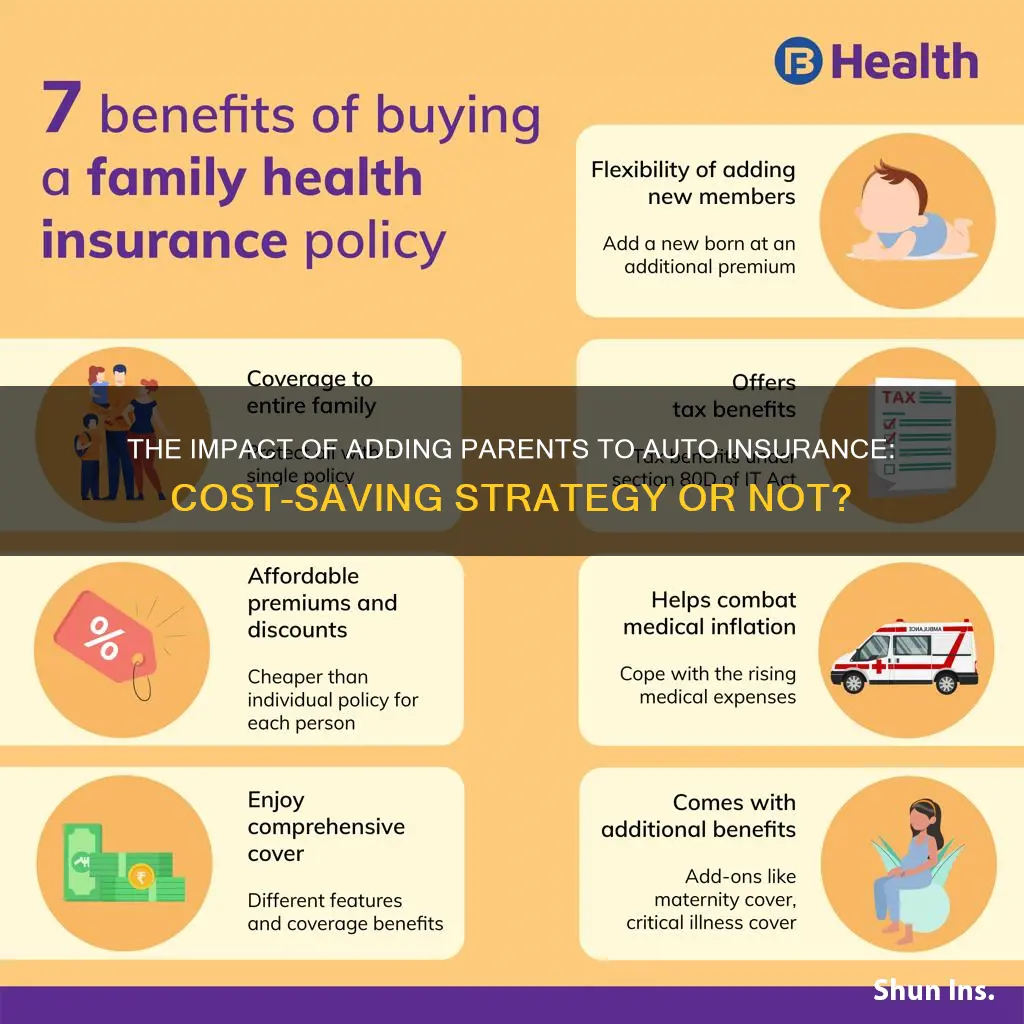

Adding parents to your auto insurance can be beneficial in many ways. Firstly, it can result in lower premiums for the parents, especially if they are older and have a good driving record. Insurance companies often offer discounts for experienced and safe drivers, which can lead to significant savings. Additionally, having multiple cars insured under one policy can lead to a multi-car discount, further reducing costs.

Another advantage is simplified policy management. With all family members on one policy, it becomes easier to make changes, pay bills, and keep track of insurance-related documentation. This can save time and effort, especially when compared to managing multiple individual policies.

It's important to note that adding parents as drivers can increase the overall cost of insurance, especially if they are considered high-risk drivers due to age or driving history. In such cases, it may be more cost-effective for the parents to have their own separate policy or explore alternative insurance options.

Ultimately, the decision to add parents to auto insurance depends on various factors, including the number of cars, the driving history of all involved parties, and the specific insurance company's policies. It's recommended to shop around, compare rates, and consider the pros and cons before making a decision.

| Characteristics | Values |

|---|---|

| Cost of adding a child to insurance | On average, adding your child to your car insurance costs $2,718 each year. |

| Cost of a child having their own insurance | If your child got their own policy, it would cost an average annual premium of $5,108. |

| Cheapest car insurance providers for family insurance | Nationwide, GEICO |

| Cost increase of family insurance with a child | 47% |

| Cost of insurance with a teen driver | $3,775 |

| Average percentage increase of insurance with a teen driver | 161% |

| Discounts | Good student discounts, distant student discounts, teen driving programs, driver's education courses, loyalty discounts, bundling discounts, multiple vehicle discounts, safe driving discounts, student away discounts, limited-use discounts, loyalty discounts, multi-car discounts, driver training discounts, monitoring program discounts, family plan discounts |

| Pros of adding a child to insurance | Lower premiums for your child, qualifying for new discounts, simplified policy management |

| Cons of adding a child to insurance | Premium spikes, rate risks, bigger claim possibilities, coverage constraints |

What You'll Learn

Adding a child to your car insurance policy

When to Add Your Child

You should add your child to your car insurance policy when they pass their driving test. However, it is advisable to notify your insurer when your child gets their learner's permit. This way, you can avoid any gaps between your child passing their test and being able to drive your vehicle legally.

