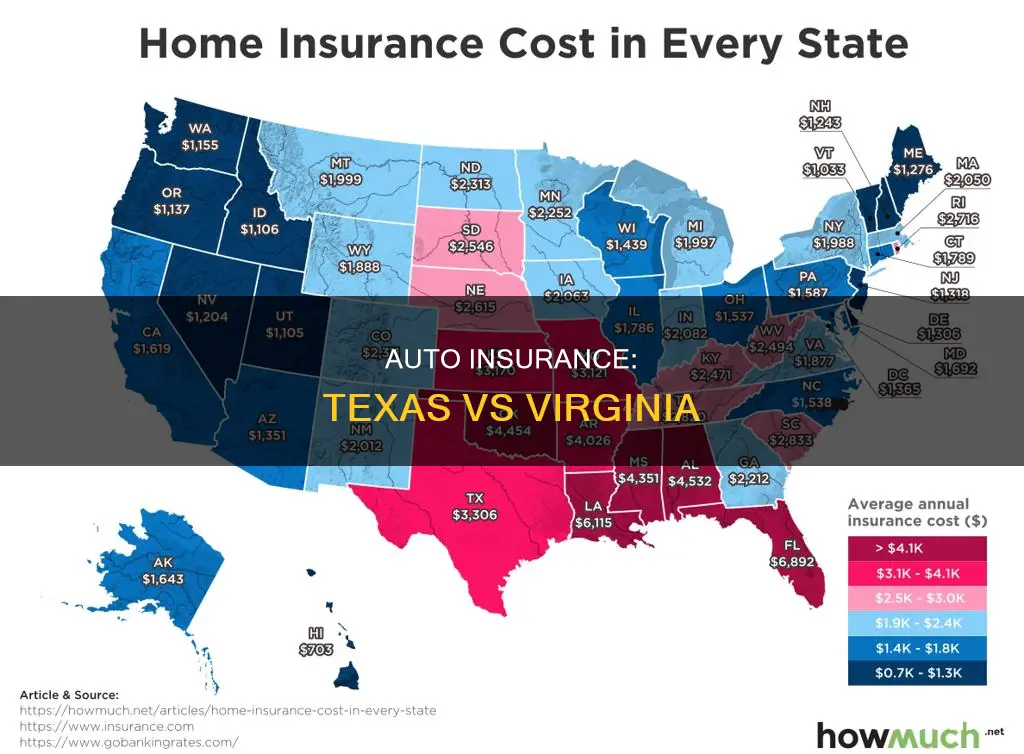

Texas and Virginia have some of the most expensive car insurance rates in the US. The average cost of a full-coverage policy in Texas is $153 per month, while in Virginia, it is $136 per month. However, the rates vary depending on factors such as age, gender, location, and driving history. Texas Farm Bureau offers the cheapest car insurance in Texas, with an average annual rate of $1,268 for full coverage. On the other hand, the cheapest car insurance company in Virginia is Erie Insurance, with an average annual rate of $873 for full coverage.

| Characteristics | Values |

|---|---|

| Cheapest car insurance in Texas | Texas Farm Bureau |

| Average cost of car insurance in Texas | $153 per month for full coverage |

| Average cost of car insurance in Texas | $48 per month for minimum-liability policy |

| Cheapest car insurance in Texas for teens | Texas Farm Bureau |

| Cheapest car insurance in Texas for young drivers | Redpoint County Mutual |

| Cheapest car insurance in Texas for seniors | Texas Farm Bureau |

| Cheapest car insurance in Texas for high-risk drivers | State Farm |

| Cheapest car insurance in Texas for drivers with a speeding ticket | Texas Farm Bureau |

| Cheapest car insurance in Texas for drivers with a recent accident | Redpoint County Mutual |

| Cheapest car insurance in Texas for drivers with a DUI | Redpoint County Mutual |

| Cheapest car insurance in Texas for drivers with poor credit | Redpoint County Mutual |

What You'll Learn

- Texas Farm Bureau has the cheapest car insurance in Texas

- Texas Farm Bureau offers the cheapest rate in Texas, at $33 per month for minimum-liability coverage

