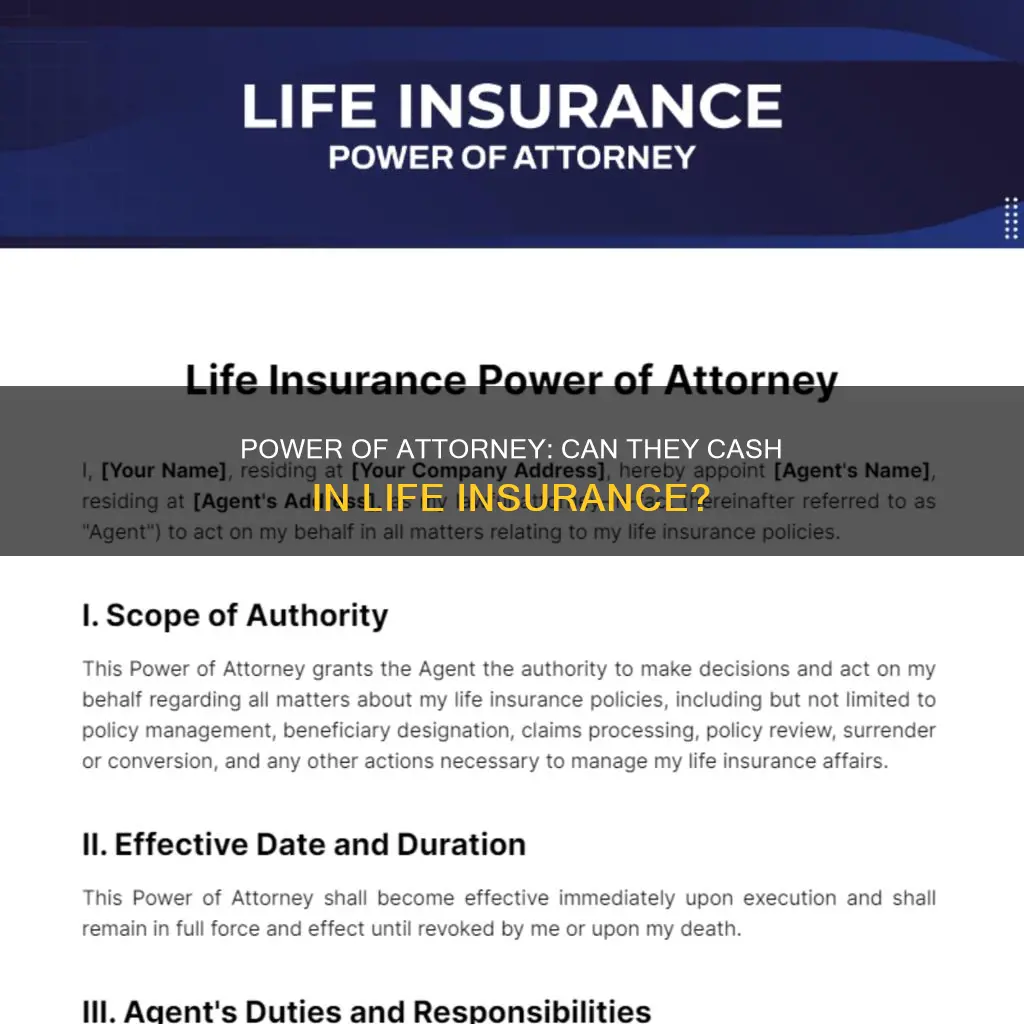

A power of attorney is a legal document that allows an individual to hand over the decision-making process to another person or organisation. Depending on the type of power of attorney, the agent may be able to cash in a life insurance policy on behalf of the policy owner.

