Renewing your vehicle insurance is a straightforward process that can be done online or by contacting your insurance agent. It's important to renew your policy on time to maintain continuous coverage and avoid penalties. Here's a step-by-step guide on how to renew your vehicle insurance:

1. Keep track of the renewal date: Mark the date on your calendar or set a reminder to ensure you don't miss the deadline.

2. Log in to your insurer's website: Visit your insurance company's website and log in to your account. Look for the Policy Renewal or similar option.

3. Provide necessary details: You may need to enter your policy number, vehicle registration number, and other relevant information.

4. Review your policy and coverage: Check if there are any changes to your coverage, and confirm if you're eligible for any discounts or bonuses, such as a No Claim Bonus (NCB).

5. Make the payment: Proceed to make the payment using the available options, such as debit or credit card, or online banking.

6. Wait for acknowledgment: Once the payment is completed, wait for a confirmation email or message from your insurer.

It's important to renew your vehicle insurance to ensure you remain legally compliant and financially protected in case of accidents, theft, or other unforeseen situations. Remember to compare different insurance providers and their quotes to get the best deal for your coverage.

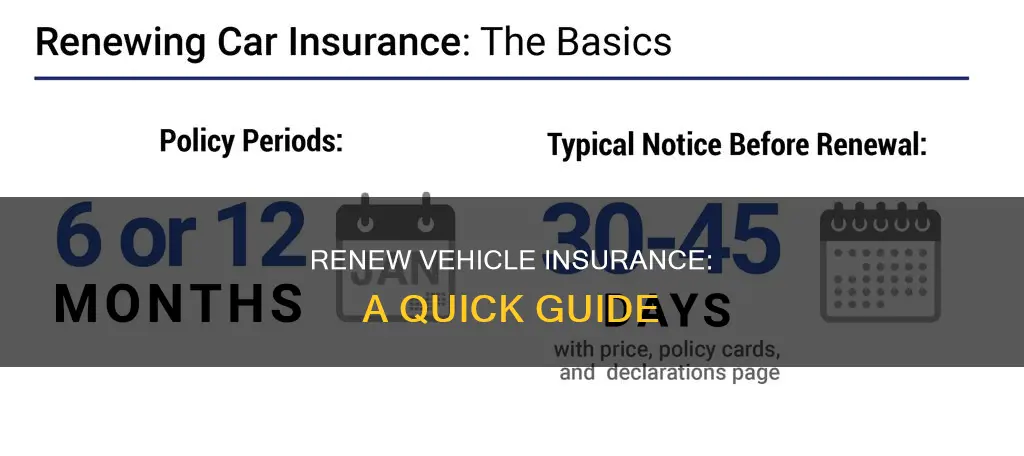

| Characteristics | Values |

|---|---|

| Renewal Methods | Online, Offline |

| Renewal Time | Before the policy expires |

| Renewal Period | 6 or 12 months |

| Renewal Process | Log in to insurer's website, fill in details, make payment |

| Renewal Payment Methods | Debit card, credit card, online banking |

| Renewal Reminders | SMS, email |

| Renewal Benefits | Continuous coverage, financial protection, no-claim bonus |

| Renewal Considerations | Sum insured, add-on covers, insurer's network garages |

What You'll Learn

How to renew vehicle insurance online

Renewing your vehicle insurance online is a quick and easy process. Here is a step-by-step guide on how to renew your vehicle insurance online:

Step 1: Visit the Insurance Company's Website

Go to the website of your chosen insurance company. You can use a search engine to find their website by searching for the company name followed by "insurance". On their website, look for the option to renew your policy. This is usually found under a "Renewal" or "Existing Customers" section.

Step 2: Log In to Your Account

If you have an account with the insurance company, log in using your credentials. If you don't have an account, you may need to create one or log in using a service such as the BC Services Card app or Interac® verification service.

Step 3: Enter Your Policy Details

You will need to enter the details of your insurance policy. This may include your policy number, vehicle registration number, and other relevant information.

Step 4: Review and Update Your Policy Details

Review the details of your current policy. If there are any changes or updates required, such as a change of address or additional drivers, make the necessary amendments.

Step 5: Confirm Your Coverage and Select Add-ons

Confirm the level of coverage you require and select any additional coverage options, also known as add-ons, that you wish to include in your policy. Add-ons provide extra protection and can include options such as roadside assistance, personal accident cover, or engine protection.

Step 6: Proceed to Payment

Once you have confirmed your coverage and selected any add-ons, proceed to the payment section. You will need to provide your payment details, such as your credit card information or bank account details.

