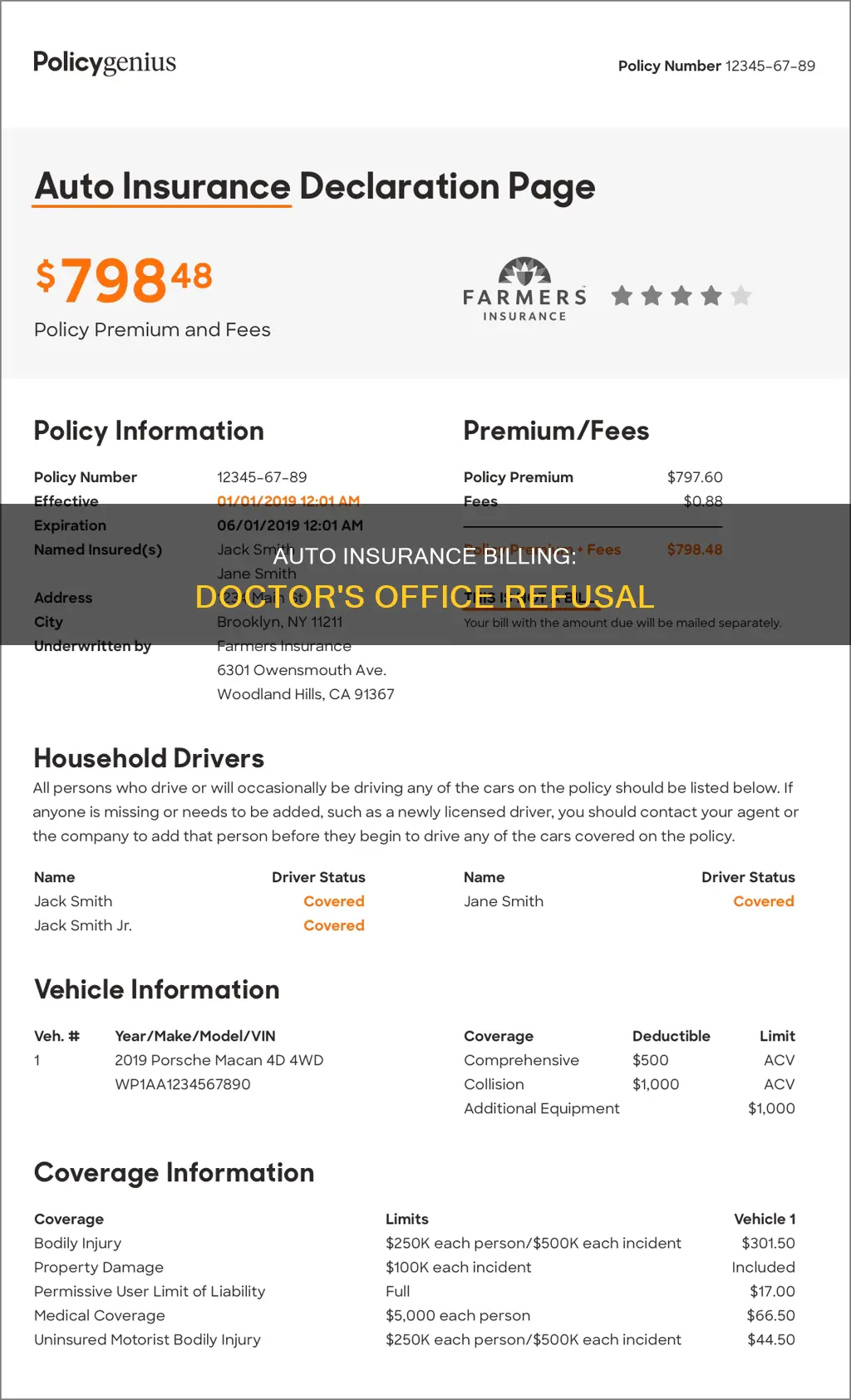

Doctors may refuse to bill auto insurance for several reasons, including the difficulty of working with insurance companies and the rates set by those companies. Physicians negotiate the price of treatment with health insurers, but if they feel the reimbursement is too low, they may refuse to accept insurance and move to a cash-only practice. This can result in unexpected medical bills for patients. In such cases, patients have a few options, including asking the doctor for a reduced fee or flexible payment terms, switching doctors, or filing a claim with their insurance company.