Legal Obligation

If your teen driver lives under your roof and will be driving a vehicle registered to you or someone in your household, they must have insurance. Insurance providers require you to list all licensed drivers residing in your home on your auto insurance policy. Driving uninsured is illegal in most states and has legal ramifications for anyone who is caught.

Pros and Cons

Pros:

- Cheaper than standalone coverage: Adding your child to your car insurance costs less than them taking out a standalone policy. Some insurers may not even cover young drivers on their own policy, so adding them to yours may be the only choice.

- Convenience: It’s more convenient to add your child to your policy than for them to take out their own.

- Discounts: Most insurers offer multiple discounts that can help decrease the cost of insuring a teen driver. For example, your insurer might offer a discount if your student maintains a good GPA or completes a driver's ed program.

Cons:

- Increased rates: Adding your child to your car insurance can increase your car insurance premiums exponentially. If your teen cannot cover the costs, you will have to pay for them yourself.

- Liability: If your child causes an accident while driving, you could be held liable, and your insurance rates will likely increase.

Insurance Coverage for Your Teen

At the very least, your teen driver should have the minimum amount of insurance coverage required by your state. Most U.S. states require drivers to carry liability coverage. Therefore, your teen will need to have at least the minimum amount of liability coverage that’s required by law in your state. However, it’s a good idea to cover your teen above the minimum requirements if you can afford to.

How to Add Your Teen to Your Policy

Step 1: Call your insurer

Contact your insurance company to let them know that your child is in the process of getting their license. Even if they only have a permit, notifying your insurer will help decrease the likelihood of a coverage gap.

Step 2: Get a quote

Ask your insurer for a quote to see how much it will cost to add your child to your auto insurance policy. Make sure the quote is for coverage with high liability limits.

Step 3: Shop around

Get quotes from several other insurers to compare premiums and coverage to determine which option works best for your budget and coverage requirements.

Step 4: Add your teen to your policy

Once your child passes their driving test, immediately contact your insurer and add them to your policy. Remember to ask if you qualify for any discounts that can help reduce your insurance costs.

Step 5: Re-shop annually

Compare rate quotes from several insurance providers each year when it’s time to renew your policy. This can help keep your costs as low as possible while maintaining adequate coverage for you and your teen.

There is no one answer to the question of when your child should get their own car insurance policy, and the age will differ for each family. If your child lives with you and drives your vehicle, keeping them on your policy is advisable. However, once they move out, get married, or have children, it’s likely time for them to take on their own insurance policy.

Mature Motoring: Understanding the Drop in Auto Insurance Rates After 55

You may want to see also

Pros and cons of adding your child to your car insurance

There are several pros and cons to adding your child to your car insurance.

Pros

- Cost efficiency: Adding a child to your car insurance policy is usually more cost-effective than them getting their own policy. Young drivers tend to face higher rates.

- Multi-car bonuses: If your child has a car, you might be able to get a multi-car discount, softening the premium hike.

- Steady coverage: Keeping your child continuously covered establishes their insurance history, setting them up for better rates in the future.

- Simplified management: Grouping family members under one policy makes payments, renewals, and claims easier to deal with.

- Extra discounts: You can explore further reductions like good student rates, driver's ed savings, or young driver safety programs.

Cons

- Premium spikes: Adding a child to your policy can cause your premiums to increase significantly. If your teen can’t cover the costs, you will have to pay for them yourself.

- Rate risks: If your child is involved in an accident or violation, the entire policy's rates might soar.

- Bigger claim possibilities: Young, less experienced drivers are more likely to get into accidents, which could lead to substantial claims that could impact your future premiums or policy status.

- Coverage constraints: Your child's driving patterns could restrict your coverage choices, possibly pushing you towards pricier options.

Auto Insurance: Single or Married Filing?

You may want to see also

When to add your child to your car insurance policy

As a parent, you may be eager or anxious about your child getting their driver's license and the responsibilities that come with it, including insurance. Here's a guide on when to add your child to your car insurance policy:

When to Add Them

You should add your child to your car insurance policy when they get their driver's license. However, it is advisable to notify your insurer when your child gets their learner's permit. This ensures the insurance company is aware that you'll be adding your child to the policy soon, helping you avoid any gaps in coverage.

Legal Requirements

In most cases, adding your child to your car insurance is a legal requirement. If your child has a driver's license, lives in your household, and drives a car registered to your home, they must be added to your policy. Insurance providers typically require listing all licensed drivers residing in your home on your auto insurance policy. Driving without insurance is illegal in most states and can lead to legal ramifications.

