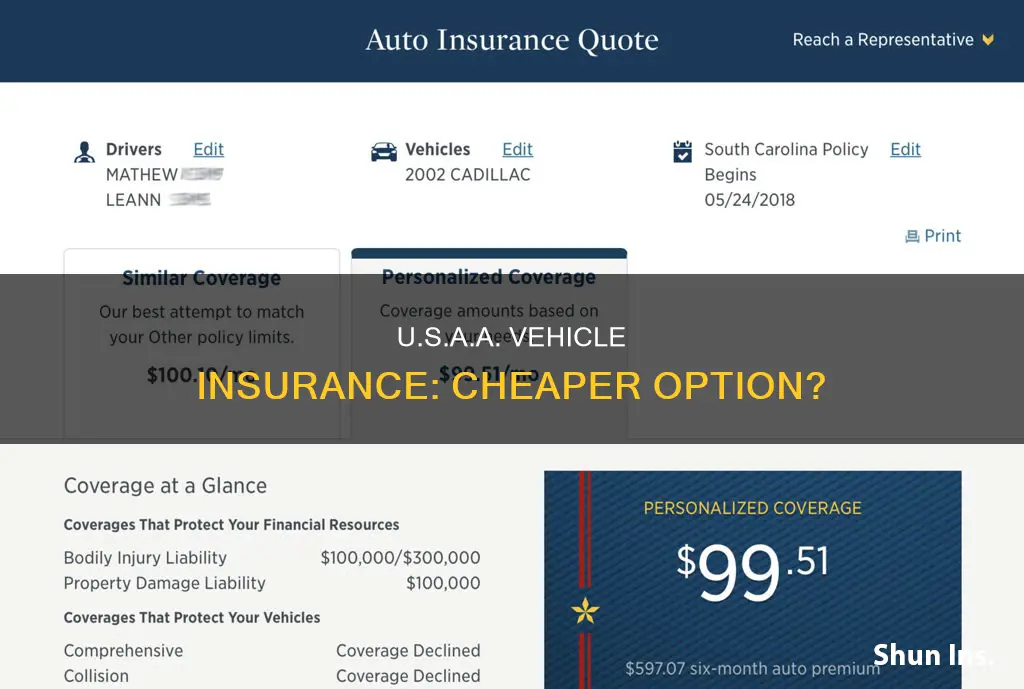

USAA is an insurance company that offers some of the cheapest car insurance rates in the United States. It is unique in that it only offers insurance to current and former members of the military and their families. USAA's car insurance rates are, on average, 30% cheaper than the rates offered by its top competitors. USAA also has a 9.2 out of 10 rating and is the fourth-largest car insurance provider in the U.S. with about 8.7% of the market share.

| Characteristics | Values |

|---|---|

| Cheaper than Geico | Yes |

| Cheaper than the national average | Yes |

| Cheaper for teen drivers | Yes |

| Cheaper for young adults | Yes |

| Cheaper for adults | Yes |

| Cheaper for seniors | Yes |

| Cheaper for drivers with poor credit | Yes |

| Cheaper for good drivers | Yes |

| Cheaper for drivers with a speeding ticket | Yes |

| Cheaper after an accident | Yes |

| Cheaper after a DUI | Yes |

| Cheaper for high coverage | Yes |

| Cheaper for minimum coverage | Yes |

| Cheaper for military members | Yes |

What You'll Learn

USAA vs. Geico: Which is Cheaper?

USAA and Geico are two of the most popular insurance companies in the United States, and both have their advantages when it comes to vehicle insurance.

USAA is only available to military personnel and their families, while Geico is available to everyone. However, USAA tends to offer cheaper insurance rates overall, especially for those with good driving histories. For example, for a 35-year-old with good credit and a good driving history, the average annual rate for full-coverage car insurance is $1,512 with USAA and $1,596 with Geico. USAA also offers the cheapest average rates for teen drivers, young adults, adults, seniors, drivers with poor credit, good drivers, drivers with a speeding ticket, drivers with an accident on their record, and drivers with a DUI on their record.

However, Geico does offer rates below the national average for drivers with poor credit, speeding infractions, or accidents on record. For drivers with very poor credit, Geico is likely the best option. Geico also offers a wider range of discounts than USAA, although USAA is often still the cheapest option.

When it comes to customer satisfaction, USAA outperforms Geico in most areas, including customer service, claims handling, and customer loyalty. However, Geico has a better customer satisfaction rating with the National Association of Insurance Commissioners (NAIC) and a higher customer review score on WalletHub.

In terms of market share, Geico is the second-largest car insurance provider in the US, while USAA is fifth. Geico also has more local agents than USAA.

Overall, both companies offer solid auto insurance options, but USAA is generally the cheaper option, especially for those with good driving records. However, Geico is a good alternative for those who are not affiliated with the military.

Registering a Vehicle: Lapsed Insurance

You may want to see also

USAA Car Insurance Discounts

USAA offers a wide range of discounts to its policyholders. While the company does not disclose the exact amount customers can save by taking advantage of these discounts, other companies advertise comparable discounts of 20-30%. Here is a list of some of the discounts offered by USAA:

Discounts for Your Driving History

- Safe driver discount: For maintaining a good driving record for more than five years.

- Defensive driving discount: For taking an approved defensive driving course.

- Driver training discount: For taking a driver's education or driver training course.

- Good student discount: For students aged 16-25 who are enrolled full-time in high school or college and maintain at least a "B" average.

- SafePilot discount: Save up to 30% by allowing USAA to track your driving habits, including speed, acceleration, and braking.

