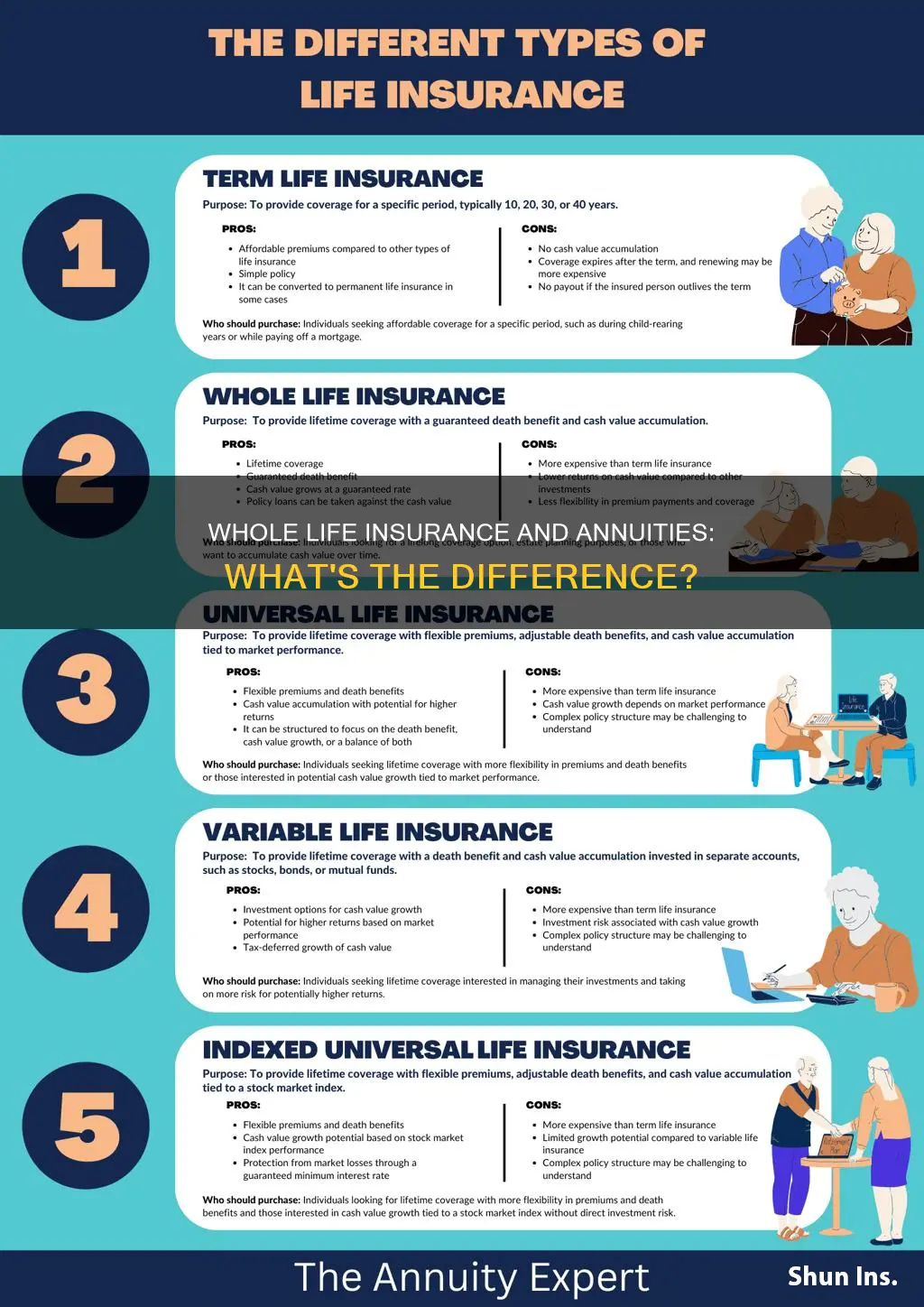

Life insurance and annuities are both insurance products that can be used as part of a long-term financial plan. While they are often confused, they serve different purposes and operate in distinct ways. Life insurance is primarily designed to provide financial protection to loved ones in the event of the policyholder's death, whereas annuities are meant to safeguard your financial well-being during retirement by providing a steady stream of income.

What You'll Learn

Whole life insurance and annuities: death benefits

Whole life insurance and annuities are both insurance products that can be used to protect your financial well-being and that of your family. They are often offered by the same companies, but they operate very differently.

