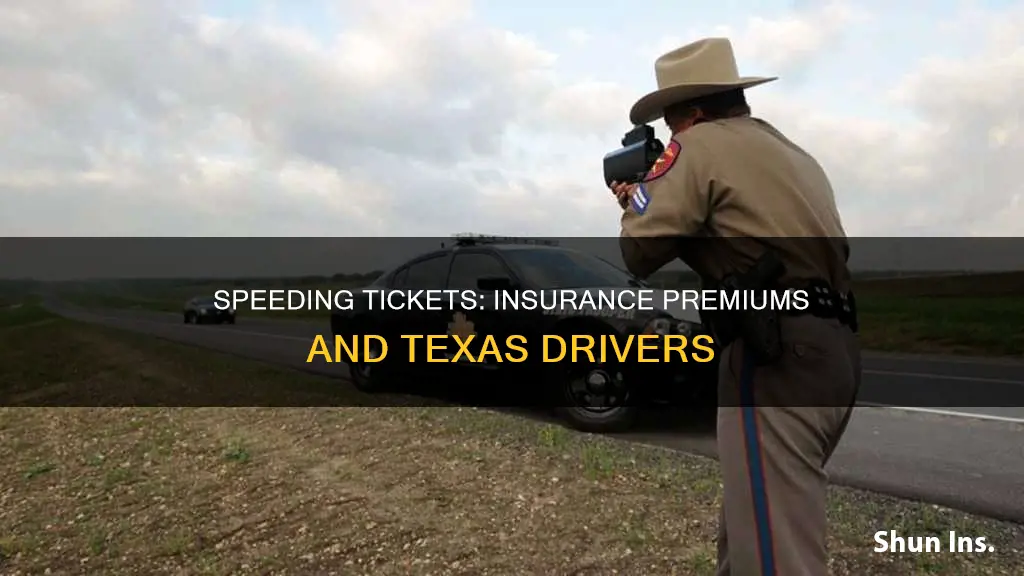

Getting a speeding ticket can be a nerve-wracking experience, and it's natural to wonder about the potential impact on your insurance. While the consequences may vary depending on the state and insurer, it's important to understand how a speeding ticket can affect your insurance in Texas. Speeding tickets are generally considered moving violations, which can lead to an increase in insurance rates. The impact on your insurance may depend on various factors, including your driving history, the severity of the violation, and the policies of your insurance company. So, let's explore the potential implications of a first speeding ticket on insurance in Texas.

| Characteristics | Values |

|---|---|

| Impact on insurance rate | A speeding ticket may increase your insurance rate. However, if it is your first speeding ticket, it may not affect your insurance rate at all. |

| Impact on insurance cost | A speeding ticket can increase your insurance cost by hundreds of dollars. |

| Impact on insurance company's perception | A speeding ticket designates you as a high-risk driver who is likely to file an insurance claim. |

| Impact on insurance company's action | Insurance companies will charge you a higher premium, anticipating more claims. |

| Impact on insurance policy | If your insurer offers a safe driving discount, you will likely lose that discount after receiving a speeding ticket. |

| Impact on driving record | A speeding ticket will remain on your driving record for three to five years, depending on your state. |

| Impact on insurance renewal | Your insurance rate may go up due to a speeding ticket when your policy renews, as insurers typically review your Motor Vehicle Record (MVR) at policy renewal. |

| Impact on insurance quote | When you get a quote, most car insurance companies will ask about any speeding tickets you've had over the last few years. |

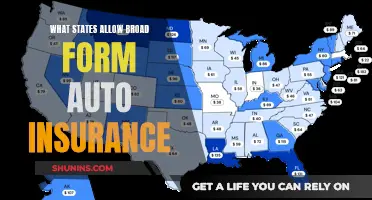

| Impact on insurance options | You can find cheap car insurance in Texas by shopping for coverage and comparing quotes from several companies. |

| Impact on insurance cost reduction | You can reduce your insurance cost by getting minimum coverage, which is the cheapest option. |

| Impact on insurance cost avoidance | You can avoid an increase in your insurance rate by taking a state-approved driving course to remove the speeding ticket from your record. |

What You'll Learn

The impact of a speeding ticket on insurance rates

For example, in Texas, speeding is considered a minor traffic violation, but the consequences can vary depending on the circumstances. If you receive a speeding ticket in Texas, you may be able to avoid an increase in your insurance rates by taking a driving safety course or pleading guilty and paying the fine. However, if you choose to fight the ticket in court, you may need to hire a traffic lawyer, and even if you are found not guilty, you will still have to pay legal fees.