Discounts for Your Vehicle

- New vehicle discount: For insuring a brand-new car.

- Multi-vehicle discount: For insuring more than one car on the same policy.

- Annual mileage discount: For driving less than 12,000 miles per year.

- Vehicle storage discount: For storing your vehicle.

Discounts for Your Policy Choices

- Family discount: For being previously listed as a named driver on a family member's USAA policy.

- Length of membership discount: For being a long-time customer.

- Military installation discount: For storing your car on a military base.

- No payment plan fees discount: For paying your entire premium upfront.

- Multi-policy discount: For buying multiple types of insurance from USAA.

USAA also offers flexible payment plans tailored to your pay schedule. Additionally, USAA provides a discount of up to 60% on premiums for those who are deployed and store their vehicles.

Check Your Car Insurance Status

You may want to see also

USAA Eligibility Criteria

USAA is a member-owned insurance and financial services company that primarily serves military service members and their families. It was founded in 1922 by 25 Army officers who wanted to insure each other's vehicles. Over the years, USAA's eligibility criteria have evolved, and today it serves a broader range of individuals with military affiliations. Here are the eligibility criteria for USAA membership:

- Active-duty military personnel or retired veterans of the U.S. Army, Navy, Air Force, Marines, Coast Guard, National Guard, and Reserves.

- Cadets, midshipmen at service academies, and officer candidates within 24 months of commissioning.

- Spouses, widows, widowers, and unmarried former spouses of USAA members who had USAA auto or property insurance while married.

- Children of USAA members.

- Individuals whose parents joined USAA.

- Members of certain federal agencies, such as the FBI.

It's important to note that while USAA initially served only military officers, eligibility expanded in 1997 to include non-commissioned officers as well. Additionally, in 2009, anyone who served honorably became eligible for USAA membership, further broadening the membership base.

To establish membership, individuals typically need to provide documentation such as a Social Security number, valid government-issued ID, and proof of military service or familial relationship to a service member.

Update Vehicle Insurance: DMV Guide

You may want to see also

USAA Customer Service Ratings

USAA has received mixed customer service ratings. While some customers praise the company's low prices, others have reported poor customer service and a slow claims process.

WalletHub gives USAA an average rating of 3.5/5, while the user rating is 2.7/5. WalletHub's rating is based on customer reviews, insurance quotes, and third-party ratings. USAA's NAIC rating is 2.27, indicating that it has received more complaints than the average car insurance provider. Customers have reported delays and denials of claims, as well as unsatisfactory settlement offers.

On Trustpilot, USAA has a rating of 2.742 out of 5, with some customers complaining about poor customer service, rude and hostile behaviour, and difficulty in getting responses.

However, USAA has also received positive reviews for its customer service. MarketWatch gives USAA a rating of 9.2 out of 10 and designates it as the "Best for Military Members". The provider ranked second in their in-depth industry study of the best car insurance companies. USAA also received high scores for reputation, coverage, and cost.

In a US News survey, 60% of respondents said they were completely satisfied with USAA's customer service, and 64% said they found it easy to contact the company's customer service. USAA also received high marks for claims handling, with 65% of respondents being completely satisfied with the ease of filing a claim and 67% being satisfied with how their claim was resolved.

Overall, USAA's customer service ratings seem to be mixed, with some customers reporting positive experiences while others have had negative encounters.

Insurance Inspections: In-Person or Virtual?

You may want to see also

USAA vs. Competitors

USAA is one of the top insurance companies in the country, offering cheap car insurance and solid customer service for members of the US military. However, its insurance is only available to current and former military members and their families. USAA's car insurance rates are considerably cheaper than average, especially for young drivers. Its average rates for full coverage are 37% cheaper than average, while its minimum coverage is 43% cheaper. An 18-year-old driver can get rates from USAA that are around half the national average.

USAA's competitors include:

Geico

USAA and Geico are both reputable auto insurance providers that score well in areas like customer service and cost. USAA, however, has a slightly higher overall score of 9.2 out of 10.0, while Geico scores 9.1. Geico is also more widely available to customers. Geico is a good alternative for those without a military affiliation, as it initially insured government employees and still has discounts for federal employees. Geico's customer satisfaction ratings are average when compared to USAA, which ranks No. 1 in customer service, claims handling, and discounts. Geico also has lower rates than USAA for drivers with poor credit.

State Farm

State Farm is a good choice for students and people with younger drivers on their policy. It offers a generous good student discount and programs to help young drivers find lower rates. It also has more local insurance agents than any other provider, making it easier to get assistance in person. State Farm does not have a nationwide discount for military members, but its low rates make it the cheapest option in some areas.

Travelers

Travelers is a great option for most drivers, offering a wide range of coverage options and policy add-ons. It also has a usage-based IntelliDrive program that helps drivers stay safe and get discounted rates.

Nationwide

Nationwide is more affordable than USAA, with an average monthly cost of $90 for car insurance, compared to USAA's $106. It offers affordable rates, many discount options, and a wide selection of coverage options available for bundling. However, it has poor customer satisfaction scores and relatively frequent customer complaints.

Insured Savings: Vehicle Protection

You may want to see also

Frequently asked questions

You must be in one of the following four categories to be eligible for USAA membership: active-duty service members (including those in the National Guard and reserves), veterans (requiring an honourable discharge), children or spouses of a USAA member, or some former spouses of a USAA member.

The primary phone numbers for USAA are 210-531-8722 and 800-531-8722.

USAA insurance is often the cheapest option for military members and their families. However, most people can't get policies.