When it comes to blending life insurance policies, finding the right ratio is crucial. This ratio determines how much of each policy to include in the blend, impacting the overall coverage and financial security for the policyholder. The goal is to create a balanced mix that provides adequate protection while also considering the cost and benefits of each individual policy. Achieving the optimal blend requires careful analysis of various factors, including the policy terms, coverage amounts, premiums, and the policyholder's financial goals and risk tolerance. Understanding these elements is essential for making informed decisions and ensuring that the blended policy meets the policyholder's needs effectively.

What You'll Learn

- Cost-Benefit Analysis: Evaluate the financial impact of blending policies

- Policy Type Compatibility: Ensure policies have similar terms and riders

- Age and Health Factors: Consider age and health when blending

- Tax Implications: Understand tax consequences of blending life insurance

- Regulatory Compliance: Adhere to insurance regulations when blending policies

Cost-Benefit Analysis: Evaluate the financial impact of blending policies

When considering the blending of life insurance policies, a cost-benefit analysis is a crucial step to evaluate the financial impact and determine the optimal policy mix. This analysis involves a comprehensive assessment of the costs associated with different policy combinations and the benefits they provide. Here's a detailed breakdown of the process:

Identifying Costs: Begin by understanding the expenses related to various life insurance policies. These costs can include premiums, administrative fees, policy maintenance charges, and any additional benefits or riders. For instance, a term life insurance policy might have lower premiums but higher administrative costs due to its simplicity. In contrast, a whole life policy could offer higher cash value accumulation but at a higher premium rate. By categorizing and quantifying these costs, you can create a clear picture of the financial burden associated with each policy type.

Benefit Evaluation: The benefits of blending policies should be carefully examined. This includes the financial security provided by the insurance, such as death benefit coverage, income replacement, or long-term care. Consider the potential payout and the likelihood of claiming the benefit. For example, a blended policy might offer a higher death benefit, ensuring a more substantial financial safety net for beneficiaries. Additionally, assess the non-financial advantages, such as peace of mind, reduced stress, and the ability to plan for future goals.

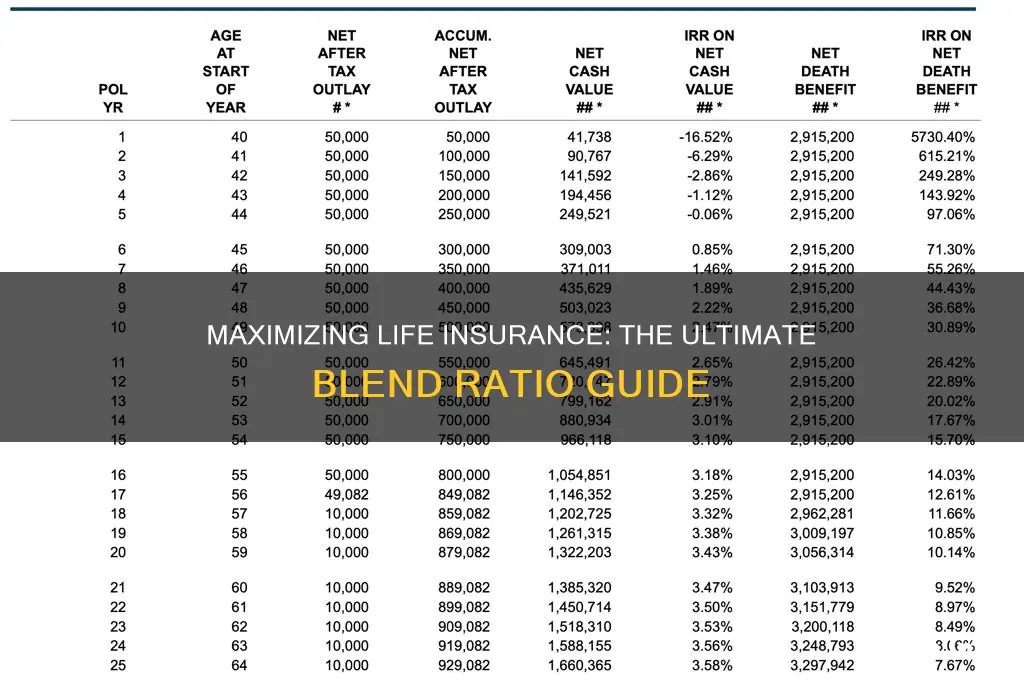

Calculating Financial Impact: This step involves a detailed calculation of the financial implications of blending policies. It requires a thorough understanding of the policy ratios and how they affect the overall cost and benefit structure. You can use financial modeling to simulate different policy combinations and their impact on the insured's finances. The analysis should consider the time value of money, ensuring that the benefits received are accurately valued in today's dollars. By comparing the costs and benefits, you can identify the policy ratios that result in the most favorable financial outcome.

Risk Assessment: Blending policies can introduce new risk considerations. Evaluate the risk profile of the combined policies and assess how it aligns with the insured's financial goals. For instance, a higher death benefit ratio might increase the risk for the insurer but provide more financial security for the insured's family. Understanding these risks is essential to make informed decisions and ensure the blended policy meets the intended objectives.

