Drive insurance, also known as pay-as-you-go insurance or usage-based insurance, is a type of car insurance that offers a unique approach to coverage. Instead of traditional premiums based on age, driving record, or vehicle value, drive insurance calculates premiums based on the actual usage and driving behavior of the policyholder. This innovative model uses technology, such as telematics devices or smartphone apps, to monitor driving patterns, including mileage, speed, and braking. By analyzing this data, insurers can provide personalized policies, often with lower premiums for safe drivers, and offer a more tailored and cost-effective insurance experience.

What You'll Learn

- Coverage Types: Comprehensive, collision, liability, and more

- Policy Details: Deductibles, premiums, and coverage limits

- Vehicle-Specific Insurance: Customized plans for different car types

- Claims Process: Filing claims, documentation, and claim settlements

- Add-Ons and Discounts: Roadside assistance, rental car coverage, and discounts

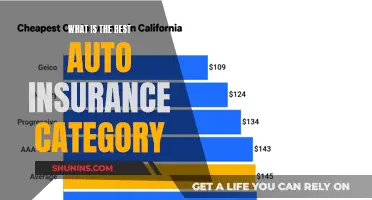

Coverage Types: Comprehensive, collision, liability, and more

Drive insurance, also known as auto insurance, is a crucial financial safeguard for vehicle owners and drivers. It provides coverage for various risks and liabilities associated with operating a motor vehicle. Understanding the different types of coverage available is essential for drivers to ensure they have adequate protection. Here's an overview of the primary coverage types:

Comprehensive Coverage: This type of insurance offers extensive protection beyond the basic liability coverage. It typically includes damage caused by natural disasters like earthquakes, floods, or wildfires, as well as theft and vandalism. Comprehensive insurance also covers non-collision incidents, such as damage from falling objects, animal collisions, or even fire. For instance, if a tree falls on your car during a storm, comprehensive insurance would cover the repairs or replacement. This coverage is especially valuable for those living in areas prone to severe weather events or high crime rates.

Collision Coverage: Collision insurance is designed to cover the costs associated with repairing or replacing your vehicle after a collision with another car, object, or even a deer. It is particularly useful when you have a loan or lease on your vehicle, as it helps protect the lender's interests. In the event of a collision, the insurance company will pay for the repairs, and you'll typically be responsible for a deductible amount. Collision coverage is beneficial for newer vehicles, as older cars may not require this level of protection.

Liability Coverage: Liability insurance is a fundamental component of drive insurance and is legally required in most places. It covers the financial responsibility of the policyholder (the driver) if they are found at fault in an accident. Liability coverage includes bodily injury liability, which pays for medical expenses and legal fees for the injured parties, and property damage liability, which covers repairs or replacements for the other driver's vehicle. For example, if you cause a minor fender-bender, your liability insurance will cover the other driver's car repairs.

Other Coverage Types:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you when involved in an accident with a driver who has insufficient or no insurance. It covers your medical expenses and vehicle repairs.

- Medical Payments/No-Fault Insurance: In certain states, this coverage pays for medical expenses of all passengers and the driver after an accident, regardless of fault.

- Roadside Assistance: This optional coverage provides help with flat tires, towing, fuel delivery, and other roadside emergencies.

- Rental Reimbursement: If your car is being repaired, this coverage pays for the cost of renting a temporary vehicle.

When choosing drive insurance, it's essential to consider your specific needs, the value of your vehicle, and the driving conditions in your area. Each coverage type serves a unique purpose, and combining them can provide comprehensive protection. Reviewing your policy regularly and adjusting it as needed ensures that you have the right level of coverage for your driving circumstances.

Boating DUI: Auto Insurance Impact

You may want to see also

Policy Details: Deductibles, premiums, and coverage limits

Drive insurance, also known as usage-based insurance or pay-how-you-drive insurance, is a type of auto insurance that tailors coverage based on an individual's driving habits and behavior. This innovative approach to insurance offers a more personalized and potentially cost-effective solution for drivers. Here, we delve into the specifics of policy details, focusing on deductibles, premiums, and coverage limits.

Deductibles:

Deductibles are a crucial aspect of any insurance policy, representing the amount a policyholder must pay out of pocket before the insurance coverage kicks in. In drive insurance, deductibles can vary depending on the insurance provider and the driver's profile. Typically, drivers are given the option to choose their deductible amount, which directly impacts the premium cost. A higher deductible often results in a lower monthly premium, as the driver assumes more financial responsibility in the event of a claim. For instance, if a driver selects a $500 deductible, they would pay this amount themselves before the insurance company covers the remaining costs for any eligible claims.

