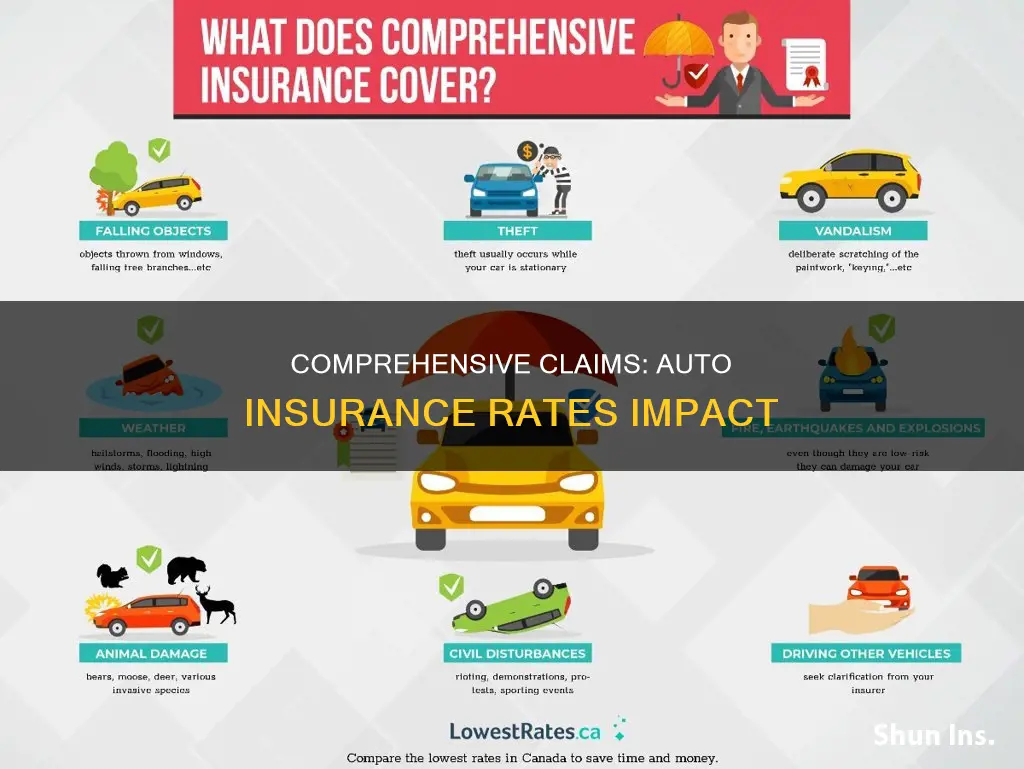

Comprehensive auto insurance is an optional type of insurance that covers damage to your car that does not occur as a result of a collision with another vehicle. This includes damage caused by animals, vandalism, theft, and weather events. While it is not a state requirement, comprehensive insurance can be a valuable addition to your policy, especially if you live in an area prone to natural disasters or have a new or expensive car. However, filing a comprehensive claim can affect your auto insurance rates.

In most cases, filing a comprehensive claim will lead to a slight increase in your insurance premiums. On average, a comprehensive claim will raise your premium by $5 per month or $36 over a standard six-month policy. The extent of the rate increase depends on factors such as the type and amount of the claim, your insurance company, and the availability of accident forgiveness programs. While comprehensive claims typically result in smaller increases compared to at-fault accidents, insurance companies view multiple claims as an indicator of higher risk, which can lead to higher premiums or even policy cancellation.

| Characteristics | Values |

|---|---|

| Comprehensive claim increase | $36 over a standard six-month policy |

| Comprehensive claim increase per month | $5 |

| Comprehensive claim increase for multiple claims | $82 over a standard six-month policy |

| Comprehensive claim increase for multiple claims (USAA) | $484 per six-month term |

| Comprehensive claim increase for multiple claims (State Farm) | N/A |

| Comprehensive claim increase for multiple claims (Nationwide) | N/A |

| Average annual cost of comprehensive car insurance | $367 |

What You'll Learn

- Comprehensive claims are more expensive in high-claim areas

- Comprehensive claims are more likely to be made in areas with high vandalism rates

