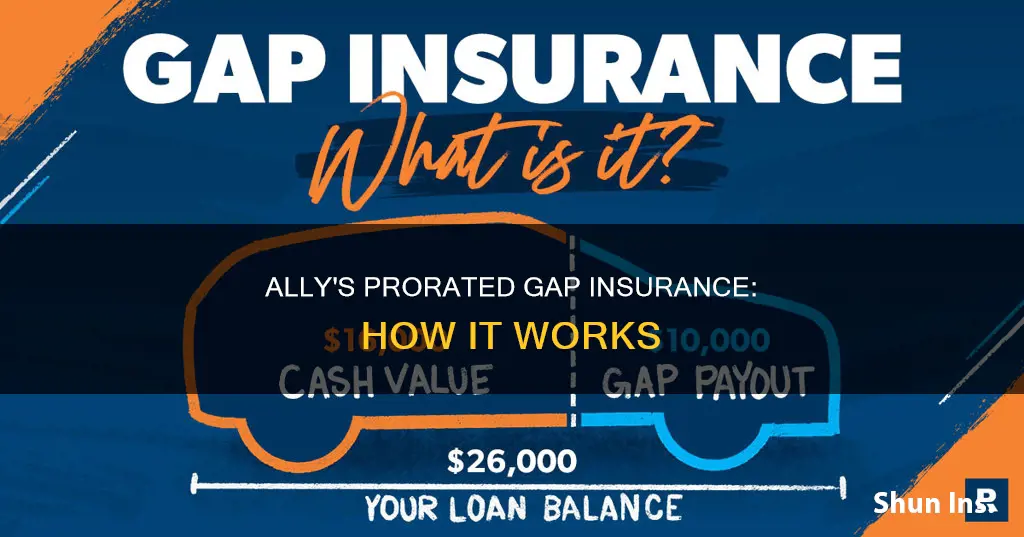

Guaranteed Asset Protection (GAP) insurance helps protect a buyer or lessee in the case of a total loss. It helps bridge the gap between how much is owed for the vehicle and how much the car is worth if it is stolen or written off. This gap occurs because insurance typically pays the cash value of your vehicle at the time of loss, and because cars depreciate, the vehicle's value may be less than what is still owed on the loan. GAP insurance is included with all Ally leases. If you decide to sell your vehicle, you can transfer your vehicle service contract to the new owner or cancel the remainder of the contract for a prorated refund.

| Characteristics | Values |

|---|---|

| What is GAP insurance? | Guaranteed Asset Protection (GAP) insurance helps protect a buyer or lessee in the case of total loss. It helps bridge the gap between how much is owed for the vehicle and how much the car is worth if it is totaled or stolen. |

| When to get GAP insurance? | When you shop for a new car, it is important to consider the possibility of your car being totaled or stolen. Your auto insurance may cover the cash value of your vehicle prior to the damage or loss, but it won't necessarily cover the total outstanding balance of your lease or finance contract. |

| How does GAP insurance work? | GAP insurance helps cover the amount between the cash value and the outstanding balance. For example, if you owe $25,000 on your car loan, but your insurance only pays you $20,000, GAP insurance will help cover the remaining $5,000. |

| When to cancel GAP insurance? | You can cancel your GAP insurance once your loan balance is lower than the vehicle's actual cash value. You can get a refund if you paid in advance for coverage and cancel the policy early, usually after paying off the loan early or selling/trading in the car. |

| How to cancel GAP insurance? | Contact your insurance agent or company, fill out the necessary paperwork, and submit any required documentation, such as an odometer disclosure statement and a payoff letter if the loan has been paid off. |

What You'll Learn

How to make a GAP claim with Ally

If your vehicle is totaled in an accident, your insurance may not cover the full amount you owe on it. This is where Guaranteed Asset Protection (GAP) comes in. GAP coverage helps protect you from the "gap" in the event of a vehicle total loss. It helps bridge the gap between how much is owed for the vehicle and how much the car is worth if it is totaled or stolen.

Step 1: Understand the Process

First, understand that your insurance company has to declare your vehicle totaled before you’re eligible for reimbursement. You will need to call Ally to initiate the claims process, and they will guide you through the next steps.

Step 2: Gather Required Information

To get started, you will need your last name, ZIP code, and Vehicle Identification Number (VIN).

Step 3: Submit Your Claim

You can submit your GAP claim through Ally's online Vehicle Coverage Center. The process is designed to be easy and straightforward.

Step 4: Provide Required Documents

Once you’ve started your claim, submit the required documents for processing. These documents typically include:

- A completed vehicle information form

- The total loss evaluation report and settlement breakdown, indicating any taxes, fees, and deductible applied

- Information regarding the cancellation of optional insurance and vehicle service contracts

- The outstanding balance on your account (payoff quote) as of the date of loss from your finance company

- A copy of your primary insurance carrier’s declarations page that covers the period in which the loss occurred

- The settlement check or proof of payment from your primary insurance carrier or third-party liability carrier

- A copy of the front and back of your GAP addendum

- Your finance agreement

- Your vehicle purchase agreement or buyer’s order

- A copy of your payment history from your finance company

Step 5: Wait for Review

Ally will review the required documents within 2 business days of receipt.

