Getting the best auto insurance rates can be tricky, but there are a few things you can do to get a good deal. Firstly, shop around and compare rates from multiple insurers. This is because each company uses a different secret sauce to set its rates, so you may find that the prices vary wildly from one insurer to another. It's also a good idea to ask about discounts – many companies offer reduced rates if you bundle your auto insurance with other policies, have a clean driving record, or agree to receive documents online. You can also increase your deductible, which will lower your premium, but be prepared to pay more out of pocket if you file a claim. Additionally, if you drive an older vehicle, you may be able to drop comprehensive and collision coverage. Finally, consider working with a smaller, regional insurer as they often have higher customer satisfaction ratings and may offer lower rates than the big-name companies.

| Characteristics | Values |

|---|---|

| Shop around for the best rate | Don't overlook smaller insurers |

| Ask about discounts | Discounts for bundling, multi-car, safe driving, good grades, etc. |

| Drop comprehensive and collision coverage for older vehicles | Comprehensive and collision coverage pays to repair or replace your vehicle, but this may not be worth it for older, low-value cars |

| Increase your deductible | A higher deductible will lower your premium, but you'll pay more out of pocket if you file a claim |

| Improve your credit score | A poor credit score can increase insurance rates by hundreds of dollars a year |

| Choose a cheaper vehicle to insure | Luxury vehicles and electric cars tend to be more expensive to insure |

What You'll Learn

Shop around for the best rate

Shopping around for the best rate is a great way to get the best auto insurance rate. It is important to note that each insurance company has its own unique method for setting rates, and these methods change over time. Comparing rates from two insurance companies may reveal vastly different results for the same driver.

When shopping around, it is important to gather multiple quotes from different insurers. Quotes should be free and can be obtained online, over the phone, or through an independent agent or broker. It is recommended to compare quotes from at least two or three companies to find the most affordable rate.

When comparing quotes, it is crucial to ensure that each quote includes the same levels of coverage, such as liability, uninsured/underinsured motorist protection, and comprehensive and collision insurance. Additionally, all quotes should include the same drivers, vehicles, and discounts to ensure an accurate comparison.

While price is an important factor when shopping for auto insurance, it is also essential to consider other factors such as customer service, financial stability, and claims satisfaction. Choosing an insurer with good reviews and a strong financial rating can help ensure a positive experience in the event of a claim.

By shopping around and comparing multiple quotes, drivers can find the best rate and coverage for their needs, ensuring they get the most value for their money.

Non-Citizen Auto Insurance: Is It Possible?

You may want to see also

Don't ignore smaller insurers

When shopping for the best auto insurance rates, it's easy to be drawn to the big names in the industry. However, it's important not to overlook smaller, regional insurers as they often have higher customer satisfaction ratings and may offer lower rates. While the big four auto insurance companies (Allstate, Geico, Progressive, and State Farm) control more than half of the market, smaller companies like Auto-Owners Insurance and Erie Insurance can provide excellent coverage at competitive prices.

Smaller insurers typically have a more limited geographic reach, focusing on specific regions or states. This allows them to develop a deeper understanding of the local market and tailor their products and services to meet the specific needs of their customers in those areas. As a result, they may be more flexible in their underwriting criteria and pricing, which can benefit drivers with unique circumstances or those who are considered high-risk by the larger companies.

When comparing insurance rates, be sure to include both the larger, national insurers and smaller, regional ones. By shopping around and getting quotes from a variety of companies, you can find the best coverage and rates for your specific needs. Remember that the cheapest option may not always be the best, so consider factors such as customer service, claims handling, and the range of coverage options offered in addition to price.

Address Affects Auto Insurance Rates

You may want to see also

Ask about discounts

Discounts are a great way to save money on your auto insurance. Insurers typically provide car insurance discounts, which vary by company and state. Here are some common discounts to ask about:

- Bundling policies: You can often get a discount if you bundle your car insurance with other policies, such as homeowners insurance. Ask your insurance provider if they offer a discount for bundling multiple policies together.

- Insuring multiple cars: Insuring multiple cars with one policy can also result in a discount. If you have more than one vehicle, consider insuring them all under the same policy to save money.

