Chase offers Guaranteed Asset Protection (GAP) insurance, which covers the difference between the value of a vehicle determined by an insurance company and the account balance if the car is stolen and not recovered or is damaged beyond repair. GAP insurance is optional and can be purchased from an auto insurer after buying a car. It is important to note that GAP insurance is separate from comprehensive insurance and helps pay the remaining balance owed on a loan. While Chase offers GAP insurance, it is not clear if it is included for free in all states or only in certain states like New York.

| Characteristics | Values |

|---|---|

| What is GAP insurance? | GAP insurance may be sold by the dealer at the time of sale or can be purchased from an auto insurer after you buy your car. This product is in addition to your comprehensive insurance and agrees to pay the bank some or all of the remaining balance owed. |

| What is a GAP waiver? | A GAP waiver is more commonly sold by auto dealers and can only be purchased at the time you buy your car. This product may cancel or “waive” some or all of the remaining balance owed. |

| When is GAP insurance useful? | If you finance a significant portion of your auto purchase, then you may owe more than the value of your car. In this case, the difference is called the “gap”. Auto insurance companies typically pay the value of your car rather than the amount remaining owed on your loan. These products may help reduce the amount owed when the proceeds from your insurance company are not enough to pay off the remaining balance owed. |

| When is GAP insurance required? | In some states, you are required to have GAP insurance on a vehicle if there is a loan on it. |

| Is GAP insurance free? | In some states, GAP insurance is offered for free. In New York, for example, many lenders include it at no cost. |

What You'll Learn

- Chase GAP insurance may be included for free in some states

- GAP insurance is optional and can be purchased from an auto insurer after buying a car

- GAP insurance is also available from dealers at the time of sale

- GAP insurance may be included for free on Chase bank loans

- GAP insurance covers the difference between the value of the vehicle and the loan balance

Chase GAP insurance may be included for free in some states

In some states, such as New York, lenders are required to offer GAP insurance, and it is often included at no extra cost. This is due to strong consumer protection laws in these states. For example, one user on Reddit reported that their daughter's car was totalled less than three months after purchase, and they found out that Chase automatically includes GAP insurance on all of their New York auto loans.

However, it is important to note that GAP insurance is not always free, and the cost can vary significantly depending on the state and the lender. In some cases, it can be purchased from the dealer at the time of sale or from an auto insurer after buying the car. It is also worth mentioning that GAP insurance is different from a GAP waiver, which is more commonly sold by auto dealers and can only be purchased at the time of the car's purchase.

Ultimately, whether or not Chase includes GAP insurance for free will depend on the state and the specific terms of the loan. It is always a good idea to carefully review the contract and understand all the details, terms, and conditions related to any voluntary protection or aftermarket products offered.

Insuring Antique Vehicles: Registration Requirements

You may want to see also

GAP insurance is optional and can be purchased from an auto insurer after buying a car

When buying a car, Guaranteed Asset Protection (GAP) insurance is an optional form of coverage that can be purchased from an auto insurer. GAP insurance is not mandatory, but it can provide valuable financial protection in certain situations.

If you finance a significant portion of your vehicle's purchase, you may owe more than the car's market value. In such cases, if your car is stolen and not recovered, or damaged beyond repair and declared a total loss, standard auto insurance policies will only cover the vehicle's current value, leaving you with a financial gap to cover. This is where GAP insurance comes into play. It helps bridge this financial gap by paying off the remaining balance on your loan or lease.

While some auto dealers may offer GAP insurance at the time of purchase, it is not mandatory to accept it. You have the option to purchase GAP insurance from a third-party insurer after buying your car. This allows you to shop around for the best rates and choose a policy that suits your needs.

It is important to note that GAP insurance is not necessary for everyone. If you have made a substantial down payment on your vehicle or plan to pay off your loan in a short period, the risk of owing more than the car's value is reduced. However, if you find yourself in a situation where the loan amount exceeds the car's value, you can consider purchasing GAP insurance to protect yourself from potential financial burden.

Additionally, it is worth mentioning that GAP insurance is separate from your comprehensive and collision insurance. While these coverages are often required by lenders, they only pay the actual cash value of the vehicle in the event of a total loss. GAP insurance specifically covers the difference between the car's value and the remaining loan balance, ensuring that you are not left with unexpected debt.

Red Alert: Are Your Wheels Covered?

You may want to see also

GAP insurance is also available from dealers at the time of sale

When purchasing a new car, Guaranteed Asset Protection (GAP) insurance is typically available from the dealer at the time of sale. This type of insurance is optional but may be required by your lender when financing your car. It is meant to protect you in case your car is stolen and not recovered, or damaged beyond repair and declared a total loss.

GAP insurance is designed to cover the difference between the value of your vehicle and the amount you still owe on your loan or lease. This difference, or "gap", can occur because auto insurance companies typically pay the value of your car rather than the amount remaining on your loan. By purchasing GAP insurance, you can reduce the amount you owe or even have your remaining loan balance taken care of.

GAP insurance can be purchased from your auto dealer at the time of sale or added to your existing auto insurance policy after you have bought your car. When purchased from a dealer, GAP insurance is usually included in the vehicle price and can cost several hundred dollars or more, spread equally throughout your loan payments with interest. On the other hand, adding GAP coverage to your auto insurance policy will typically result in a minimal increase in your premium.

It is important to note that GAP insurance is not necessary if you are not financing or leasing your car. However, if you are financing your vehicle, it can be a good idea to consider GAP coverage, especially if you have a small down payment, a long finance period, or a vehicle that depreciates quickly.

Before purchasing GAP insurance, be sure to review the terms and conditions, understand the coverage and exclusions, and compare the cost with the potential value of the insurance for your specific situation.

