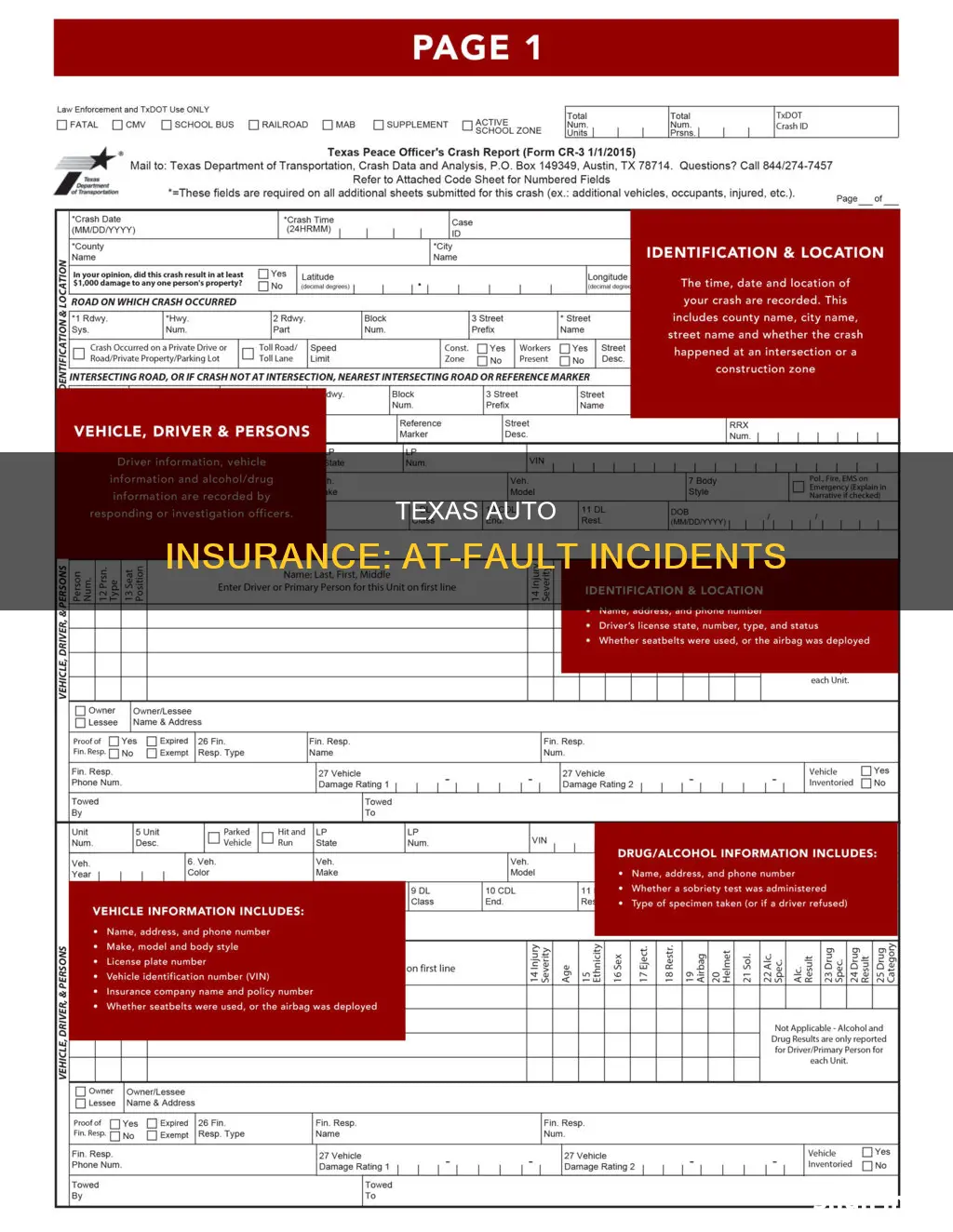

Texas is an at-fault state, meaning it follows a tort liability system to determine damages in car accident cases. Texas law requires drivers to show proof that they can pay for accidents they cause, which is usually done by purchasing auto liability insurance. This insurance covers the other driver's car repair and medical bills if you are at fault in an accident. If the other driver is at fault, their insurance should cover your repairs and medical bills. If their insurance company refuses to pay, you can file a claim with your own insurance company, provided you have collision coverage.

| Characteristics | Values |

|---|---|

| Type of state | At-fault |

| Tort liability system | Yes |

| Minimum liability limits | 30/60/25 coverage |

| Minimum coverage amount per injured person | $30,000 |

| Minimum coverage amount per accident | $60,000 |

| Minimum coverage amount for property damage per accident | $25,000 |

What You'll Learn

Minimum insurance requirements in Texas

Texas law requires all drivers to have adequate car insurance. The minimum insurance coverages are $30,000 per injured person, up to $60,000 per accident, and $25,000 for property damage. This basic coverage is called 30/60/25.

