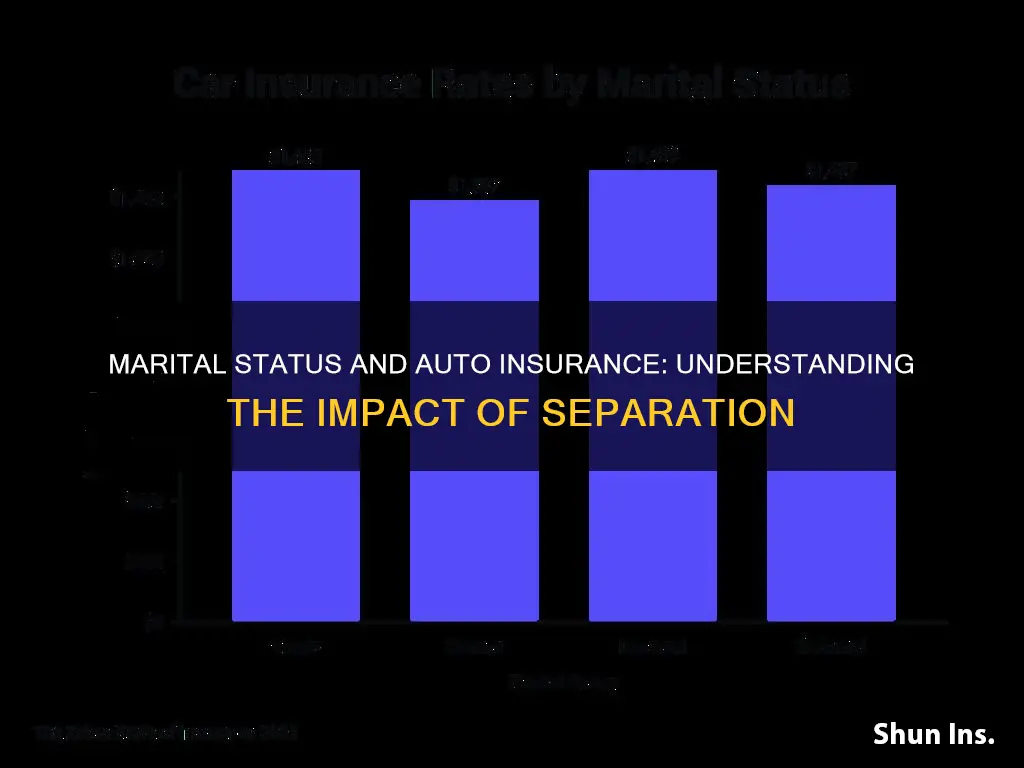

Being married or separated can have a significant impact on auto insurance rates. Married couples are often viewed as safer drivers and are considered less risky by insurance companies, resulting in lower premiums. On the other hand, divorced drivers are typically charged higher rates than married individuals due to historical data indicating a higher number of claims. When it comes to separation, it can be challenging to navigate the changes in auto insurance policies, especially if there are shared vehicles and teen drivers involved. Ultimately, the impact of marital status on auto insurance rates varies depending on individual circumstances, and it's essential to consult with insurance providers to understand the specific implications.

| Characteristics | Values |

|---|---|

| Effect of marriage on auto insurance | Auto insurance companies tend to offer lower rates to married couples than to single drivers. |

| Married couples are considered "lower-risk" than single people. | |

| Married couples are more likely to own a home and qualify for multi-driver discounts. | |

| Married couples are also more likely to bundle insurance policies. | |

| Effect of divorce on auto insurance | Divorcees will need to purchase their own auto insurance. |

| Divorcees may need to file for a vehicle title change in ownership with the state. | |

| Divorcees will need to update their address and other contact information with local authorities if they've moved to a new location. | |

| Divorced drivers tend to be charged more than married or single drivers. | |

| Effect of separation on auto insurance | If spouses live together after separation, it is best to leave the car insurance policy as is. |

| If spouses live separately after separation, the policyholder can remove the non-policyholder and their vehicle from the policy. | |

| The non-policyholder can then create a new policy with updated vehicle information and a new address. |

What You'll Learn

Removing your spouse from your insurance policy

Understanding Policyholder Rights

If you are the Primary Named Insured (PNI) or policyholder, you have the right to make changes to the policy, including removing your spouse and their vehicle. However, if you are not the PNI, you may only remove yourself and your vehicle from the policy. In this case, you would need to create a new policy with updated vehicle information and your new address.