Step 6: Follow Up

After submitting your claim, Ally will reach out to you regarding your status. If you need additional help or have questions, you can call their customer support line at 1-866-212-1304. Your GAP addendum will provide specific details on your coverage, and they can help guide you through the process.

Remember, GAP coverage is designed to protect you financially in the event of a total loss of your vehicle. By following these steps, you can ensure a smooth and efficient claims process with Ally.

GM Financial: Leased Cars and Insurance

You may want to see also

When to cancel GAP insurance

GAP insurance is an optional form of coverage that can be added to your auto insurance policy. It covers the difference between the actual cash value of your car and what you owe on your loan in the event of a total loss. This can be especially useful for newer vehicles, as cars can lose up to 20-30% of their value in the first year of ownership.

While GAP insurance can provide valuable protection, there may come a time when you no longer need or want it. Here are some scenarios in which it may make sense to cancel your GAP insurance:

- Your loan amount drops below the car's value: This typically happens after a couple of years of payments. Once your loan balance is less than the car's actual cash value, you may no longer need GAP insurance.

- You pay off your loan early: If you pay off your car loan ahead of schedule, there may no longer be a need for GAP coverage.

- You trade or sell the vehicle: If you get rid of your car, you can cancel GAP insurance. However, it is recommended to wait until after the sale or trade is complete to avoid any gaps in coverage.

- You no longer feel GAP insurance is necessary: Over time, your vehicle's value may exceed the remaining loan balance. In this case, you are essentially paying for coverage that you will never use, even if your car is stolen or totalled.

- You want to switch insurance providers: If you find a better deal or prefer the services of another insurance company, you can cancel your current GAP insurance and switch to a new provider.

- You need to lower your insurance premiums: If you are looking to cut costs, cancelling GAP insurance may be an option, especially if you feel the coverage is no longer financially beneficial.

It is important to note that the decision to cancel GAP insurance should be made carefully, as it provides valuable protection in certain situations. Before cancelling, be sure to review the terms and conditions of your policy, including any cancellation fees that may apply. Additionally, if your lender or lease agreement requires GAP insurance, you may need to keep the coverage until you pay off the loan or end the lease term.

Gap Insurance: Limited or Unlimited?

You may want to see also

How to cancel GAP insurance

Cancelling your GAP insurance is a straightforward process, but there are a few things to consider before you do so. Firstly, it's important to understand what GAP insurance is and how it benefits you. GAP insurance covers the difference between the actual cash value of your car and what you owe on a loan in the event of an accident or total loss. This type of insurance is particularly useful when you owe more than your car is worth, as it can protect your finances.

However, there may come a time when you feel that GAP insurance is no longer necessary or beneficial to you. Here are the steps to cancel your GAP insurance:

- Review your policy: Before initiating the cancellation process, carefully review the terms and conditions of your GAP insurance policy. Check for any cancellation fees, as some insurers may charge a significant percentage of your premium if you cancel within the first 60 days. Understanding the financial implications of cancelling your policy will help you make an informed decision.

- Contact your insurer: You can cancel GAP insurance by reaching out to your insurance company or dealership. If you purchased GAP insurance from an insurance company, contact them directly to express your intention to cancel. If you obtained GAP insurance from a dealership, you may need to contact both the dealership and the insurance company they use for GAP coverage.

- Provide necessary information: Be prepared to provide relevant information and documents to your insurance company or dealership. This may include your name, address, vehicle identification number (VIN), and proof of the sale, trade-in, or payoff of your vehicle.

- Complete the required paperwork: Your insurance company or dealership will likely require you to fill out and submit specific forms or provide written notice of your intent to cancel. Make sure to sign and return all the necessary documentation promptly to expedite the process.

- Purchase alternate coverage (if needed): If you are switching to a different GAP insurance provider, ensure that your new coverage is in place before cancelling your current policy. This will prevent any gaps in your vehicle's coverage during the transition.

- Follow up on refunds: If you are eligible for a refund, which depends on the terms of your contract and the timing of your cancellation, expect to receive a check by mail within a few weeks to months. Stay in communication with your insurance company or dealership to understand their refund process and timeline.

By following these steps, you should be able to successfully cancel your GAP insurance. Remember to carefully consider your decision and review the implications before proceeding with the cancellation.

Gap Insurance: Standard on All Toyotas?

You may want to see also

Getting a GAP insurance refund

If you have paid for GAP insurance upfront and then cancel it early, you may be able to get a refund for unused premiums. The amount of refund you receive will depend on your policy and your location. If you are cancelling within 30 days of the policy start date, you may be able to get a full refund, minus any cancellation fees. After 30 days, you may only be eligible for a partial refund.