It's important to note that not all speeding tickets will affect insurance rates. If it is your first speeding ticket, it may not impact your insurance at all, especially if you have a clean driving record. However, multiple speeding tickets or other violations within a short period can lead to significant increases in insurance rates.

To mitigate the impact of a speeding ticket on insurance rates, drivers can compare quotes from different insurance companies, as rates can vary significantly. Additionally, participating in a driving safety course approved by the insurer may help reduce the increase in insurance rates.

RV Gap Insurance: How to Purchase

You may want to see also

How to fight a speeding ticket in court

A speeding ticket in Texas can increase your insurance rate, as insurance companies will now consider you a high-risk driver. However, if it is your first speeding ticket, it may not affect your insurance rate at all, depending on your insurance company and driving record.

Now, if you want to fight a speeding ticket in court, here are some steps you can take:

- Review the Evidence: Before deciding to fight the ticket, carefully review any evidence you may have, such as witness statements, dashcam footage, or maintenance records that indicate a faulty speedometer. Strong evidence will improve your chances of success in court.

- Hire a Traffic Lawyer: Fighting a speeding ticket can be a complex and time-consuming process. Consider hiring a traffic lawyer who can guide you through the court proceedings and help you build your case. They can assess the specific traffic laws in your county and improve your chances of a favorable outcome.

- Plead Not Guilty: If you believe you are not guilty of the offence, you have the right to plead not guilty and fight the ticket in court. You can notify the county court of your not guilty plea either in person or by mail before the due date on your ticket. Remember that signing the ticket does not mean you are admitting guilt.

- Prepare Your Case: Research the specific traffic laws and regulations in your county or seek guidance from a lawyer. Present your case in a calm and collected manner, and be prepared to provide evidence that supports your argument.

- Attend the Court Hearing: During the court hearing, the judge will hear your case and make a decision. If the judge agrees that you did not intentionally break the law, your ticket could be dismissed or your fine could be reduced. If you are found guilty, you may have to pay a fine and face other penalties.

- Consider a Driving Safety Course: Even if you decide to fight the ticket, keep in mind that you may still be eligible to have the ticket dismissed by taking a state-approved defensive driving course. This option can help keep the ticket off your record and prevent insurance increases.

Remember, fighting a speeding ticket can be a lengthy and costly process, and there is no guarantee of success. Carefully consider your options and seek legal advice if necessary.

Marital Status and Auto Insurance: Understanding the Impact of Separation

You may want to see also

The cost of minimum coverage insurance in Texas

In Texas, the minimum car insurance required is liability coverage, which includes bodily injury coverage and property damage coverage. The minimum liability limits required by Texas law are $30,000 per person for bodily injury, $60,000 per accident, and $25,000 per accident for property damage. This basic coverage is often referred to as 30/60/25.

The average annual cost of minimum coverage insurance in Texas is $628, compared to $1,358 for full coverage policies with higher limits. The cost of insurance in Texas can range from $450 to $7,284.81 for new drivers and, on average, Texans pay 6% more than the rest of the US. The cost of insurance depends on various factors, such as the size of deductibles, the size of limits, the number of coverages, and the type of vehicle. A higher deductible typically leads to lower premiums, but it is important to ensure that the deductible is affordable in case of an accident.

Additionally, it is worth noting that Texas is a no-fault state, and liability insurance is required to cover the costs of the other party's medical and vehicle damage expenses in the event of an accident. While minimum coverage meets the legal requirements, it may not provide sufficient financial protection in the event of an accident, as the average cost of property damage from a collision is $4,600, and it can increase significantly with injuries or fatalities.

