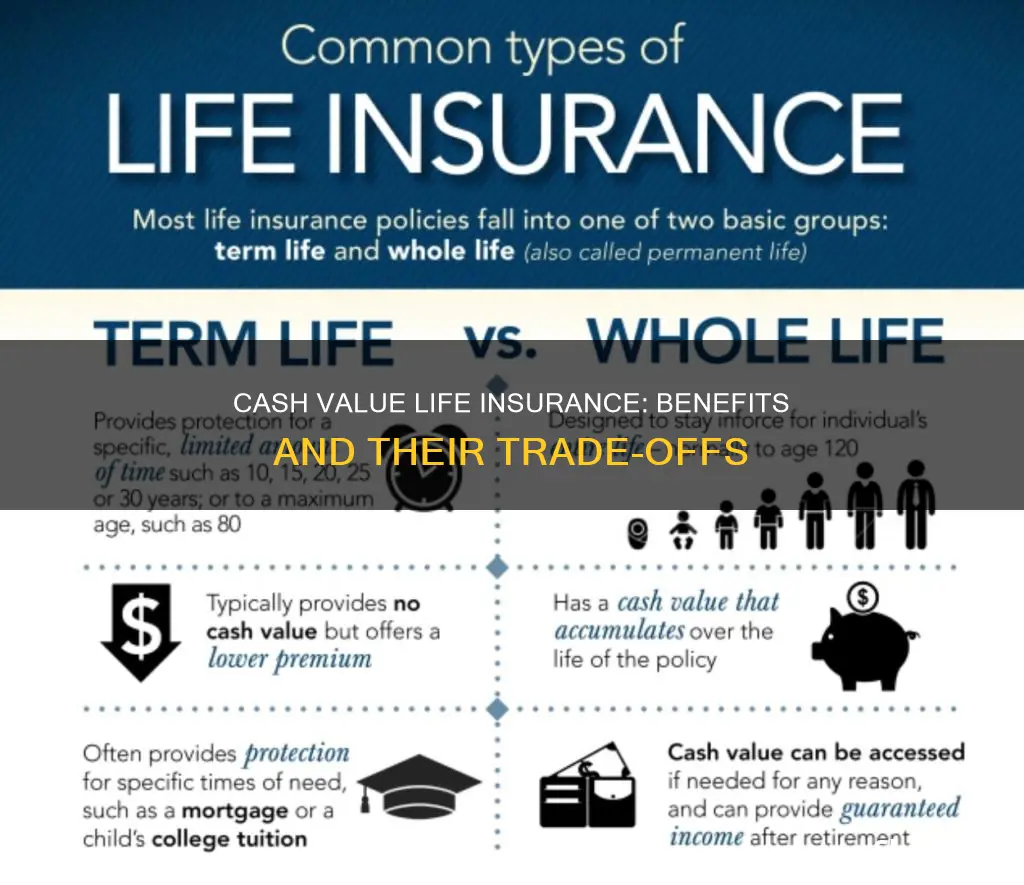

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. The cash value is the portion of the policy that accumulates over time and may be available for the policyholder to withdraw or borrow against for long-term savings needs. This type of insurance is more expensive than term life insurance, but it offers several advantages, including lifelong coverage, flexible access to funds, and reasonable premiums.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Coverage | Lifelong |

| Cash Value | Can be used for loans, withdrawals, paying premiums, buying a house, paying for children's college costs, retirement income, etc. |

| Death Benefit | Paid to beneficiaries |

| Tax | Deferred, tax-free withdrawals |

| Premium | Higher than term life insurance |

| Risk | Unpaid loans can reduce the death benefit |

What You'll Learn

Cash value life insurance can be used to pay for a child's college fees

Firstly, it's worth noting that permanent life insurance policies such as whole life insurance and universal life insurance can accumulate cash value over time. This cash value can be used to pay for a variety of expenses, including college fees. One advantage of using cash value life insurance to pay for college is that it offers more flexibility than other savings options such as 529 plans. While 529 plans can only be used for qualifying educational expenses, the cash value of a life insurance policy can be used for any type of expense. This means that if your child decides not to go to college, you can still use the money for other purposes without incurring tax penalties.

