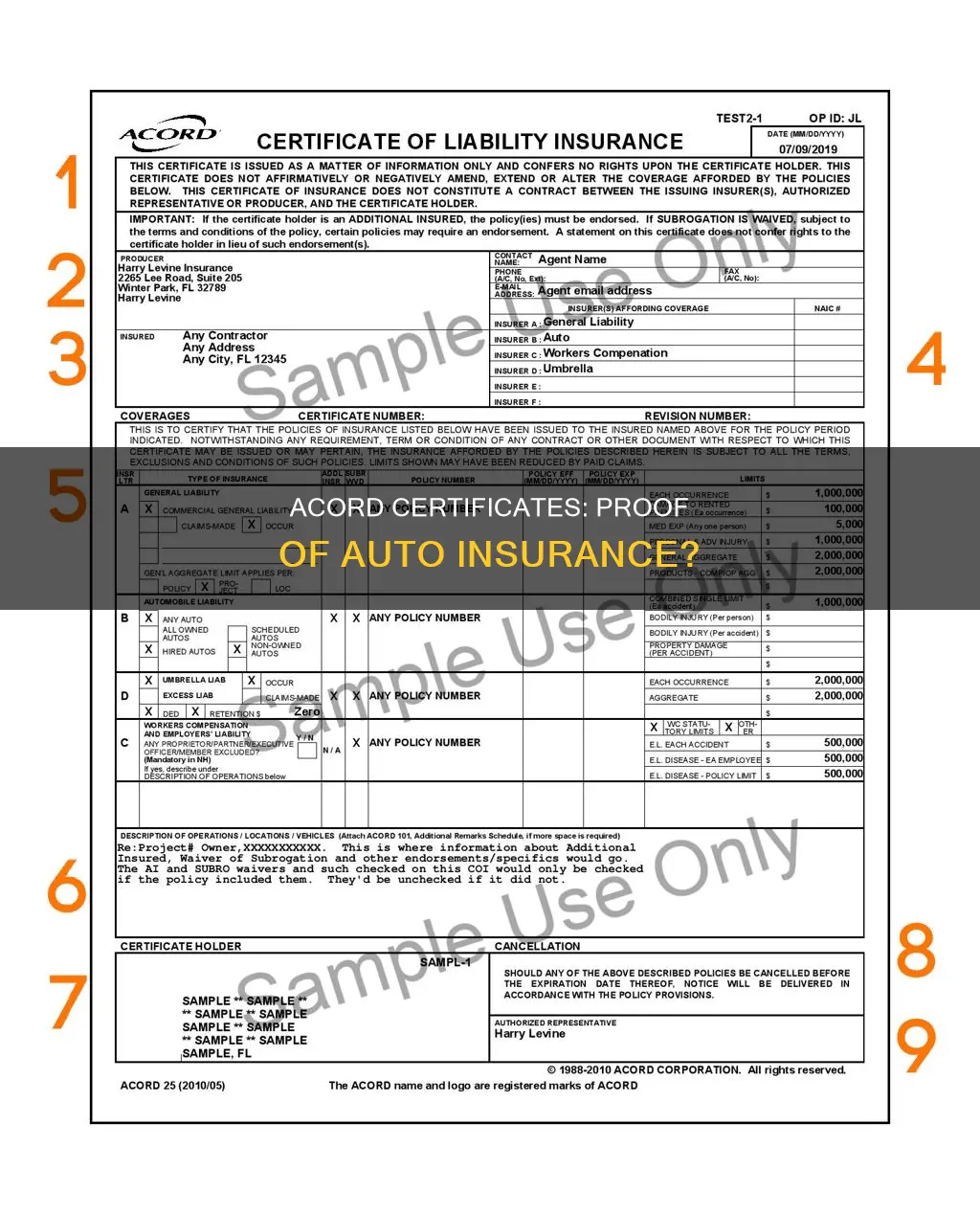

An ACORD certificate of insurance is a one-page document that summarises key information about your business's insurance policy. It is also known as an ACORD 25 certificate of insurance, certificate of insurance (COI), or a certificate of liability insurance. This form proves that business owners have general liability insurance coverage. It is typically provided by your insurance company when you buy a business insurance policy.

The Association for Cooperative Operations Research and Development (ACORD) was formed in the 1970s by insurance companies to minimise confusion and unify their approach to liability insurance policy forms. The ACORD 25 certificate is the most popular and commonly requested COI, providing evidence of liability insurance, such as general liability, workers' compensation, professional liability, and more.