When shopping for minimum coverage insurance in Texas, it is advisable to compare quotes from multiple insurance companies and consider factors such as discounts, bundling policies, and adjusting deductibles and limits to find the most suitable option.

College Students: Cheaper Auto Insurance, Why?

You may want to see also

How to reduce insurance costs after a speeding ticket

A speeding ticket in Texas can increase your insurance costs by an average of 9-13%. However, there are several ways to reduce insurance costs after receiving a speeding ticket:

Shop Around for Quotes

Different insurance companies have different risk assessment models, and some may weigh your speeding ticket less heavily than others. By shopping around and requesting quotes from several companies, you can find the one that offers the lowest premium.

Maintain a Clean Driving Record

While a speeding ticket may increase your insurance costs, maintaining a clean driving record for several years after the ticket will reduce its long-term impact. Over time, the speeding ticket will have less influence, and you will be able to find cheaper insurance.

Take a Driving Safety or Defensive Driving Course

If you are eligible to get your ticket dismissed by taking a driving safety or defensive driving course, this is often the best option. Not only can it remove the violation from your driving record, but it may also qualify you for cheaper insurance as it demonstrates a commitment to safe driving.

Get Minimum Coverage

If you only need basic insurance, getting the minimum coverage required in Texas can help reduce your premiums. The minimum car insurance required in Texas is liability coverage, including $30,000 of bodily injury coverage per person, $60,000 per accident, and $25,000 of property damage coverage. While this option will cost less in premiums, keep in mind that liability coverage only pays for costs outside of your vehicle.

Pay Your Ticket on Time

While it may seem counterintuitive, paying your ticket on time is important. Failing to do so could result in additional fines, late fees, or even a suspended license, which could make it more difficult to obtain cheap insurance.

Participate in a Telematics Program

Some companies offer a premium reduction if you participate in a telematics program that tracks your driving habits. This can be a way to demonstrate safe driving habits and potentially reduce your insurance costs.

Liberty Mutual Auto Insurance: Understanding LA Coverage

You may want to see also

How long a speeding ticket stays on your record

A speeding ticket can have several consequences, including fines, possible license suspension, and increased insurance premiums. It can also affect your employment, as some employers may require a clean driving record.

In Houston, a speeding ticket typically stays on your driving record for three years from the date of the violation. However, this duration may vary depending on the state. In most of the U.S., speeding tickets remain on your record for three to five years, but this can differ across states and is based on the severity of the violation.

In Texas, speeding becomes a criminal offense when a driver exceeds the posted speed limit by more than 25 miles per hour, resulting in reckless driving charges and more severe penalties.

To prevent license points from impacting your record, you can take a Texas-approved defensive driving course. If you receive a notice from the Texas court system that your ticket is eligible for dismissal by taking such a course, it is advisable to do so.

While a speeding ticket can increase your insurance rates, the impact may vary depending on the insurer and the state. Some insurance companies may be more lenient towards minor offenses, while others may raise rates immediately. It is recommended to shop for coverage to find the lowest premium, as personal factors like driving records are weighed differently by each insurer.

Auto Insurance Options for Georgia Teens

You may want to see also

Frequently asked questions

Yes, your insurance rate will likely increase after your first speeding ticket. However, the increase depends on several factors, including your driving history, location, and insurance company.

The average insurance rate increase for drivers with a speeding ticket is 26%, or about $500 more per year. The increase also depends on the severity of the violation. For example, speeding between 6-10 mph over the limit will increase rates by about $480 per year, while speeding 21-25 mph over the limit will increase rates by about $648 per year.

You can reduce your insurance rate by taking a driving safety course, which may also remove the ticket from your record. You can also shop around for insurance providers to find the lowest rate.

A speeding ticket can affect your insurance rate for a few years, typically between three to five years.

In addition to insurance rate increases, speeding tickets in Texas can result in fines, points on your license, license suspension, or even jail time in more severe cases.