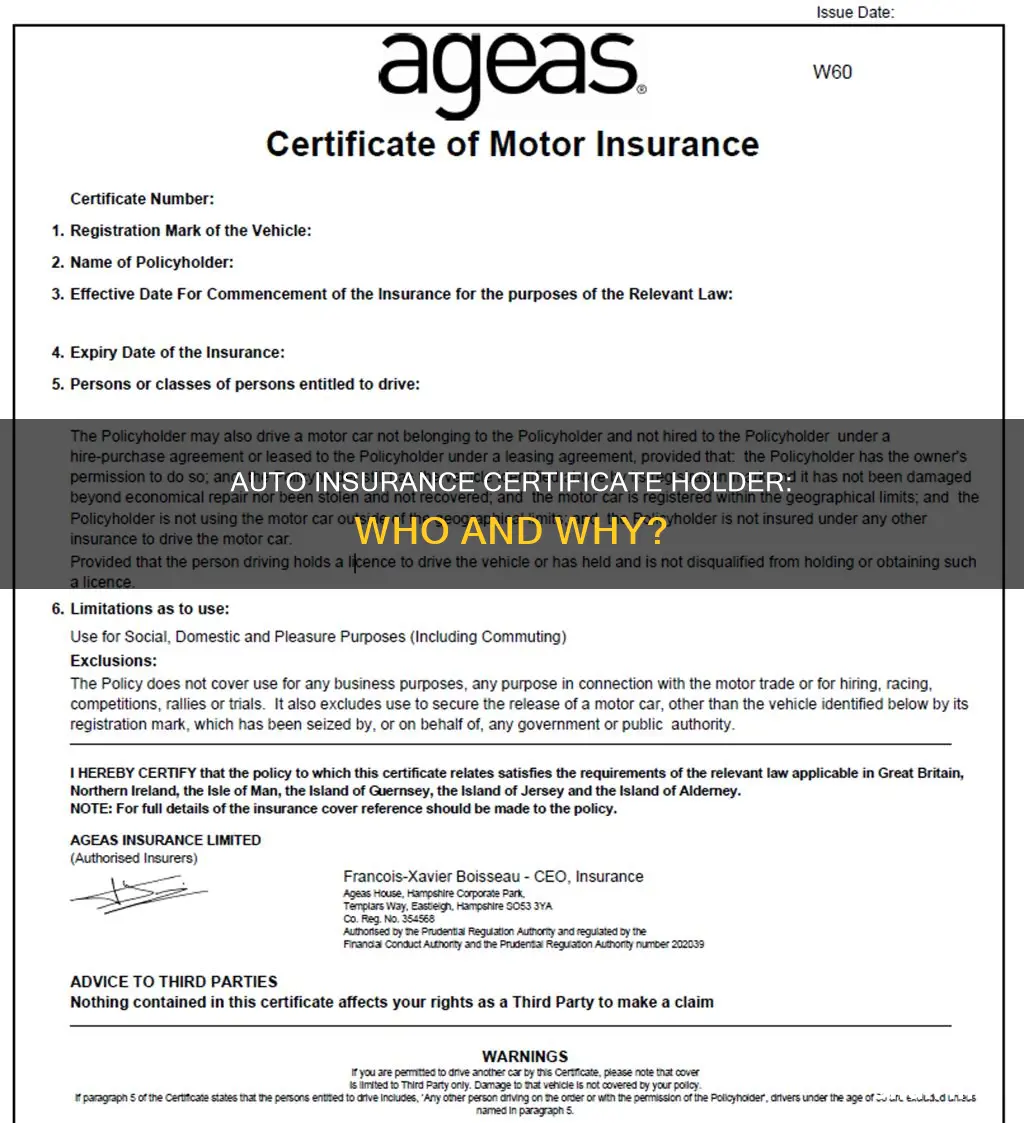

A certificate holder in personal auto insurance is an individual or entity that is named on your certificate of insurance (COI) and has proof of your insurance coverage. This can include vendors, contractors, landlords, and other third parties that require proof of insurance before working with you. The certificate holder is not the same as the policyholder on insurance. The certificate holder is simply provided with proof of insurance coverage and does not have the same rights as the policyholder. They cannot make changes to the policy, cancel it, or receive a payout in the event of a claim.