While the document you submit as proof of insurance does not need to be ACORD-approved, ACORD certificates are secure, internationally recognised, and used by almost every insurance company. They ensure standardisation, making it faster to validate and process the documents.

| Characteristics | Values |

|---|---|

| What is an ACORD Certificate? | A one-page document that proves you have insurance coverage. |

| Who issues an ACORD Certificate? | An insurance company when you buy a business insurance policy. |

| What is ACORD? | The Association for Cooperative Operations Research and Development, a global non-profit organization that works to improve the efficiency and accuracy of data use in the insurance industry. |

| When was ACORD formed? | In the 1970s by a group of insurance companies to standardize forms and minimize confusion. |

| What does an ACORD Certificate cover? | Types of insurance coverage, issuing insurance company, policy effective date, and policy expiration date. |

| Why do I need an ACORD Certificate? | To provide proof of insurance coverage to potential business partners or clients. |

| How do I get an ACORD Certificate? | Request it from your insurance agent or through your insurance company's online portal. |

| What are the benefits of an ACORD Certificate? | Standardization, security, international recognition, faster validation, always up-to-date, and quick to process. |

| What are the different formats of ACORD documents? | Printable documents, e-forms, or PDFs. |

| How often are ACORD Certificates updated? | ACORD publishes updates regularly, and it is important to use the most recent version to ensure compliance with regulations. |

What You'll Learn

What is an ACORD certificate?

An ACORD certificate, also known as an ACORD 25 certificate of insurance, certificate of insurance (COI), or a certificate of liability insurance, is a typically one-page document that summarises essential information about your business insurance policy. It is a proof of business owners having general liability insurance coverage. It is provided by the insurance company when a business insurance policy is purchased.

The Association for Cooperative Operations Research and Development (ACORD) was formed by insurance companies in the 1970s to minimise confusion and unify their approach to liability insurance policy forms. The ACORD certificate was thus created to introduce standardisation and make the process less chaotic. The ACORD corporation develops standard forms that are more usable and readable for everyone in the insurance industry.

The ACORD certificate covers key information about your business insurance policy, such as the types of insurance coverage, the issuing insurance company, the policy effective date, and the policy expiration date. It also includes the certificate holder's name and contact information, as well as their insurer's name and contact information.

The ACORD certificate is important because it serves as proof that a business has the necessary insurance coverage to protect against various claims, such as property damage, personal injury, or substandard work. It provides legal security and peace of mind for small business owners and their clients.

ACORD certificates are widely accepted in the United States and abroad and are useful tools for small business owners to ensure that their vendors, subcontractors, and contractors have the necessary insurance coverage.

U.S. Auto Insurance: Who Qualifies for USAA?

You may want to see also

What does an ACORD certificate cover?

An ACORD certificate of insurance is a one-page document that summarises key information about your business insurance policy. It is also known as an ACORD 25 certificate of insurance, certificate of insurance (COI) or a certificate of liability insurance.

The ACORD certificate covers essential information about your business insurance policy, such as:

- Types of insurance coverage

- Issuing insurance company

- Policy effective date

- Policy expiration date

The certificate serves as proof that a business has insurance coverage to protect against claims of property damage, personal injury, and substandard work. For example, if a vendor or subcontractor you hired caused damage to a client's property, your business insurance policy would cover the repairs. Similarly, if one of your employees caused bodily injury to someone else on a job site, your policy would cover any resulting legal liability.

The Association for Cooperative Operations Research and Development (ACORD) was formed in the 1970s by insurance companies aiming to minimise confusion and unify their approach to liability insurance policy forms. ACORD develops standard forms, including the ACORD certificate of insurance, to ensure that everyone in the insurance industry has access to usable and readable forms. The ACORD 25 is the most popular and commonly requested COI, providing evidence of liability insurance, such as general liability, workers' compensation, and professional liability, among others.

RV Gap Insurance: How to Purchase

You may want to see also

Why do I need an ACORD certificate?

An ACORD certificate is a document that proves you have insurance coverage. It is typically a one-page document that summarises key information about your business insurance policy. It is also known as an ACORD 25 certificate of insurance, certificate of insurance (COI), or a certificate of liability insurance.

The ACORD certificate is especially important for business owners. If you own a business, you may be asked to provide an ACORD certificate of liability insurance for a variety of reasons. When you enter into a contract with other professionals, you need to request proof of insurance. By collecting ACORD certificates from third-party vendors, you can protect your business from vendors' costly mistakes.