- Comprehensive claims are more likely to be made in areas with high theft rates

- Comprehensive claims are more likely to be made in areas with high hurricane damage

- Comprehensive claims are less likely to be made by those with high deductibles

Comprehensive claims are more expensive in high-claim areas

Comprehensive insurance is an optional addition to most car insurance policies. It covers damage caused by factors other than a collision, including theft, animals, vandalism, and weather. It is designed to pay for repairs to your vehicle caused by things other than a collision.

Comprehensive insurance rates are often higher in areas with a high number of claims. Insurance carriers consider the probability of filing claims when adjusting rates. So, if you live in an area with a high level of theft, weather-related damage, or other comprehensive claims, your insurer may compensate for the added risk by raising your comprehensive insurance premiums.

For example, the average driver in Louisiana, the most expensive state to insure a car in the US, spends $1,495 on full car insurance each year. In contrast, the average driver in North Dakota, the least expensive state, pays only $692 per year.

The Zebra found that a comprehensive claim increases auto insurance premiums for a standard six-month policy by an average of $36. However, this amount can vary depending on the insurance company and the specific circumstances of the claim.

If you live in an area with a high number of comprehensive claims, you may want to consider the following ways to lower your insurance premiums:

- Shop and compare providers to find the best balance of low premiums and desired coverage.

- Increase your deductible. Raising your car insurance deductible tends to lower your monthly premiums.

- Remove unnecessary coverage. Drop coverage that you don't use or need, such as roadside assistance if it is already provided by your credit card issuer or auto club.

- Take advantage of discounts offered by insurance carriers, such as safe driving habits, low mileage, or bundling policies.

Gap Insurance: Missed Payment, Now What?

You may want to see also

Comprehensive claims are more likely to be made in areas with high vandalism rates

Comprehensive insurance is an optional addition to most car insurance policies. It covers damage caused by events other than collisions, including theft, animals, weather, and vandalism. Vandalism claims are covered under comprehensive insurance, and they can include scratches, dents, slashed tires, graffiti, and other types of damage.

When comprehensive claims are made due to vandalism, the process typically involves several steps. First, the incident should be reported to the local police, and a police report is usually required by insurance companies when filing a claim. Second, the insurance company should be contacted, and they will ask for details about the incident, such as the location, extent of the damage, and police report number. Third, an adjuster will be assigned to assess the damage and guide the claimant through the process. Finally, the claimant can take their vehicle to a repair shop, pay their deductible, and the insurance company will reimburse or pay the auto shop directly for the repairs.

It is worth noting that comprehensive insurance does not cover personal belongings within the car if they are stolen or damaged during a vandalism incident. Coverage for personal belongings would typically fall under renters or homeowners insurance policies. Additionally, comprehensive insurance does not cover normal wear and tear or routine maintenance costs.

Metal Gap Insurance: What Vehicle Owners Need to Know

You may want to see also

Comprehensive claims are more likely to be made in areas with high theft rates

Comprehensive insurance is an optional addition to most car insurance policies. It covers damage to your vehicle that is not caused by a collision, including theft, vandalism, hail, and animal-related incidents. This type of insurance is particularly useful in areas with high theft rates, as it can provide financial protection in the event of car theft or break-in.

Comprehensive insurance will pay out if your car is stolen, up to the actual cash value of your vehicle, minus your deductible. It also covers the cost of replacing stolen car parts, such as a catalytic converter, and repairing damage caused by theft or attempted break-in. This type of insurance is especially valuable in areas with high theft rates, as it can provide reimbursement for these types of incidents.

While comprehensive insurance does not cover personal items stolen from your vehicle, renters or homeowners insurance can provide coverage for these items. Additionally, comprehensive insurance does not include the cost of a rental car while your claim is being settled. However, you can add rental reimbursement insurance to your policy to cover this expense.