| Characteristics | Values |

|---|---|

| Can a power of attorney cash in a life insurance policy? | If the POA document specifically grants this right to the agent and specifies the life insurance policy, the agent can cash in a life insurance policy on behalf of the policy owner. |

| Can a power of attorney cancel a life insurance policy? | A power of attorney cannot cancel a life insurance contract without the POA document specifically granting the agent this right. |

| Can a power of attorney change the beneficiary of a life insurance policy? | A power of attorney may have the authority to change beneficiary designations on behalf of the policyholder but is disallowed from naming themselves as a beneficiary unless the document explicitly grants them this right. |

| Can a power of attorney be the beneficiary of a life insurance policy? | Yes, an individual who acts as an agent with a power of attorney can be the beneficiary of a life insurance policy should the policy owner decide to name them. |

What You'll Learn

- A power of attorney can be general or durable

- A power of attorney cannot alter or cancel a life insurance policy

- A power of attorney can be temporary or permanent

- A power of attorney can be general, medical, durable, or limited

- A power of attorney can be used to cash in a life insurance policy if explicitly authorised

A power of attorney can be general or durable

A power of attorney (POA) is a legal document that allows someone else to handle your legal, medical, or financial affairs. A power of attorney can be general or durable.

A general power of attorney gives authority to make various decisions for you when you are alive and of sound mind. The power of attorney becomes invalid when you are incapacitated, dead, or disabled. As a general POA, your agent can help with a wide range of transactions, such as managing finances and real estate transactions, purchasing insurance policies, and hiring professionals.

On the other hand, a durable power of attorney overcomes the limitations of a general POA by remaining in effect even after disability or incapacitation. A durable POA allows your agent to continue making decisions on your behalf if you become incapacitated due to illness, accident, or mental decline. There are two types of durable POAs: one for financial matters and one for medical matters. The former is also known as a durable power of attorney for finances, while the latter is called a healthcare power of attorney.

It is important to note that a power of attorney, whether general or durable, cannot alter or cancel a life insurance policy. While they have the authority to sign contracts and handle financial matters, they cannot change the beneficiaries of a life insurance policy.

FedEx Part-Time Employees: Life Insurance Benefits Explained

You may want to see also

A power of attorney cannot alter or cancel a life insurance policy

A power of attorney is a legal contract that allows you to hand over the decision-making process to another individual. A power of attorney may be general or durable. A general power of attorney gives authority to make various decisions for you when you are alive and of sound mind. The power of attorney is no longer valid when you are incapacitated, dead, or disabled. A durable power of attorney overcomes these limitations, allowing the power of attorney to continue even after a disability or incapacitation.

A power of attorney can do many things, but cannot alter or cancel a life insurance policy. A life insurance policy is a contract that protects your family from the negative financial consequences of your death by providing money to pay for your financial obligations. Since the beneficiaries have a right to this money, this becomes an important feature of a power of attorney document. A person is prevented from taking advantage of you or your family when you're unable to make decisions for yourself.

While a power of attorney cannot alter or cancel your life insurance policy, you should still be careful in selecting one. Your power of attorney has the authority to sign contracts, accept cash, and handle your financial affairs. If your power of attorney fails to pay a life insurance premium, it could trigger the policy's cancellation for non-payment of premiums.

A power of attorney can, however, change the beneficiary of a life insurance policy. If you are the power of attorney for another person, you will need to write a letter to the insurance company that wrote the policy, explaining in detail why a change in beneficiary needs to be made. The company will then send you the appropriate forms that must be filled out and returned for the process to take place. It is important to note that a power of attorney cannot name themselves as the beneficiary unless it is specifically stated in the documents that this is allowed.

Life Insurance: Unearned Income or Smart Investment?

You may want to see also

A power of attorney can be temporary or permanent

A power of attorney (POA) is a legal document that gives one person the power to act for another. The person who receives the authority is referred to as the agent or attorney-in-fact, and the subject of the POA is called the principal. The agent can have broad legal authority or limited authority to make decisions about the principal's property, finances, or medical care.

A Limited Power of Attorney is typically used in situations such as when the principal is travelling or living abroad for an extended period, needs to buy or sell property in another state or country, or becomes ill and needs someone to conduct a business transaction on their behalf. The principal can revoke the Limited Power of Attorney once the situation or purpose has passed, and it is automatically revoked upon the death of the principal.

