Freedom Life Insurance Company of America is a subsidiary of USHEALTH Group and offers a simple term life insurance plan. The company has only one plan, so if you are looking for complete coverage, this might not be the best option for you. However, Freedom Life's parent company, USHEALTH Group, offers a variety of medical, dental, and vision coverages, as well as health insurance plans. These plans often include basic medical coverage and cater to different needs and budgets. While Freedom Life itself does not seem to provide health insurance, pairing your life insurance policy with USHEALTH Group's health coverage is an option to consider.

| Characteristics | Values |

|---|---|

| Type of insurance | Life insurance |

| Parent company | USHealth Group |

| Life insurance policy | LifeProtector |

| Life insurance term | 10 years |

| Life insurance renewability | Until age 70 |

| Life insurance cost | $10-$50 per month |

| Health insurance availability | Yes |

| Dental insurance availability | Yes |

| Vision insurance availability | Yes |

| Available states | 33 |

| Customer service availability | Monday-Saturday |

What You'll Learn

- Freedom Life Insurance Company of America is a subsidiary of USHEALTH Group

- Freedom Life Insurance offers a simple term life policy

- Freedom Life Insurance's parent company, USHEALTH Group, offers health, dental, and vision coverage

- Freedom Life Insurance is not available in all 50 states

- Freedom Life Insurance does not offer riders or endorsements

Freedom Life Insurance Company of America is a subsidiary of USHEALTH Group

As a subsidiary of USHEALTH Group, Freedom Life Insurance customers can also access other benefits offered by the parent company, including health, dental, and vision coverage. USHEALTH Group has a broad choice of flexible solutions and secure insurance plans, allowing customers to tailor their health coverage to their specific needs. The company has a dedicated Member Services Team that can assist with information about claims, benefit guidance, and additional coverage.

USHEALTH Group has served over 15 million members to date and has won several awards, including the Gold Stevie Award for 2017, 2018, 2019, and 2020. The company has also been recognised as the insurance company of the year for four consecutive years.

It is important to note that Freedom Life Insurance is not available in all 50 states. Additionally, Freedom Life Insurance has received mixed reviews, with some customers appreciating the simplicity and affordability of their policies, while others desire more comprehensive coverage and improved customer service.

Understanding Backup Withholding on Life Insurance: Your Responsibilities

You may want to see also

Freedom Life Insurance offers a simple term life policy

Freedom Life Insurance Company of America is a subsidiary of USHEALTH Group and offers a simple term life insurance plan for families who want to protect their loved ones. The company's only policy, LifeProtector, is a 10-year renewable term life insurance plan that can be renewed until the age of 70. This means that the policyholder will have coverage for 10 years, and if they pass away during that period, their beneficiaries will receive a death benefit. After the 10-year term expires, the policy can be renewed, but if the policyholder passes away, their beneficiaries will not receive any benefits.

Freedom Life's term life insurance rates are affordable, ranging from $10 to $50 per month, with increments of $5. The company's customer service has received mixed reviews, with some people appreciating the simplicity and ease of cancellation, while others desire more policy options and riders. It's important to note that Freedom Life Insurance is not available in all 50 states of the US.

USHEALTH Group, the parent company of Freedom Life Insurance, offers a variety of other insurance products, including health, dental, vision, accident protection, and disability insurance. These additional insurance options can be paired with Freedom Life's term life insurance policy to provide comprehensive coverage for individuals and families.

Overall, Freedom Life Insurance offers a straightforward and affordable term life insurance plan. While it may not be suitable for those seeking more comprehensive coverage or additional riders, it can be a good option for those looking for basic protection without any complexities.

