Auto insurance is important because it provides financial protection in the event of an accident or theft. It can save you money in the long run by covering vehicle repairs, medical bills, and legal fees. Most states require drivers to have auto insurance, and failing to obtain the minimum coverage can result in fines or even jail time. When choosing an auto insurance policy, it's important to consider your needs and budget and shop around for the best rates. Understanding the different types of coverage, such as liability, collision, and comprehensive insurance, can help you make an informed decision about the level of protection you need.

| Characteristics | Values |

|---|---|

| Coverage | Property damage, bodily injury, medical expenses, liability, collision, comprehensive, uninsured/underinsured motorist |

| Financial protection | Protection against financial loss in the event of an accident or theft |

| Legal compliance | Required by law in most states |

| Peace of mind | Confidence and reassurance that you’re protected in the event of an accident |

| Customization | Ability to customize coverage amounts and add-ons to suit your needs and budget |

| Cost savings | Avoids costly expenses and saves money in the long run |

What You'll Learn

Liability insurance

Property damage coverage pays for repairs to the other driver's vehicle, rental vehicles, and damage to buildings, fences, or personal property inside a vehicle. It also covers legal fees if you are sued for property damage. Bodily injury coverage, on the other hand, takes care of the medical expenses, rehabilitation, and legal costs of individuals injured in an accident caused by you.

Most states require a minimum amount of liability insurance to legally drive a vehicle. However, the required limits vary across states. While liability insurance is essential, it is important to note that it does not cover damages to your property or your injuries. To protect yourself, you may need additional coverages such as personal injury protection and uninsured/underinsured motorist coverages.

The cost of liability insurance depends on various factors, including the amount of coverage selected. Higher coverage limits typically come with a higher price tag. When choosing liability coverage, it is important to understand the coverage limits and select a plan that suits your needs.

Comprehensive Auto Insurance: Does it Cover Flood Damage?

You may want to see also

Collision insurance

It's worth noting that collision insurance is separate from comprehensive insurance, which covers events beyond a driver's control, such as natural disasters, vandalism, or theft. Collision insurance, on the other hand, covers events within a driver's control, including collisions with other vehicles or objects such as guardrails, trees, or potholes.

When purchasing collision insurance, you can choose a deductible amount that suits your needs. A higher deductible can lead to lower monthly premiums, but it's important to ensure you can cover the deductible amount in the event of a claim. Collision insurance can provide valuable financial protection, especially if you live in a state that requires it by law.

By investing in collision insurance, you can drive with the confidence that your vehicle is covered in case of an accident. This type of insurance is designed to protect you from financial losses and the hassle of negotiating with other drivers and managing repair or replacement costs on your own. It's a crucial component of auto insurance, ensuring you can maintain your vehicle's value and safety while protecting yourself and your family financially.

Battling Auto Insurance: Fighting Accident Reports

You may want to see also

Comprehensive insurance

When it comes to auto insurance, comprehensive coverage is an optional yet important aspect to consider. Comprehensive insurance protects your vehicle from damage caused by unexpected events outside of your control, excluding collisions. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather damage, and other acts of nature. For instance, if a tree branch falls on your car during a storm and dents the roof, comprehensive coverage will help pay for the repairs.

Comprehensive coverage is different from collision coverage, which pertains to damage caused by colliding with another vehicle or object. While collision coverage is typically mandated by law in most states, comprehensive coverage is optional but highly recommended. It ensures that you're covered for a wide range of unforeseen events that could result in costly repairs or replacements.

The cost of comprehensive insurance varies depending on factors such as the age and value of your car, as well as your driving record and location. It's worth noting that comprehensive insurance doesn't cover every possible scenario. For example, if you're responsible for an accident involving a collision with an object or another vehicle, you'll need separate coverage.

When deciding on comprehensive insurance, it's essential to understand your specific needs and compare rates from different insurance providers. By doing so, you can ensure that you're getting the best coverage for your vehicle at a price that fits your budget.

The Auto Insurance Score: Scaling the Heights of Financial Security

You may want to see also

Medical payments

MedPay provides financial protection by helping to pay for medical expenses for you or your passengers in the event of a car accident, regardless of who is at fault. This includes medical treatments, surgeries, procedures, hospital stays, nursing services, ambulance fees, and health insurance deductibles and co-pays. It can also cover specific diagnostics and treatments, such as X-rays and dental procedures.

Unlike health insurance, MedPay has no deductibles or co-payments, and it starts paying from the first dollar of incurred expenses. The cost of MedPay varies, but it is generally inexpensive, with many policyholders adding coverage for $5 to $8 per month. The coverage limits typically range from $1,000 to $10,000, and it is recommended to carry coverage equal to your health insurance deductible.

It is important to remember that MedPay has its limitations. It will not cover expenses that exceed your policy's coverage amount, nor will it cover wage reimbursement if you are unable to work due to your injuries. Additionally, MedPay is specifically for auto-related accidents and will not cover any medical treatments that are not related to the accident.

In summary, MedPay can provide valuable financial protection by helping to cover medical expenses resulting from a car accident. It ensures that you and your passengers can receive prompt medical attention and treatment without worrying about the financial burden, even if you are at fault for the accident.

The Mystery of Auto Insurance Premiums: Unraveling the Factors that Influence Your Rate

You may want to see also

Uninsured/underinsured motorist coverage

- Uninsured motorist bodily injury (UMBI) covers medical bills for both the policyholder and their passengers if they are hit by an uninsured driver.