It's worth noting that comprehensive insurance claims can affect your auto insurance rates. On average, a comprehensive claim will raise your premium by $5 per month or $36 over a standard six-month policy. However, the impact on your insurance rates may vary depending on your insurance company and other factors.

To summarize, comprehensive insurance is a valuable option for car owners, especially in areas with high theft rates. It provides financial protection against theft, vandalism, and other non-collision incidents. While it may result in a slight increase in insurance rates, it can offer peace of mind and financial assistance in the event of a claim.

Auto Insurance Claims: Costly Aftermath

You may want to see also

Comprehensive claims are more likely to be made in areas with high hurricane damage

Comprehensive insurance is an optional addition to most car insurance policies. It covers damage caused by or related to theft, animals, vandalism, and weather. It is important to note that comprehensive auto insurance does not cover normal wear and tear and provides restricted coverage on maintenance costs.

In the aftermath of a hurricane, it is crucial to initiate insurance claims promptly and accurately to increase the chances of a positive outcome. This involves contacting your insurance company, documenting the damage, understanding your insurance policy and its limitations, submitting repair estimates, and potentially seeking legal assistance if issues arise.

To mitigate the risk of high hurricane damage, property owners can install features such as hurricane shutters, impact-rated glass, and reinforced roofing materials. These measures not only protect the property but can also lead to discounts on hurricane insurance premiums.

Ontario's Cheapest Vehicle to Insure

You may want to see also

Comprehensive claims are less likely to be made by those with high deductibles

Comprehensive auto insurance is an optional addition to most car insurance policies. It covers damage caused by events outside of the policyholder's control, such as theft, vandalism, weather, and collisions with animals. Comprehensive insurance does not cover damage resulting from a collision with another vehicle; this is covered by collision insurance.

Making a comprehensive claim will generally increase your auto insurance costs. However, the extent of the rate increase depends on several factors, including the type and amount of the claim, your insurance company, and the availability of accident forgiveness.

The Zebra discovered that a comprehensive claim increases auto insurance premiums for a standard six-month policy by an average of $36. However, this increase may be mitigated by choosing a higher deductible. A deductible is the amount you pay out of pocket to repair or replace your vehicle after your claim is approved. A higher deductible typically means a lower insurance rate, but you'll pay more out of pocket for repairs. For example, if you have a $400 comprehensive deductible and file a claim for $1,000 worth of damage, you'll pay $400 out of pocket, and the insurance company will pay the remaining $600.

If you know you can afford to pay for a larger portion of repair costs yourself and you rarely file claims, then a higher comprehensive deductible may be a good option for you. By choosing a higher deductible, you are betting against having an accident, but if you've had accidents in the past and often drive on busy roads, you may be more likely to file a claim and pay a deductible.

In summary, comprehensive claims are less likely to be made by those with high deductibles because policyholders with high deductibles will need to pay more out of pocket for repairs, which may deter them from filing smaller claims. Additionally, those with high deductibles typically have lower insurance rates, which may also reduce the likelihood of making a comprehensive claim.

Obesity: Auto Insurance Premiums Affected?

You may want to see also

Frequently asked questions

Yes, a comprehensive claim might increase your insurance rates, depending on your insurer and state.

A comprehensive claim is a type of auto insurance claim that covers damage caused by events other than collisions, such as vandalism, car theft, inclement weather, or hitting an animal.

Insurers factor in comprehensive claims because they can indicate a higher risk of filing more claims in the future. For example, if you hit a deer once, insurers may view you as more likely to make another claim if you are, say, driving in an area with a large deer population.

On average, a comprehensive claim will raise your premium by $5 per month or $36 over the course of a standard six-month policy.

Here are some strategies to lower your insurance rates:

- Limit the number of times you file a claim each year.

- Avoid paying for more coverage than necessary.

- Use in-car monitoring to reduce your deductible.