Benefits of Adding Your Child

Adding your child to your policy is usually more cost-effective than them getting their own policy. It is also more convenient, as you won't need to go through the process of excluding them from coverage. Additionally, your child can benefit from various discounts offered by insurers, such as good student discounts or discounts for completing driver's education programs.

Costs and Drawbacks

Adding your child to your policy will likely result in increased insurance premiums. The exact increase will depend on various factors, including the insurance company's rating practices and your child's driving history. Another drawback is the potential liability you incur if your child causes an accident.

When to Remove Them

There is no definitive age or timeframe for when your child should get their own policy. As long as they live with you and drive your vehicle, it is generally advisable to keep them on your policy. However, if your child moves out, gets married, has children, or becomes financially independent, it may be time for them to have their own insurance.

Auto Insurance: Game of Life Costs

You may want to see also

When should your child get their own car insurance policy?

There is no one-size-fits-all answer to the question of when your child should get their own car insurance policy. It depends on several factors, including the child's driving record, maturity, financial situation, and the parents' plans for their financial future. However, there are some key indicators that it might be time for your child to take on their own car insurance policy:

- If your child moves out, especially if they have their own car, it's likely time for them to have their own policy.

- If your child gets married or has children, it's probably better for them to take out their own policy, even if they still live with you.

- If your child purchases and titles their own car, they will need their own insurance policy.

- If your child moves to a different state with lower insurance premiums, it may make sense for them to get their own policy.

- If your child has a full-time job and can afford their own insurance, they may be ready to take on their own policy.

- If your child has multiple traffic violations, a license suspension, or a DUI, your insurance company may require you to exclude them from your policy, and they will need to get their own.

It's important to note that there is no age limit for how long a child can stay on their parents' car insurance policy. However, insurance rates typically decrease significantly once a driver turns 25, as they are no longer considered high-risk. Therefore, if your child is under 25 and has a clean driving record, it may be more cost-effective for them to stay on your policy.

Additionally, if your child is a full-time student, they may be eligible for discounts that can make staying on your policy more affordable. Ultimately, the decision of when your child should get their own car insurance policy depends on a combination of factors, and it may be helpful to consult an insurance agent to determine the best option for your family.

Vehicle Impound: No Insurance, Now What?

You may want to see also

How to add your child to your car insurance policy

Adding a child to your car insurance is a requirement in most cases. If your child has a driver's license, lives in your household, and drives a car registered to your home, they will need to be added to your car insurance policy. This is true even if they are over the age of 18. Here is a step-by-step guide on how to add your child to your car insurance policy:

Step 1: Notify Your Insurer

Contact your insurance company to inform them that your child is in the process of getting their driver's license. Even if your child only has a learner's permit, it is advisable to notify your insurer. This helps to ensure there are no gaps in coverage when your child passes their driving test.

Step 2: Get a Quote

Request a quote from your current insurer to understand the potential cost of adding your child to your policy. Ensure that the quote includes coverage with high liability limits.

Step 3: Shop Around

Obtain quotes from multiple insurers to compare premiums and coverage options. This will help you determine the most suitable option for your budget and coverage requirements.

Step 4: Add Your Child to Your Policy

Once your child obtains their driver's license, immediately contact your chosen insurer and add them to your policy. Don't forget to inquire about any available discounts to help reduce insurance costs.

Step 5: Re-evaluate Annually

Compare rate quotes from different insurance providers annually when it's time to renew your policy. This proactive approach can help you maintain adequate coverage while keeping costs as low as possible.

Important Considerations:

- Timing: It is generally recommended to add your child to your car insurance policy once they obtain their driver's license. However, some insurance companies may require you to list student drivers before they are fully licensed. It is best to inform your insurer when your child is close to getting licensed to ensure uninterrupted coverage.

- Address Changes: If your child moves out and has a different permanent address, you may need to remove them from your policy. However, if they are attending college and using your vehicle regularly, you can keep them on your policy and take advantage of discounted rates for students living away from home.

- Learner's Permit: Teens with learner's permits are often automatically covered under their family's policy while learning to drive, and you typically won't pay higher rates until they obtain their license.

- Excluding Your Child: If your child has a driver's license but doesn't plan on driving, you can formally exclude them from your policy. However, if they drive your vehicle, they will be considered uninsured.

Sisterhood Auto Insurance: Military Discounts

You may want to see also

Frequently asked questions

Yes, in most cases, adding your child to your car insurance is legally required. Children under 18 are too young to sign insurance contracts, so it falls on the parents to ensure teens are covered according to state minimum car insurance requirements.

Adding your parents to your auto insurance can have several benefits, including lower premiums, simplified policy management, and access to discounts. However, there can also be drawbacks, such as increased rates and higher liability if your parents cause an accident.

The cost of adding your parents to your auto insurance will vary depending on several factors, including your location, insurer, and your parents' age. It's recommended to contact your insurer for a quote to determine the exact cost.

There are several ways to save money on auto insurance when adding your parents, such as taking advantage of student discounts, increasing deductibles, bundling policies, and comparing rates from different insurers.