Life insurance is a complex topic, with many different types of policies available to consumers. Whole life insurance, for example, offers permanent coverage and builds cash value over time, but requires premium payments for the duration of the policyholder's life. In contrast, limited payment whole life policies offer the same permanent coverage but allow policyholders to pay premiums over a shorter period, such as 20 or 25 years. Modified and graded premium whole life policies are also available, offering lower premiums in the early years and appealing to younger consumers. Single premium whole life policies are another option, requiring a single premium payment, usually for a specified number of years, after which the policyholder is covered for life.

Characteristics of non-ordinary life insurance

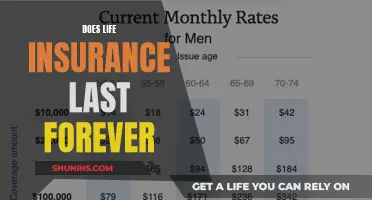

| Characteristics | Values |

|---|---|

| Type | Whole life insurance, Limited payment life insurance, Modified endowment contract, Single premium converge, 10-pay whole life insurance, Participating whole life insurance, Interest-sensitive coverage, Indexed whole life insurance |

| Premium options | Level, Single, Limited payment, Modified, Variable, Flexible |

| Premium period | Limited period of time, e.g. 20 or 25 years, 10 years |

| Taxation | Withdrawals or loans before age 59 1/2 may result in substantial tax penalties |

| Dividends | Dividends may be paid out and can be applied to premiums, taken as cash, or added to a cash value account |

| Cash value | Funds cannot be forfeited and the policy owner is entitled to them; builds tax-deferred savings |

| Coverage | Does not expire; lasts until age 100 or 120 |

| Suitability | Consumers who want guarantees of whole life insurance and lower premiums in the early years, younger people starting their careers, those who want to pay within a finite period |

What You'll Learn

Limited payment whole life policies

The main advantage of limited payment whole life policies is that they offer the security of whole life coverage without the lifetime payment commitment. This can be especially beneficial during retirement, as income is no longer tied up in insurance payments. Additionally, the cash value of the policy can grow faster due to the shorter payment timeframe. The cash value grows tax-deferred and can be borrowed against or withdrawn under certain conditions.

However, it's important to note that the premiums for limited payment whole life policies are typically higher than those for traditional whole life policies. This is because the payments are condensed into a fixed timeframe. The higher premium payments may strain potential policyholders financially, making it challenging to afford the coverage. Therefore, it is crucial to carefully assess one's financial situation before choosing this type of policy.

Life Insurance: Decreasing Coverage, Increasing Peace of Mind

You may want to see also

Premium options

Whole life insurance is a popular choice for individuals who want a policy that will cover them for their entire lives. It offers a range of assurances, which may appeal to someone who wants to avoid any uncertainty after purchasing life insurance. Whole life insurance policies can come with either fixed or variable premiums. The former offers predictability and stability, while the latter offers the potential for higher returns but with greater risk, depending on the performance of underlying investments.

Fixed Premiums

Fixed premiums are the most common type of whole life insurance premium. The policyholder pays a constant amount during the course of the insurance when the premiums are set. As a result, premium payments are stable and predictable. Whole life insurance provides peace of mind for loved ones by guaranteeing a death benefit to dependents upon the insured's demise. Additionally, as cash value builds up over time, policyholders can access funds or even borrow against the insurance as needed.

Variable Premiums

Variable premiums may be ideal for younger people who are just beginning their careers and who expect their incomes to increase in the future. With variable premiums, the policyowner pays a lower fixed rate for a specified number of years (such as the first 5 or 10) and then pays a higher rate later on. This type of premium is based on current interest assumptions and offers flexibility.

Single Premium

Single premium whole life insurance requires the policyholder to pay a single large lump sum payment upfront, instead of ongoing monthly or yearly premiums. Once the premium is paid, the policy and the cash value are funded for the rest of the policyholder's life with a guaranteed death benefit. There is also the potential for the cash value to grow at a set interest rate over time, which the policyholder may be able to withdraw from or borrow against. However, doing so may impact the death benefit.

