Auto insurance companies can cancel your coverage at any time, but there are specific procedures to follow to avoid unnecessary costs. While you can cancel your policy at any time, it's important to be aware of potential cancellation fees and to give sufficient notice to your insurer. In some cases, you may need to pay a fee of around $50 or a small percentage of your final premium. To avoid a lapse in coverage, it's recommended to have a new policy in place before cancelling your current one.

| Characteristics | Values |

|---|---|

| Can you cancel your car insurance policy at any time? | Yes |

| Do you need to give a notice period? | In some cases, you may need to give a 30-day notice period. |

| What are the potential consequences of cancelling? | Cancellation fees, losing the chance to get a refund for advance payments, higher future premiums due to a lapse in coverage, fines and jail time for driving uninsured. |

| What is the cancellation process? | Contact your insurance provider, ask to speak to an agent about cancellation, send a cancellation letter or form, request a policy cancellation notice. |

| Will you get a refund? | Depends on the insurer and the circumstances. You may get a full or partial refund for unused prepaid premiums. |

What You'll Learn

Cancellation fees

Some insurers let you avoid the cancellation fee if you wait to cancel until the date your policy is set to expire.

If you cancel your policy without notifying your insurer, or you stop paying your premiums, you may be charged extra fees.

State laws can determine whether a cancellation fee is allowable. If so, it is up to the insurer to set that fee, which is often taken out of any refund.