Step 7: Complete the Renewal and Print Your Documents

After completing the payment, review your policy details and confirm the renewal. Your insurance company will provide you with the option to print or download your insurance documents. Make sure to keep a printed copy of your insurance documents in your vehicle at all times.

It is important to note that the process may vary slightly depending on your insurance company and location. Always refer to the instructions provided by your specific insurance company. Additionally, ensure that you renew your policy before its expiry date to avoid any lapse in coverage.

Insurance: A Prerequisite for Vehicle Registration?

You may want to see also

How to renew vehicle insurance offline

Renewing your car insurance offline is a straightforward process. Here's a step-by-step guide to help you through it:

Step 1: Analyze Your Insurance Requirements

First, evaluate your insurance needs. Decide what type of coverage you require, such as liability, collision, or comprehensive insurance. Consider the extent of coverage you need and any specific add-ons you may want to include.

Step 2: Research Insurance Companies

Look for local insurance companies that offer auto insurance. Compare their customer service, ratings, and reviews to make an informed decision. You can also compare the cost and benefits of their insurance plans to find one that suits your needs and budget.

Step 3: Choose a Policy

After comparing different insurance companies and their plans, select the coverage that best fits your requirements and financial situation. You can purchase the policy either directly from the insurance company or through an insurance agent.

Step 4: Provide Necessary Details

Once you've chosen a policy, provide the insurance company with all the required information, including your personal details, vehicle information, and driving record. Ensure that all the information you provide is accurate and up to date.

Step 5: Pay the Premium

After selecting your policy and providing all the necessary details, you need to pay the premium to activate your coverage. You can pay the premium online or through other payment methods accepted by the insurance company.

Document Requirements for Offline Renewal:

When renewing your car insurance offline, you will typically need to provide the following documents:

- Government-issued ID proof (PAN card, Aadhar Card, Passport, etc.)

- Copy of your driving license

- Vehicle registration number and certificate

- Pollution test certificate

- Existing motor insurance policy number

Benefits of Renewing Car Insurance:

Renewing your car insurance is crucial and offers several advantages:

- Compliance with Legal Requirements: Most countries require drivers to have valid auto insurance. By renewing your coverage, you can ensure you comply with the law and avoid legal repercussions.

- Financial Protection: Car insurance provides financial security against third-party liabilities and damage to your vehicle. Renewing your coverage ensures this protection is maintained.

- No-Claim Bonus: Many insurance companies offer a No-Claim Bonus (NCB) if you do not file any claims during the policy period. By renewing your coverage, you can accumulate this bonus and enjoy lower premiums.

- Customizable Coverage: Auto insurance coverage can be tailored to your unique needs. When renewing your policy, you can evaluate your coverage and make any necessary adjustments to ensure adequate protection.

- Discounts: Some insurance companies offer discounts to customers who renew their coverage, which can help lower your insurance rates.

Vehicle Registration: Insurance or Not?

You may want to see also

What to do if you miss the renewal date

If you miss the renewal date for your vehicle insurance, you will need to act fast to avoid further complications. Here are the steps you should take:

- Contact your insurance provider immediately: Get in touch with your insurer as soon as possible to check your options. Some insurers may not allow online renewal in this case and may require you to visit their office with the necessary documents. They can also advise you on the specific next steps and any penalties or fines you may be facing.

- Check for a grace period: In some cases, insurance companies offer a grace period to pay the premium and renew your policy after the due date. This grace period can range from 10 to 90 days, with or without late charges or penalties.

- Renew your policy, if possible: If your insurer allows for a late renewal, follow their instructions to renew your policy as soon as possible. You may have to pay revised premium payments and go through a vehicle inspection process.

- Apply for a fresh policy, if necessary: If your insurer does not allow for a late renewal, you may need to apply for a new policy. Compare the plans offered by different insurers, considering features and premium rates. Keep your previous policy documents, details of any past claims, and mandatory car documents such as the registration certificate, pollution under control (PUC) certificate, and driving license handy.

- Get a vehicle inspection: If you are applying for a new policy, your insurer will likely assign a surveyor to inspect your vehicle and determine whether you are entitled to a No-Claim Bonus (NCB) on your fresh policy.

- Make a final decision: The premium offered by the company may only be valid for a limited time, so you will need to decide quickly.

- Prevent future lapses: To avoid missing the renewal date again, set reminders on your phone or calendar. You can also opt for automatic payment options with your insurer to ensure timely payments.

Fleet Insurance: Vehicles Count

You may want to see also

How to switch insurance providers

Switching insurance providers is a straightforward process, but it's important to do your research and time it right to avoid penalties and lapses in coverage. Here's a step-by-step guide on how to switch insurance providers:

- Consider your coverage options: Understand the different types of insurance coverage available, such as liability coverage, collision insurance, and comprehensive insurance. Decide what type of coverage you need based on factors such as the age and value of your vehicle, and whether you have a loan or lease.