Premiums:

Premiums are the regular payments made by the policyholder to the insurance company to maintain coverage. In drive insurance, premiums are calculated based on various factors, including driving history, vehicle type, and the chosen deductible. The more comprehensive and safer a driver's record, the lower the premium is likely to be. Additionally, the type of vehicle insured can influence premium rates, with sports cars or high-performance vehicles often commanding higher premiums due to increased risk. It's essential for drivers to understand that drive insurance premiums can fluctuate over time, especially if their driving behavior or circumstances change.

Coverage Limits:

Coverage limits refer to the maximum amount an insurance company will pay for a specific claim or type of loss. In drive insurance, coverage limits can vary widely depending on the policy and the insurance provider's offerings. These limits are set to protect both the insurance company and the policyholder. For instance, a collision coverage limit might be set at $10,000, meaning the insurance company will pay up to that amount for vehicle repairs or replacement in the event of a collision. It's crucial for drivers to carefully review and select appropriate coverage limits that align with their financial situation and potential risks.

Understanding the intricacies of deductibles, premiums, and coverage limits is essential for drivers to make informed decisions when selecting drive insurance. These policy details can significantly impact the overall cost and coverage of the insurance, allowing drivers to customize their policy to better suit their needs and driving habits.

Uninsured Motor Vehicle Insurance: What's Covered?

You may want to see also

Vehicle-Specific Insurance: Customized plans for different car types

Vehicle-specific insurance is a tailored approach to car coverage, recognizing that different vehicles have unique characteristics and risks. This type of insurance is designed to provide customized plans for various car types, ensuring that drivers receive appropriate protection based on their vehicle's specific needs. By considering the make, model, age, and usage of a car, insurers can offer more precise and relevant coverage options.

For instance, a classic car, an antique or a vintage vehicle, requires a different insurance approach compared to a modern sports car or a family sedan. Classic car insurance often focuses on the car's value and historical significance, providing coverage for restoration, maintenance, and participation in events. In contrast, a high-performance sports car may need specialized insurance that accounts for its powerful engine, advanced technology, and potential for high-speed driving, including coverage for modifications and enhanced liability protection.

When it comes to family cars, insurers might offer comprehensive coverage that includes collision, comprehensive, and liability insurance. These plans are designed to protect the vehicle and its occupants in various scenarios, such as accidents, theft, natural disasters, and liability claims. The insurance policy can be customized to include specific coverage for the car's features, such as advanced driver-assistance systems, adaptive cruise control, or lane-keeping assist, which may require additional protection.

Additionally, the usage of a vehicle plays a significant role in determining insurance coverage. For example, a car primarily used for commuting to work or running errands may benefit from a more standard insurance plan that covers everyday risks. However, a vehicle used for business purposes, such as a taxi or a delivery truck, requires insurance that accounts for higher mileage, potential business-related incidents, and commercial liability.

Vehicle-specific insurance allows insurers to provide more accurate quotes and tailored coverage, ensuring that drivers pay for the protection they need. This approach also helps drivers understand the specific risks associated with their car and make informed decisions about their insurance choices. Ultimately, customized plans for different car types contribute to a more efficient and effective insurance system, benefiting both insurers and policyholders.

Auto Insurance Renewal: Billing Changes and What to Expect

You may want to see also

Claims Process: Filing claims, documentation, and claim settlements

The claims process is a critical aspect of any insurance policy, and understanding how to file a claim effectively is essential for policyholders. When it comes to Drive Insurance, the process involves several steps to ensure a smooth and efficient resolution. Here's an overview of the key elements:

Filing a Claim: When an incident occurs that qualifies for a claim, policyholders should act promptly. The first step is to notify the insurance company as soon as possible. This can typically be done through a dedicated claims hotline, online portal, or by contacting your assigned claims adjuster. Provide all relevant details, including the date, time, and location of the incident, as well as a description of the events that led to the claim. Quick notification ensures that the insurance company can initiate the investigation process without delay.

Documentation: Documentation is vital in the claims process. After filing the initial claim, you will be guided through the necessary paperwork. This includes providing evidence and supporting documents to substantiate your claim. For instance, if the incident involves a vehicle accident, you might need to submit police reports, medical records, repair estimates, and witness statements. Ensure that all documents are accurate, legible, and provided in a timely manner to avoid any delays in processing.

Claim Investigation: Once the claim is filed and the required documentation is received, the insurance company's claims adjuster will conduct a thorough investigation. They will review the provided information, assess the validity of the claim, and determine the coverage applicable to the incident. This step may involve inspecting the damaged property, interviewing involved parties, and verifying the facts. The adjuster's role is to make an impartial decision regarding the claim's settlement.