- Uninsured motorist property damage (UMPD) covers damage to the policyholder's vehicle caused by an uninsured driver.

- Underinsured motorist bodily injury (UIMBI) covers medical bills for the policyholder and their passengers if they are hit by a driver with insufficient insurance.

- Underinsured motorist property damage (UIMPD) covers damage to the policyholder's vehicle caused by a driver with insufficient insurance.

The cost of uninsured/underinsured motorist coverage can vary depending on the state and the insurance company. In some states, a deductible may be required for UMPD/UIMPD, while UMBI/UIMBI generally does not include a deductible. It is worth noting that uninsured motorist coverage may also apply in hit-and-run accidents, providing additional financial protection for policyholders.

When purchasing auto insurance, it is essential to understand the different types of coverage available and their potential benefits. Uninsured/underinsured motorist coverage can provide valuable peace of mind, knowing that you are protected in the event of an accident with an uninsured or underinsured driver. This type of coverage can help alleviate the financial burden of medical bills and vehicle repairs, ensuring that you and your passengers are taken care of.

To ensure you have adequate protection, it is recommended to review your insurance policy and consider adding uninsured/underinsured motorist coverage if it is not already included. By understanding the risks associated with uninsured and underinsured drivers, you can make an informed decision about the level of coverage that is right for you and your family. Remember to shop around and compare quotes from different insurance providers to find the best rates and coverage options that suit your specific needs.

Finding the Right Auto Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

Auto insurance is important because it provides financial protection in the event of an accident or theft. It can help cover the costs of repairs, medical bills, and other damages. Additionally, most states legally require drivers to have auto insurance, and failing to obtain the minimum required insurance can result in fines or even jail time.

The main types of auto insurance coverages include liability coverage, collision coverage, and comprehensive coverage. Liability coverage pays for the other party's expenses, such as medical costs and vehicle repairs, if you are at fault in an accident. Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of fault. Comprehensive coverage pays for non-collision damages, such as fire, vandalism, or natural disasters.

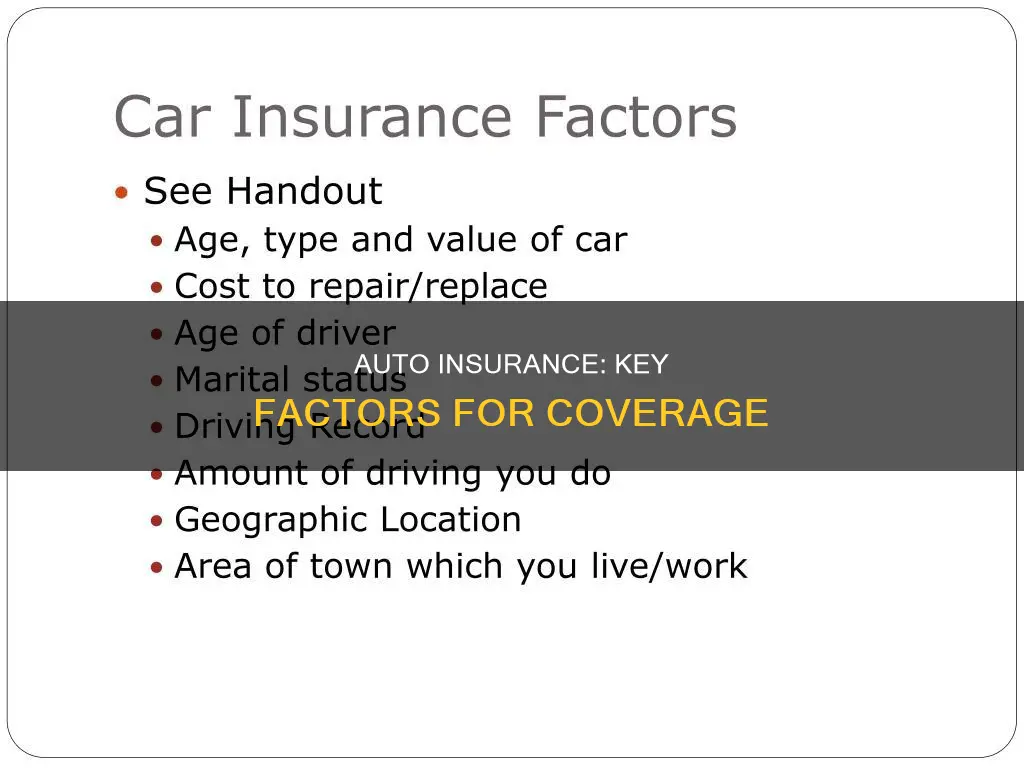

Insurance companies consider various factors when determining auto insurance rates, including age, gender (in some states), driving record, credit history, vehicle type, and location. By evaluating these factors, insurance companies assess the risk associated with insuring a particular driver and set the premium accordingly.

While you cannot directly negotiate the quoted auto insurance rate, there are ways to lower your premium. You can ask for discounts, increase your deductible, or compare rates from different insurance providers to find the best deal. Maintaining a safe driving record and improving your credit score can also positively impact your insurance rate.

If you are found to be driving without the required auto insurance, you may face legal consequences, including fines, license suspension, or even jail time for repeat offenses. Additionally, without insurance, you will be personally responsible for covering all expenses related to an accident, including repairs, medical bills, and legal fees.