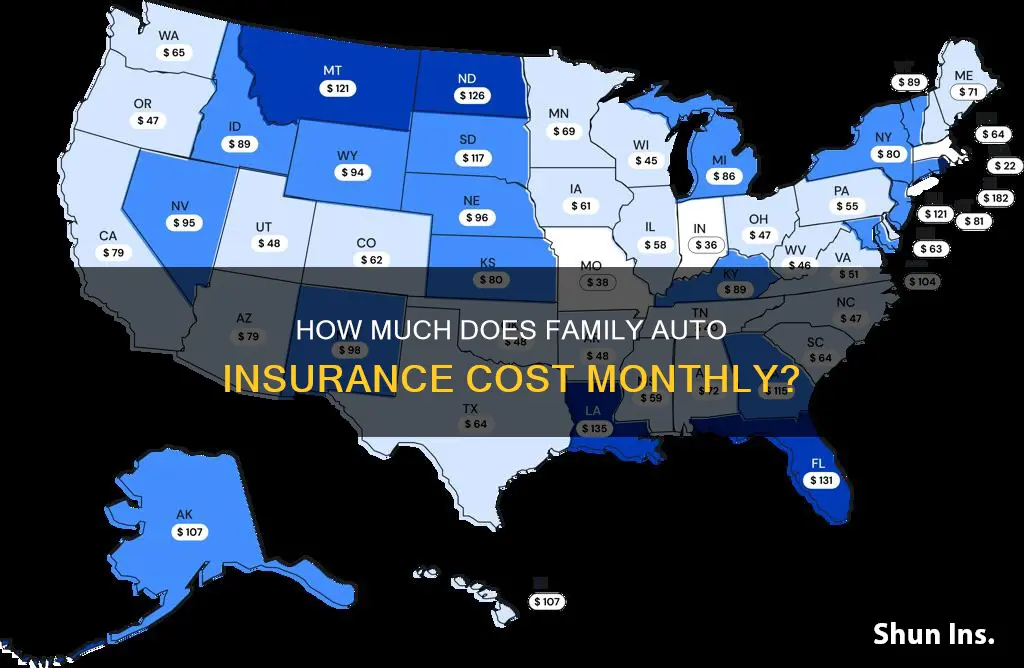

The average cost of car insurance in the United States is $196 per month for full coverage and $53 for minimum coverage, according to Bankrate's research. However, the cost of car insurance can vary depending on factors such as age, gender, driving history, and location. For example, young drivers tend to pay more for car insurance due to their lack of experience and higher risk of accidents. Additionally, rates can differ significantly from state to state, with Idaho having one of the lowest average annual rates at $1,326, while New York has one of the highest at $3,757. It's important to note that these averages may not reflect the actual cost of car insurance for individuals, as personal factors can greatly influence the price.

| Characteristics | Values |

|---|---|

| Average monthly cost for full coverage | $196 |

| Average monthly cost for minimum coverage | $53 |

| Average annual cost for full coverage | $2,348 |

| Average annual cost for minimum coverage | $639 |

What You'll Learn

Average Cost of Car Insurance by State

The cost of car insurance varies between states in the US. Factors such as the cost of labour and vehicle parts, vehicle theft frequency, and road conditions all play a role in determining the average cost of car insurance in each state.

Idaho, Vermont, Ohio, Maine, and Hawaii

Idaho, Vermont, Ohio, Maine, and Hawaii are among the states with the lowest annual full-coverage car insurance rates in the country. Cheaper living expenses, a lower likelihood of accidents and claims, and less traffic congestion may all be factors in these states' lower average premiums. The average annual cost of car insurance in Idaho is $1,326, which is 44% less than the national average. Vermont and Ohio, with average annual costs of $1,396 and $1,492, respectively, are also substantially below the national average.

New York, Louisiana, Florida, Nevada, and Colorado

On the other hand, New York, Louisiana, Florida, Nevada, and Colorado are among the states with the highest average annual cost of full-coverage car insurance. This could be due to the high frequency of claims in these states, making drivers more expensive to insure overall. The average annual cost of car insurance in New York is $3,757, which is 58% higher than the national average. Louisiana and Florida are also significantly more expensive than the national average, with average annual costs of $3,683 and $3,450, respectively.

Wyoming, Vermont, New Hampshire, Idaho, and Ohio

Wyoming, Vermont, New Hampshire, Idaho, and Ohio are among the cheapest states for full-coverage car insurance. The average annual cost of car insurance in Wyoming is $970, while Vermont and New Hampshire have average annual costs of $1,072 and $1,136, respectively.

Florida, Louisiana, Texas, Michigan, and Kentucky

Florida, Louisiana, Texas, Michigan, and Kentucky are among the most expensive states for full-coverage car insurance. The average annual cost of car insurance in Florida is $3,090, while Louisiana and Texas have average annual costs of $3,067 and $2,567, respectively.

Renew Vehicle Insurance: A Quick Guide

You may want to see also

Average Cost of Car Insurance by Company

The average cost of car insurance in the US varies depending on the company, the driver's age, and other factors. Here is an overview of the average cost of car insurance by company:

USAA

USAA offers some of the cheapest full-coverage car insurance policies, with an average annual rate of $1,335. However, USAA policies are only available to military personnel, veterans, and their families.