The ACORD certificate serves as proof that a business has the type of insurance coverage to protect against claims of property damage, personal injury, or substandard work. All business owners want to feel confident that they won't be held liable for mistakes caused by third parties. Companies or contractors who work for you should be able to provide proof of liability insurance coverage before any work begins.

Additionally, if you are a business owner, you may need to provide an ACORD certificate to a potential business partner or client to assure them that you are insured before doing business with them. The COI provides a snapshot of your coverage, listing information such as limits, policy terms, carrier name, and more. It lets potential business partners know that you have purchased insurance to protect yourself from various accidents and mishaps that could occur during your day-to-day business activities.

The ACORD certificate of insurance was created by the Association for Cooperative Operations Research and Development (ACORD), an international nonprofit organisation formed in the 1970s by a group of companies that believed the insurance business needed a way of standardising forms. Before the introduction of standardised forms, every insurer had its own policy forms, which made things confusing for agents, brokers, and anyone who purchased business insurance. ACORD was authorised to create forms that everyone in the insurance industry would use to introduce standardisation and make the process less chaotic.

White Cars: Cheaper Insurance?

You may want to see also

How do I get an ACORD certificate?

An ACORD certificate is a document that proves you have liability insurance coverage. It is typically a one-page summary of your business insurance policy, including policy limits, types of coverage, and effective and expiration dates. It is also known as an ACORD 25 certificate of insurance, certificate of insurance (COI), or a certificate of liability insurance.

To get an ACORD certificate, you must first purchase a business liability insurance policy. After buying a policy, you can request a certificate of insurance from your insurance provider. This certificate is usually provided automatically when you purchase a business insurance policy.

If you need another copy of your certificate, you can either request it through your agent or visit your insurance company's online portal, if they have one. Most insurance companies will provide an ACORD certificate for various small business insurance policies, including general liability insurance, business owner's policy, commercial auto insurance, and workers' compensation insurance.

It is important to note that while an ACORD certificate is widely recognized and used by many insurance companies, it is not a requirement for proof of insurance. However, having one can provide peace of mind to potential business partners or clients and demonstrate that your business is protected from common risks.

Auto Accident: Insurance Record Impact

You may want to see also

What are the benefits of an ACORD certificate?

The ACORD certificate, also known as the ACORD 25 certificate, is a one-page document that summarises essential information about your business insurance policy. It is a universally recognised document that verifies your insurance coverage. Here are some benefits of the ACORD certificate:

Standardisation

The Association for Cooperative Operations Research and Development (ACORD) is an international nonprofit organisation that was created in the 1970s to standardise insurance forms. Before ACORD, every insurer had its own policy forms, which made things confusing for agents, brokers, and anyone who purchased business insurance. With ACORD, all insurance companies use the same forms, which makes it easier for everyone in the industry to work together. This also increases efficiency and accuracy in communications between carriers and business partners.

Compliance

ACORD forms are carefully crafted to align with regulatory requirements and industry standards, making them a great option for gaining confidence that you're providing the information required by regulations. ACORD also monitors changes that states make to their insurance regulations, so using an ACORD form ensures compliance with state laws.

Trust and Peace of Mind

The ACORD certificate is a trusted symbol in the insurance industry. It fosters trust between parties, ensuring that businesses are protected against potential liabilities. As a business owner, you can ask your vendors, subcontractors, and contractors for their ACORD certificates, and they can do the same for you. This provides legal security and peace of mind that everyone is insured and protected against potential claims.

Accessibility

ACORD forms are available in various formats, including printable documents, e-forms, and PDFs, making it convenient for users to access and fill out the forms.

Return-to-Invoice GAP Insurance: What's Covered?

You may want to see also

Frequently asked questions

An ACORD certificate is a document that proves you have insurance coverage. It is also known as an ACORD 25 certificate of insurance, certificate of insurance (COI) or a certificate of liability insurance.

An ACORD certificate covers essential information about your business insurance policy, such as the types of insurance coverage, the issuing insurance company, the policy effective date, and the policy expiration date.

As a business owner, you may need to provide proof of insurance to potential business partners or clients before doing business with them. An ACORD certificate serves as this proof and provides a snapshot of your coverage.

You can obtain an ACORD certificate from your insurance company when you buy a business insurance policy. If you need another copy, you can request it through your agent or through your insurance company's online portal.

Yes, ACORD certificates are secure, internationally recognized, and used by almost every insurance company in the country. They ensure standardization, making it easier for businesses to get the same document and information from their insurers. ACORD certificates are also faster to validate, always up-to-date, and quick to process.