| Characteristics | Values |

|---|---|

| Whether a doctor's office can refuse to bill auto insurance | Yes |

| Whether a doctor's office is obliged to ensure that an insurance claim is filed in a timely manner | No |

| Whether a patient is liable for the bill if the doctor's office doesn't bill the insurance company in time | Yes |

| Whether a patient can negotiate with the doctor's office to pay the negotiated amount the insurance company would have paid | Yes |

| Whether a patient can ask the doctor's office to submit an out-of-network claim as a courtesy | Yes |

| Whether a patient can submit a claim to the insurance company themselves | Yes |

What You'll Learn

What to do if a doctor doesn't accept your insurance

Doctors may refuse to accept insurance and instead request cash payments for a number of reasons. This could be due to the extensive paperwork required by insurance companies, the time it takes to process claims, or because they believe the insurance company isn't paying them enough.

If your doctor doesn't accept your insurance, there are several steps you can take to resolve the issue:

- Contact your insurance company: Explain the situation and ask for an appeal. They may be able to negotiate with your doctor or suggest alternative options.

- Check your network coverage: Chances are that the services you require are available from an alternative in-network physician or service provider in your area.

- Ask your doctor's office to submit an insurance claim: If your physician is out-of-network, request that they submit an out-of-network claim as a courtesy. If they refuse, ask for documentation to help you submit the claim yourself.

- Request a reduced fee or flexible repayment terms: Discuss the possibility of a discount for paying upfront or explore flexible financing options with the doctor's office.

- Inquire about concierge medicine options: Your healthcare provider may agree to provide services for a prepaid annual, monthly, or regular fee.

- Consider switching insurance plans: Your doctor may accept a different insurance carrier or policy. Confirm with the provider which insurance plans they accept.

- Explore payment assistance options: Check if the practice offers financial assistance programs that can reduce or eliminate your bill, depending on your financial situation.

- Visit an urgent care clinic: Walk-in clinics that provide non-emergency services may charge significantly less than private practices or hospitals.

It's important to understand your options and know your rights when dealing with insurance and medical billing. Be sure to review your insurance plan's coverage details and don't hesitate to reach out to your insurance company and healthcare provider for clarification or assistance.

Canceling 21st Century Auto Insurance: A Step-by-Step Guide

You may want to see also

Why doctors refuse to bill insurance companies

Doctors may refuse to bill insurance companies for a variety of reasons, and this can result in unexpected medical bills for patients.

Firstly, doctors may stop working with insurance companies if they believe the reimbursement rates are too low. Insurance companies negotiate the price of treatment with health providers, and if doctors are unhappy with the rates, they may refuse to accept insurance. This can be particularly common with government-funded programs like Medicare and Medicaid, which offer lower reimbursements. Additionally, insurance companies often include quality metrics that doctors must meet for full reimbursement, which can be challenging for physicians to adhere to.

Secondly, the extensive paperwork and administrative burden associated with insurance companies can be a significant deterrent for doctors. Each patient with insurance generates a large amount of paperwork, and insurance companies often deny coverage, requiring even more administrative work. This leads to an increased need for staff to manage the paperwork, adding further costs for doctors.

Moreover, insurance companies may not approve medications or tests recommended by doctors, creating an administrative burden as physicians have to appeal these decisions on behalf of their patients. As a result, doctors may feel that their hands are tied, and they cannot provide the best care for their patients.

In addition, when insurance companies lower reimbursement rates, doctors may feel pressured to see more patients to maintain their income. This can compromise patient care, as doctors have less time to spend with each patient.

