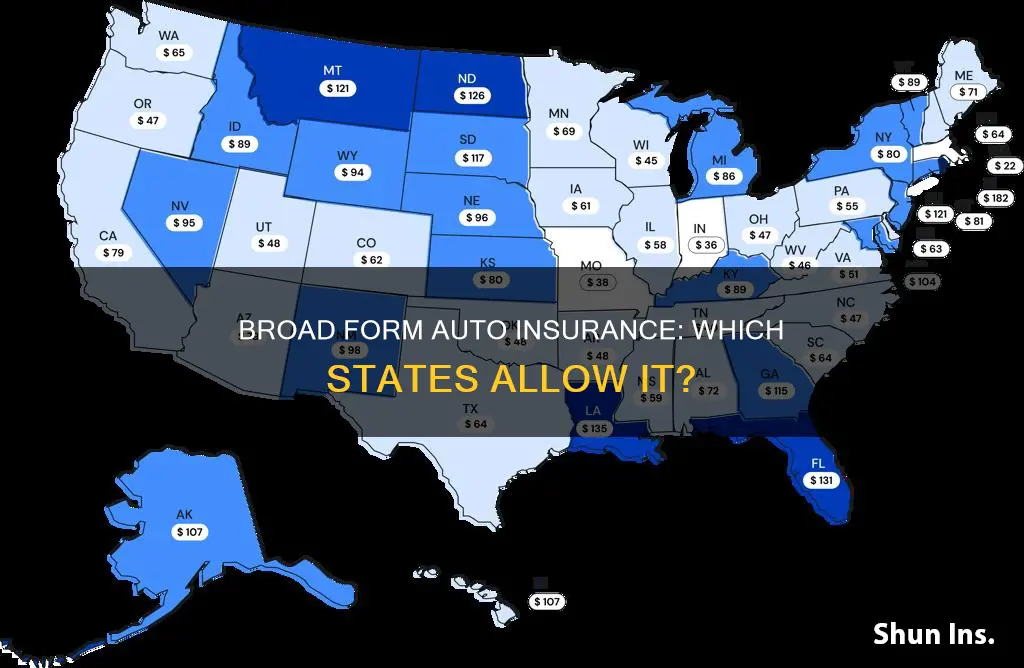

Broad form auto insurance is a type of insurance that covers a specific driver rather than a specific vehicle. This means that the policyholder is covered to drive almost any car, including borrowed cars, rental cars, and cars they own. This type of insurance is typically very inexpensive, but it also has limited coverage. Broad form insurance is not available in every state, and it may not meet the legal minimum insurance requirements in some states. Washington, Idaho, and Oregon are among the few states that offer this type of policy.

| Characteristics | Values |

|---|---|

| States that allow broad form insurance | Washington, Idaho, Oregon |

| Who is it suitable for? | Single drivers without children/dependents, drivers of older vehicles, drivers who don't own a vehicle |

| Who is it not suitable for? | High-risk drivers, drivers with family members or others who drive their car, drivers who want coverage for non-traditional vehicles |

| Coverage | Only one named driver with minimal liability insurance |

| Cost | Cheaper than most types of coverage |

What You'll Learn

Broad form insurance is not available in every state

Broad form insurance is a type of liability insurance that covers a single driver, no matter how many cars are owned or driven. It is important to note that this type of insurance is not available in every state. In fact, it is only offered in a few states, including Washington, Idaho, and Oregon.

The reason broad form insurance is not available in all states is that it may not meet the minimum insurance requirements set by each state. Broad form insurance provides very limited coverage and may leave drivers underinsured. It is important for drivers to understand the specifics of their state's insurance requirements before considering broad form insurance.

One of the key features of broad form insurance is that it covers only one named driver. This means that if anyone else operates the insured vehicle, they will not be covered by the policy. As such, broad form insurance is not suitable for drivers who allow others to drive their car, such as family members or significant others.

Additionally, broad form insurance does not provide coverage for driving non-traditional vehicles like RVs or motorcycles. It also does not provide coverage for vehicle damage incurred in an at-fault accident. These limitations are important to consider when deciding if broad form insurance is the right choice for your needs.

Broad form insurance can be appealing to some drivers because of its low price point. It can be an affordable way to meet the minimum insurance requirements in states where it is allowed. However, it is important to remember that broad form insurance may not provide sufficient coverage in the event of an accident.

Assurant: Vehicle Insurance Available?

You may want to see also

It is a good option for those who don't own a car

Broad form auto insurance is a good option for those who don't own a car as it is a cheaper alternative to other forms of auto insurance. It is a form of liability car insurance that covers a single driver, which produces cheaper rates. This type of insurance does not extend to third parties. Broad form insurance is also a good option for those who don't own a car as it provides liability protection for the driver to meet legal driving requirements. This means that if you don't own a car but frequently drive borrowed or rented cars, broad form insurance can offer you on-the-road protection.

However, it is important to note that broad form insurance is not available in all states and may not meet the minimum insurance requirements in some states. Currently, broad form insurance is only authorized in a few states, including Washington, Idaho, and Oregon. Additionally, broad form insurance does not provide coverage for driving a non-traditional vehicle like an RV or motorcycle. It also does not provide coverage for driving a company car.