Ontario's Cheapest Vehicle to Insure

You may want to see also

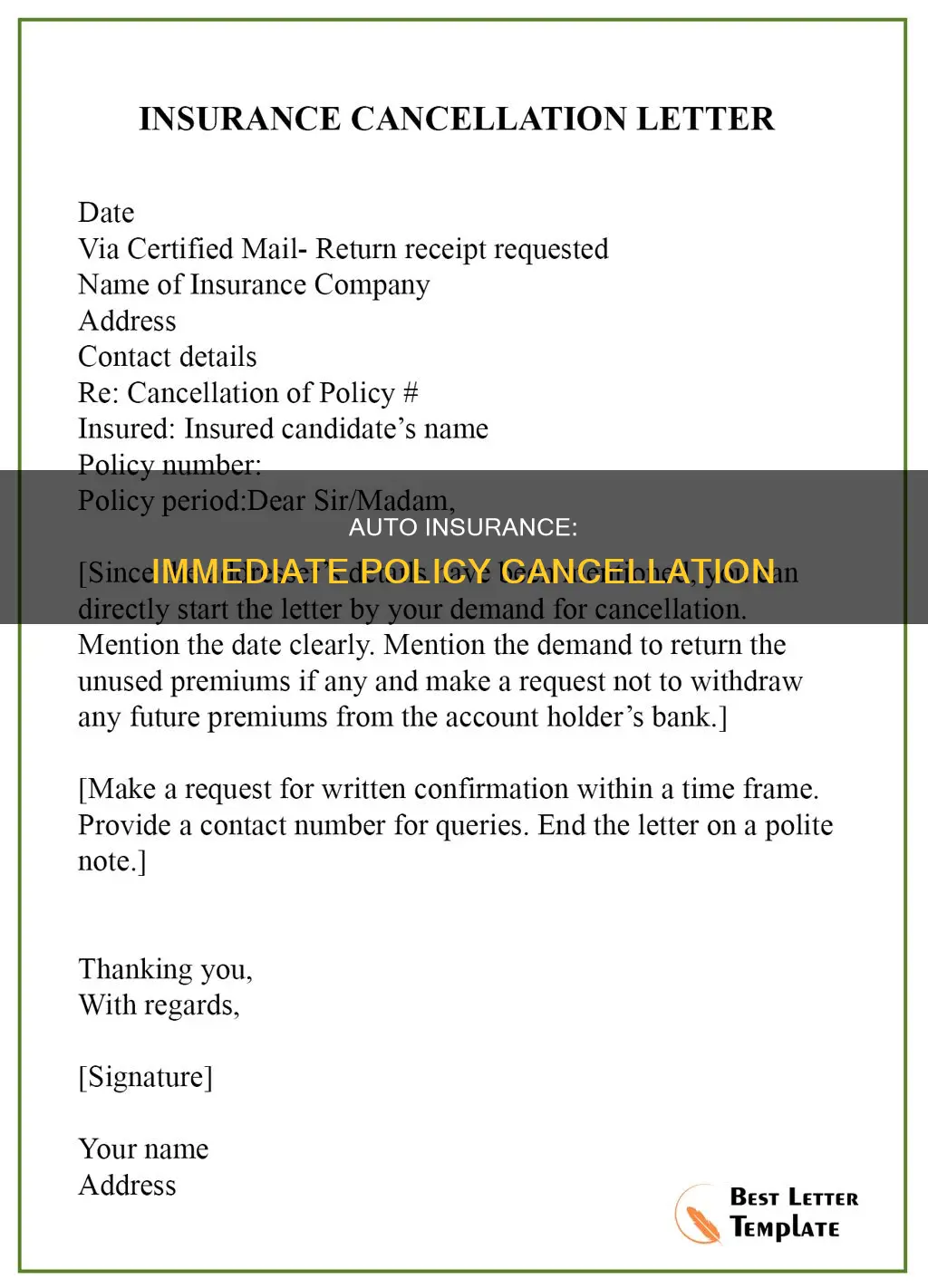

Cancellation letters

Understanding Cancellation Letters

- Date: Begin the letter with the current date.

- Recipient: Address the letter to the insurance company, specifically the cancellation department or a designated contact person.

- Policy Information: Provide your policy number, name, address, and other relevant personal details.

- Effective Date: Clearly state the date from which you want the cancellation to take effect.

- Reason for Cancellation: Explain why you are cancelling the policy. Common reasons include finding a better rate, dissatisfaction with service, or selling your vehicle.

- Request for Confirmation: Ask for written confirmation of the cancellation and specify a timeframe, such as within 30 days.

- Refund Request: If you have prepaid premiums, request a refund for the unused portion.

- Automatic Payment Cessation: If you have set up automatic payments, include a request to stop these deductions from your account.

Crafting a Professional Letter

When writing your cancellation letter, it's important to maintain a professional and courteous tone. Here are some tips to make your letter more effective:

- Proofread and Edit: Ensure your letter is free of spelling and grammatical errors. A well-written letter leaves a positive impression and helps streamline the cancellation process.

- Provide Contact Information: Include your contact information, such as phone number and email address, to facilitate easy communication.

- Be Concise and Clear: Express your intention to cancel the policy directly and clearly. Avoid unnecessary details that may complicate the message.

- Format and Structure: Use proper formatting, including appropriate margins, font style, and font size. Structure your letter with clear paragraphs and proper salutations.

- Signature: Sign the letter with your full name and consider including your contact information below the signature.

Sample Cancellation Letter

Below is a sample cancellation letter that you can use as a template:

" [Date]

To Whom It May Concern,

I am writing to request the cancellation of my auto insurance policy, [policy number], effective [date of cancellation]. As of that date, I will no longer require the coverage provided by your company. Please stop all automatic payments or debits from my account as of that date.

I kindly request written confirmation of the cancellation and a timely refund of any unused premiums. You can send the confirmation and refund to the following address:

[Your Name]

[Your Address]

[City, State, ZIP Code]

If you have any questions or concerns, please don't hesitate to contact me at [phone number] or [email address].

Thank you for your attention to this matter.

Sincerely,

[Your Signature]

[Your Full Name]"

Remember to retain a copy of the letter for your records and send it via certified mail or email, depending on your insurance company's preferences.

Chase Auto Loans: Gap Insurance Coverage

You may want to see also

Notice period

Some auto insurance companies require a notice period before you can cancel your policy. This is usually 30 days, but it's important to check with your insurance provider, as it can vary. If you don't give enough notice, you may be charged a cancellation fee, and your new policy may become effective before your old one concludes, creating a lapse in coverage. This could lead to higher rates in the future.

To avoid any issues, it's best to contact your insurance provider and ask about their specific cancellation policy. They will be able to guide you through the process and let you know what steps you need to take. It's also a good idea to ask about any cancellation fees or refunds you may be entitled to.

If you are switching insurance providers, it's essential to have your new policy in place before cancelling your old one to ensure there is no gap in coverage.

Vehicle Teardown: Pre-Insurance Inspection Essential?

You may want to see also

Contacting your insurance company

- Review your policy documents: Before initiating contact, thoroughly review your policy documents, including the fine print. These documents will outline the specific cancellation guidelines, requirements, and procedures stipulated by your insurance company. Understanding these details will help you navigate the process more effectively.

