when there is clear evidence of something in the brain causing the condition, such as a scar or damage from an injury. Cryptogenic epilepsy is when there are signs that something might be causing the epilepsy, but the cause is not obvious. Idiopathic epilepsy, on the other hand, has no clear or obvious cause.

Nature of seizures

The nature of seizures also impacts the cost of life insurance. Seizures can range from Petit Mal (or absence seizures) to Grand Mal (or tonic-clonic seizures), myoclonic, atonic, simple partial, complex partial, febrile, reflex, or nocturnal seizures. The specific type of seizure an individual experiences will be considered by insurance underwriters when determining coverage and pricing.

Frequency and timing of seizures

In addition to the type of epilepsy and seizures, the frequency and timing of seizures are crucial factors in the life insurance underwriting process. The likelihood of obtaining coverage and the cost of premiums are influenced by how recently the seizures occurred, with longer periods since the last seizure resulting in more favourable rates. If the last seizure occurred over five years ago, individuals may be able to obtain coverage at standard rates. However, if the seizures are more recent (within the last two years), the premium may increase by 25% for each increase in the rating table.

Managing epilepsy and seizures

Individuals with epilepsy can improve their chances of obtaining life insurance and securing more favourable rates by effectively managing their condition. This includes working closely with healthcare providers, adhering to prescribed treatment plans, and making lifestyle changes to achieve better seizure control. Maintaining a healthy weight, exercising regularly, managing stress, and quitting smoking can all positively impact overall health and, subsequently, life insurance rates.

Shopping around

It is essential to compare quotes from different insurance companies, as each company may view applications differently. Working with independent insurance agents who represent multiple companies can increase the chances of finding the most competitive rates.

Life Insurance and Long-Term Disability: What's the Deal?

You may want to see also

The severity and frequency of seizures are considered by insurance companies

When applying for life insurance, it is important to be upfront about your health history, particularly when it comes to epilepsy. Insurance companies will want to know the specifics of your condition, including the type of seizures you experience, the frequency and duration of your seizures, and the time elapsed since your last seizure. This information helps them assess the risk associated with insuring you.

The severity and frequency of seizures are crucial factors in this evaluation process. Insurance companies are primarily concerned about accidents that may occur as a direct consequence of a seizure. For instance, a person may fall and hurt themselves or suffer a head injury during a seizure. The likelihood of such incidents increases with more severe and frequent seizures.

If you have tonic-clonic seizures (formerly known as grand mal seizures), insurance providers will consider this information carefully. Tonic-clonic seizures are characterised by a sudden loss of consciousness, followed by muscle convulsions that cause the body to shake. Due to the intense physical nature of these seizures, insurance companies will take them into account when determining your premiums.

The time elapsed since your last seizure also plays a significant role in the insurance company's decision-making process. Generally, the longer it has been since your last seizure, the better your chances of obtaining life insurance at a standard rate. If your last seizure occurred more than five years ago, you may have a good chance of securing a favourable rate. However, if your seizures are more recent (within the last two years or less), your premiums are likely to increase.

It's important to note that the impact of seizure severity and frequency on your life insurance options is not just about the type of seizures but also how well-controlled they are. If you can demonstrate effective seizure management and a commitment to your treatment plan, you may be able to access more affordable insurance options.

Globe Life Insurance: Understanding the Waiting Periods

You may want to see also

Improving your health can lower life insurance rates

A grand mal seizure, also known as a tonic-clonic seizure, is a severe type of epileptic seizure that can cause a sudden loss of consciousness, convulsions, and loss of bladder control. While death from epilepsy is rare, the likelihood of dying from a seizure is higher for people who have a history of frequent, uncontrollable seizures, including grand mal seizures.

If you have epilepsy or have experienced a grand mal seizure, it is important to know that you can still obtain life insurance. However, your health will be a significant factor in determining the cost of your coverage. Here are some ways that improving your health can lower your life insurance rates:

- Time since the last seizure: The more time that has passed since your last seizure, the better. If it has been over five years since your last seizure, you may be able to obtain coverage at a standard price. On the other hand, if your last seizure was within the last year, it will be more difficult and expensive to get covered.

- Frequency and severity of seizures: The fewer and less severe your seizures are, the lower your insurance rates are likely to be. This is because the risk of sudden death is higher for individuals with a history of frequent and severe seizures.

- Age of onset: The risk of sudden death is also higher for individuals whose seizures began at a young age. Therefore, if your seizures started later in life, you may be able to obtain lower insurance rates.

- Duration of epilepsy: The longer you have had epilepsy, the higher the chance of sudden death, and the higher your insurance rates are likely to be.

- Compliance with treatment: Taking your anti-seizure medication as directed and seeing a doctor if your current therapy isn't effective can help prevent seizures and improve your health. This may result in lower insurance rates.

- Identifying triggers: Keeping a seizure diary to identify patterns or situations that bring on seizures can help you avoid triggers and reduce the number of seizures. This may also have a positive impact on your insurance rates.

- Lifestyle choices: Dangerous hobbies and activities, such as extreme sports, may result in higher insurance rates. Therefore, avoiding such activities and making healthier lifestyle choices can help lower your rates.

- Overall health: Your overall health, including your age, gender, personal and family health history, and tobacco, alcohol, and drug use, can all impact your insurance rates. Improving your health in these areas can help lower your rates.

By focusing on these aspects of your health, you may be able to improve your insurance rates and overall well-being. It is important to remember that the cost of life insurance is influenced by various factors, and it is always a good idea to shop around and consult with an independent insurance broker or advisor to find the best coverage for your needs.

Credit Life Insurance: Cash Value or Not?

You may want to see also

Frequently asked questions

Insurance companies will consider factors such as the date of diagnosis, the severity of your condition, treatments received, neurological evaluations, seizure types, seizure frequency, and the time since your last seizure. They will also look at your general health, including your blood pressure, heart rate, weight, and blood and urine test results.

The more time that has passed since your last seizure, the better. If you have had a seizure in the last 12 months, it will be difficult to get cover. If your last seizure was over two years ago, you are more likely to get a standard rate. If your seizures are more recent (two years or less), you may qualify for a standard table two or table four rating, which is 25% more expensive.

If you are experiencing myoclonic, Petit Mal, or absence seizures and your last seizure was over two years ago, several insurance companies will offer you a standard rate. With other types of seizures, it depends on how controlled they are.

Manage your epilepsy effectively through medical care, adhere to treatment plans, achieve better seizure control, adopt a healthier lifestyle, and quit smoking. Also, seek quotes from different insurers and work with independent agents.