Finally, some doctors choose to operate as cash-only practices or offer "concierge medicine," where patients pay a monthly, quarterly, or yearly fee for services. This allows doctors to cut out the paperwork and administrative burden of dealing with insurance companies, but it can also result in higher costs for patients, as they have to pay for the full cost of treatment without insurance coverage.

When a doctor refuses to bill an insurance company, patients have several options. They can ask the doctor to submit an out-of-network claim or provide documentation to help them submit a claim themselves. Patients can also request reduced fees or flexible repayment terms, or ask about concierge medicine options. If these options are not feasible, patients may need to switch to a different doctor who accepts their insurance.

Auto Insurance: Tire Damage Covered?

You may want to see also

What to do if a doctor is out-of-network

If a doctor is out-of-network, it means they have not agreed to a contract with your insurance company and may charge higher rates for the same services. This doesn't mean your insurance company will pay these higher rates. If your insurance company provides out-of-network coverage, it may only pay the amount it would for an in-network service, leaving you with a larger bill.

- Know the difference between in-network and out-of-network providers: In-network providers have agreed to charge rates determined by your insurance company. When you use in-network providers, you pay a set portion of the total bill, known as a copayment or coinsurance. Out-of-network providers, on the other hand, can charge higher rates, and your insurance company may not cover the full amount.

- Understand copays and coinsurance for in-network and out-of-network care: Compare the potential costs for the same service from an in-network and out-of-network doctor. The difference in copayments and coinsurance can be significant.

- Be aware of out-of-network services that aren't covered: Some insurance plans, such as HMOs, may not cover out-of-network services at all. In these cases, you may need to make an appeal to your insurance company and ask them to make an exception.

- Understand the new rules for surprise billing: If you receive out-of-network care in an emergency or from a provider you didn't choose while at an in-network facility, your insurance company must treat these "surprise bills" as if they were in-network and apply in-network cost-sharing.

- Carefully compare out-of-network costs: Research shows that spending on out-of-network providers is a small portion of overall medical costs for those with insurance. Out-of-network costs are also rising faster than in-network costs, so it's usually more cost-effective to use in-network providers.

- Plan ahead and do your homework: Whenever possible, use in-network providers for non-emergency care. Compare prices between different providers, in-network and out-of-network, to make informed decisions. Check your benefits package for information about copays, coinsurance, and out-of-network costs.

- Consider supplemental insurance: Supplemental health insurance can help pay for deductibles and other out-of-pocket expenses in the event of a major accident or serious diagnosis. However, it's important to purchase this coverage in advance, as it may not provide coverage after an injury or illness occurs.

Allstate Vehicle Service: Insurance or Contract?

You may want to see also

What to do if a doctor won't bill your insurance company

If a doctor refuses to bill your insurance company, there are several steps you can take to resolve the issue. Here are some options to consider:

- Contact your insurance company: Explain the situation to your insurance provider and ask for their assistance. They may be able to negotiate with the doctor or help you understand your coverage options.

- Check your network coverage: Confirm if there are any alternative in-network physicians or service providers in your area who accept your insurance. If so, consider switching to one of those doctors.

- Ask the doctor's office to submit an out-of-network claim: If your doctor is outside your insurance network, request that they submit an out-of-network claim on your behalf as a courtesy. This can help streamline the process.

- Request documentation: If the doctor's office is unable or unwilling to submit the claim, ask them to provide you with the necessary documentation to submit the claim yourself. This will make the process easier and ensure you have all the required information.

- Negotiate with the doctor: Discuss the possibility of a reduced fee or flexible repayment terms directly with the doctor's office. They may be open to offering discounts for upfront payments or flexible financing options.

- Explore concierge medicine options: Inquire about the possibility of prepaid arrangements, where you pay an annual, monthly, or regular fee for a predetermined number of services or visits.

- Consider switching insurance plans: Check with the doctor to see if they accept other insurance plans or policies. You may need to switch to a different carrier or plan to receive coverage for their services.

- Inquire about payment assistance: Ask the doctor's office or hospital about financial assistance programs that can reduce or eliminate your bill, especially if you have a financial need.

