Driving for root insurance can be a great way to save money on your car insurance premiums. It involves keeping your car in a secure location, such as a garage or driveway, for a significant portion of the year. This practice can reduce the risk of theft and damage, which in turn can lower your insurance costs. In this guide, we'll explore the benefits of driving for root insurance, provide tips on how to choose the right policy, and offer advice on how to maintain a safe and secure vehicle to maximize your savings.

What You'll Learn

- Understanding Root Insurance: Know coverage, benefits, and requirements for root insurance

- Choosing the Right Plan: Select a plan based on your driving habits and needs

- Safe Driving Techniques: Practice defensive driving to reduce claims and save on premiums

- Vehicle Maintenance: Regular maintenance ensures optimal performance and lower insurance costs

- Claims Process: Understand how to file a claim and what to expect

Understanding Root Insurance: Know coverage, benefits, and requirements for root insurance

Root Insurance is a unique and innovative approach to car insurance, designed specifically for young drivers. It offers a range of benefits and coverage options tailored to the needs of new and inexperienced drivers, often at competitive rates. Understanding the specifics of Root Insurance is crucial for anyone looking to secure affordable and comprehensive coverage.

Coverage and Benefits:

Root Insurance provides a comprehensive set of coverage options, including liability, collision, and comprehensive insurance. One of its key advantages is the ability to customize your policy based on your driving habits and vehicle. For instance, you can opt for usage-based insurance, where your premium is adjusted based on your driving performance and frequency. This encourages safe driving habits and can lead to significant savings over time. The policy also covers a wide range of incidents, from accidents and theft to natural disasters, ensuring that young drivers are protected in various scenarios.

Requirements and Eligibility:

To be eligible for Root Insurance, you typically need to be a young driver, usually under the age of 25. The company focuses on providing insurance for individuals who are new to the driving world. One of the requirements is to have a valid driver's license and a clean driving record. Root Insurance also considers your vehicle's make, model, and usage. For instance, insuring a high-performance car might come with different terms and conditions compared to a standard sedan. Additionally, you may need to provide proof of residency and financial information to ensure you meet the eligibility criteria.

Driving Behavior Monitoring:

A unique feature of Root Insurance is its emphasis on monitoring driving behavior. They use an app or device that tracks your driving patterns, including speed, acceleration, and braking. This data helps in assessing your driving skills and can lead to personalized discounts. For instance, consistent safe driving might result in lower premiums over time. This approach also allows the insurance company to identify and reward safe drivers, making it an attractive option for those who want to prove their responsibility behind the wheel.

Getting Started with Root Insurance:

To initiate the process, you'll need to visit the Root Insurance website or download their app. Here, you can request a quote based on your personal details and vehicle information. The application process is straightforward, and you may be required to provide additional documentation. Once approved, you can choose your coverage options and set up a payment plan. Root Insurance often offers flexible payment methods, making it accessible to a wide range of young drivers.

In summary, Root Insurance is a specialized provider catering to the specific needs of young drivers. By understanding the coverage, benefits, and requirements, you can make an informed decision about your insurance options. This type of insurance encourages safe driving practices and provides a cost-effective solution for those seeking affordable coverage.

Protect Your Travel: Weighing the Benefits of Ticket Insurance

You may want to see also

Choosing the Right Plan: Select a plan based on your driving habits and needs

When it comes to selecting the appropriate plan for your Root Insurance, it's crucial to consider your unique driving habits and requirements. Root Insurance offers a personalized approach to car insurance, allowing you to choose the coverage that best fits your needs. Here's a guide to help you make an informed decision:

Assess Your Driving Profile: Begin by evaluating your driving habits. Are you a frequent city driver or do you mostly commute on highways? Do you drive long distances for work or leisure? Understanding your typical driving patterns is essential. For instance, if you frequently drive in urban areas with heavy traffic, you might want to consider a plan that provides comprehensive coverage for potential accidents and minor collisions. On the other hand, if you drive less frequently, a more basic plan might suffice.

Consider Your Vehicle and Usage: The type of vehicle you drive and how you use it play a significant role in plan selection. If you own a high-performance or luxury car, you may want to opt for a higher level of coverage to protect your investment. Additionally, if you use your vehicle for business purposes, you'll need a plan that accommodates commercial usage and provides the necessary liability coverage. Root Insurance offers flexible options to cater to various vehicle types and usage scenarios.