You can get a GAP insurance refund in the following situations:

- You are paying off, selling, or trading in the covered car.

- You are switching to a different GAP insurance company.

- Your loan balance is no longer more than the car's actual value.

If you are selling or trading in the car, wait until the car no longer legally belongs to you before cancelling your GAP insurance. You will then need to provide the appropriate paperwork to your insurance provider, such as proof of sale or auto payoff letter. Some insurance companies may also require odometer verification to show the mileage on your car.

If you are refinancing, wait until your previous loan is no longer in effect before cancelling your GAP insurance.

You cannot get a GAP insurance refund if the insured car is declared a total loss before the policy's expiration date. In this case, the GAP insurance will pay for the difference between the car's value and the loan balance, but drivers will not be eligible for a refund for the remaining months of coverage.

It typically takes 4-6 weeks to receive a GAP insurance refund. Staying in contact with your insurance provider and promptly returning signed paperwork can help expedite the process.

To cancel your GAP insurance policy and request a refund, follow these steps:

- Contact your insurance provider and inform them that you want to cancel your GAP insurance and request a refund for the remaining coverage.

- Gather and submit the required documents, such as proof of sale or auto payoff letter.

- Complete and submit any forms required by your insurance provider to complete the cancellation process.

- Clearly state that you want a refund for the unused GAP insurance coverage.

Pleasure vs Commute: Cheaper Insurance?

You may want to see also

GAP insurance refund calculations

GAP insurance, or Guaranteed Asset Protection, helps protect a buyer or lessee in the case of a total loss. It covers the "gap" between how much is owed for the vehicle and how much the car is worth if it is stolen or totaled. This gap occurs because insurance typically pays the cash value of the vehicle at the time of loss, and because cars depreciate, the vehicle's value may be less than what is still owed on the loan.

For example, if you owe $25,000 on your car loan, but your insurance company valued the vehicle at $21,000, your insurance provider would pay you $21,000 (the value of the vehicle), minus your deductible, which could be $1,000. So, you would receive $20,000 from your insurer, but you would still owe $5,000 on your loan. This is where GAP insurance comes in, covering that extra $5,000 so you don't lose money.

However, if you pay off your vehicle within the first years of ownership, you won't need GAP insurance anymore. The policy typically automatically expires after a set period, but you may also be able to end it early and receive a refund for the premiums you won't be using.

To calculate a GAP insurance refund, you need to determine how much you're owed. Look at the price you paid for the insurance, then divide it by the number of months it covers. For instance, if you paid $1,000 for 36 months of coverage, the monthly amount is $27.78. If you paid off the car at the end of 24 months, you would have 12 months remaining, which means a refund of $333.36 for the time you didn't use the coverage.

It's important to note that not all insurers offer refunds. Check your policy to see what the insurer promised to do if you paid off your loan early. If you live in Alabama, Colorado, Indiana, Iowa, Maryland, Massachusetts, Oklahoma, Oregon, or South Carolina, your state requires insurers to refund the premiums. Otherwise, contact your state commerce department if your insurer refuses to issue a refund.

Before cancelling your GAP insurance, make sure it isn't a requirement of your loan or lease, and that you've met the contract's requirements to cancel the coverage. This usually means that you've paid off the loan or have enough equity in the vehicle that there is no longer a gap between the vehicle's value and the loan amount. You can also cancel your GAP insurance if you sell or trade in the vehicle.

To initiate the cancellation process, contact your agent or insurance company and let them know that you want to cancel your policy. They will provide the necessary paperwork and inform you of any additional information required. Most insurance carriers will need to see an odometer disclosure statement verifying the car's current mileage, which can be obtained from your state's DMV website. If you cancel your GAP insurance because your auto loan has been paid off, your insurance company may also request a letter from your lender verifying that the car loan was closed.

Once you've submitted all the necessary paperwork and documentation, you should receive your refund. Most insurance companies offer the choice between a physical check or a direct deposit to your bank account.

Vehicle Diagram Insurance: Describing Damage

You may want to see also

Frequently asked questions

Guaranteed Asset Protection, or GAP insurance, helps protect a buyer or lessee in the case of total loss. It helps bridge the gap between how much is owed for the vehicle and how much the car is worth if it is totaled or stolen.

If your vehicle is totaled in an accident, your insurance may not cover the full amount you owe on it. GAP insurance helps cover the amount between the cash value and the outstanding balance.

You can get a GAP insurance refund if you paid in advance for coverage and cancel the policy early. GAP insurance refunds are most commonly issued after a loan is paid off early or the car is sold or traded in.

You can cancel your GAP insurance if you sell or trade in the vehicle. You can also cancel your GAP insurance policy because your auto loan has been paid off.

The cost of GAP insurance depends on factors like the make and model, vehicle condition, deductible, and the contract coverage level selected. Your dealer can provide you with pricing options.