- Texas Farm Bureau has the cheapest full-coverage car insurance in the state, at $119 per month

- Texas Farm Bureau has the cheapest rates for teens and those aged 21 to 25

- Texas Farm Bureau has the cheapest rates for drivers with a speeding ticket

Texas Farm Bureau has the cheapest car insurance in Texas

Texas Farm Bureau has the cheapest car insurance rates in Texas, according to multiple sources. Its average annual rate of $863 is roughly half the statewide average cost of car insurance, $1,716 per year, and more than $100 per year less expensive than the next-cheapest option.

Texas Farm Bureau's rates are especially competitive for married 35-year-old drivers. Female adult drivers pay, on average, $754 per year for a Texas Farm Bureau policy, compared to a statewide average cost of $1,555. The insurer's sample rate for male drivers in this category is slightly higher, $794 per year, compared to a statewide average cost of $1,623.

However, Texas Farm Bureau's rates are higher than the statewide average for drivers who have a speeding ticket on their record. Additionally, purchasing an insurance policy from the organization requires paying an annual membership fee of $50.

Texas Farm Bureau's auto insurance policy offerings are fairly standard, with a limited number of add-on features, which are also offered by most other insurers. The company has a strong customer service reputation and is worth considering if you're looking for cheap car insurance in Texas.

Vehicle Teardown: Pre-Insurance Inspection Essential?

You may want to see also

Texas Farm Bureau offers the cheapest rate in Texas, at $33 per month for minimum-liability coverage

Texas Farm Bureau offers the cheapest car insurance in Texas, with rates for minimum-liability coverage as low as $33 per month. This rate is 42% cheaper than the average cost of minimum coverage in Texas. The average cost of car insurance in Texas is $48 per month for a minimum-liability policy and $153 per month for a full-coverage policy.

Texas Farm Bureau's low rates are especially beneficial for young drivers, who typically pay far more for car insurance than older, more experienced drivers. An 18-year-old in Texas pays nearly triple what a 30-year-old does for a minimum-coverage policy. Texas Farm Bureau offers the best rates for Texas teens, with a minimum-coverage policy costing $64 per month and full coverage costing $143 per month.

Texas Farm Bureau also has competitive rates for drivers with a speeding ticket or accident on their record. For drivers with a speeding ticket, Texas Farm Bureau charges $86 per month for full coverage, which is much cheaper than average. For drivers who have caused an accident, State Farm is the cheapest option at $124 per month, followed by Texas Farm Bureau at $142 per month.

Texas Farm Bureau's rates are also favourable for drivers with a DUI conviction or who require an SR-22. Full coverage from Texas Farm Bureau costs $166 per month, which is 29% cheaper than the state average.

In addition to its low rates, Texas Farm Bureau has a strong customer service reputation. In J.D. Power's 2023 Insurance Study, Texas Farm Bureau ranked third in Texas for overall customer satisfaction, scoring eight points above the state average.

However, Texas Farm Bureau's auto insurance policies are only available to residents of Texas. Additionally, the company does not offer online quotes, making it difficult for customers to get a quick price estimate and compare it to other insurers.

Insurance Glitch: Vehicle Registration Woes

You may want to see also

Texas Farm Bureau has the cheapest full-coverage car insurance in the state, at $119 per month

Texas Farm Bureau offers the cheapest full-coverage car insurance in the state, at $119 per month. This is a highly competitive rate, with the average cost of full-coverage insurance in Texas being $3,156 per year, or $263 per month. Texas Farm Bureau's rate is also significantly cheaper than the national average, which is 18% higher.

The company also offers the cheapest minimum-liability coverage in Texas, at $40 per month, or $483 per year. This is 42% cheaper than the average cost of minimum coverage in Texas.

Texas Farm Bureau's insurance rates are available to all Texas residents, and are especially affordable for young drivers, seniors, and those with speeding tickets. For example, a minimum-coverage policy for a 16-year-old costs $64 per month, and full coverage costs $143 per month. For 65-year-olds, the average rate is $1,200 per year, and for 75-year-olds, it's $1,270. Texas Farm Bureau also has some of the lowest rates for high-risk drivers, including those with speeding tickets, recent accidents, or poor credit.