| Characteristics | Values |

|---|---|

| What is a certificate holder? | An individual or entity that is named on your certificate of insurance (COI) and has proof of your insurance coverage. |

| Who can be a certificate holder? | Vendors, contractors, landlords, or other third parties that require proof of insurance before working with the policyholder. |

| What is the difference between a certificate holder and a policyholder? | The policyholder is the person who purchased the policy and is also referred to as the "named insured". The certificate holder is not typically the policyholder but a third party who has an interest in the policy. |

| What is the difference between a certificate holder and an additional insured? | A certificate holder only has proof of insurance coverage, while an additional insured is covered under the policy and can file a claim. |

| What is the benefit of being a certificate holder? | A certificate holder is entitled to receive notices of any changes in the policy. |

| Can a certificate holder make changes to the policy? | No, the certificate holder does not have the same rights as the policyholder and cannot make changes to the policy. |

What You'll Learn

A certificate holder is not the same as a policyholder

A certificate holder, on the other hand, is a third party that may be named on a Certificate of Insurance (COI). They receive a copy of the COI as proof of insurance coverage and are notified of any changes to the policy, such as cancellation, renewal, or modification. However, being a certificate holder does not grant them any rights or coverage under the policy. In other words, a certificate holder only has proof that the policyholder has insurance and is not entitled to file a claim.

For example, a landlord may request to be listed as a certificate holder on their tenant's commercial property insurance policy. This allows the landlord to be notified of any changes to the policy and ensures that the tenant maintains insurance coverage during the lease period.

It is important to distinguish between a certificate holder and an additional insured. While both are third parties associated with an insurance policy, an additional insured is added to the original policy and is entitled to the same coverage and benefits as the policyholder. They can file a claim if needed. On the other hand, a certificate holder only receives verification of insurance and notifications of any changes but has no protection or ability to file a claim under the policy.

Auto Insurance Payments: Taxable or Not?

You may want to see also

A certificate holder does not have the same rights as the policyholder

A certificate holder is a third party that may be named on a Certificate of Insurance (COI). A COI is a document issued by an insurance company or broker that verifies the existence of an insurance policy and summarises its key aspects and conditions. It includes details such as the policyholder's name, the policy's effective date, the type of coverage, and policy limits.

While a certificate holder holds proof of insurance, they do not have the same rights as the policyholder. The certificate holder is simply advised of the insurance coverage and any changes made to the policy. They do not have the right to make a claim against the policy or receive any benefits from it. The certificate holder is not covered by the policy and is not entitled to any insurance payouts.

On the other hand, the policyholder is the person whose name is on the insurance policy and who directly benefits from its coverage. They are sometimes referred to as the "named insured" and are typically the ones who purchased the policy, make decisions about coverage, and pay the premiums. The policyholder has the right to make changes to the policy and is responsible for ensuring the coverage is adequate and up-to-date.

In the context of auto insurance, the policyholder is the individual who can anticipate compensation from their insurance provider when a valid claim is submitted and granted. The certificate holder, on the other hand, only has a certificate listing the various coverages on the vehicle. This certificate does not grant any insurance coverage or rights to the holder.

To summarise, a certificate holder does not have the same rights as the policyholder. The certificate holder only holds proof of insurance and is informed of any changes, while the policyholder has the right to make claims, receive benefits, and make changes to the policy.

Mandatory Vehicle Insurance: What's Covered?

You may want to see also

A certificate holder can be added to an insurance policy

A certificate holder is someone who is not the policyholder but has a vested interest in the policy. They may be a vendor, a third party, or any other entity that needs some form of protection under the policy. A certificate holder can be added to an insurance policy, and this is a simple process that provides an additional layer of protection and peace of mind.

To add a certificate holder to your insurance policy, you will need to contact your insurance provider or agent and request that they be included. The certificate holder will then receive a copy of the Certificate of Insurance (COI), which serves as proof of coverage. It is important to note that the certificate holder does not have the same rights as the policyholder. They cannot make changes to the policy, cancel it, or receive a payout in the event of a claim. The certificate holder is simply provided with proof of insurance coverage.

