Auto insurance renewal is often automatic, but you should confirm it with your provider to avoid a lapse in coverage once your policy term ends. While auto-renewal is convenient, it can also mean that your rates go up without you noticing. You should receive a letter or email from your insurer 21 to 30 days before your policy expires, informing you of the renewal and any changes to your rate. If you don't want to renew, you can opt out of auto-renewal by contacting your insurer. However, if you let your policy lapse, you might have to pay a cancellation fee and risk driving without insurance.

| Characteristics | Values |

|---|---|

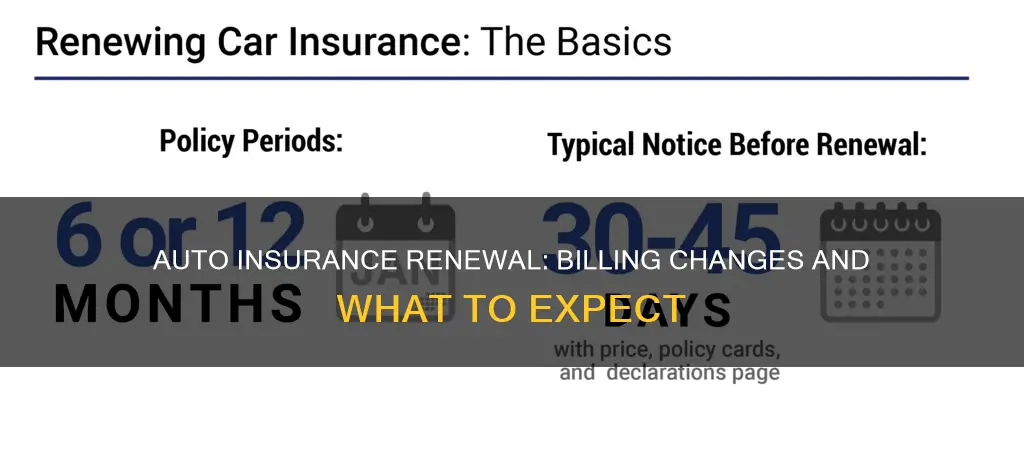

| Renewal Frequency | Every 6 or 12 months |

| Renewal Notice | Mailed or emailed 21-30 days before renewal |

| Automatic Renewal | Depends on insurance company and state laws |

| Renewal Rates | May be higher than previous year |

| Reasons for Higher Rates | Age, driving experience, driving history, credit score, vehicle type, driving habits, location, parking, etc. |

| Cancellation Policy | May vary, usually requires written or phone confirmation |

| Non-renewal | Insurer may decline to renew due to business decisions or high-risk drivers |

| Lapsed Policy | May be reinstated with a penalty fee or require a new policy |

| Optional Extras | May auto-renew with the main policy |

| Excess Charges | May increase after renewal |

| Customer Action | Update details with insurer, shop around for better rates |

What You'll Learn

Auto-renewal letters/emails

Auto-renewal letters or emails are a standard part of the car insurance renewal process. These letters or emails serve as a notification that your current policy is about to expire and will be automatically renewed for another term, typically lasting six or twelve months.

Here's what you can expect from auto-renewal letters or emails:

- Timing: You should receive this correspondence approximately 21 to 30 days before your policy expires. This period is known as the "auto-renewal window" and gives you time to decide whether to continue with the auto-renewal or explore other options.

- Content: The letter or email will inform you that your policy is about to expire and that it will automatically renew if you take no further action. It will also include information about your current premium and the new price for the upcoming term. This information helps you understand any changes in your insurance rates.

- Action Required: If you are satisfied with the new terms and wish to continue with the same insurer, you don't need to take any further action. Your policy will automatically renew, and you can continue making payments as usual. However, if you want to opt out of auto-renewal, you can contact your insurer and inform them that you do not want to renew your policy. You may need to do this via phone or by sending a letter or email, depending on the insurer's requirements.

- Optional Changes: If you decide to continue with the auto-renewal, you can also use this opportunity to review and update your policy details. For example, you might want to reconsider any optional add-ons or extras that are included in your coverage.

- Cooling-Off Period: Even if your policy has been automatically renewed, you usually have a "cooling-off" period of 14 days after the renewal date. During this time, you can cancel the renewed policy without incurring significant penalties. However, you will still be charged for the days you were covered under the new policy, and there may be a small administrative fee.

Remember, while auto-renewal can be convenient, it's essential to review your policy and compare it with other options to ensure you're getting the best value for your money. By staying proactive and informed, you can make informed decisions about your car insurance coverage.

Capital One Loans: Gap Insurance Included?

You may want to see also

How to decline auto-renewal

Auto-renewal can be convenient as it means you don't have to rush to sort out a new policy before your current one runs out. However, it can also leave you tied into a policy you don't like, especially if your rates have gone up.

- Opt out: Contact your insurer and inform them that you don't want to auto-renew when your policy runs out. Some insurance companies will ask if you want to opt in or out of auto-renewal when you take out your policy, but most of the time, you're automatically opted in.

- Switch providers: If you decide to switch providers, make sure you inform your current insurer during the auto-renewal window, which is typically 21 to 30 days before your policy expires. You might have to give them a call to do this.