Whole life insurance provides coverage for the entirety of the insured person's life. It guarantees the payment of a death benefit to beneficiaries in exchange for regular premium payments. Whole life insurance policies also include a savings component, known as the "cash value," which the policy owner can draw on or borrow from. Interest accrues on a tax-deferred basis. The death benefit can be affected by certain policy provisions or events, such as unpaid policy loans.

Annuities, on the other hand, are designed to turn your money into future income payments. You can buy an annuity with a lump-sum payment or multiple payments over time. Annuities can be set up with a growth period, allowing your savings to build. The return on an annuity depends on its type. For example, a fixed annuity pays a guaranteed interest rate, while a variable annuity lets you invest in mutual funds.

Annuities can include a death benefit, which provides a payout to your heir based on the contract terms and your balance. However, annuity death benefits are smaller relative to life insurance. Additionally, heirs would owe income tax on annuity investment earnings, whereas life insurance death benefits are tax-free.

While whole life insurance is primarily used to pay your heirs when you pass away, some policies allow you to build savings while you are alive. Similarly, while annuities are mainly used to grow your savings and pay you income while you are alive, they can include a death benefit.

In summary, whole life insurance is focused on providing a death benefit to your beneficiaries, whereas annuities are focused on providing you with income during your retirement years, with the option of a death benefit. Both tools can be used as part of a comprehensive financial plan, depending on your specific needs and goals.

Life Insurance: USAA's Comprehensive Coverage Options

You may want to see also

Whole life insurance and annuities: tax implications

Whole life insurance and annuities are both insurance products, but they differ in how they pay policyholders. Whole life insurance is a type of permanent life insurance that pays a benefit upon the death of the insured and is characterised by level premiums and a savings component. Annuities, on the other hand, are designed to turn your money into future income payments, providing a pension-like stream of income that you can use to fund your retirement.

Tax Implications of Whole Life Insurance

Whole life insurance policies can be used to save for future goals like retirement. You can withdraw or borrow against the cash value of your policy using a policy loan. With whole life insurance, you can withdraw up to what you paid in premiums tax-free. However, if you withdraw any gains, you will owe income tax on them. You can also take out a policy loan against the cash value, which is not subject to income tax. However, the insurer will charge interest on the outstanding loan balance. It is important to note that the cash value of a whole life insurance policy grows tax-deferred, and you may be taxed on any gains when you withdraw more than your basis.

Tax Implications of Annuities

The tax implications of annuities depend on how the annuity contract was purchased. If you bought the annuity with pre-tax dollars from a qualified retirement plan, such as a 401(k) or IRA, your future income payments will be fully taxable as ordinary income. On the other hand, if you purchased the annuity with after-tax dollars, your future income payments will include a tax-free return of your premiums and taxable gains. It's important to note that annuities offer tax-deferred growth, and you will be taxed on any earnings when you withdraw them. Additionally, if you are under the age of 59.5 when you cancel or make a lump-sum withdrawal from an annuity, you may be subject to a 10% early withdrawal penalty on top of income tax on any gains.

Credit Card Debt: Can It Access Your Life Insurance?

You may want to see also

Whole life insurance and annuities: who they're for

Whole life insurance and annuities are both insurance products that can help with financial planning. However, they serve different purposes and are suitable for different individuals depending on their financial goals, budget, and life stage.

Whole life insurance is a type of permanent life insurance policy that lasts for the entire lifetime of the insured person and has a guaranteed death benefit. It tends to have higher premiums than term life insurance but offers a cash value component that the policyholder can borrow or withdraw from as needed. Whole life insurance is often purchased by individuals with financial dependents, such as a spouse or children, to ensure their financial security in the event of the insured person's death. It is also a good option for those seeking a tax-efficient way to accumulate wealth through the cash value of the policy.

On the other hand, annuities are designed to provide a steady stream of income during retirement. They are typically purchased later in life to supplement pension or other retirement income sources. Annuities can be funded through a single lump-sum payment or multiple payments over time. The two main types of annuities are fixed annuities, which provide guaranteed returns, and variable annuities, which allow for investment of premiums in stocks, bonds, or money market accounts and offer the potential for higher returns but also carry greater risk.

Annuities are generally more suitable for individuals who are worried about having sufficient income during retirement or who expect to live a long life and want to ensure their financial security. They can also be a good option for those looking to satisfy required minimum distributions and supplement their Social Security benefits.

Both whole life insurance and annuities offer distinct benefits and serve different needs. Whole life insurance is ideal for those who want to ensure their loved ones are financially protected after their death, while annuities are better suited for individuals seeking a reliable income stream during their retirement years. It is not uncommon for individuals to have both whole life insurance and annuities as part of their financial portfolio, providing a comprehensive "portfolio of protection".