Review Coverage Options: Root Insurance provides a range of coverage options to choose from. These typically include liability, collision, comprehensive, and personal injury protection. Liability coverage is mandatory and protects you against claims from other drivers for bodily injury or property damage. Collision coverage pays for repairs to your vehicle if you're in an accident, while comprehensive coverage offers protection against non-collision incidents like theft, vandalism, or natural disasters. Personal injury protection covers medical expenses for you and your passengers.

Tailor Your Plan: Root Insurance's unique feature is its ability to tailor plans based on your driving behavior. They use a usage-based insurance model, where your driving habits can influence your premium. If you drive safely and responsibly, you might be eligible for discounts and lower premiums. Conversely, aggressive driving or frequent claims may result in higher rates. This approach encourages safe driving and provides an incentive to maintain a good driving record.

Compare and Adjust: When choosing a plan, compare different coverage options and their associated costs. Root Insurance's platform allows you to customize your policy, ensuring you only pay for the coverage you need. You can start with a basic plan and add or remove coverage as required. Regularly reviewing and adjusting your policy will ensure that you have the right level of protection without overpaying.

Discount Auto Insurance: Legit or a Scam?

You may want to see also

Safe Driving Techniques: Practice defensive driving to reduce claims and save on premiums

Safe driving is a crucial aspect of maintaining a good relationship with your insurance provider, especially when it comes to companies like Root Insurance that offer usage-based insurance. Defensive driving techniques not only help you stay safe on the road but also contribute to lower insurance premiums and a reduced number of claims. Here's a guide on how to master these techniques and benefit from them:

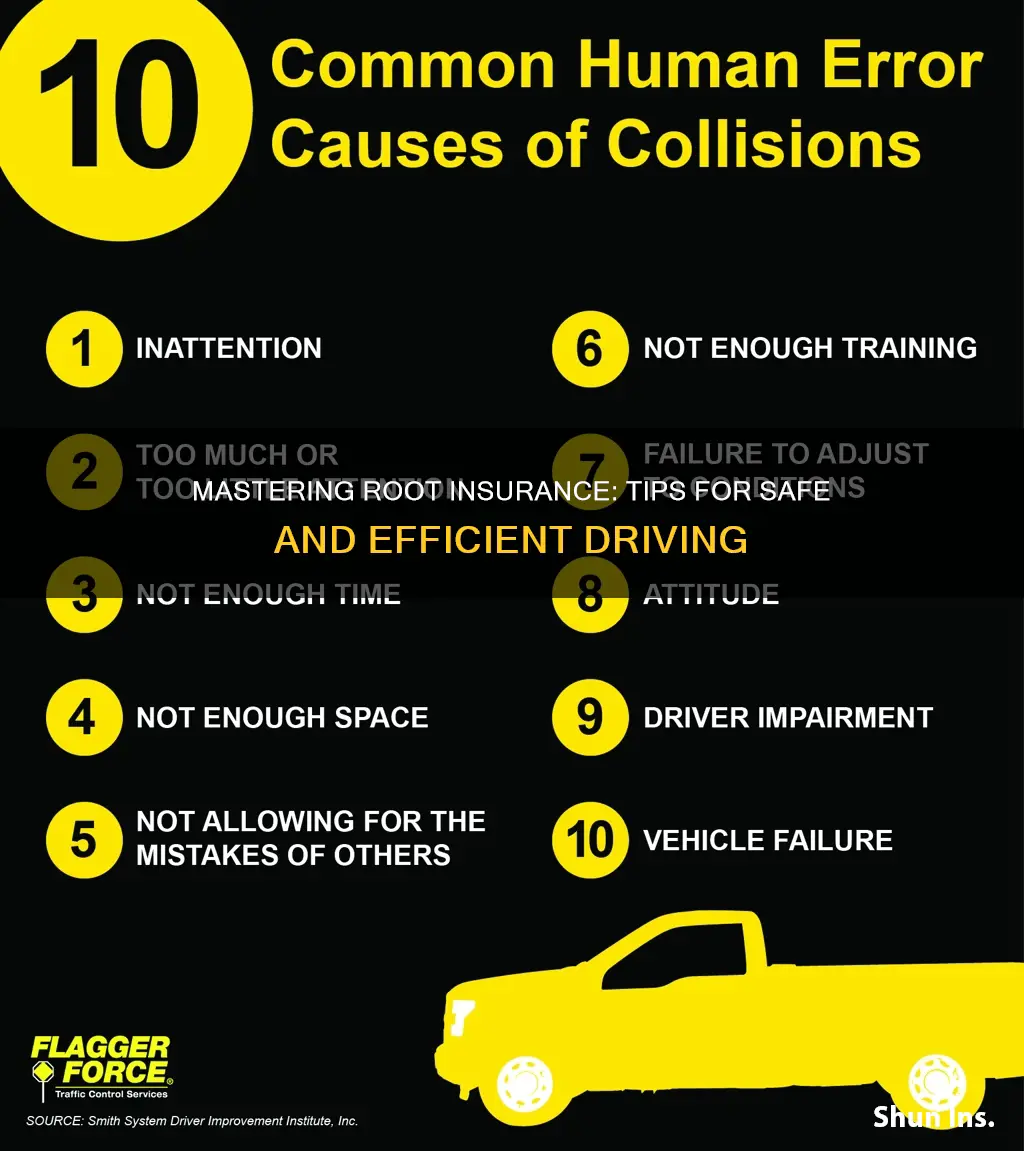

Understand Defensive Driving: Defensive driving is a mindset and a set of skills that enable you to anticipate and respond to potential hazards on the road. It involves constant awareness, quick decision-making, and maintaining control of your vehicle. The goal is to avoid accidents and minimize the risk of damage, which directly translates to fewer insurance claims.

Stay Focused and Aware: One of the fundamental practices of defensive driving is maintaining concentration. Keep your eyes scanning the road ahead, checking mirrors frequently, and being mindful of your surroundings. Pay attention to other drivers' behaviors, road conditions, and potential obstacles. This awareness allows you to react promptly to any sudden changes or dangers.

Anticipate and Plan: Anticipation is a powerful tool in defensive driving. Try to predict potential risks and plan your actions accordingly. For example, if you see a car running a red light, prepare to slow down or take evasive action. Similarly, when driving in heavy traffic, anticipate the actions of other drivers and plan your lane changes or speed adjustments in advance. This proactive approach can significantly reduce the chances of accidents.

Maintain a Safe Following Distance: Keeping a safe distance from the vehicle ahead is essential. It provides you with more time to react and stop if they suddenly brake or slow down. The general rule is to maintain at least a two-second gap, but in adverse weather conditions, or when driving at higher speeds, increase this distance. This technique helps prevent rear-end collisions and gives you a better chance of avoiding accidents caused by sudden stops.

Master Smooth Driving: Aggressive driving behaviors, such as rapid acceleration, frequent braking, and sudden lane changes, increase the likelihood of accidents. Instead, practice smooth and controlled driving. Accelerate and decelerate gradually, and use your brakes gently but firmly when needed. Smooth driving not only improves road safety but also contributes to better fuel efficiency, which can indirectly lead to lower insurance premiums.

Practice Regular Vehicle Maintenance: Well-maintained vehicles are less likely to break down or experience mechanical failures, which could lead to accidents. Regularly check your tire pressure, ensure proper brake function, and keep your lights and signals in good working order. Address any mechanical issues promptly to avoid unexpected breakdowns while driving.

By adopting these safe driving techniques, you not only enhance your overall driving skills but also demonstrate to your insurance company that you are a responsible and cautious driver. This can result in lower insurance premiums and a better driving record. Remember, defensive driving is a skill that improves with practice, and it plays a vital role in keeping yourself and others safe on the roads.

Auto Insurance Discounts: How to Save on Your Policy

You may want to see also

Vehicle Maintenance: Regular maintenance ensures optimal performance and lower insurance costs

Regular vehicle maintenance is an essential practice that not only ensures your car runs smoothly but also plays a significant role in reducing insurance premiums. By keeping your vehicle in top condition, you can avoid costly repairs and potential safety hazards, which are often factors that insurance companies consider when determining rates. This proactive approach to car care is a win-win situation, as it benefits both you and your insurance provider.