Another benefit of using cash value life insurance to pay for college is that it is typically excluded from college financial aid formulas. This means that it won't reduce the amount of financial aid your child is eligible for, whereas other assets, such as 529 plans, are considered when calculating financial aid.

However, there are also some drawbacks to using cash value life insurance to pay for college. One of the main disadvantages is the cost. Cash value life insurance policies tend to have higher premiums than other types of insurance, and it can take a long time for the cash value to accumulate. Additionally, there may be fees and charges associated with the policy that can eat into your savings.

Another thing to consider is that if you withdraw money from the cash value of your life insurance policy, it will reduce the total life insurance benefit. This means that you need to weigh the benefit of using the money for college fees against the risk of reducing your family's financial protection in the event of your untimely death.

Overall, while cash value life insurance can be used to pay for a child's college fees, it's important to carefully consider the advantages and disadvantages before making a decision. It may be a good idea to consult a financial professional to determine the best approach for your family's unique situation.

Life Insurance Disqualifiers: Health, Age, and Lifestyle Factors

You may want to see also

It can be used to cover retirement costs

One of the advantages of cash value life insurance is that it can be used to cover retirement costs. This type of life insurance allows you to build a nest egg over time, providing a source of funds during retirement. The cash value component of the policy functions as a savings account, allowing you to withdraw money or borrow against the accumulated cash value. This can supplement your retirement income and help cover expenses during your golden years.

Cash value life insurance, also known as permanent life insurance, includes a savings component that grows over time. The policyholder can access this cash value during their lifetime, providing flexibility to utilise the funds as needed. The cash value earns interest, and the growth is tax-deferred, offering a tax-advantaged way to save for retirement.

It's important to note that accessing the cash value will typically reduce the death benefit paid out to beneficiaries. Additionally, there may be fees or penalties associated with early withdrawals, and the cash value account may have higher premiums compared to term life insurance. However, the ability to use the cash value for retirement planning can be a significant advantage for those seeking long-term financial security.

When considering cash value life insurance for retirement planning, it's essential to carefully review the policy details, including any restrictions, fees, and potential impacts on the death benefit. Consulting with a financial advisor or insurance expert can help individuals make informed decisions about whether cash value life insurance aligns with their retirement goals and overall financial strategy.

Whole Life Insurance: Taxable or Not?

You may want to see also

It can be used to pay for a down payment on a home

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. This feature allows the policyholder to borrow or withdraw cash from their policy. The cash value component typically earns interest or other investment gains and grows tax-deferred.

One of the advantages of cash value life insurance is that it can be used to pay for a down payment on a home. Here's how:

Building Cash Value

Cash value life insurance policies, such as whole life and universal life, allow the policyholder to accumulate cash value over time. A portion of each premium payment goes towards the cost of insurance, while the remainder is deposited into a cash value account. This cash value account earns interest, and the money can be accessed for various purposes during the policyholder's lifetime.

Borrowing Against Cash Value

The cash value in a life insurance policy can be borrowed against to cover significant expenses, such as a down payment on a home. Policyholders can take out loans from the cash value and use the funds to make a down payment on a property. It's important to note that the outstanding loan amount will reduce the death benefit, and interest will be charged on the loan.

Withdrawing Cash Value

In some cases, policyholders may be able to withdraw cash from their life insurance policy to cover expenses like a down payment on a home. Withdrawing money from the cash value will reduce the death benefit, and there may be tax implications if the withdrawal exceeds the amount paid into the cash value.

Using Cash Value to Pay Premiums

If the cash value in a life insurance policy accumulates to a high enough level, it can be used to pay policy premiums. This could free up money in the policyholder's budget to save for a down payment on a home.