However, these are simply minimums and may not cover all the costs of recovery and repairs if you're injured in an accident. It's a good idea to consider including insurance against uninsured and underinsured drivers in your policy. This type of insurance protects you if you're injured in an accident caused by a driver who didn't have insurance or didn't have enough coverage.

In addition to purchasing auto insurance, you also need to show proof of insurance if police request it. You must produce proof of insurance if you're pulled over for a traffic violation, involved in an accident, registering your car, or getting a Texas driver's license.

There are several types of insurance coverage in Texas, including:

- Liability coverage: This is all that's legally required in Texas. It pays for medical bills, funeral expenses, lost wages, pain and suffering compensation, and property damage.

- Collision coverage: This covers damage to your car while you still owe money on it. It will pay out the car's actual value, the amount necessary to repair or replace it, or the amount on the insurance declaration page, whichever is least.

- Comprehensive coverage: This is similar to collision coverage but covers the cost of repairing or replacing your car in incidents other than a collision, such as theft, vandalism, or hail damage.

- Uninsured/Underinsured Motorist coverage: This will pay out damages for bodily injury and property damage if you're in an accident caused by a driver who doesn't have insurance.

Auto and Home Insurance: What You Need to Know

You may want to see also

What to do if you're in an accident that isn't your fault

If you're in a car accident that isn't your fault, there are several steps you should take to ensure your safety, protect your rights, and seek compensation. Here's a guide on what to do:

Immediately After the Accident:

- Ensure your safety and the safety of others. Move yourself and your vehicle to the side of the road if it is safe to do so.

- Call 911 if anyone has been injured or there are serious injuries. Contact the police to report the accident, even if there are no injuries.

- Exchange information with the other driver. Get their name, address, phone number, driver's license, and license plate number. Also, take a picture of their insurance card and driver's license.

- Gather evidence and documentation. Take photographs of the accident scene, damage to the vehicles, and any visible injuries. Get the names and contact details of passengers and witnesses. Obtain a copy of the police report, if available.

Inform Your Insurance Company:

Contact your insurance company as soon as possible, even if the accident seems minor. Report the accident and explain what happened. Your insurance company can help you navigate the claims process and protect your rights. They may also provide coverage if the at-fault driver's insurance doesn't pay.

File a Claim with the Other Driver's Insurance:

You can file a claim with the other driver's insurance company to seek compensation for damages and injuries. Let your insurance company know that you're doing this. Provide them with the police report and any other relevant information. However, keep in mind that the other driver's insurance company may deny your claim or offer insufficient compensation.

Understand Your Insurance Coverage:

Review your insurance policy to understand your coverage options. If you have collision coverage, it will pay for repairs to your vehicle. Uninsured/underinsured motorist coverage will protect you if the at-fault driver doesn't have insurance or has insufficient coverage. Medical payments coverage or personal injury protection (PIP) can help cover your medical bills.

Consider Legal Options:

If the other driver's insurance company refuses to pay or offers inadequate compensation, you may need to consider legal options. Consult with an attorney who can help you navigate insurance laws and protect your rights. They can assist you in negotiating with the insurance company or filing a lawsuit if necessary.

Remember, it's important to remain calm and collected at the accident scene. Avoid admitting guilt or apologizing, as it could affect your insurance coverage and any potential legal proceedings. Focus on gathering the necessary information and protecting your rights.

Launching Auto Insurance: Steps to Success

You may want to see also

How to file a complaint against an insurance company

If you have a complaint against an insurance company in Texas, there are a few ways to address it. The Texas Department of Insurance (TDI) can help with insurance problems, complaints, and questions. Here is a step-by-step guide on how to file a complaint:

Step 1: Talk to the Insurance Company

The first step is to try to resolve the issue by communicating directly with your insurance company or agent. Most companies have a toll-free customer helpline, and you can also find a phone number on your policy or online. Discuss any disagreements with the adjuster's estimate and provide supporting documents if necessary.

Step 2: Ask for an Appraisal

If your policy includes an appraisal process, you can use this to resolve complaints. In this process, you and the company each hire an appraiser, who then chooses a third appraiser as an umpire. The appraisers review your claim and estimate the damage, and if their estimates differ, the umpire decides. Keep in mind that you are responsible for paying for your appraiser and half of the umpire's costs.

Step 3: File a Complaint

If the issue remains unresolved, you can file a formal complaint against the insurance company, agents, or adjusters. The TDI provides a Complaint Portal to guide you through the process. You can also call the TDI's Help Line at 800-252-3439 for assistance. Additionally, you can file a complaint with the Office of the Attorney General's Consumer Protection Division.