- Avoid a lapse in coverage: To avoid a gap in coverage, buy a new policy that takes effect one or two days before your current policy expires.

- Contact your current provider: Get in touch with your current insurance provider to cancel your policy.

- Confirm the policy expiry: Make sure that your policy will expire when your current term ends.

- Get written confirmation: Protect yourself from potential charges for a new term by getting confirmation of the cancellation in writing.

Chase AARP Rewards Card: Understanding Auto Rental Insurance Benefits

You may want to see also

Cancelling after auto-renewal

Cancelling your car insurance after auto-renewal is possible, but there are a few things to keep in mind. Firstly, you have a cooling-off period of 14 days after your policy has renewed, during which you can change your mind and cancel without incurring major penalties. However, even during this period, you may still have to pay a small fee, and you will be charged for the days you were covered.

If you cancel after the 14-day cooling-off period, you will likely have to pay a cancellation fee, which can be quite high. Additionally, if you have prepaid your premiums, the refund you receive may be subject to a short-rate cancellation, where a percentage (usually between 10% to 15%) is deducted from the unused premium. To avoid this, it is recommended to wait until the end of your policy and choose not to renew instead of cancelling mid-policy.

To cancel your policy, you will need to contact your insurance company, either by phone, email, or through their mobile app. They may require you to submit a formal letter of intent to cancel or a specific cancellation form. Make sure to confirm the cancellation in writing to protect yourself in case you are charged for a new term. It is also important to set the cancellation date of your old policy and the start date of your new policy on the same day to avoid a gap in coverage.

Vehicle Finance Insurance: What You Need to Know

You may want to see also

Lapsing vs. cancelling

Lapsing refers to letting your car insurance policy expire and not renewing it. This is different from cancelling your car insurance policy, which involves ending the policy before its term ends. While lapsing does not affect your no-claims bonus, cancellation will likely result in losing your no-claims bonus for that year.

When you let your policy lapse, you won't have to pay a cancellation fee. However, it's crucial to inform your insurer, especially if you're on an auto-renewal policy. Lapsing can lead to higher rates in the future, fines, a suspended license, and even repossession of your car if it is leased or financed. Additionally, a lapse in coverage means you will no longer be legally allowed to drive in most states.

On the other hand, cancelling your car insurance policy often incurs a fee, typically around £50, although it depends on the company and the timing of the cancellation. If you cancel within the first 14 days, the fee may be lower or waived altogether. When you cancel, you are usually entitled to a refund for the remaining period of coverage, excluding the final one or two months. However, if you have made a claim or used any optional extras, you may not receive a refund for those.

To cancel your car insurance, you typically need to check your policy documents for cancellation fees, contact your insurer, confirm the fees and refund, and, if necessary, submit a letter stating your intention to cancel.

While lapsing may seem like a more convenient option to avoid cancellation fees, it is essential to understand the consequences of both choices. Lapsing can lead to higher rates and legal penalties, while cancellation may result in losing your no-claims bonus and facing cancellation fees.

To avoid unexpected renewals, it is advisable to opt out of auto-renewal and carefully review the terms and conditions of your policy.

Enterprise Auto Insurance: Understanding the Requirements

You may want to see also

Renewal fees

In most cases, car insurance policies will automatically renew after a set period, often six or twelve months. This automatic renewal process is designed to ensure continuous coverage and avoid the inconvenience of having to manually renew your policy. However, it is important to note that you are not obligated to accept the renewal offer from your current insurer. You have the option to switch insurers or decline the renewal altogether.

If you choose to remain with your current insurer, the renewal fees may be included in your new premium. These fees can vary depending on various factors, such as your age, driving history, vehicle type, and location. For example, if you have had an accident or filed multiple claims, your renewal fees may be higher to compensate for the increased risk associated with your policy. Similarly, if you drive a luxury or sports car, which are considered high-risk vehicles, your renewal fees could be higher.

On the other hand, if you decide to switch insurers, you may still be subject to renewal fees from your previous policy. In some cases, insurers may charge a cancellation fee or penalty for terminating your policy early. Additionally, if you have made any changes to your coverage or added optional extras, such as breakdown cover, these may also be subject to renewal fees.

To make an informed decision about your car insurance renewal, it is essential to review your policy terms and conditions carefully. Understanding the factors that influence your premium and the potential impact of renewal fees can help you navigate the renewal process effectively. By comparing quotes from different insurers and considering your coverage needs, you can ensure that you are getting the best value for your money. Remember, you have the right to decline the renewal offer and switch to a different insurer if you find a better deal.

State Farm: Decades of Auto Insurance Leadership

You may want to see also

Frequently asked questions

Yes, most car insurance policies renew automatically after six or 12 months. However, you should check your policy terms to ensure your insurance provider auto-renews, as some don't.

You can opt out of auto-renewal at any time by contacting your insurance provider. You are under no obligation to stay with your current insurer and can cancel your policy at any time.

If you plan on switching insurers, do it sooner rather than later. If you let your current policy auto-renew and then decide to switch, you might have to pay a cancellation fee.

The best time to think about renewing or switching your car insurance is 18 days before your policy expires. According to data, this is when prices tend to be the cheapest.