Canceling Irish Life Health Insurance: A Step-by-Step Guide

You may want to see also

Freedom Life Insurance's parent company, USHEALTH Group, offers health, dental, and vision coverage

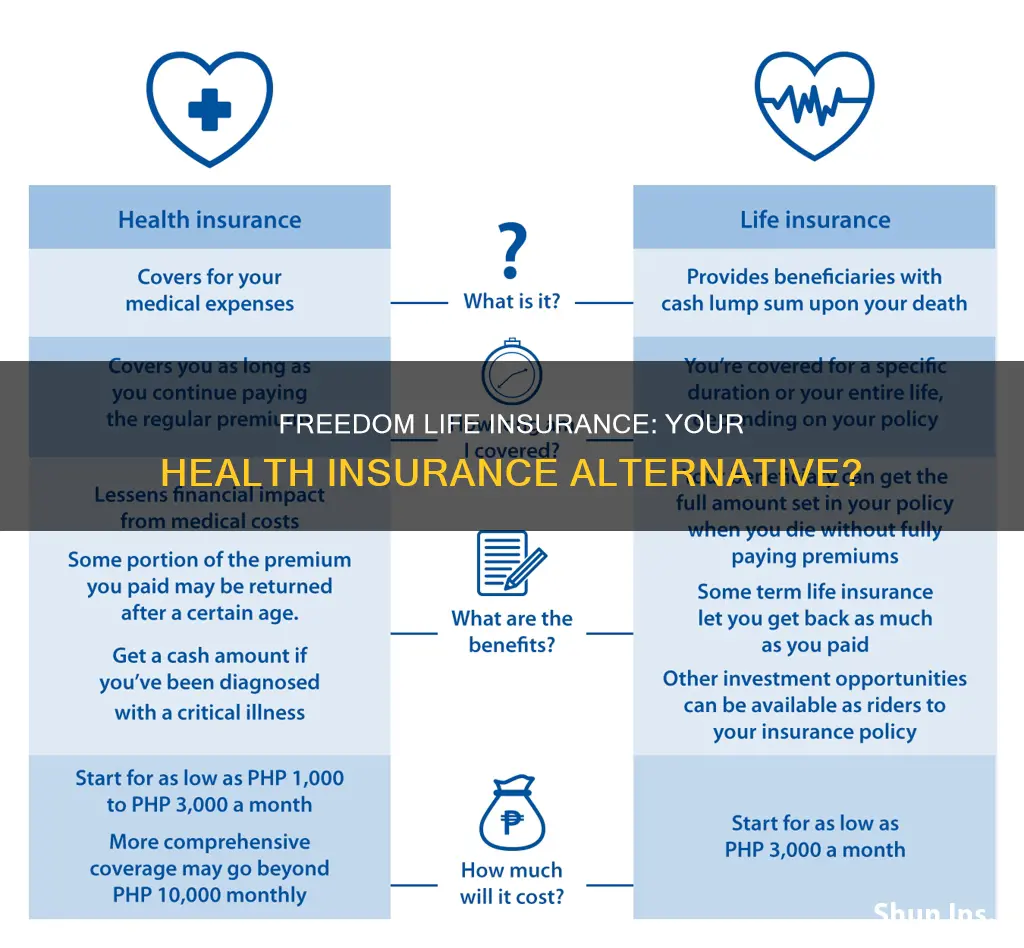

Freedom Life Insurance Company of America is a subsidiary of USHEALTH Group and offers a simple term life insurance plan. However, its parent company, USHEALTH Group, provides a broader range of health, dental, and vision coverage options.

USHEALTH Group is dedicated to providing innovative insurance solutions, including health, specified disease/sickness, accident, and disability insurance. The company serves self-employed individuals, families, business owners, and their employees. USHEALTH Group has covered over 15 million members to date and has a presence in 33 states across the country.

USHEALTH Group's health insurance plans offer flexibility and reliability, with options available for those on a limited budget as well as those seeking additional benefits. Their health plans provide 24-hour coverage, on and off the job, and include quality coverage for periods of critical illness. They also offer wellness and health screening benefits.

In terms of dental coverage, USHEALTH Group provides three plans to choose from, including preventative, basic, and major dental care services. Orthodontic care services are also available. For vision coverage, they offer comprehensive eye exam coverage, as well as corrective lenses and contact lenses coverage, along with an annual allowance towards frames.

While Freedom Life Insurance itself only offers term life insurance, those seeking health, dental, or vision insurance can explore the options provided by its parent company, USHEALTH Group, to find a plan that suits their specific needs.