Claim Settlement: After the investigation, the insurance company will provide a settlement offer if the claim is approved. This offer will outline the compensation amount and the terms of the settlement. It is essential to review the offer carefully and seek clarification on any doubts. Policyholders have the right to negotiate and discuss the settlement terms, especially if they believe the offered amount is insufficient. Once an agreement is reached, the settlement process can be finalized, and the compensation will be disbursed accordingly.

In summary, the claims process for Drive Insurance involves prompt notification, thorough documentation, a detailed investigation, and a fair settlement. Policyholders play a crucial role in this process by providing accurate information and cooperation during the claim filing and documentation stages. Understanding these steps ensures that policyholders can navigate the claims process effectively and receive the necessary compensation when needed.

Farmers Auto Insurance: Leaving Florida? What You Need to Know

You may want to see also

Add-Ons and Discounts: Roadside assistance, rental car coverage, and discounts

Drive Insurance, a comprehensive car insurance policy, offers a range of add-ons and discounts to enhance coverage and provide added value to policyholders. These add-ons and discounts can significantly improve the overall insurance experience, ensuring that drivers are protected in various scenarios. Here's an overview of the key add-ons and discounts available:

Roadside Assistance: One of the most popular add-ons is roadside assistance, which provides invaluable support when you're stranded on the road. This service covers a wide range of issues, including flat tires, fuel delivery, battery jumps, and towing. When you purchase this add-on, you gain access to a 24/7 emergency hotline, ensuring that help is just a phone call away. Whether you're facing a flat tire in the middle of nowhere or your car won't start in the morning, roadside assistance can save you time, stress, and potentially costly repairs. Many insurance companies partner with reputable roadside assistance providers, ensuring that you receive professional and reliable service.

Rental Car Coverage: Another valuable add-on is rental car coverage, which provides a temporary vehicle when your car is being repaired or serviced. This coverage is especially useful when unexpected breakdowns or accidents occur, and you need to get back on the road quickly. With rental car coverage, you won't have to worry about finding and paying for a rental car yourself. The insurance company will arrange for a temporary vehicle, often at a discounted rate, ensuring that your daily life or business operations are not significantly disrupted. This add-on is particularly beneficial for those who frequently rely on their vehicles for work or personal commitments.

Discounts: Drive Insurance also offers various discounts to reduce the overall cost of the policy. These discounts can vary depending on the insurance provider and your specific circumstances. Common discounts include:

- Safe Driver Discounts: Insurers often reward safe drivers with lower premiums. This discount is typically earned by maintaining a clean driving record over a certain period.

- Multi-Policy Discounts: Combining multiple insurance policies, such as home and auto insurance, with the same provider, can lead to significant savings.

- Good Student Discounts: Students who maintain a certain GPA or academic achievement may qualify for reduced rates.

- Loyalty Discounts: Long-term customers of the insurance company may be eligible for loyalty rewards, which can lower premiums over time.

- Safety Feature Discounts: Vehicles equipped with advanced safety features, such as airbags, anti-lock brakes, or advanced driver-assistance systems, may attract lower insurance rates.

By taking advantage of these add-ons and discounts, policyholders can customize their insurance coverage to better suit their needs and budget. It's essential to review the available options and choose the add-ons that provide the most value and peace of mind. Additionally, understanding the discount criteria can help drivers make informed decisions and potentially save money on their insurance premiums.

Ally's Prorated Gap Insurance: How It Works

You may want to see also

Frequently asked questions

Drive insurance, also known as pay-as-you-go insurance or usage-based insurance, is a type of car insurance that provides coverage based on how much and how often you drive. It is designed to offer personalized insurance rates by monitoring and evaluating your driving behavior.

Drive insurance companies typically install a small device in your vehicle or use a mobile app to track your driving patterns. This device or app records data such as mileage, driving speed, acceleration, braking, and the time of day you drive. The information is then used to calculate your insurance premium.

Drive insurance offers several advantages. Firstly, it can provide lower premiums compared to traditional insurance as you only pay for the coverage you need. Secondly, it promotes safe driving habits, as drivers are more likely to be cautious on the road when they know their driving is being monitored. Additionally, it can help identify areas for improvement in driving skills and offer personalized tips for better driving.

Drive insurance is available to most drivers, but it is particularly beneficial for those who drive less frequently, have a history of accidents or traffic violations, or want to save on insurance costs. Young drivers, in particular, may find this type of insurance advantageous as it can help them build a positive driving record.

While drive insurance has its advantages, there are a few potential drawbacks. The installation of tracking devices may be seen as an invasion of privacy, and some drivers might feel uncomfortable with the idea of their driving being monitored. Additionally, the accuracy of the data collected can vary, and there might be instances where the insurance company's assessment of driving behavior differs from the driver's perception.