Limited Payment Plans

Limited payment whole life policies appeal to customers who want permanent coverage but wish to pay for it within a finite period of time (not their entire life). A policy with a ten-year premium period would be called a ten-pay life policy. One that requires premiums to be paid until the policyholder reaches 65 would be called a life-paid-up-at-65 policy. Premiums for limited payment life insurance policies are higher and payable for a shorter time than ordinary life premiums.

Prudential Life Insurance: A Historical Overview of Its Longevity

You may want to see also

Single premium converge

Single premium life insurance is a type of permanent insurance policy that provides guaranteed lifetime coverage and cash value growth. Unlike traditional life insurance policies, which require ongoing monthly, quarterly, or yearly premium payments, single premium life insurance is funded with a one-time, upfront lump-sum payment. This means that the policyholder's beneficiaries will receive a guaranteed death benefit.

Single premium life insurance offers a strategic approach that allows the policyholder to build cash value quickly, which can be accessed through policy loans or withdrawals, offering a financial resource during their lifetime. This type of insurance is particularly useful for those looking to maximize their investment quickly and is often favored by high-net-worth individuals for its accumulation benefits. While the initial payment can be substantial, no further financial commitment is needed to maintain the policy, which eliminates the need to budget for future premiums.

Single premium life insurance is often viewed as a straightforward option compared to traditional life insurance. However, it can also be more complex in certain ways. For example, the high upfront cost and modified endowment contract (MEC) classification can result in potential tax implications on withdrawals, making it less suitable for those without substantial funds. Additionally, the cash value in a single premium variable life insurance policy can fluctuate based on the performance of chosen investments, introducing the possibility of losses.

Single premium life insurance provides immediate coverage and a guaranteed death benefit. It is important to consider both the perks and potential drawbacks of this type of insurance before committing to such a substantial upfront investment. The suitability of single premium life insurance depends on the individual's needs and current financial situation.

Life Insurance Cash Redemptions: Michigan's Tax Implications Explained

You may want to see also

Interest-sensitive coverage

Interest-sensitive whole life insurance, also known as current assumption whole life insurance, is a type of permanent life insurance policy that offers a blend of guaranteed death benefits and a cash value component that can grow based on current interest rates. Interest sensitivity applies to a range of life insurance options, with all universal life insurance policies being interest-sensitive, while only some whole life policies offer interest-sensitive features.

Interest-sensitive whole life insurance policies are generally more expensive than term life insurance policies, with the cost depending on various factors, including age, health, coverage amount, gender, and lifestyle factors. For example, women may pay slightly lower premiums than men due to their longer average life expectancies, and younger, healthier individuals can expect lower premiums. Lifestyle factors such as smoking, alcohol consumption, and high-risk activities can also impact the cost of premiums.

One of the key benefits of interest-sensitive whole life insurance is its flexibility. Policyholders can change indexing options and have flexible premium payments, unlike traditional whole life insurance, which has fixed premiums. The cash value component of interest-sensitive policies acts as a tax-deferred savings account, growing over time due to the tax advantage. Additionally, the insurance company periodically re-evaluates factors like interest rates and mortality costs to determine premiums and cash value growth, allowing for potential significant growth.

However, interest-sensitive policies also carry greater risks than traditional whole life policies. If interest rates fall, the policyholder may be asked to pay additional premiums to make up for the lower cash value growth. It is important for policyholders to regularly review their policies and make adjustments to their financial plans when market conditions change.

Variable Life Insurance: Death Benefit Guaranteed?

You may want to see also

Whole life insurance

There are different types of whole life insurance policies, including limited payment, modified and graded premium, and single premium. Limited payment whole life insurance policies provide coverage for the insured's entire life but have premiums that are paid for a limited period, such as 20 or 25 years. Modified and graded premium whole life policies have lower premiums in the early years, making them ideal for younger people who are just starting their careers and expect their incomes to increase. Single premium policies have a lower total premium as the premium is stretched over several or many years.

Life Insurance: Maturing and Your Benefits

You may want to see also