Gap Insurance: Dealerships' Secret Weapon

You may want to see also

GAP insurance may be included for free on Chase bank loans

GAP insurance is an optional form of coverage that may be included for free on Chase bank loans. GAP insurance is designed to protect you in the event that your car is stolen and not recovered, or is damaged beyond repair and declared a total loss. If you have financed a significant portion of your auto purchase, you may owe more than the value of your car. In this case, the difference is called the "gap". Auto insurance companies typically pay the value of your car rather than the amount remaining on your loan. This is where GAP insurance comes in – it may help reduce the amount you owe, or even take care of your remaining loan balance, when the payout from your insurance company is not enough to cover the remaining balance.

While GAP insurance is not always included for free on Chase bank loans, there have been instances where it has been. For example, one person on Reddit shared that their daughter bought a Subaru with a loan from Chase, and when the car was totalled, they found out that Chase had automatically included GAP insurance on the loan. Another person on the same Reddit thread said that they work for an auto group based out of New York and that they "ALWAYS gave away GAP for free". They pitched it as a "benefit" to customers.

It's important to note that GAP insurance is not required when you buy or finance a vehicle. It is usually sold by the dealer at the time of sale, or can be purchased from an auto insurer after you buy your car. If you are interested in GAP insurance, be sure to ask your dealer or lender about it.

If you have a Chase bank loan and are unsure whether GAP insurance is included, be sure to carefully review your contract.

MCA Assessments: Vehicle Insurance Explained

You may want to see also

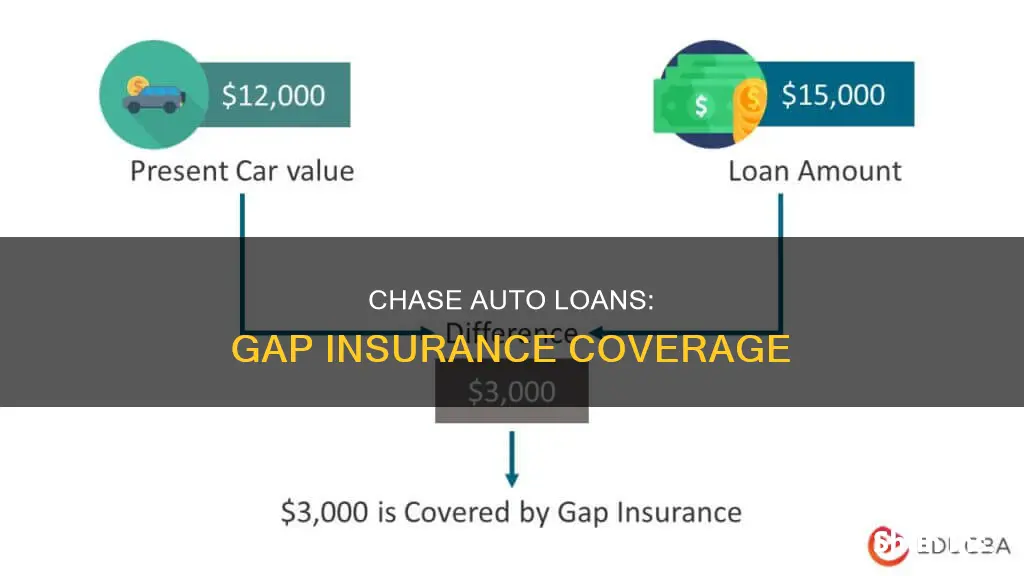

GAP insurance covers the difference between the value of the vehicle and the loan balance

Guaranteed Asset Protection (GAP) insurance covers the difference between the value of a vehicle and the remaining loan balance in the event of a total loss. This includes situations where the vehicle is stolen and not recovered, or damaged beyond repair and declared a total loss.

If you finance a significant portion of your vehicle, you may owe more than the value of your car. In this case, the difference is called the "gap". Auto insurance companies typically pay the value of your car rather than the amount remaining on your loan. This is where GAP insurance comes in, as it may help reduce the amount owed or even take care of your remaining loan balance.

For example, let's say you purchased a new car with a sticker price of $28,000 and made a 10% down payment, bringing your loan cost to $25,200. With a five-year auto loan and a 0% financing deal, your monthly payment is $420. After 12 months, you've paid $5,040 and still owe $20,160.

Now, let's say your car is totaled in an accident. The insurance company calculates the current value of the vehicle, which has depreciated by 20% since you purchased it. The current value is $22,400. Your GAP insurance will cover the remaining $2,240 that you owe on the loan.

However, if your car depreciated by 30% since you purchased it, the insurance payout would be $19,600. In this case, you would owe your lender $560, and GAP insurance would again cover the difference.

GAP insurance is typically offered by dealers at the time of sale or can be purchased from an auto insurer after buying your car. It is important to note that GAP insurance is optional and not required by any insurer or state. However, some lenders or leasing companies may require it, especially if you finance a significant portion of your vehicle's purchase price.

Insuring Off-Road Vehicles: Tag-Based Policies

You may want to see also

Frequently asked questions

Chase offers Guaranteed Asset Protection (GAP) insurance and GAP waivers. These products are offered to customers who have financed the purchase of their car.

GAP insurance covers the difference between the value of a car and the loan balance if the car is stolen and not recovered, or damaged beyond repair and declared a total loss.

Check your contract to see if you purchased a GAP product. You can also contact the Total Loss Department at 1-866-300-5141, Monday–Friday from 9 AM to 5:30 PM ET, to discuss your claim.

You may be eligible for a refund if you cancel your GAP insurance. Contact your dealer or the product administrator listed on the product agreement to request a cancellation.

In some states, you are required to have GAP insurance if you have a loan on your vehicle. However, this may vary depending on the state and the lender.