Surrendering the Policy

In certain circumstances, the policyholder may choose to surrender their life insurance policy and withdraw the accumulated cash value. This option would provide a lump sum of money that could be used for a down payment on a home. However, surrendering the policy would mean losing the life insurance coverage, and there may be surrender fees or tax implications.

Keep Life Insurance Statements: How Long is Too Long?

You may want to see also

It can be used to cover medical emergencies

Cash value life insurance is a type of permanent life insurance that features a cash value savings component. This means that the policyholder can borrow or withdraw cash from their policy. This cash can be used to cover medical emergencies, supplement retirement income, or for anything else the policyholder wishes.

The cash value component of life insurance serves as a living benefit for policyholders, allowing them to access funds for a variety of purposes. While the cash value is building, the policyholder can borrow against it or make partial withdrawals. Withdrawing more than the amount paid into the cash value will result in taxation on the excess amount as ordinary income.

In the case of a medical emergency, the policyholder could use the cash value to pay for their medical expenses. This could be done through a loan or a partial withdrawal. For example, if the policyholder has accumulated a significant amount of cash value, they could borrow against it to cover the cost of their medical treatment. The loan amount would accrue interest until it is paid back in full, and the policyholder would need to make sure they maintain the minimum cash value level to avoid policy lapse.

Alternatively, the policyholder could make a partial withdrawal from their cash value to cover their medical expenses. However, this would reduce the life insurance death benefit that their beneficiaries would receive upon the policyholder's death. Withdrawals are typically limited to a certain amount, such as $500, and may be restricted to a certain number per term or calendar year.

It's important to note that accessing the cash value of a life insurance policy may come with certain restrictions and penalties. For example, withdrawing all the cash value and surrendering the policy will result in the termination of the life insurance coverage, and there may be a surrender fee charged by the insurance company. Additionally, it can take years to build up enough cash value to access, and unpaid loans can reduce the death benefit paid to beneficiaries.

Strategies for Independently Selling Life Insurance Successfully

You may want to see also

It can be used to pay for a mortgage

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. This means that the policyholder can use the cash value for many purposes, including borrowing or withdrawing cash from it, or using it to pay policy premiums.

One of the advantages of cash value life insurance is that it can be used to pay for a mortgage. This can be done in a few different ways. One way is to borrow against the cash value of the policy. The policyholder can take out a loan from the insurance company, using the cash value as collateral, and use the loan to pay for the mortgage. This option typically has a low-interest rate, and the loan can be used for any purpose, including paying off a mortgage.

Another way to use cash value life insurance to pay for a mortgage is to withdraw money from the cash value. The policyholder can take out a partial withdrawal, which will reduce the death benefit, or withdraw all the cash value and surrender the policy. Withdrawing money from the cash value of a life insurance policy is often tax-free, as the IRS considers it a return of the premiums paid. However, if the amount withdrawn exceeds the amount paid in premiums, the excess may be taxed as ordinary income.

Additionally, if the cash value of the policy is high enough, it can be used to pay the premiums on the policy itself. This can free up money in the policyholder's budget that can then be used to pay for a mortgage.

It's important to note that accessing the cash value of a life insurance policy will generally reduce the death benefit, so policyholders should carefully consider their options and speak to a financial advisor before making any decisions.

Life Insurance and Probate: What's the Connection?

You may want to see also

Frequently asked questions

Cash value life insurance is a type of permanent life insurance that includes a cash value feature. The policyholder can use the cash value for many purposes, including borrowing or withdrawing cash from it, or using it to pay policy premiums.

Cash value life insurance offers several advantages, including lifelong coverage, flexible access to funds, and reasonable premiums. It also allows policyholders to build wealth over time and access funds while still alive.

Cash value life insurance operates similarly to a standard permanent life insurance policy. However, it diverts some of the premium into a savings or investment account that the policyholder can access while alive. The policyholder can withdraw directly from the account or borrow against the value.