- Clean driving record: Maintaining a clean driving record is not only safe but can also help you save on car insurance. Most insurance companies offer discounts for drivers with no accidents or violations on their record.

- Annual or six-month premium payment: Paying your entire annual or six-month premium at once can often lead to a discount. This is because insurance companies prefer receiving a lump sum payment rather than monthly instalments.

- Paperless documentation: Agreeing to receive documents online instead of through the mail can also result in a discount. Insurance companies save on printing and mailing costs, and they pass some of those savings on to you.

- Safety and anti-theft features: If your car has certain safety or anti-theft features, you may be eligible for a discount. This includes features like airbags, anti-lock brakes, and alarm systems.

- Membership in professional organizations: Being a member of particular professional organizations or affiliate groups can sometimes lead to a discount on your car insurance. Ask your insurance provider about any group discounts they offer.

Remember to ask about discounts when shopping for car insurance and compare rates from multiple insurers to ensure you're getting the best deal.

Marriage and Auto Insurance: Staying on Parents' Policy

You may want to see also

Improve your credit score

Improving your credit score can help you get better auto insurance rates. Here are some ways to improve your credit score:

- Pay your loans on time: Your payment history is the most important factor in determining your credit score. Always make your payments on time to maintain a good credit score.

- Don't get too close to your credit limit: Try to keep your credit utilisation low. The recommended guideline is to use less than 30% of your credit limit, but the lower, the better.

- Maintain a long credit history: Avoid closing your oldest credit accounts, as the length of your credit history also affects your score.

- Dispute credit report errors: Regularly check your credit reports for any inaccuracies or fraudulent activity and dispute any errors to maintain a positive credit history.

- Become an authorised user: If possible, become an authorised user on a friend or family member's credit card account with a good history of on-time payments.

- Pay credit card balances strategically: Pay off your credit card balances before the billing cycle ends or make multiple payments throughout the month to keep your balance low.

- Ask for higher credit limits: If your income has increased or you have a positive credit history, you can ask your credit card issuer to increase your credit limit, which will lower your overall credit utilisation and improve your score.

- Add to your credit mix: Consider adding another credit account, such as a loan or a new credit card, especially if it is a different type of credit than you already have.

- Limit new credit applications: Every time you apply for new credit, a hard inquiry is made on your credit report, which can lower your score. Only apply for new credit when necessary and consider getting prequalified instead, which only requires a soft credit check.

Auto Insurance Agents: Can They Ask for Your License?

You may want to see also

Drop comprehensive and collision coverage for an older car

Dropping comprehensive and collision coverage for an older car can be a great way to save money on your auto insurance. While these coverages are valuable for newer vehicles, they may not be worth the cost for older cars that have depreciated in value. Here are some things to consider when deciding whether to drop comprehensive and collision coverage on an older car:

Value of Your Car

The value of your car is an important factor in determining whether to keep comprehensive and collision coverage. As your car gets older, its value decreases, and at some point, the cost of repairs may exceed the value of the car. In this case, it may not make financial sense to continue paying for comprehensive and collision coverage.

Cost of Repairs

Consider how much it would cost to repair or replace your older car if it were damaged in an accident or another covered event. If the cost of repairs is close to or exceeds the value of the car, it may be more economical to drop comprehensive and collision coverage.

Age and Mileage of Your Car

Age and mileage used to be significant factors in deciding whether to drop comprehensive and collision coverage. However, this is no longer a good way to determine whether to keep or drop the coverage. Some older cars may still have a high value, while some newer cars may have depreciated quickly. It's important to assess the specific value of your car rather than relying solely on age and mileage.

Your Financial Situation

Consider your financial situation and whether you could afford to repair or replace your car if it were damaged or totalled. If you have the financial resources to cover these costs, you may decide that comprehensive and collision coverage is unnecessary.

Cost of Coverage

Weigh the cost of comprehensive and collision coverage against the potential payout in the event of a claim. If the cost of coverage is close to or exceeds the value of your car, it may be more cost-effective to drop the coverage. Additionally, consider the deductible amount you would have to pay in the event of a claim. If the deductible is high, it may not make sense to continue paying for coverage that may not provide a significant payout.