Funeral Pre-Planning: Life Insurance for Peace of Mind

You may want to see also

Freedom Life Insurance is not available in all 50 states

Freedom Life Insurance Company of America is a subsidiary of USHEALTH Group and offers a simple term life insurance plan for those seeking basic coverage. This plan, LifeProtector, is good for 10 years at a time and can be renewed until the age of 70. While Freedom Life Insurance provides a straightforward option for those seeking no-frills life insurance, it is important to note that their policies are not available in all 50 states.

The company's life insurance products are underwritten by two other USHEALTH Group subsidiaries, National Foundation Life Insurance Company and Enterprise Life Insurance Company, and are only sold through agents. You cannot obtain quotes or purchase coverage online. Unfortunately, Freedom Life Insurance is not eligible for residents of certain states, including Connecticut, Hawaii, Massachusetts, New Hampshire, New York, Rhode Island, Vermont, and Puerto Rico.

This limitation in availability across the United States may be a significant consideration for individuals who frequently travel or plan to move between states. It is crucial to verify the eligibility of Freedom Life Insurance in your state before considering their services. Additionally, Freedom Life Insurance does not offer health insurance plans directly. However, as a subsidiary of USHEALTH Group, their life insurance plans can be paired with other benefits offered by the parent company, including health, dental, and vision coverage.

USHEALTH Group serves customers in 33 states through its family of companies and has covered over 15 million members to date. While Freedom Life Insurance may be a suitable option for those seeking simple and affordable life insurance, it is important to carefully review the availability and coverage options in your specific state before making a decision.

Life Insurance: O'Reilly Auto Parts' Employee Benefits

You may want to see also

Freedom Life Insurance does not offer riders or endorsements

Freedom Life Insurance Company of America is a subsidiary of USHEALTH Group and only offers a term life insurance policy. This policy is good for 10 years at a time and can be renewed until the age of 70. The cost of a term life policy with Freedom Life Insurance starts at $10 a month and goes up to $50 a month in $5 increments. While Freedom Life Insurance does offer health insurance, it is not available in all 50 states and does not offer riders or endorsements.

Riders are additional benefits that can be added to an insurance policy to enhance coverage. They allow policyholders to customise their insurance plan to suit their specific needs. However, Freedom Life Insurance does not offer any riders or endorsements to their policies. This means that policyholders cannot customise their coverage beyond the basic plan offered by the company.

While Freedom Life Insurance does not offer riders or endorsements, its parent company, USHEALTH Group, offers a range of other insurance products, including health, dental, and vision coverage. USHEALTH Group also has subsidiaries that offer specified disease/sickness, accident, and disability insurance. These additional insurance options provide policyholders with more comprehensive coverage choices.

It is important to note that Freedom Life Insurance policies are not available in all states. Currently, the company does not offer coverage in Connecticut, Hawaii, Massachusetts, New Hampshire, New York, Rhode Island, Vermont, or Puerto Rico. Therefore, it is essential to check the availability of coverage in your state before considering Freedom Life Insurance.

Prudential Life Insurance: Checks by Mail?

You may want to see also

Frequently asked questions

Freedom Life Insurance is a subsidiary of USHealth Group and only offers term life insurance. However, USHealth Group offers a range of health insurance plans, including individual and family health insurance options, which you can pair with your Freedom Life Insurance policy.

Freedom Life Insurance is a subsidiary of USHealth Group, meaning it is owned by the same company. Freedom Life Insurance only offers term life insurance, while USHealth Group offers a wider range of insurance products, including health, dental, and vision insurance.

USHealth Group health insurance plans typically include medical, surgical, and hospital expenses. Some plans may also offer preventative care and wellness programs.

Freedom Life Insurance offers a simple term life insurance plan with no add-ons or riders. This may be a good option for those looking for basic coverage without any additional features. However, if you are seeking more comprehensive coverage or riders, you may need to consider other insurance providers.

Freedom Life Insurance quotes are not available online. To get a quote, you need to contact an insurance agent or call the Freedom Life Insurance customer service phone number.