Broad form insurance is also known as broad form named operator insurance. It provides minimal auto liability insurance for one named driver, which means very limited coverage for one person and one person only, driving a personal vehicle or vehicles. The coverage is so limited that it does not meet the auto insurance requirements of most states. This type of limited liability coverage means that if you are in a car accident with another vehicle, your policy will only cover the other vehicle and the injuries sustained by the other driver.

Broad form insurance is a controversial option as it provides a very narrow scope of protection on the road. It is important to carefully consider the limitations of broad form insurance before deciding if it is the right choice for you. It may leave you with significant financial risk in the event of an accident.

Auto Injury Insurance: Uncovering the Scope of Laser Treatment Coverage

You may want to see also

It is not suitable for high-risk drivers

Broad form auto insurance is not suitable for high-risk drivers. This is because it is a very basic form of insurance that provides minimal coverage for one person. It is a type of liability-only coverage that only covers a single driver, which is why it is cheaper than other types of insurance.

Broad form insurance is not suitable for high-risk drivers because it does not provide adequate coverage in the event of an accident. It does not cover the driver or their passengers' injuries, nor does it cover collision damage to the driver's car. It also does not cover others driving the vehicle; the liability coverage only applies to the named driver on the policy.

Broad form insurance also does not cover driving a non-traditional vehicle like an RV or motorcycle. It is considered secondary auto insurance when driving a vehicle that the insured person does not own.

Furthermore, broad form insurance may not meet the minimum insurance requirements of certain states. It is only available in a few states, including Washington, Idaho, Oregon, Colorado, Delaware, Iowa, Maryland, Mississippi, Nebraska, Nevada, Ohio, and Tennessee.

High-risk drivers should consider other types of insurance that offer more comprehensive coverage, such as full coverage insurance, which includes comprehensive and collision coverage, and higher liability limits. While it may be more expensive, it provides better protection in the event of an accident.

Dairyland Auto Insurance: Good or Bad?

You may want to see also

It is not ideal if there is more than one driver in the household

Broad form insurance is a type of liability insurance that covers only one specific driver, rather than a specific car. This means that the policyholder is covered to drive any car, including borrowed or rented vehicles, but no other drivers are covered to drive the policyholder's car. This type of insurance is typically cheaper than other forms of coverage, but it is not ideal if there is more than one driver in the household.

Broad form insurance is only suitable for drivers who know that no one else will ever drive their car. If you live with other licensed drivers, such as family members or roommates, they will not be covered by your broad form insurance policy if they borrow your car. This means that you could be held legally responsible and required to pay if they get into an accident. In this case, broad form insurance could leave you underinsured and financially vulnerable.

Broad form insurance is also not recommended for households with multiple drivers because it does not provide adequate coverage for high-risk drivers or expensive, brand-new vehicles. If you have a family or a significant other who is likely to drive your car, you should consider a different type of insurance policy that offers more comprehensive coverage.

Additionally, broad form insurance does not provide coverage for non-traditional vehicles like motorcycles, RVs, or company cars. If you live in a household with multiple drivers and have access to these types of vehicles, broad form insurance may not be sufficient for your needs.

Overall, broad form insurance is designed for single drivers without dependents who own lower-value vehicles. If there is more than one driver in the household, it is important to consider other insurance options that can provide more comprehensive coverage for all drivers and vehicles involved.

Auto Insurance in the 21st Century: Better or Worse?

You may want to see also

It is not recommended for newer, more expensive cars

Broad form auto insurance is not recommended for newer, more expensive cars. This is because it is a very basic form of insurance that only covers the minimum legal requirements. It is a cheap option for those seeking to insure one vehicle with one driver, but it does not offer comprehensive coverage.

Broad form insurance is a type of liability insurance that only covers one driver, resulting in cheaper rates. It is important to note that this type of insurance does not extend to third parties. This means that if you are in an accident and it is your fault, the damage to your vehicle will not be covered by your insurance company. You will be responsible for the cost of repairs to your car.

Broad form insurance also does not cover company-owned vehicles, motorcycles, or RVs. It is not recommended for those with newer or more expensive cars because it does not provide adequate coverage in the event of an accident. If you are in an accident and your car is damaged, you will have to pay for the repairs yourself. This can be very costly, especially for a newer or more expensive car.

Additionally, broad form insurance may not meet the minimum insurance requirements in your state. It is only available in a few states, including Washington, Idaho, and Oregon. Even if it is allowed in your state, your insurance agent may not recommend it because it does not meet strict legal liability standards.

In conclusion, broad form auto insurance is not recommended for newer, more expensive cars because it does not provide adequate coverage in the event of an accident and may not meet the minimum insurance requirements in your state. It is a very basic form of insurance that will not cover the cost of repairs to your vehicle if you are in an accident.

West Auto Insurance: The Best Coverage for Your Car

You may want to see also

Frequently asked questions

Broad form auto insurance, also known as broad form named operator insurance, is a type of insurance that covers a specific driver rather than a specific car. This means that the policyholder is covered to drive almost any car.

Broad form auto insurance covers the policyholder to drive any owned or non-owned personal-use vehicle. It does not cover other drivers or any damage to the insured vehicle.

Broad form auto insurance is only available in a few states, including Washington, Idaho, and Oregon.

Broad form auto insurance is suitable for those who don't own a vehicle but want to be insured, those who borrow vehicles frequently, those who own multiple cars that no one else drives, and those who need an SR22 but don't own a vehicle.