Alternative Coverage Options

If you decide to drop comprehensive and collision coverage, you may want to consider alternative coverage options to protect yourself financially. For example, you could opt for liability-only coverage, which would cover damage you cause to others in an accident but not damage to your own vehicle.

In conclusion, dropping comprehensive and collision coverage on an older car can be a strategic way to save money on auto insurance. However, it's important to carefully consider your specific circumstances, including the value of your car, the cost of repairs, your financial situation, and alternative coverage options, before making a decision.

Insuring a Vehicle: Ownership Flexibility

You may want to see also

Frequently asked questions

If you have a poor driving record, you can expect to pay more for auto insurance. The best way to get the best rate is to shop around and compare quotes from multiple insurers. You may also want to consider working with an insurance broker or independent agent to help you find the best rate.

Many insurers use credit-based insurance scores to calculate car insurance rates. If you have poor credit, you can expect to pay more for auto insurance. To get the best rate, shop around and compare quotes from multiple insurers. You may also want to work on improving your credit score.

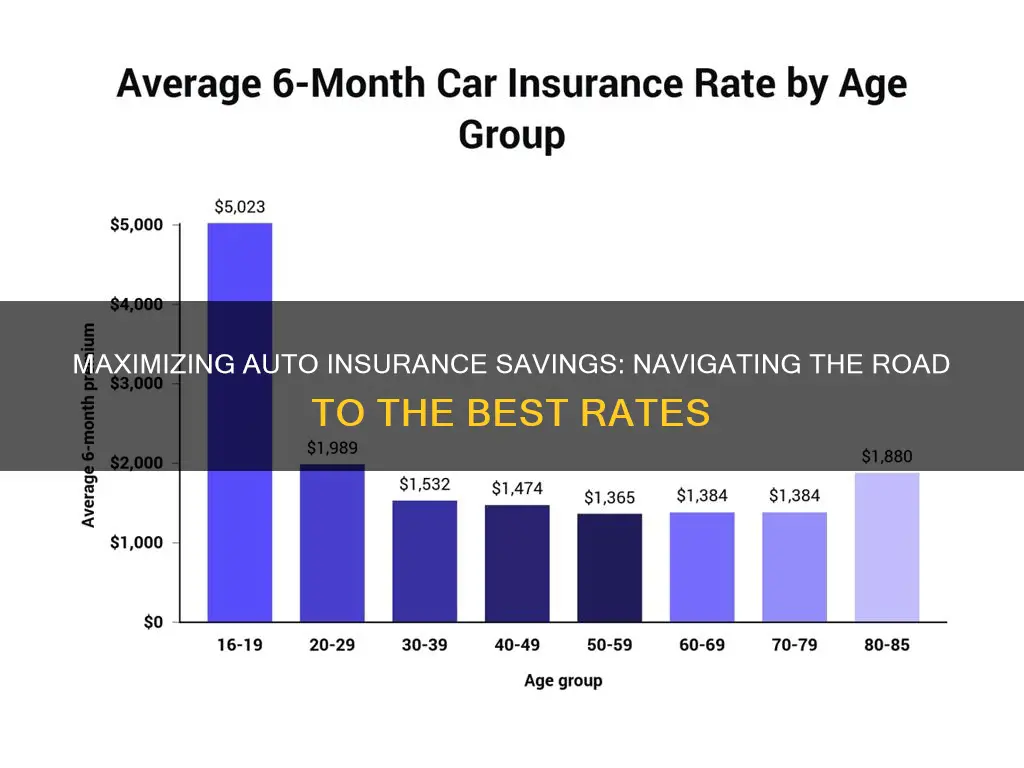

If you are a young driver, you may have a hard time getting cheap car insurance. Auto insurers view drivers without a recent driving history as riskier to insure. To get the best rate, shop around and compare quotes from multiple insurers. You may also want to consider staying on your family's policy until your driving history is more robust.

Car insurance rates are relatively low when you first enter your golden years. As you reach your 70s, rates start to creep up. To get the best rate, shop around and compare quotes from multiple insurers.