Step 4: TDI Investigates

Once you have filed your complaint, the TDI will contact the insurance company and request a response. Auto and home insurance companies typically have 15 to 25 days to respond, and they can ask for an extension.

Step 5: Review Response and Take Further Action

After receiving the company's response, the TDI will review it and inform you of its implications for your complaint. If you are still dissatisfied with the outcome, you may need to seek legal assistance.

It is important to note that the average time to resolve a complaint is 40 days, but it can sometimes be faster or take longer. Additionally, the TDI cannot decide who was at fault in an accident or determine damage amounts.

GAP Insurance: Protecting Your Assets

You may want to see also

The benefits of hiring a personal injury attorney

If you've been in a car accident, it can be challenging to figure out the legal system and fight for compensation for your injuries. Here are some benefits of hiring a personal injury attorney to help you through this difficult time:

They Handle the Legal Details

An experienced personal injury attorney will handle all the legal details of your case, allowing you to focus on your recovery. They will gather evidence, including eyewitness testimonies, expert interviews, police reports, and medical records, to build a strong case and ensure your rights are protected.

They Have Expert Knowledge

Personal injury litigation is complex, and most people are unfamiliar with the process. An attorney will bring knowledge and experience to your case, knowing the intricacies of personal injury law and keeping your best interests in mind when negotiating a settlement or going to trial.

They Deal with Insurance Companies

Insurance companies often aim to minimize their financial obligations, and you deserve representation to counter this. Personal injury attorneys are skilled negotiators who can deal with insurance companies on your behalf, fighting for maximum compensation for your injuries, lost wages, medical bills, and property damage.

They Identify the Liable Party

One of the most critical roles of a personal injury attorney is determining who is responsible for the accident. They will conduct a thorough investigation to identify all parties who played a part in causing your accident and hold them accountable.

They Provide Peace of Mind

Car accidents can cause emotional and psychological trauma, and dealing with legal matters can add to the stress. A personal injury attorney will handle all aspects of your claim, allowing you to focus on recovery. They will fight for your best interests and ensure you receive the compensation you deserve.

They Help You Get Faster Compensation

With a personal injury attorney, you don't have to wait until you've fully recovered to start the settlement process. They can immediately file personal injury claims on your behalf, using their experience to navigate any setbacks and get you compensated quickly.

No Upfront Fees

Most personal injury attorneys work on a contingency fee basis, meaning they only get paid if they win your case. This means there is no financial risk to you, and you can focus on your recovery without worrying about legal fees.

Vehicle Insurance: Am I Covered?

You may want to see also

The Texas Consumer Bill of Rights for auto insurance

The Bill of Rights provides consumers with a basic understanding of their rights and responsibilities regarding auto insurance. It covers various topics, including the minimum insurance requirements in Texas, additional insurance options, consumer rights when purchasing and claiming insurance, and protections against discrimination.

When purchasing auto insurance, consumers have the right to know the minimum insurance requirements. In Texas, the minimum requirement is "30/60/25" coverage, which translates to $30,000 per person, $60,000 per accident, and $25,000 in property damage. Consumers can choose to add other types of insurance, such as personal injury protection, collision coverage, comprehensive coverage, underinsured motorist coverage, and uninsured motorist coverage.

The Bill of Rights also outlines consumer rights when dealing with insurance companies. Insurance companies are prohibited from making false, misleading, or deceptive statements. They cannot require consumers to purchase more coverage than what is legally required or deny insurance solely based on credit information. Consumers have the right to pay their premiums in installments and choose their preferred repair shops and replacement parts for their vehicles.

Additionally, the Bill of Rights protects consumers from discrimination. Insurance companies cannot discriminate based on race, colour, religion, or national origin. While they can consider age, gender, disability, marital status, and geographic location, it must be based on sound actuarial principles and not result in unfair discrimination.

Root Auto Insurance: Good or Bad?

You may want to see also

Frequently asked questions

Texas law requires drivers to show proof that they can pay for accidents they cause. If you don't have auto insurance, a police officer will likely give you a ticket, and the court could fine you up to $350. If it happens again, you could be fined up to $1,000 and have your driver's license suspended.

Texas law requires you to have at least $30,000 of coverage for injuries per person, up to a total of $60,000 per accident, and $25,000 of coverage for property damage. This is known as 30/60/25 coverage.

If you are found at fault for an accident and the damages exceed your insurance coverage, injured parties have the right to sue you to collect the difference.

If you have uninsured or underinsured motorist coverage, an attorney can help you file a claim with your insurance company. This type of coverage is available as an additional option on auto insurance policies.

If your insurance company refuses to pay your claim, you can file a complaint with the Texas Department of Insurance (TDI). TDI will contact the company and ask for a response to your complaint. If you are still not satisfied with the outcome, you can seek legal help.