Obtaining Spouse's Consent

If you are removing your spouse from a joint policy, it is important to obtain their signed consent. The specific procedure may vary depending on your insurance company's rules. Additionally, if you share a home with your spouse, they will need to obtain their own auto insurance policy before you can remove them from yours. Some insurers may even require an affidavit from your spouse's auto insurance company to confirm the policy details.

Legal Considerations

If you are going through a divorce, consult with your divorce lawyer to review your current policy and make any necessary adjustments. The terms of your divorce decree may also dictate how your insurance policy is handled. Additionally, if there are children or relatives named on the shared policy, you will need to assign them to one of the new policies, which should also be specified in the divorce decree.

Vehicle Title and Registration

When removing your spouse from your policy, it's important to also address vehicle ownership. If you and your spouse bought a vehicle together, you will need to decide on sole ownership. Once this is agreed upon, the other driver should be removed from the car's registration, title, and insurance. If your spouse is keeping the vehicle, they can remove you from the title and registration through their state's DMV.

Teen Drivers and Custody

If you share custody of a teenage driver, it's important to note that they may need to be listed on both parents' auto insurance policies, even if primary custody is granted to one parent. Insurance providers will need to be aware of each driver on the policy to provide accurate pricing, as teen drivers are considered a substantial risk.

Impact on Discounts and Premiums

Removing your spouse from your policy may also impact any discounts you were receiving. For example, you could lose a multi-car discount if your spouse is removed from the policy. Additionally, if your spouse has a clean driving record, combining your policies could have resulted in lower premiums. Removing them from the policy might result in higher rates.

Lower Auto Insurance Premiums: What Works?

You may want to see also

Shared vehicles: registration, title, and insurance

If you and your spouse bought a vehicle together, deciding how to handle car ownership after a separation can be tricky. Once you agree on who will take ownership of the vehicle, the other driver should be removed from the car's registration, title, and insurance.

If your spouse is keeping the vehicle, they will be able to remove you from the title and registration through their state's DMV. Documentation will vary by state, but it should be straightforward.

It is important to remove yourself from the title, registration, and insurance as soon as possible to avoid confusion or shared responsibility for a vehicle that is no longer yours.

If you live with your spouse after your separation, the easiest option is to leave your car insurance policy alone. Most likely, you share a policy and a residence, and it makes sense to keep the policy as is.

If your spouse has moved out or you would like your own insurance policy, the next steps will depend on who is the primary named insured (PNI) or policyholder. Only the owner of the policy or PNI will be able to make changes to the policy. If you are the PNI, you can call the insurance company and request that your spouse and their vehicle be delisted from the policy.

If you are not the PNI, you won't be able to remove a driver while maintaining control of the policy. However, you should be able to remove yourself and potentially your vehicle, freeing yourself to create a new policy at your new address.

Controlling Your Car Insurance During a Separation

- The policyholder should remove the non-policyholder and their vehicle from the policy.

- Create a new policy with updated vehicle information and a new address (if you were the one removed from the policy).

This process can be a bit more confusing if you share vehicles.

Hippo: Your One-Stop Shop for Auto Insurance?

You may want to see also

Teen drivers and insurance

Getting car insurance for a teenager can be expensive due to their lack of driving experience. In most cases, it is more affordable to add a licensed or permitted teen driver to an existing auto insurance policy.

The average cost of teen car insurance depends on the exact age of the driver, their ZIP code, driving history, and vehicle type. A separate car insurance policy for a 16-year-old driver who has just received their license will likely be more expensive than a policy for an 18-year-old with more driving experience. As teens get older, their rates can go down due to added driving experience, especially if they have a clean driving record.

How to save on car insurance for teens

There are several ways to save on car insurance for teens:

- Good student discounts: Several companies give discounts to teen drivers for maintaining good grades, typically a "B" average or higher.

- Driver safety course: Some insurance companies offer a discount for new drivers if they complete an approved defensive driving course.

- Mobile tracking: Some insurance companies give discounts after evaluating driving habits and usage through apps.

- Bundling insurance: You can save by bundling different types of insurance policies (such as homeowners and auto) with one company.

- Lower your coverage: Removing coverages you no longer need is an easy way to save.

