Whole life and group life insurance are two types of life insurance policies that provide financial protection and peace of mind to individuals and their loved ones. Whole life insurance is a permanent policy that offers lifelong coverage, with a guaranteed death benefit and a fixed premium. It also includes an investment component, allowing policyholders to build cash value over time. On the other hand, group life insurance is a type of coverage offered through an employer or organization, providing coverage to a group of people at a lower cost compared to individual policies. Both options offer financial security, ensuring that beneficiaries receive a payout in the event of the insured's death, making them valuable tools for risk management and financial planning.

What You'll Learn

- Definition: Whole life and group life insurance are long-term coverage options offering guaranteed death benefits

- Key Differences: These policies differ in cost, flexibility, and investment components

- Benefits: They provide financial security for beneficiaries and potential investment growth

- Eligibility: Group life insurance is typically offered through employers, while whole life is purchased individually

- Cost Factors: Premiums are influenced by age, health, and coverage amount

Definition: Whole life and group life insurance are long-term coverage options offering guaranteed death benefits

Whole life and group life insurance are two distinct but related forms of long-term coverage that provide financial security for individuals and their beneficiaries. These insurance policies are designed to offer peace of mind and financial protection for the insured's loved ones in the event of their passing.

Whole Life Insurance: This type of insurance is a permanent coverage option, meaning it remains in force for the entire life of the insured individual. It provides a guaranteed death benefit, which is a fixed amount of money that the insurance company will pay out to the policyholder's designated beneficiaries upon the insured's death. The key feature of whole life insurance is that the death benefit is guaranteed, meaning it will be paid out regardless of the insured's age or health at the time of death. This makes it a reliable and secure financial tool for long-term planning. Premiums for whole life insurance are typically higher compared to other life insurance types due to the guaranteed benefit and the policy's permanent nature. Over time, the policy also accumulates cash value, which can be borrowed against or withdrawn, providing additional financial flexibility.

Group Life Insurance: Group life insurance is a coverage option offered by employers or associations to their members or employees. It provides a death benefit to the designated beneficiaries of the insured individual, typically at a lower cost compared to individual whole life insurance. Group policies often have a simpler application process and may not require extensive medical exams, making it more accessible to a broader population. The death benefit in group life insurance is also guaranteed, ensuring financial support for the insured's family during their time of need. This type of insurance is particularly valuable for employees, as it provides an additional layer of financial security without the need for extensive individual research and application.

Both whole life and group life insurance serve as essential tools for individuals and families to plan for the future and ensure financial stability. The guaranteed death benefit is a critical aspect of these policies, offering a sense of security and peace of mind, knowing that loved ones will be financially protected even in the event of the insured's passing. Understanding the differences and benefits of these insurance types can help individuals make informed decisions about their long-term financial planning and risk management.

Lemonade Life Insurance: What You Need to Know

You may want to see also

Key Differences: These policies differ in cost, flexibility, and investment components

Whole life and group life insurance are two distinct types of insurance policies that offer financial protection and peace of mind to individuals and their beneficiaries. While both provide coverage in the event of the insured's death, they differ significantly in their structure, benefits, and overall approach to insurance.

Cost and Affordability: One of the most notable differences lies in their cost structures. Whole life insurance is a permanent policy with a fixed premium that remains constant throughout the insured's lifetime. This predictability in pricing makes it easier for individuals to plan and budget for their insurance needs. The premium is typically higher compared to group life insurance, which is often provided as a benefit by employers. Group life insurance policies are usually more affordable because the risk is shared among a large group, and the cost is typically lower per person. This makes it an attractive option for employees who want coverage without the financial burden of an individual policy.

Flexibility and Customization: In terms of flexibility, whole life insurance shines. It offers a wide range of customization options, allowing policyholders to tailor the policy to their specific needs. This includes the ability to choose the death benefit amount, which can be increased or decreased over time, providing flexibility as your financial situation changes. Additionally, whole life insurance policies often include an investment component, where a portion of the premium is invested in various financial instruments, offering the potential for long-term growth. On the other hand, group life insurance policies may have limited customization options, as they are standardized and designed to cater to a broad range of individuals. The terms and conditions might be less flexible, providing less control over the policy's specifics.