Canceling Life Insurance: Over the Phone Possible?

You may want to see also

Policy Type Compatibility: Ensure policies have similar terms and riders

When blending life insurance policies, one crucial aspect to consider is the compatibility of the policy types. This involves ensuring that the underlying policies have similar terms and riders, which is essential for a smooth blending process and to avoid potential issues. Here's a detailed guide on why and how to focus on policy type compatibility:

Understanding Policy Types: Life insurance policies can vary significantly in their structure and features. Common types include term life, whole life, universal life, and variable universal life. Each policy type has unique characteristics, such as different death benefits, premium structures, and investment options. For instance, term life insurance provides coverage for a specified period, while whole life offers lifelong coverage with a guaranteed death benefit. Understanding these differences is the first step in ensuring compatibility.

Term and Rider Comparison: When blending policies, the terms and riders should align. Riders are additional benefits or options added to a policy, providing extra protection or flexibility. For example, a critical illness rider offers financial assistance if the insured person is diagnosed with a critical illness. When combining policies, ensure that the terms and riders are similar or compatible. If one policy has a specific rider, the other policy should ideally offer a comparable benefit to maintain a balanced blend. This ensures that the blended policy provides comprehensive coverage without gaps or overlaps.

Impact of Policy Differences: Incompatible policy types can lead to complications during the blending process. If one policy has a higher death benefit or different premium payment options, blending it with another policy might result in an imbalance. For instance, blending a term life policy with a whole life policy that has a significantly higher death benefit could lead to an over-insured situation, potentially causing premium increases or policy cancellations. Similarly, differences in investment options or cash values can create complexities, especially when calculating the blended policy's value and ensuring proper distribution of benefits.

Blending Strategies: To address policy type compatibility, consider the following strategies:

- Policy Conversion: In some cases, converting one policy to match the other's type might be necessary. For example, converting a term life policy to a whole life policy with similar coverage can ensure compatibility.

- Riders and Endorsements: Review the available riders and endorsements in both policies. Identify the most relevant and beneficial riders that are common to both policies or can be added to the less comprehensive one.

- Policy Review and Analysis: Thoroughly review and analyze both policies to identify any discrepancies in terms, coverage, and riders. This process ensures that the blending process is well-informed and avoids potential issues.

By focusing on policy type compatibility and ensuring similar terms and riders, you can create a blended life insurance policy that is comprehensive, balanced, and tailored to the insured's needs. This approach minimizes potential complications and ensures a smooth transition during the blending process.

Life Insurance and Estate Planning in Canada: What's Included?

You may want to see also

Age and Health Factors: Consider age and health when blending

When determining the optimal blend ratio for life insurance policies, age and health are critical factors that should not be overlooked. These elements significantly influence the risk assessment and, consequently, the premium calculations. As individuals age, their health status may change, and certain medical conditions can become more prevalent, impacting the overall risk profile. For instance, older adults might face a higher likelihood of chronic illnesses or age-related health issues, which could affect the insurance company's decision on the policy blend.

Age is a fundamental determinant in assessing risk. Younger individuals generally have a lower risk profile compared to older adults. They are more likely to have a higher life expectancy, reduced likelihood of severe health issues, and a more robust overall health status. As a result, insurance companies might offer more favorable terms and lower premiums for younger policyholders. In contrast, older individuals may face higher insurance rates due to the increased risk associated with age-related health concerns.

Health status plays an equally important role in blending life insurance policies. A person's medical history, current health conditions, and lifestyle choices can significantly impact the blend ratio. For instance, individuals with a history of chronic diseases, such as diabetes or heart disease, may require a more cautious approach when blending policies. Insurance companies often consider the severity and management of these conditions to determine the appropriate blend ratio. A healthy lifestyle, including regular exercise and a balanced diet, can positively influence the blend, potentially leading to lower premiums.

When blending life insurance policies, it is essential to consider the age and health of the policyholder to ensure a fair and accurate assessment. A comprehensive understanding of these factors allows insurance providers to offer tailored solutions that cater to the specific needs of each individual. By taking age and health into account, insurance companies can create blends that provide adequate coverage while also considering the financial implications for both the policyholder and the insurer.

In summary, age and health are vital considerations when determining the blend ratio for life insurance policies. Younger individuals and those with a healthy lifestyle may benefit from more favorable terms, while older adults and those with pre-existing health conditions might require a more tailored approach. By carefully evaluating these factors, insurance companies can provide appropriate coverage and ensure a balanced blend that meets the needs of diverse policyholders.

Unleash Your Potential: 6 High-Paying Careers with a Life Insurance License

You may want to see also

Tax Implications: Understand tax consequences of blending life insurance

When blending life insurance policies, it's crucial to understand the tax implications that can arise from this financial strategy. The tax consequences can vary depending on the specific policies involved and the individual's tax situation. Here's a detailed breakdown of what you need to know:

Policy Ownership and Taxation: Life insurance policies are typically considered assets of the policy owner. When blending policies, the ownership structure should be carefully considered. If the policies are owned jointly with rights of survivorship, the tax treatment may differ from policies owned individually. Joint ownership can result in tax implications for both policyholders, even if one passes away. It's essential to review the tax laws in your jurisdiction regarding joint ownership to ensure compliance.