- Increase your deductible: Increasing your comprehensive and collision deductible will increase your out-of-pocket expenses for a claim, but it will reduce your rate.

A teenage driver must have car insurance in almost every state, so they can either be added to an existing policy or insured with a separate policy. Buying a standalone policy for a teenager is usually more expensive due to their lack of driving experience and higher likelihood of accidents.

Postponing Auto Insurance: Can I Delay Payment?

You may want to see also

Changing your name after marriage

Driver's License

Firstly, it is important to note that the laws surrounding name changes on driver's licenses vary depending on your location. In some places, you must legally change your name on your driver's license when you get married. Failure to do so could result in a fine. However, in other places, it is not a legal requirement to change your name on your license, and you can continue to use your maiden name if you prefer. It is essential to check the specific laws in your area to ensure you are complying with the relevant regulations.

Timing of Name Change

When it comes to the timing of your name change, there are a few things to consider. Some people choose to send off their marriage certificate and get their new driver's license before changing their name on their car insurance. This can help to avoid potential issues or confusion if your name on the license doesn't match the name on your insurance policy. However, others choose to change their name with their insurance company at the same time as changing it with the relevant driver licensing authority, to avoid multiple admin fees. It is worth noting that, in most cases, having a mismatch between your driver's license and insurance policy will not affect the validity of either.

Informing Your Insurer

Regardless of when you choose to change your name, you will need to inform your insurance company of your new name. They will likely ask for a copy of your marriage certificate as proof of the name change. There may be an admin fee associated with changing your name on your policy, which can vary depending on the insurer. Changing your name with your insurer is not urgent, and it will not affect your risk assessment or invalidate your insurance if you need to make a claim. However, it is essential to update your name when you renew your policy.

Insurance Rates

Cincinnati Auto Insurance: Does It Work in Kentucky?

You may want to see also

Dividing up assets and belongings

Make a List of Your Belongings

Go through your house, garage, shed, and any other storage areas to create a comprehensive list of your belongings. This includes everything from furniture and appliances to jewellery, collectibles, and vehicles. It's important to be as detailed as possible and include any items of significant value.

Determine Ownership and Value

For items that you bought together or that were given as gifts, it's essential to determine ownership. Generally, the person who purchased an item is considered the owner. If you bought something jointly, you may need to discuss a buyout option, especially if one person contributed more financially. It's also a good idea to get specialised valuations for high-value items or collections.

Decide on Division and Allocation

Consider the practical aspects of dividing your belongings. If you both need to furnish new properties, it may be fair to split furniture and appliances evenly. For items with strong sentimental value, try to be understanding of each other's wishes. Use mediation if needed to help reach agreements.

Address Shared Debts

Don't forget to address any shared debts, such as credit card debts or loans. Even if you divide them, you are both responsible for the full amount. Ensure you have a plan for repayment to avoid future complications.

Update Insurance and Registration

If you jointly own vehicles, you'll need to decide who will keep them and update insurance and registration accordingly. The person keeping the vehicle should be removed from the other's insurance and registration to avoid confusion and shared responsibility.

Seek Legal Advice if Needed

For complex situations, don't hesitate to seek legal advice. A family law solicitor can guide you through the process and ensure a fair division of assets.

Remember, it's important to try to remain amicable and compromise when possible. By working together and being honest about your finances, you can make dividing up assets and belongings a little less challenging during this difficult time.

Auto Insurance: Blown Engine Coverage

You may want to see also

Frequently asked questions

If you are the primary named insured (PNI) or policyholder, you can call the insurance company and request that your spouse and their vehicle be removed from the policy. If you are not the PNI, you won't be able to remove your spouse from the policy but you should be able to remove yourself and your vehicle.

Once you agree on who will take ownership of the vehicle, the other driver should be removed from the car's registration, title, and insurance.

Both parents will need to contribute to their child's car insurance costs. If your child will be using both parents' vehicles regularly, they will need to be listed as a covered driver on both policies at your new addresses.

Married people are often viewed as safer drivers and are more likely to be financially stable, so they typically pay less for car insurance. On average, a married driver pays $96 less per year for car insurance than a single, widowed, or divorced driver.

Divorce and car insurance can be difficult to navigate, especially if you jointly own a vehicle. You may need to revisit finance agreements and take sole possession of the car. The current, jointly-owned policy should be cancelled at the same time the new, individual policies go into effect.