Investment Components: Both types of insurance can incorporate investment elements, but the approach differs. Whole life insurance policies often include an investment account, where a portion of the premium is invested in a separate account. This investment component can grow tax-deferred, providing a potential source of cash value that can be borrowed against or withdrawn. Over time, the cash value can accumulate, offering a financial asset. Group life insurance, while it may also have some investment features, typically focuses more on providing pure death benefit coverage. The investment aspect is usually secondary, and the primary goal is to offer affordable insurance to a group of people.

In summary, the key differences between whole life and group life insurance lie in their cost structures, flexibility, and investment components. Whole life insurance provides a more personalized and comprehensive solution with higher premiums and customizable features, while group life insurance is more affordable and often provided as a group benefit, offering a basic level of coverage with less customization. Understanding these distinctions is essential for individuals to make informed decisions when choosing the right insurance policy for their circumstances.

Life Insurance Proceeds: Can Creditors Garnish Your Money?

You may want to see also

Benefits: They provide financial security for beneficiaries and potential investment growth

Whole life insurance is a long-term financial product that offers a range of benefits, primarily providing financial security for the policyholder's beneficiaries. This type of insurance is a permanent policy, meaning it remains in force for the entire life of the insured individual, hence the name. One of the key advantages is the guaranteed death benefit, which is a fixed amount paid out to the beneficiaries upon the insured's passing. This financial safety net ensures that the family or designated recipients of the policyholder are financially protected during difficult times, such as when the primary earner is no longer able to provide income.

The financial security aspect is further enhanced by the accumulation of cash value over time. As premiums are paid, a portion of the money goes into building this cash value, which grows tax-deferred. This feature allows the policy to accumulate a substantial amount of money, which can be borrowed against or withdrawn, providing financial flexibility. For instance, policyholders can take out loans against the cash value to fund major purchases or investments, knowing that the loan is secured by the policy's value.

Group life insurance, on the other hand, is a type of coverage offered by employers to their employees. It provides a convenient and often more affordable way to obtain life insurance. The primary benefit here is the group discount, which can significantly reduce the cost of premiums compared to individual policies. This makes it an attractive option for employees, especially those who may not otherwise be able to afford comprehensive coverage.

Both whole life and group life insurance offer the potential for investment growth. The cash value accumulation in whole life policies can be invested, and the earnings can be used to enhance the policy's value. This investment component allows policyholders to potentially grow their money over time, providing an additional financial benefit. In group life insurance, the funds collected from premiums can be invested, and the earnings can be used to provide additional benefits to the group, such as improved coverage or additional features for the employees.

In summary, whole life and group life insurance provide a robust financial safety net for beneficiaries and offer the potential for investment growth. These policies ensure that financial obligations are met and provide a means to build wealth over time, making them valuable tools for long-term financial planning and security. Understanding the benefits and features of these insurance products can help individuals and employers make informed decisions about their insurance needs.

Understanding Life Events: Impact on Health Insurance Coverage

You may want to see also

Eligibility: Group life insurance is typically offered through employers, while whole life is purchased individually

Group life insurance and whole life insurance are two distinct types of coverage with different eligibility criteria and benefits. Understanding these differences is crucial for individuals to make informed decisions about their insurance needs.

Group Life Insurance:

Group life insurance is a type of coverage that is offered as a benefit to employees by their employers. It provides financial protection to the employee's family in the event of their death. This type of insurance is often included as part of an employee's benefits package and is typically more affordable due to the group discount. Employers may offer varying levels of coverage, and the premium is usually deducted from the employee's paycheck, making it convenient and cost-effective. Group life insurance is an excellent option for individuals who want coverage without the hassle of individual purchasing and who benefit from the employer's negotiated rates.

Eligibility and Accessibility:

One of the key advantages of group life insurance is its accessibility. Since it is offered through employers, it is readily available to employees. This type of insurance is often a standard benefit in many companies, making it a convenient choice for workers. The employer's role in providing this coverage simplifies the process for employees, as they don't need to go through the complexities of individual insurance purchases. Additionally, group life insurance policies may offer higher coverage amounts compared to individual policies, providing more comprehensive protection.