One of the key aspects of vehicle maintenance is adhering to a regular service schedule. Most modern cars come with a built-in maintenance reminder system, which alerts you when it's time for an oil change, fluid top-ups, or other routine checks. These services are designed to keep your engine lubricated, ensure proper cooling, and maintain optimal performance. By following the manufacturer's recommendations, you can prevent premature wear and tear, extend the lifespan of your vehicle, and potentially lower the risk of breakdowns or major issues that might lead to higher insurance claims.

During routine maintenance, mechanics will inspect various components, including the engine, transmission, brakes, and suspension. They will look for signs of wear, corrosion, or damage that could impact safety and performance. Addressing these issues promptly can prevent them from escalating into more significant problems, which often result in higher repair costs. For instance, regular brake inspections and pad replacements can ensure safe and efficient braking, reducing the likelihood of accidents and associated insurance liabilities.

Additionally, keeping your vehicle clean and well-maintained can have visual benefits that may impact insurance rates. A clean car appears well-cared for, which can be perceived as a sign of responsibility and attention to detail. This is especially important if you plan to sell your car, as a well-maintained vehicle can fetch a higher price, potentially saving you money in the long run.

In summary, regular vehicle maintenance is a crucial habit for any car owner. It not only ensures your safety on the road but also contributes to the longevity of your vehicle. By staying on top of routine checks and addressing any issues promptly, you can avoid costly repairs and potentially lower your insurance premiums. Remember, a little preventative care goes a long way in keeping your car running smoothly and keeping your insurance costs in check.

Auto Hail Damage: Filing an Insurance Claim

You may want to see also

Claims Process: Understand how to file a claim and what to expect

The claims process for Root Insurance is designed to be straightforward and efficient, ensuring that you receive the support you need after an accident. Here's a step-by-step guide to help you navigate the process:

Reporting the Incident: As soon as possible after an accident, contact Root Insurance. You can file a claim by calling their customer service hotline or using their online portal. Provide details such as the date, time, and location of the accident, as well as the other driver's information (if available). Root's team will guide you through the necessary steps and may ask for specific documentation.

Documentation and Evidence: Root Insurance will request various documents to support your claim. This typically includes police reports, witness statements, medical records (if you or anyone else involved in the accident requires medical attention), and photos or videos of the accident scene and vehicle damage. Ensure that you gather and submit these documents promptly to expedite the claims process.

Claim Assessment: Once Root receives your claim, their team will review the information and evidence provided. They will assess the circumstances of the accident, determine liability, and calculate the compensation. This process may involve communicating with the other party's insurance company and adjusting for any applicable deductibles. Root aims to provide a fair and transparent assessment, and they will keep you informed throughout.

Compensation and Settlement: If the claim is approved, Root Insurance will inform you of the compensation amount. This may include coverage for vehicle repairs, medical expenses, or other related costs. The settlement process can vary depending on the specific circumstances of the accident. Root may offer a direct payment to cover the expenses or facilitate repairs through an approved repair shop. It is essential to understand the terms and conditions of the settlement to ensure a smooth resolution.

Follow-up and Support: Root Insurance is committed to providing ongoing support during and after the claims process. They will assign a dedicated claims adjuster to handle your case and answer any questions. If there are any complications or disputes, the adjuster will work with you to find a resolution. Remember, Root's goal is to make the claims process as stress-free as possible, so don't hesitate to reach out for assistance.

Auto Insurance for Non-US Licensed Drivers: Who's Covered?

You may want to see also

Frequently asked questions

Root Insurance is a usage-based insurance company that offers personalized car insurance based on how you drive. It provides coverage for liability, collision, comprehensive, and personal injury protection. The policy is designed to reward safe drivers with lower premiums and offer discounts for safe driving habits.

To sign up, you can download the Root app on your smartphone. The app uses your phone's sensors to monitor your driving behavior. You'll need to provide some basic information, such as your email address and phone number, and then you can start driving and earning safe driving points.

The Root app offers several advantages. It provides real-time feedback on your driving, helping you improve your skills. You can also track your progress and see how your driving habits impact your insurance rates. Additionally, the app allows you to manage your policy, make payments, and receive notifications about your coverage.

To get the most out of your Root Insurance policy, focus on safe driving. The more consistently safe you drive, the more points you'll earn, and the lower your premiums will be. Avoid traffic violations, maintain a steady driving record, and consider taking defensive driving courses to further enhance your safety score.