John Hancock is a longstanding company that has been in the business of providing life insurance for over 160 years. The company offers both term and permanent life insurance policies, with optional Vitality programs that incentivize healthy lifestyle choices. John Hancock's life insurance policies are available to individuals up to 80 or 90 years of age, depending on the type of policy. The company's commitment to helping customers live longer, healthier, and better lives sets it apart, and it has a range of products designed to add value for its customers.

| Characteristics | Values |

|---|---|

| Company Name | John Hancock |

| Founded | Over 160 years ago |

| Mission | Helping customers live longer, healthier, better lives |

| Product | Life Insurance |

| Product Type | Term and Permanent Life Insurance |

| Term Life Insurance Age Limit | 18-80 years |

| Permanent Life Insurance Age Limit | 3 months - 90 years |

| Coverage Limits | Up to $65 million |

| Optional Program | Vitality |

| Whole Life Insurance | Not available |

| Availability | Varies by state |

| Contact | 888-955-5432 |

What You'll Learn

John Hancock's life insurance policy options

John Hancock offers a range of life insurance policy options to cater to different needs. Their life insurance policies can be broadly categorized into two types: term life insurance and permanent life insurance.

Term Life Insurance

Term life insurance provides financial protection for a specific period, such as 10, 15, 20, or 30 years. This type of policy helps protect your loved ones and meet their immediate and long-term financial needs in the event of your death. The cost of term life insurance depends on various factors, including the insured's age, health status, and the amount and duration of coverage.

Permanent Life Insurance

Permanent life insurance offers lifetime coverage and can provide peace of mind at every stage of life. This type of policy can grow with you and your family, offering support even for future generations. Permanent life insurance has the potential to build cash value over time, which can be used to supplement retirement income, cover emergencies, or fund other expenses such as college tuition.

John Hancock Vitality Program

Both term and permanent life insurance policies offered by John Hancock come with the option to participate in the John Hancock Vitality Program. This program rewards policyholders for adopting healthy habits and making healthy choices. There are two versions of the program:

- Vitality GO: This program is available exclusively to John Hancock life insurance customers and is free of charge. It rewards you for everyday healthy activities, such as walking, buying healthy food, or getting a health check-up. Vitality GO offers discounts to select retailers, such as REI® and Fitbit®, as well as access to fitness and nutrition tips from industry experts.

- John Hancock Aspire: This program is specifically designed for customers living with type 1 or type 2 diabetes. It offers day-to-day diabetes support, virtual consultations with diabetes experts, personalized health coaching, and complimentary diabetes testing devices and supplies.

Types of Permanent Life Insurance

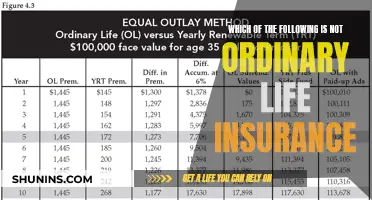

John Hancock offers three types of permanent life insurance policies, each providing different levels of flexibility and cash value growth potential:

- Universal Life Insurance: This policy allows you to customize the timing and amount of your premium payments. It offers lifetime protection and the potential for cash value accumulation. You have the flexibility to adjust the amount and frequency of premium payments and withdraw or borrow cash from your policy.

- Indexed Universal Life Insurance: Similar to Universal Life Insurance, this policy offers premium payment flexibility and lifetime coverage. However, it provides more opportunities for cash value growth by earning interest based on a linked indexed account.

- Variable Universal Life Insurance: This policy provides the highest potential for cash value growth by allowing you to choose from a range of investment options with different risk categories. The cash value of the policy may fluctuate depending on the market performance of the selected investments.

John Hancock has been in the business of helping people protect what matters most for over 160 years. Their life insurance policies are designed to add real value throughout the life of the policy, and they are committed to helping their customers live longer, healthier, and better lives.

Life Insurance: Pinnacle's Offerings Make Sense?

You may want to see also

The cost of John Hancock's life insurance

John Hancock offers both term and permanent life insurance options. The cost of life insurance depends on a variety of factors, including age, health status, and the amount and duration of coverage.

The company's term policies offer coverage ranging from $250,000 to $30 million, and you can select a term of 10, 15, 20, or 30 years. The permanent policies are available to applicants as young as three months old, up to 90 years of age, and offer coverage ranging from $50,000 to $65 million.

- For a 35-year-old female: $71.76

- For a 45-year-old female: $137.16

- For a 55-year-old female: $298.56

- For a 65-year-old female: $852.66

- For a 65-year-old male: $1,219.56

It's important to note that these rates are for illustrative purposes only and that actual rates may vary based on individual circumstances. John Hancock also offers optional Vitality programs that provide access to savings and discounts for healthy lifestyles. These programs may impact the overall cost of the policy.

Additionally, some riders may have additional fees and expenses associated with them, such as the accelerated benefit rider and the critical illness benefit rider.

To get a more accurate quote that is tailored to your specific needs and circumstances, it is recommended to speak with an insurance professional or licensed agent.

Life Insurance in Europe: What You Need to Know

You may want to see also

John Hancock's life insurance policy restrictions

John Hancock offers both term and permanent life insurance policies. Permanent life insurance offers coverage for the entire life of the insured, while term life insurance provides coverage for a specific period, such as 10, 15, 20, or 30 years.

The John Hancock Vitality Program is available with both term and permanent policies. This program rewards policyholders for making healthy choices, such as exercising, buying healthy food, and getting adequate sleep. Rewards include complimentary or discounted wearable fitness devices, savings at the grocery store, and travel and retail discounts. The Vitality Program is not available in New York or Puerto Rico.