Tax-Free Distribution: One of the advantages of life insurance is the potential for tax-free distribution of death benefits to beneficiaries. When blending policies, the tax-free status of the death benefit may still apply, but the process can become more complex. The tax laws often allow for the tax-free transfer of life insurance proceeds to beneficiaries, provided the policies meet certain criteria. However, if the blended policies exceed specific limits, the death benefit may be subject to income tax for the policy owner. Understanding these limits and seeking professional advice can help ensure proper tax treatment.

Taxable Gifting: Blending life insurance policies can also have implications for gifting strategies. If the policy owner gifts a portion of the policy's cash value to another individual, it may be considered a taxable event. The gift tax rules apply, and the excess value gifted above the annual exclusion amount may be subject to tax. Additionally, if the gifted policy is surrendered, the surrender charge may be taxable income for the recipient. Careful planning and consideration of the tax implications of gifting are essential to avoid unexpected tax liabilities.

Policy Loans and Taxation: Another aspect to consider is the taxation of policy loans. If the blended policies have a significant cash value, taking out a loan against the policy may have tax consequences. Policy loans are generally not taxable income, but the interest paid on the loan may be taxable. It's important to understand the tax treatment of policy loans and the potential impact on the overall tax liability. Consulting with a tax professional can help navigate these complexities.

In summary, blending life insurance policies requires a thorough understanding of the tax implications associated with ownership, distribution, gifting, and policy loans. Seeking professional advice from a tax expert or financial advisor is highly recommended to ensure compliance with tax laws and to make informed decisions regarding your life insurance strategy. Proper planning can help maximize the benefits of blending policies while minimizing potential tax drawbacks.

Life Insurance and Suicide: What's Covered?

You may want to see also

Regulatory Compliance: Adhere to insurance regulations when blending policies

When blending life insurance policies, regulatory compliance is of utmost importance to ensure the process is conducted ethically and legally. Insurance regulations are in place to protect both the policyholders and the insurance companies, and adhering to these rules is essential to avoid any legal repercussions. One key aspect of regulatory compliance is understanding the specific guidelines and requirements set by the relevant insurance regulatory bodies in your jurisdiction. These regulations often dictate the criteria for policy blending, including the types of policies that can be combined, the eligibility criteria for policyholders, and the maximum allowable policy ratios.

For instance, insurance regulators may specify that only term life insurance policies can be blended with whole life policies, and there must be a clear and documented reason for the blend, such as a strategic financial planning decision. The regulatory body might also set a maximum ratio of blended policies, ensuring that the combined policy does not exceed a certain threshold, which could impact the insurer's risk assessment. Adhering to these guidelines is crucial to maintain the integrity of the insurance industry and protect the interests of all stakeholders.

Insurance companies must also ensure that the blending process is transparent and fair. This includes providing clear and accurate information to policyholders about the blended policy, its terms, and any changes that may occur. Policyholders should be informed of the reasons for blending and how it benefits them, ensuring they understand the implications of the blended policy. Transparency builds trust and ensures that policyholders are not misled or taken advantage of during the blending process.

Furthermore, insurance regulators often require insurers to maintain detailed records and documentation related to policy blending. This includes records of the blending process, the rationale behind the blend, and any changes made to the policy. These records are essential for audit purposes and to demonstrate compliance with regulatory requirements. Proper documentation ensures that the blending process can be traced and verified, providing an additional layer of protection for both the insurer and the policyholder.

In summary, regulatory compliance is a critical aspect of blending life insurance policies. It requires a thorough understanding of the relevant insurance regulations, ensuring that the blending process adheres to the specified criteria, and maintaining transparency and fairness throughout. By following these guidelines, insurance companies can navigate the blending process while upholding ethical standards and legal requirements, ultimately benefiting both the industry and its customers.

Term Life Insurance vs Short-Term Disability: What's the Difference?

You may want to see also

Frequently asked questions

Blending life insurance policies, also known as policy blending or policy aggregation, is a strategy used by individuals to optimize their insurance coverage. It involves combining multiple life insurance policies from different providers to achieve a desired death benefit or to meet specific financial goals. This approach can be beneficial for those who want to ensure comprehensive coverage or to take advantage of different policy features and benefits.

The ratio for blending life insurance policies depends on various factors, including your financial objectives, risk tolerance, and the types of policies you own. A common approach is to consider the total coverage amount you desire and then allocate a portion of that amount to each policy based on the policy's features and costs. For example, you might decide to allocate 60% of your desired coverage to a term life policy and the remaining 40% to a permanent life policy, depending on your specific needs and preferences.

Yes, there can be tax and regulatory implications when blending life insurance policies. Tax laws may treat blended policies differently, and there could be tax advantages or disadvantages depending on the jurisdiction. Additionally, some insurance providers might have specific guidelines or restrictions on policy blending. It is essential to consult with a financial advisor or insurance professional to understand the tax implications and ensure compliance with any relevant regulations.