Texas Farm Bureau's full-coverage insurance includes standard features, such as bodily injury and property damage liability coverage, collision and comprehensive coverage, medical payments coverage, and personal injury protection. There are also some unique add-ons, such as Mexico coverage, which allows policyholders to drive across the border into Mexico and still be covered.

While Texas Farm Bureau's auto insurance rates are highly competitive, its homeowners insurance rates are even more affordable, with policies that are 52% to 36% cheaper than average, depending on the coverage level. However, it's worth noting that Texas Farm Bureau's auto insurance policies are not available online, and there is an additional annual membership fee of $50.

Vehicle Insurance Accounting in Tally

You may want to see also

Texas Farm Bureau has the cheapest rates for teens and those aged 21 to 25

Texas Farm Bureau offers the cheapest car insurance rates in Texas for teens and those aged 21 to 25. The company's average annual rate of $863 is roughly half the statewide average cost of car insurance, which is $1,716 per year.

For 17-year-old female drivers, Farmers has the cheapest sample rates in Texas, with an average annual rate of $2,569 compared to the statewide average of $4,541. For 17-year-old males, USAA has the most affordable rates, at $3,147 per year.

For 25-year-old drivers, USAA has the cheapest average annual rates in Texas for both female and male young adults: $1,045 and $1,078, respectively. For young adult drivers who don't qualify for USAA membership, Progressive and Allstate offer the cheapest average rates. Progressive's average annual rate for female young adults is $1,127, while Allstate's rate for male drivers is $1,277.

Texas Farm Bureau also offers the cheapest rates for 35-year-old drivers in the state. Its sample rates of $754 for adult females and $794 for adult males are significantly lower than the statewide averages in those categories.

In addition to its competitive rates, Texas Farm Bureau provides a range of benefits to its members, including discounts on products and services. The company has a strong presence in Texas, with over 850 local agents, 300 claims personnel, and 300 offices across the state. It also offers a full line of auto insurance coverage, from minimum liability to full coverage policies, with add-ons such as rental reimbursement, roadside assistance, and ridesharing coverage.

Texas Farm Bureau's auto insurance products are only available in Texas, and the company requires an annual membership fee that varies depending on the customer's residence. Despite this, Texas Farm Bureau's affordable rates, local presence, and comprehensive coverage options make it a compelling choice for teens and young adults in the state.

Splitting Vehicle Insurance for Taxes

You may want to see also

Texas Farm Bureau has the cheapest rates for drivers with a speeding ticket

Texas auto insurance rates are generally cheaper than Virginia's. The average cost of car insurance in Texas is $1,716 per year, while in Virginia, it is $1,846 per year.

Texas Farm Bureau has the cheapest car insurance rates in Texas, according to multiple sources. The company offers rates that are roughly half the statewide average cost of car insurance in Texas.

For drivers with a speeding ticket, Texas Farm Bureau also offers the cheapest full-coverage rates, charging $86 per month, which is much cheaper than average. The average auto insurance rates in Texas go up by 12% for a driver with a speeding ticket. However, some companies, like State Farm or Texas Farm Bureau, may not increase rates for drivers with a clean record who have a single speeding ticket.

Texas Farm Bureau's average annual rate for drivers with a speeding ticket is $1,662, while USAA, the second cheapest option, offers an average rate of $1,998.

Switching Auto Insurance: Mid-Policy Changes

You may want to see also

Frequently asked questions

The average cost of car insurance in Texas is $1,716 per year, or $143 per month.

The average cost of car insurance in Virginia is $1,543 per year, or $129 per month.

Yes, auto insurance rates in Texas are cheaper than in Virginia.

The cheapest car insurance companies in Texas are Texas Farm Bureau, State Farm, Geico, Redpoint County Mutual, and USAA.

The cheapest car insurance companies in Virginia are Erie Insurance, Geico, State Farm, USAA, and Nationwide.