Life Insurance Agents: Fiduciary Duty or Not?

You may want to see also

Whole life insurance and annuities: when to choose each

Whole life insurance and annuities are both insurance products that can help with financial planning. However, they serve different purposes and are suitable for different situations. Here are some key points to help you choose between the two:

Whole Life Insurance

Whole life insurance is a type of permanent life insurance policy, which means it lasts for your entire lifetime and has a guaranteed death benefit. It tends to have higher premiums than term life insurance but offers additional benefits, such as a cash value component. This cash value can be borrowed or withdrawn from as needed while you are alive. Whole life insurance is often purchased to provide financial protection for loved ones, such as a spouse or children, after your death. It can help replace lost income, cover funeral costs, and pay off outstanding debts. Whole life insurance is also a good option for those who want to accumulate wealth in the form of cash value within the policy.

Annuities

Annuities, on the other hand, are designed to provide a steady stream of income during retirement. They are typically purchased later in life to supplement pension or other retirement income sources. With an annuity, you pay a lump sum or periodic payments to the insurer, who then provides you with regular income payments, often for the rest of your life. Annuities can be a form of "longevity insurance," ensuring you don't outlive your assets. They offer investment and income benefits, with the potential for higher returns compared to whole life insurance. Annuities are also a good option for those who want to offload some financial risk to the insurance company.

When to Choose Each

Choose whole life insurance if you want to ensure your loved ones are financially secure after your death, especially if you have dependents or significant financial obligations. Whole life insurance is also a good choice for those looking for a tax-efficient way to accumulate wealth through the policy's cash value.

Choose an annuity if you are concerned about having enough income during retirement or want to create an additional income source. Annuities are ideal if you expect to live a long life and want "longevity insurance." They are also a good option if you want to reduce financial risk by having a guaranteed income stream.

Hypertension and Life Insurance: What You Need to Know

You may want to see also

Whole life insurance and annuities: how they differ

Whole life insurance and annuities are both financial products offered by insurance companies, but they serve different purposes. Whole life insurance is a type of permanent life insurance policy, which means it lasts for the entirety of the policyholder's life and has a guaranteed death benefit. On the other hand, annuities are designed to provide a steady income stream during retirement.

Whole life insurance policies offer a death benefit that is paid out to the policyholder's beneficiaries upon their death. This benefit is typically paid out as a lump sum, although some insurers may offer the option of receiving the payout as an annuity, or in regular instalments over time. The death benefit provides financial protection to the policyholder's loved ones, helping to replace lost income, cover funeral costs, and pay off any outstanding debts. Whole life insurance policies also have a cash value component, which allows the policyholder to borrow or withdraw funds as needed.

In contrast, annuities are primarily designed to provide a steady income stream during retirement. Annuities can be purchased with either a lump sum payment or multiple payments over time. The annuity then provides income payments, which can be set up over a fixed period or guaranteed for the rest of the annuitant's life. This makes annuities a form of insurance against outliving one's income. Annuities may also include a death benefit, where the remaining balance is paid out to the annuitant's heir upon their death.

One key difference between whole life insurance and annuities is the timing of payments. Whole life insurance provides financial protection to beneficiaries after the policyholder's death, whereas annuities provide income payments directly to the annuitant while they are still alive. Additionally, whole life insurance policies require the policyholder to pay premiums, whereas annuities involve investing a lump sum or multiple payments to generate future income.

Another distinction is the focus of each product. Whole life insurance is designed to provide financial security to loved ones in the event of the policyholder's death, while annuities are focused on generating retirement income and protecting against the risk of outliving one's assets. Whole life insurance is often purchased earlier in life when the death benefit protection is more important to loved ones, whereas annuities are typically purchased later in life as a way to supplement retirement income.

In summary, whole life insurance and annuities differ in their purpose, timing of payments, focus, and the stage of life when they are typically purchased. Whole life insurance provides financial protection to loved ones after the policyholder's death, while annuities offer a steady income stream during retirement.

Life Insurance Options Post-Prostate Cancer: What You Need to Know

You may want to see also

Frequently asked questions

The primary purpose of life insurance is to financially provide for your loved ones after you die.

The primary purpose of an annuity is to provide you with a stream of income throughout your retirement.

Yes, in many cases, it makes sense to have both life insurance and an annuity. Since one product helps safeguard your family’s lifestyle and the other helps safeguard your retirement, people often use both to build what is essentially a “portfolio of protection”.