- Choose your preferred method of contact: Different insurance companies offer various methods of communication. Some common options include contacting your insurance agent or company representative through a phone call, email, mobile app, or in-person meeting. Choose the method that is most convenient and accessible for you.

- Gather relevant information: Before making contact, ensure you have all the necessary information at hand. This includes your policy number, personal details, and the desired cancellation date. Having this information readily available will streamline the process and help you provide the necessary details during the interaction.

- Initiate contact and discuss cancellation: Using your chosen method of communication, reach out to your insurance company and express your intention to cancel your auto insurance policy. Be clear about your desire to cancel and provide the requested information, such as your policy number and desired cancellation date. Ask any questions you may have about the process, requirements, and potential consequences.

- Understand the cancellation process and requirements: During your interaction with the insurance company, seek clarification on the specific steps and procedures involved in cancelling your policy. Ask about any documentation or forms that need to be completed, such as a cancellation letter or form. Inquire about potential cancellation fees, refunds, and the timeline for processing your request.

- Address any concerns or issues: If you have any concerns or issues regarding the cancellation, be sure to address them with the insurance company representative. This may include discussing alternatives to cancellation, such as suspending your policy or reducing your coverage. Ask about the potential impact on your premiums, future rates, and any legal or financial risks associated with cancelling your policy.

- Follow up with documentation: After your initial contact, follow up with any required documentation, such as a cancellation letter or form. Be sure to include all the necessary details, such as your policy number, name, and desired cancellation date. Send this documentation to the designated person or department within the insurance company, following their specified guidelines.

- Request confirmation of cancellation: Once you have submitted your cancellation request and any required documentation, ask for confirmation that your policy has been officially cancelled. This confirmation can be in the form of a letter, email, or any other method that provides you with a record of the transaction. This step ensures that both parties are in agreement and that your request has been processed accordingly.

- Be mindful of potential consequences: When cancelling your auto insurance policy, be aware of potential consequences, such as cancellation fees, increased future rates, or legal implications. Discuss these possibilities with the insurance company representative to understand how they may apply in your specific situation.

- Seek clarification on refunds: If you have prepaid your premiums, inquire about the possibility of a refund for the unused portion of your policy. Understand the insurer's refund policy and the process for obtaining any money owed to you. Ask about the timeline for receiving the refund and the method of payment.

Auto Insurance Escrow: How Does It Work?

You may want to see also

Getting a refund

If you have paid your premium in advance and cancel your policy before the end of the term, the insurance company might refund the remaining balance. The amount of the refund will depend on how much of the premium you paid in advance and how much time is left on your policy. Most auto insurers will prorate your refund based on the number of days your current policy was in effect.

If you pay in monthly installments and cancel your policy at the end of the month or billing cycle, you probably won't get a refund. However, if you cancel in the middle of the month or billing cycle, you may get a refund for the rest of that month.

Whether you pay monthly or upfront, you may have to pay a cancellation fee when you cancel your policy. This will depend on your insurer and the laws in your state. Cancellation fees can be a flat fee or a short-rate fee, which is usually around 10% of the unearned premium.

If you sell your car, your insurance company may send you a refund check if your policy is canceled before the end of its term. However, you may have to pay a cancellation fee in this scenario.

If you make changes to your policy, such as decreasing your coverage limits or removing a vehicle from your policy, you may also get a refund. However, you may receive a credit on your account instead of a refund, depending on your insurer.

If your insurance company cancels your policy, you will usually receive a refund unless they cancel for non-payment or another violation of the insurance agreement. In this case, you will not receive a refund and will continue to owe the insurer any unpaid premiums.

Umbrella Insurance: New Vehicle, New Policy?

You may want to see also

Frequently asked questions

Yes, your insurance company can cancel your coverage. If you don't pay your premium on time, lie on your auto application, or your driver's license gets suspended or revoked, your insurer could cancel your policy.

If your policy is cancelled, you can shop for a new policy from another auto insurance company, but be prepared to pay higher rates. Since you're now considered a high-risk driver, you may have to buy non-standard auto insurance.

Yes, you can cancel your auto insurance policy at any time. However, some insurance companies may require a 30-day notice before you can cancel, so it's important to check your insurer's specific cancellation policy to avoid paying cancellation fees or losing your chance to get a refund for any advance payments.