Erie

Erie is the second-cheapest option, with an average annual rate of $1,532. Their rates are especially competitive for teen drivers, young adults, and senior drivers.

Auto-Owners

Auto-Owners is the third most affordable option, with an average annual rate of $1,619. They also have competitive rates for drivers with a clean record, a speeding ticket, or an accident on their record.

Geico

Geico is another affordable option, with rates well below the national average, especially for young adult and adult drivers.

Nationwide

Nationwide offers competitive rates for drivers with poor credit, as well as low-mileage drivers. Their average annual rate is $1,824.

Progressive

Progressive's rates vary depending on the state, with an average cost of $79.83 per month in low-cost states, $105.36 in medium-cost states, and $157.27 in high-cost states.

Other Companies

Other large insurance companies, such as Allstate, American Family Insurance, and State Farm, have average annual rates ranging from $2,000 to over $3,000.

It's important to note that these averages may not reflect the exact rates offered by these companies, as car insurance rates are highly individualized and depend on various factors.

Streamline Health Insurance Claims with Automation Alternatives

You may want to see also

Average Cost of Car Insurance by Age

The cost of car insurance varies depending on a number of factors, including age, gender, location, driving record, and credit score. In the US, the average cost of car insurance is $2,348 per year, or $196 per month, for full coverage, and $639 per year, or $53 per month, for minimum coverage. However, these costs can vary significantly depending on age.

For younger drivers, those aged 16 to 25, car insurance costs are significantly higher. This is because younger and less experienced drivers are considered higher risk and are more likely to be involved in accidents. For a 20-year-old driver with a clean driving record and good credit, the average cost of car insurance is $3,653 for full coverage and $1,046 for minimum coverage. As drivers age, their insurance costs tend to decrease. By age 40, the national average cost of full coverage car insurance for men is only 2% more than for women.

For older drivers, those in their 70s, insurance costs begin to increase again, as reaction times slow down and eyesight may deteriorate.

Secura Home and Auto Insurance: Is It Worth It?

You may want to see also

Average Cost of Car Insurance by Credit Score

The average cost of car insurance in the US varies depending on factors such as age, location, driving history, and credit score. According to Bankrate, drivers with poor credit pay nearly 85% more for full-coverage car insurance than those with good credit. This is because drivers with poor credit are seen as more likely to file insurance claims and pose a greater financial risk to insurance companies.

In states that allow credit scores to be used when setting insurance rates, insurance companies will review a driver's insurance credit tier, which may differ from their regular credit score. California, Hawaii, Massachusetts, and Michigan are states that do not allow credit scores to be used when setting insurance rates.

According to a study by U.S. News, the average annual rate for car insurance for drivers with poor credit is $4,381, compared to $2,095 for drivers with good credit. This is a difference of $2,286 annually.

The study also found that Nationwide had the lowest sample rates for drivers with poor credit, at 48% below the national average. USAA and Geico also offered competitive rates, with sample costs 42% and 32% below the national average, respectively.

Switching Auto Insurance: A Guide to Changing Providers

You may want to see also

Average Cost of Car Insurance by Driving Record

The cost of car insurance is influenced by several factors, including age, gender, driving record, credit score, and location. Here is a breakdown of how driving records can impact the average cost of car insurance:

- Clean Driving Record: A driver with a clean driving record and good credit will pay around $196 per month for full coverage and $53 for minimum coverage in the USA.

- Speeding Ticket: A speeding ticket can increase insurance rates by an average of 22%. For a 40-year-old driver, this could mean an increase from $196 to $239 per month for full coverage.

- At-Fault Accident: An at-fault accident can raise insurance rates by approximately 44%. For a 40-year-old driver with full coverage, the monthly premium may increase from $196 to $281.

- DUI Conviction: A DUI conviction will significantly impact insurance rates, with an average increase of 94%. A 40-year-old driver with full coverage could see their monthly premium jump from $196 to $380.

It's important to note that these are average costs and that insurance rates can vary widely depending on other factors such as age, gender, location, and credit score. Additionally, insurance companies may have different algorithms for calculating rates, so it's always a good idea to shop around and compare quotes from multiple providers.

Direct Auto: What's in a Name?

You may want to see also

Frequently asked questions

The average cost of car insurance in the USA is $196 per month for full coverage and $53 for minimum coverage. However, this can vary depending on factors such as age, location, vehicle type, credit history, and driving history.

The cost of car insurance for a family of four can vary depending on various factors, including the age of the drivers, the number of vehicles, and the location. It is recommended to compare quotes from multiple insurance companies to find the most affordable option for a family of four.

To get cheap car insurance for your family, consider the following strategies:

- Compare quotes from multiple insurance companies.

- Bundle your insurance policies, such as home and auto insurance.

- Maintain a good credit history and a clean driving record.

- Increase your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in.

- Look for discounts, such as good student discounts, low mileage discounts, or safe driving discounts.