Whole Life Insurance:

In contrast, whole life insurance is a permanent life insurance policy that individuals purchase individually. It provides coverage for the entire lifetime of the insured, hence the name "whole life." Policyholders pay a fixed premium over time, and the insurance company guarantees a death benefit to the policyholder's beneficiaries. Whole life insurance offers a range of features, including a cash value component that grows over time, providing a source of funds that can be borrowed against or withdrawn. This type of insurance is more expensive compared to term life insurance but offers long-term financial security.

Individual Purchase:

Whole life insurance is purchased directly by individuals, often through independent insurance agents or brokers. This means that the insured has full control over the policy and can customize it to their specific needs. The eligibility criteria for whole life insurance may vary, but generally, it is available to individuals of all ages and health conditions. However, the older the applicant, the higher the premium, and the more comprehensive the coverage is likely to be. This type of insurance is ideal for those who want a long-term financial safety net and are willing to invest in a more expensive but comprehensive policy.

In summary, group life insurance is typically a benefit offered by employers, making it accessible and affordable for employees. On the other hand, whole life insurance is an individual purchase, allowing policyholders to tailor the coverage to their needs. Understanding these eligibility and accessibility differences is essential for individuals to choose the right insurance coverage based on their personal circumstances and financial goals.

Superannuation: Life Insurance Coverage and Your Options

You may want to see also

Cost Factors: Premiums are influenced by age, health, and coverage amount

When considering life insurance, understanding the cost factors is crucial, especially when it comes to the premium you pay. The premium is the amount you pay regularly (usually monthly) to maintain your insurance policy. Several key elements influence the cost of your life insurance premium, and these are primarily age, health, and the coverage amount you choose.

Age is a significant determinant of the premium. Younger individuals typically pay lower premiums compared to older adults. This is because younger people are generally considered less risky to insure. As you age, your risk of developing health issues increases, which can lead to higher premiums. Additionally, older individuals may have accumulated more financial responsibilities, such as raising a family or paying off a mortgage, which can also impact the perceived risk and, consequently, the premium.

Health plays a critical role in determining the cost of your life insurance. Insurers assess your health through medical exams, health questionnaires, and sometimes even dental and vision exams. If you have a history of chronic illnesses, such as diabetes or heart disease, or if you smoke, drink heavily, or have a sedentary lifestyle, your premiums will likely be higher. This is because these factors increase the likelihood of you making a claim, and thus, the insurance company's risk.

The coverage amount you choose also directly affects the premium. The higher the death benefit (the amount paid out upon your death), the higher the premium. This is because a larger coverage amount means a more significant financial loss for the insurance company if you were to pass away. Therefore, when selecting your coverage, it's essential to consider your financial goals and the needs of your beneficiaries. Striking a balance between adequate coverage and affordable premiums is key.

In summary, the cost of life insurance premiums is influenced by a combination of age, health, and the coverage amount. Younger individuals and those in good health generally pay lower premiums, while older individuals with health issues may face higher costs. Additionally, choosing a higher coverage amount will result in a more expensive premium. Understanding these factors can help you make informed decisions when selecting a life insurance policy that suits your needs and budget.

Term Life Insurance Expiry: What's Next?

You may want to see also

Frequently asked questions

Whole life insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a combination of death benefit, savings component, and investment options. The premiums for whole life insurance are typically higher than term life insurance but offer guaranteed death benefits and cash value accumulation over time.

Group life insurance is a type of life insurance policy offered to a group of people, such as employees of a company or members of an organization. It provides coverage to the entire group, and the premiums are usually paid by the employer or the organization. Group life insurance policies often have lower premiums compared to individual policies due to the larger group size, and they may offer additional benefits like accidental death coverage.