In contrast, a general power of attorney is not limited to specific situations or timeframes and provides the agent with broader authority to act on behalf of the principal. However, a general power of attorney is no longer valid when the principal becomes incapacitated, dies, or is disabled. To overcome these limitations, the principal can opt for a durable power of attorney, which remains in effect even after the principal's disability or incapacitation.

Best Life Insurance: AM Rating Agency's Guide

You may want to see also

A power of attorney can be general, medical, durable, or limited

A power of attorney (POA) is a legal document that allows someone else to act as your representative and make decisions on your behalf. There are several types of POA, each with different purposes and limitations. Here are the four main types:

General Power of Attorney

A general power of attorney gives broad authority to the agent to make various decisions on behalf of the principal when they are alive and of sound mind. This type of POA covers a wide range of transactions and financial matters, such as managing finances, buying property, and signing documents. However, it is important to note that a general power of attorney becomes invalid if the principal becomes incapacitated, dies, or is disabled.

Medical Power of Attorney

A medical power of attorney, also known as a healthcare power of attorney or health care proxy, is solely for making healthcare decisions on behalf of the principal. This type of POA allows the agent to communicate with doctors and make medical treatment decisions when the principal is unconscious or unable to make choices about their care. It is important to have a medical power of attorney to ensure that your healthcare wishes are carried out, especially in end-of-life situations.

Durable Power of Attorney

A durable power of attorney is similar to a general power of attorney but with additional wording that makes it effective even if the principal becomes incapacitated. This type of POA can be used for financial matters or medical matters and is usually contained in separate documents. A durable power of attorney helps plan for medical emergencies, cognitive decline, or other situations where the principal is no longer capable of making decisions.

Limited Power of Attorney

A limited power of attorney grants the agent the authority to act on behalf of the principal in specific matters or situations. It may cover a particular period or be limited to certain financial accounts or transactions. For example, it could explicitly state that the agent is only permitted to manage the principal's retirement accounts or property transactions.

It is important to choose the appropriate type of power of attorney based on your specific needs and circumstances. Each type of POA has different powers, limitations, and purposes, so it is crucial to understand the differences before granting this important authority to someone else.

Life Insurance Proceeds: Tax-Free Transfer for Beneficiaries

You may want to see also

A power of attorney can be used to cash in a life insurance policy if explicitly authorised

A power of attorney is a legal document that allows someone to make decisions on your behalf. This can include making financial and business decisions, such as paying bills, settling claims, or buying a life insurance policy. While a power of attorney can do many things, there are some limitations to their power. For example, they cannot alter or cancel a life insurance policy unless explicitly authorised to do so. This is because the beneficiaries of the policy have a right to the money, and this protection is an important feature of a power of attorney document.

It is important to note that the power of attorney ceases upon the death of the policy owner. Therefore, a person with power of attorney can no longer act on behalf of the deceased policy owner, and the named beneficiary will receive the death benefit. Additionally, a power of attorney cannot name themselves as a beneficiary of the life insurance policy unless the document explicitly grants them this right.

The laws governing power of attorney can vary from state to state, so it is important to consult with a lawyer to ensure that any power of attorney document is drafted in accordance with the relevant laws and is legally binding.

Esurance Life Insurance: What You Need to Know

You may want to see also

Frequently asked questions

Yes, if the POA document specifically grants this right to the agent and mentions the life insurance policy, the agent can cash it in on behalf of the policy owner.

While an agent with a POA has many rights, they cannot revoke a life insurance policy unless explicitly granted this authority in the POA form.

Yes, an agent with a POA can be the beneficiary of a life insurance policy if the policy owner decides to name them. However, unless explicitly stated in the agreement, an agent with a POA cannot name themselves as the beneficiary.

No, a POA does not allow the representative to change the life insurance beneficiary designation after the policyholder dies.

A power of attorney (POA) is a legal document that grants someone the authority to make decisions on another person's behalf. The POA may be temporary or permanent, and it can be general, durable, or limited.