A Certificate of Insurance is a document that proves an insurance policy exists. It is typically issued by the insurance company or broker and contains all the important information needed to confirm coverage, including the name of the policyholder, policy effective date, and policy coverage limitations. The COI is a one-page document that summarizes the most vital information contained in your insurance policy, which can often be many pages long.

Adding a certificate holder to your insurance policy can be beneficial in several ways. It can help you comply with regulations, protect you from claims, and improve your relationships with clients and subcontractors. It also ensures that your interests are protected and that you are in compliance with any contractual requirements.

It is important to understand the insurance coverage and requirements before making any changes to your policy. Consult with an insurance professional or risk management expert if you have any questions or concerns.

Gap Insurance: Extended Coverage Explained

You may want to see also

A certificate holder can be designated as an additional insured

A certificate holder is not the same as an additional insured. A certificate holder holds a certificate of insurance (COI) that proves the policyholder has insurance and the correct coverage at that time. They are not covered by the policyholder's insurance unless they are also named as an additional insured on the COI.

An additional insured is someone who has been added to the original policy and is covered under the policy. They are not responsible for paying any of the premiums and they don't have the right to alter the policy in any way. However, they can benefit from the free coverage of someone else's policy.

It is important to note that the policyholder is responsible for paying the full amount of the premium listed on the policy if they add an insurance certificate holder as an additional insured. This also means that they are responsible for any incurred damages per their insurance policy.

Cheapest Auto Insurance in NY: Who Wins?

You may want to see also

A certificate holder can help protect personal assets

A certificate holder is someone who is designated to receive a certificate of insurance (COI). This certificate outlines the terms of the policy and serves as proof of insurance coverage. While the certificate holder is not the policyholder, they have an interest in the policy, such as a lender or landlord. The COI includes the policyholder's name, the policy's effective date, the type of coverage, policy limits, and other important details.

Adding a certificate holder to an insurance policy can be beneficial for protecting personal assets. Here's how:

Proof of Insurance Coverage

The certificate holder receives proof of insurance coverage through the COI. This document verifies the existence of the insurance policy and summarises its key aspects. This proof can protect the certificate holder from financial consequences resulting from a claim or lawsuit.

Compliance with Regulations

Adding a certificate holder to an insurance policy helps ensure compliance with state laws and regulations. By understanding certificate holder endorsements, policyholders can meet all requirements. Certificate holder endorsements add a certificate holder to the policy and provide them with proof of insurance coverage.

Protection from Claims

The COI outlines the coverage provided, liability limits, and any special requirements. This information helps protect the certificate holder from potential claims by ensuring they are aware of the policy's terms and conditions.

Enhanced Security

The COI provides an additional layer of security for the certificate holder. It ensures that their interests are protected and reduces the risk of loss or theft. Reputable institutions, such as banks or financial institutions, typically hold these certificates, providing a secure environment for the certificate holder's interests.

Confidentiality and Privacy

In addition to physical security, the COI offers confidentiality and privacy. The certificate holder's personal information and policy details remain confidential, minimising the risk of unauthorised access or information leakage.

Peace of Mind

Perhaps the most valuable aspect of having a certificate holder is the peace of mind it provides. Knowing that their interests are protected and backed by legal documentation can alleviate stress and anxiety associated with asset protection.

Vehicle Insurance: Active or Not?

You may want to see also

Frequently asked questions

A certificate holder is an individual or entity that is named on your certificate of insurance (COI) and has proof of your insurance coverage. This can include vendors, contractors, landlords, and other third parties that require proof of insurance before working with you.

A policyholder is a person or company who purchases an insurance policy and is often referred to as the "named insured". The certificate holder, on the other hand, is a third party who has an interest in the policy but is not a party to the insurance contract.

A certificate holder simply receives proof of insurance from the policyholder. An additional insured, on the other hand, is added to the policy as a named insured and has coverage under the policy, allowing them to file a claim if necessary.

To add a certificate holder to your insurance policy, you need to contact your insurance provider and request a certificate of insurance that includes the certificate holder's name and information. This document will serve as proof of your insurance coverage.