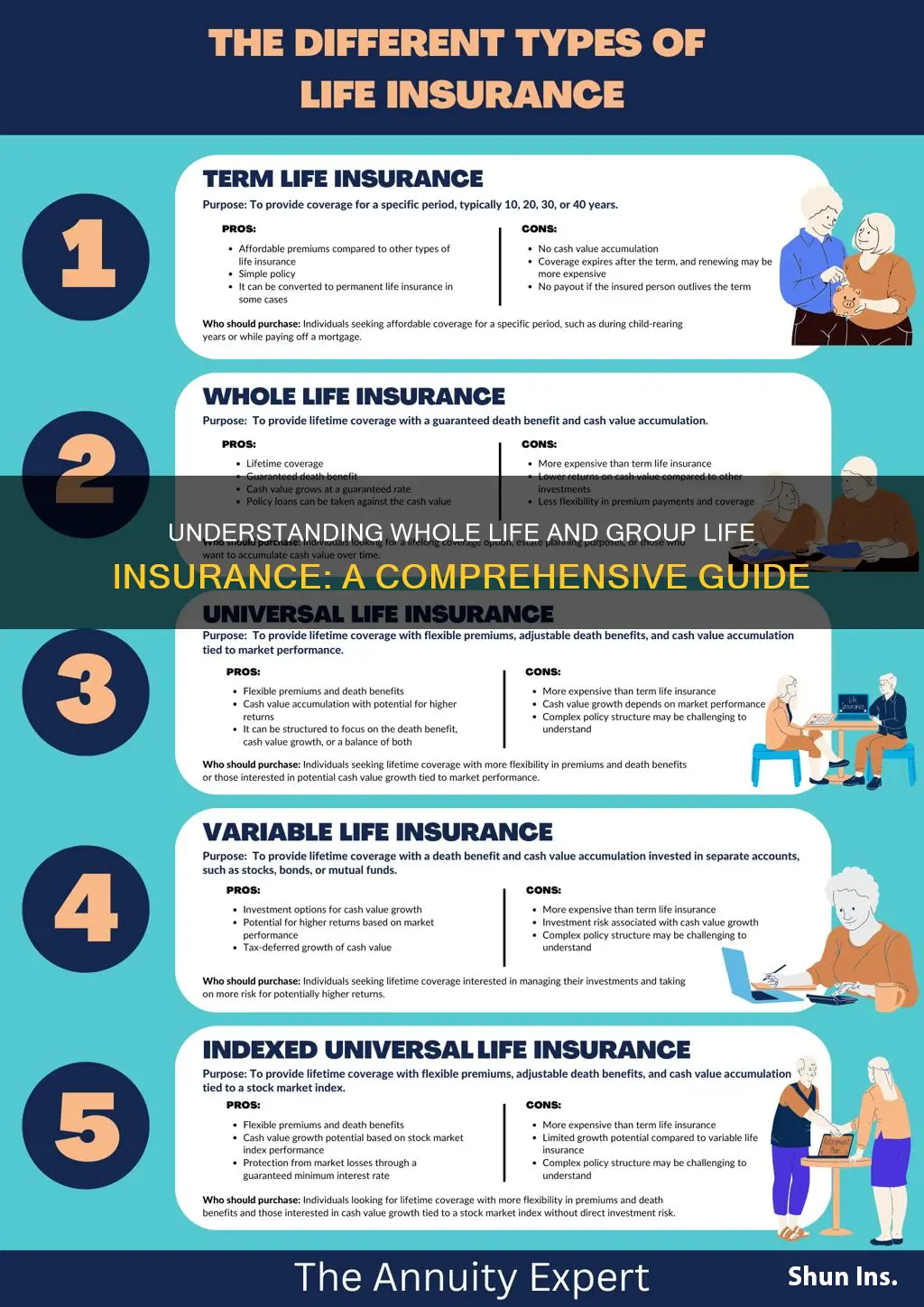

The main difference lies in the duration of coverage. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, while whole life insurance offers coverage for the entire lifetime of the insured. Term life is generally more affordable, but it doesn't accumulate cash value. Whole life, on the other hand, provides lifelong coverage and a savings component, making it a more comprehensive option.

Yes, it is possible to convert a term life insurance policy to a whole life policy. This process is known as conversion. It allows policyholders to switch from a temporary coverage to a permanent one. However, the conversion process may vary, and certain conditions and fees might apply. It's best to review the policy terms and consult with an insurance advisor for guidance.

Group life insurance offers several advantages. Firstly, it provides affordable coverage to a large group, making it cost-effective for both the employer and employees. Secondly, group policies often have simplified underwriting processes, which can result in quicker approval and easier eligibility. Additionally, group life insurance may offer additional benefits, such as dependent coverage, accidental death riders, and potential tax advantages.