John Hancock also offers a program called Aspire, which is designed for people living with type 1 or type 2 diabetes. Aspire provides day-to-day diabetes support, virtual consultations with diabetes experts, personalized health coaching, and complimentary diabetes testing devices and supplies. Aspire is not available in New York, Idaho, and Puerto Rico.

The cost of John Hancock's life insurance policies is based on factors such as the insured's age, health status, the amount of coverage, and the duration of coverage. Policyholders can also borrow cash from their policy, but they must repay the funds to avoid a decrease in the cash value and final payout.

John Hancock's life insurance policies have exclusions and limitations, and policyholders must meet certain requirements to keep their policy in force. Specific policy features may vary by product and are subject to underwriting approval.

Life Insurance and Taxes: What's the Connection?

You may want to see also

John Hancock's life insurance riders

John Hancock offers a range of life insurance riders, which are optional benefits that can be added to a life insurance policy for an additional cost. Here is a detailed overview of some of John Hancock's life insurance riders:

- Accelerated Benefit Rider for Terminal Illness: This rider allows individuals diagnosed with a terminal illness to access a portion of their death benefit while they are still alive. The rider provides financial resources to help cover medical expenses or other needs. The specific terms and conditions of this rider may vary, but it typically allows for the acceleration of up to 50% or 100% of the death benefit, depending on the policy.

- Disability Benefit Rider: This rider provides financial protection in the event of the policyholder becoming disabled. To be eligible for benefits, the policy must be in force, include an active disability benefit rider, and the policyholder must have been disabled for at least six consecutive months. The eligibility requirements may vary based on the specific disability rider included in the policy.

- Long-Term Care Rider: John Hancock offers a Long-Term Care Rider that provides benefits to help cover the costs of long-term care. This rider can be a valuable addition to a life insurance policy, especially for individuals concerned about the potential need for long-term care in the future.

- Vitality Rider: John Hancock's Vitality Rider is a unique program that rewards policyholders for maintaining a healthy lifestyle. It offers two versions: Vitality GO and Vitality PLUS. Vitality GO is included at no additional cost and provides rewards for healthy choices, such as discounts on wearable fitness devices, savings at the grocery store, and travel and retail discounts. Vitality PLUS offers additional benefits, such as the option to choose a complimentary or discounted fitness device, access to exclusive rewards, and premium savings. The level of premium savings varies based on the policy type, terms, and the policyholder's Vitality Status.

- Aspire Rider: This rider is specifically designed for individuals living with type 1 or type 2 diabetes. It offers financial protection and personalized support, including virtual consultations with diabetes experts, personalized health coaching, and complimentary diabetes testing devices and supplies. The benefits available under Aspire may vary depending on the type of diabetes, the coverage amount, and the level of engagement with the John Hancock Vitality Program.

It is important to note that some of these riders may have additional fees and expenses associated with them. Policyholders should carefully review the terms and conditions of their John Hancock life insurance policy to understand the specific riders available to them and any associated costs.

Life Coaching: Can You Claim It on Insurance?

You may want to see also

John Hancock's life insurance claims process

John Hancock offers a variety of life insurance products and services, including term and permanent life insurance policies. They also have a program called John Hancock Vitality that rewards customers for making healthy choices, such as going for a walk or getting a health check-up. This program is available exclusively to John Hancock life insurance customers and offers rewards and discounts from various companies.

When it comes to the life insurance claims process, John Hancock has a dedicated life insurance claims centre on its website, which provides all the necessary forms to initiate the claims process and access benefits. Here is a step-by-step guide to the John Hancock life insurance claims process:

- Report the Death: The first step is to report the passing of your loved one. This can be done online or by calling John Hancock at 888-887-2739. You may also qualify for their paperless express claims process, which has certain eligibility requirements, including a death benefit amount of less than $100,000 per beneficiary and the beneficiary being an individual residing in the US.

- Complete the Claim Form: If you haven't already completed the claim form during the online death report, you will need to visit the forms section on the website and search for 'claim'. Select the appropriate claim package for your state, complete the form, and mail it to John Hancock. Additional supporting documents may be required, so be sure to review the claim package for a list of applicable requirements.

- Receive Benefit Proceeds: The death benefit will be disbursed via check, Safe Access Account (not available for policies issued in New York), or electronic funds transfer (EFT) for policies issued after December 31, 2004. The disbursement will include interest.

For other types of claims, such as accelerated death benefit claims, disability benefit claims, or long-term care rider claims, John Hancock provides step-by-step guides on their website. Additionally, they offer a variety of contact options, including phone numbers and mailing addresses, to reach out to their customer service team for further assistance.

Globe Insurance: Term Life Insurance Options and Availability

You may want to see also

Frequently asked questions

Yes, John Hancock sells both term and permanent life insurance policies.

John Hancock offers term life insurance policies to individuals up to 80 years of age and permanent life insurance policies to individuals up to 90 years of age. The permanent life insurance policies include universal, variable universal, and indexed universal life insurance.

The coverage limits for John Hancock's life insurance policies range from $250,000 to $65 million.

Yes, John Hancock offers the Vitality Program, which rewards members for healthy choices and activities such as exercising, buying healthy food, and getting adequate sleep. The program includes savings, discounts, and other benefits.

You can fill out an online form or call John Hancock directly at 888-955-5432 to get a quote for life insurance.