- Visit an urgent care clinic: Walk-in clinics that provide non-emergency services may charge significantly less than private practices or hospitals.

It is important to understand that doctors are not required to accept all insurance plans or the rates set by insurance companies. Some doctors may choose to operate as cash-only practices or decide not to work with specific insurers due to low reimbursement rates or administrative burdens. In such cases, you may need to explore alternative options to ensure you can access the care you need while managing your financial responsibilities.

Realtors: Extra Auto Insurance Needed?

You may want to see also

What to do if a hospital doesn't take your insurance

If a hospital doesn't take your insurance, there are several steps you can take to resolve the issue and ensure you receive the care you need. Here is a guide on what to do in this situation:

Understand Your Rights:

Firstly, it's important to know that hospitals are required by law to treat you in an emergency, regardless of your insurance status. Under the Emergency Medical Treatment and Labor Act (EMTALA), hospitals must stabilise and treat anyone who goes to the emergency room, even if they are uninsured. So, if you are facing a medical emergency, don't hesitate to seek treatment.

Assess the Situation:

Not all visits will qualify as emergencies under EMTALA. Routine doctor visits, prenatal care, check-ups, and minor issues like the flu may not be covered. In these cases, the hospital may transfer or discharge you once your immediate condition is stabilised. It's important to understand whether your situation constitutes an emergency to know what options are available to you.

Explore Payment Options:

If you receive treatment without insurance, you will typically be responsible for the full cost of the visit. However, there are several ways to make this more affordable:

- Charity Care or Financial Assistance Programs: Many hospitals offer charity care or financial assistance programs for uninsured or low-income patients. These programs can help adjust your bills based on your ability to pay. Non-profit hospitals are required by law to provide such assistance.

- Negotiate Bills: Hospitals may be willing to negotiate your bills, especially if you do so before hospitalisation for elective surgery. They may offer discounts or allow you to pay negotiated amounts over time through payment plans.

- Apply for Medicaid or Other Coverage: If you're uninsured, look into whether you qualify for Medicaid or coverage through the Health Insurance Marketplace (www.healthcare.gov). These programs can help ensure you have access to affordable healthcare and may even provide cost-savings on premiums and other expenses.

Understand Your Insurance Coverage:

Review your insurance plan to determine what is covered and what is not. Understand the in-network and out-of-network providers under your plan, as this can significantly impact your costs. Contact your insurance company to clarify any doubts and confirm whether a specific healthcare provider is in your plan's network.

Appeal Denied Claims:

If your insurance company denies a claim, don't give up. There may have been errors in processing your claim, or your healthcare provider may have billed your visit incorrectly. Contact both your insurance company and healthcare provider to try and rectify these errors, and go through the insurance company's appeals process if necessary.

Consult a Professional:

If you have questions about your medical bills or insurance, consider seeking help from a medical billing advocate or an experienced personal injury lawyer. They can help you understand your rights, negotiate with the hospital, and resolve billing issues.

Remember, it's important to be persistent but polite in your communications, and keep good documentation of your efforts, including the dates and contact information of each person you speak with.

Comprehensive Insurance: Beyond Collision Coverage

You may want to see also

Frequently asked questions

If your doctor's office refuses to bill your auto insurance, you can try contacting the insurance company and asking them to tell you what the "reasonable and customary" approved payment would be. You can then offer to pay the doctor's office that amount.

If your doctor's office bills your insurance too late, you may still be liable for the bill, but you can try negotiating with the doctor's office to pay a reduced fee.

If your doctor's office bills you for something that should be covered by your insurance, you should first confirm that the service is covered by your insurance plan. If it is, you can try negotiating with the doctor's office to have the charge removed from your bill.

If your doctor's office is out-of-network with your insurance, you may have to pay higher costs. You can try contacting your insurance company to see if they will negotiate with the doctor's office, or you may need to find a different doctor.

If your doctor's office doesn't accept insurance at all, you will be responsible for paying the full cost of treatment. You may be able to negotiate a reduced fee or flexible repayment terms with the doctor's office.