- Check for potential penalties: Review the terms and conditions of your current insurance policy to see if there are any penalties for switching providers before the end of your policy term. You may save money by waiting until your policy is up for renewal to avoid cancellation fees.

- Compare quotes from multiple carriers: Get quotes from at least three different insurance companies, making sure to compare the same coverage types and limits for an accurate assessment. Provide basic information such as your address, vehicle details, and driver's license numbers to get personalized quotes. Ask about potential discounts, such as those for bundling policies or having a good driving record.

- Contact your current carrier: Before switching, consider discussing your circumstances with an agent at your current insurance company. They may be able to identify new discounts or savings opportunities, or help you drop unnecessary coverages. If you're using an independent agent, they can also help you find a new policy from another company that better suits your needs.

- Research the new company: Don't just focus on price; consider other factors such as customer service, financial stability, and customer satisfaction. Check reviews, ratings, and third-party assessments to ensure the new company is reputable and will provide a good experience if you need to file a claim.

- Avoid a lapse in coverage: Ensure there is no gap between the end of your old policy and the start of your new one. Ask your old insurance company for a written statement confirming the end date of your policy, and choose a start date for your new policy that aligns with that. This will prevent you from driving without insurance, which is illegal in most places and can result in financial risk.

- Cancel your old policy: Contact your current insurance company or agent to notify them of your decision to cancel. If you have set up automatic payments, remember to cancel those as well. Ask for written confirmation of the cancellation and ensure you understand any specific requirements or forms that need to be completed.

- Access your new insurance ID cards: Once you've cancelled your old policy and started your new one, update your insurance ID cards. Your new insurance company should provide proof of insurance, which may be sent physically or accessed digitally through email or a mobile app, depending on your location.

- Notify relevant parties: If you have a car loan or lease, remember to inform your lender or leasing company about the change in insurance. Additionally, if you have added any new drivers or vehicles to your policy, make sure to update your insurance information with them as well.

How to avoid a lapse in coverage

A lapse in vehicle insurance coverage can have several negative consequences, so it is important to take steps to avoid it. Here are some ways to help you avoid a lapse in coverage:

- Practice responsibility: Vehicle insurance policies are typically cancelled due to non-payment or driving offences. As a vehicle owner, it is your responsibility to consistently pay your insurance premium and drive safely. Too many tickets or accidents on your record can cause an insurer to cancel your policy, resulting in a lapse in coverage.

- Discuss affordable coverage options: Talk to your insurance provider about any discounts you may be eligible for to help keep your premiums affordable. Some providers may also offer annual reviews to assess your current coverage and adjust or update your policy based on your needs.

- Maintain continuous coverage: Even if you are not currently driving your vehicle, maintaining continuous insurance coverage is important. If you are deployed overseas or studying abroad for an extended period, contact your insurance company to discuss options for suspending your coverage. Some companies may allow you to suspend your policy during this time, which can help you avoid a lapse.

- Set up payment reminders: Unintentional lapses in coverage often occur due to missed payments. To avoid this, set up a system to remind yourself when your premium is due. You can use calendar reminders, set up automatic payments, or sign up for payment notifications from your insurance company.

- Plan ahead when switching policies: If you are switching insurance policies, ensure there is no gap in coverage between the end of your old policy and the start of your new one. Double-check the dates to make sure there is no lapse in coverage.

- Consider non-owner car insurance: If you do not own a car but still drive occasionally, consider purchasing non-owner car insurance. This type of insurance can provide financial protection in the event of an accident and help you avoid a lapse in coverage.

- Shop around for the best rates: If you are struggling to afford your current insurance premiums, consider shopping around for a more affordable policy. Compare rates from multiple insurers and look for discounts or lower coverage limits to help reduce your costs.

Frequently asked questions

The process of renewing your vehicle insurance online is simple. First, keep track of the date of renewal and log in to your insurer's website. Click on the 'Policy Renewal' option, make the payment, and wait for the acknowledgement.

If you don't renew your vehicle insurance by the time your current policy expires, your insurance will lapse, and you will be left uninsured. Driving without insurance is illegal in most states and can result in fines or license suspension.

Some insurers may give a short grace period to renew your insurance if you missed the deadline. However, there may still be a lapse in coverage from the date your previous policy expired until the date you renewed it. If you are unable to renew your previous policy, you can always purchase a new one.

Yes, you can switch insurers at any time by cancelling your current policy and buying a new one. You don't need to wait for your policy term to end.