Banks offer life insurance as a complementary financial product to their customers, providing an additional layer of security and peace of mind. Life insurance can be a valuable tool for individuals and families, offering financial protection in the event of the insured's death. By offering life insurance, banks can enhance their customer service, build trust, and diversify their revenue streams. This product can be tailored to meet the specific needs of different customers, such as term life insurance for short-term coverage or whole life insurance for long-term financial security. Additionally, banks can leverage their existing customer relationships to promote and sell life insurance policies, making it a convenient and accessible option for their clients.

What You'll Learn

- Financial Security: Banks offer life insurance to provide financial protection for dependents in the event of the policyholder's death

- Debt Management: Life insurance can help pay off debts and loans, ensuring financial stability for the family

- Income Replacement: It replaces lost income, covering daily expenses and maintaining the family's standard of living

- Long-Term Savings: Some policies offer investment components, helping build long-term wealth and savings

- Peace of Mind: Offering life insurance gives customers peace of mind, knowing their loved ones are protected

Financial Security: Banks offer life insurance to provide financial protection for dependents in the event of the policyholder's death

Banks offer life insurance as a strategic financial product to ensure the financial stability and security of their customers' families and dependents in the event of the policyholder's death. This is a critical aspect of their role in the financial services industry, as it provides a safety net for individuals who rely on the income and support that the policyholder provides. The primary purpose of this insurance is to offer financial protection, which is especially crucial for those who have financial commitments, such as mortgage payments, children's education, or other dependents who depend on the policyholder's income.

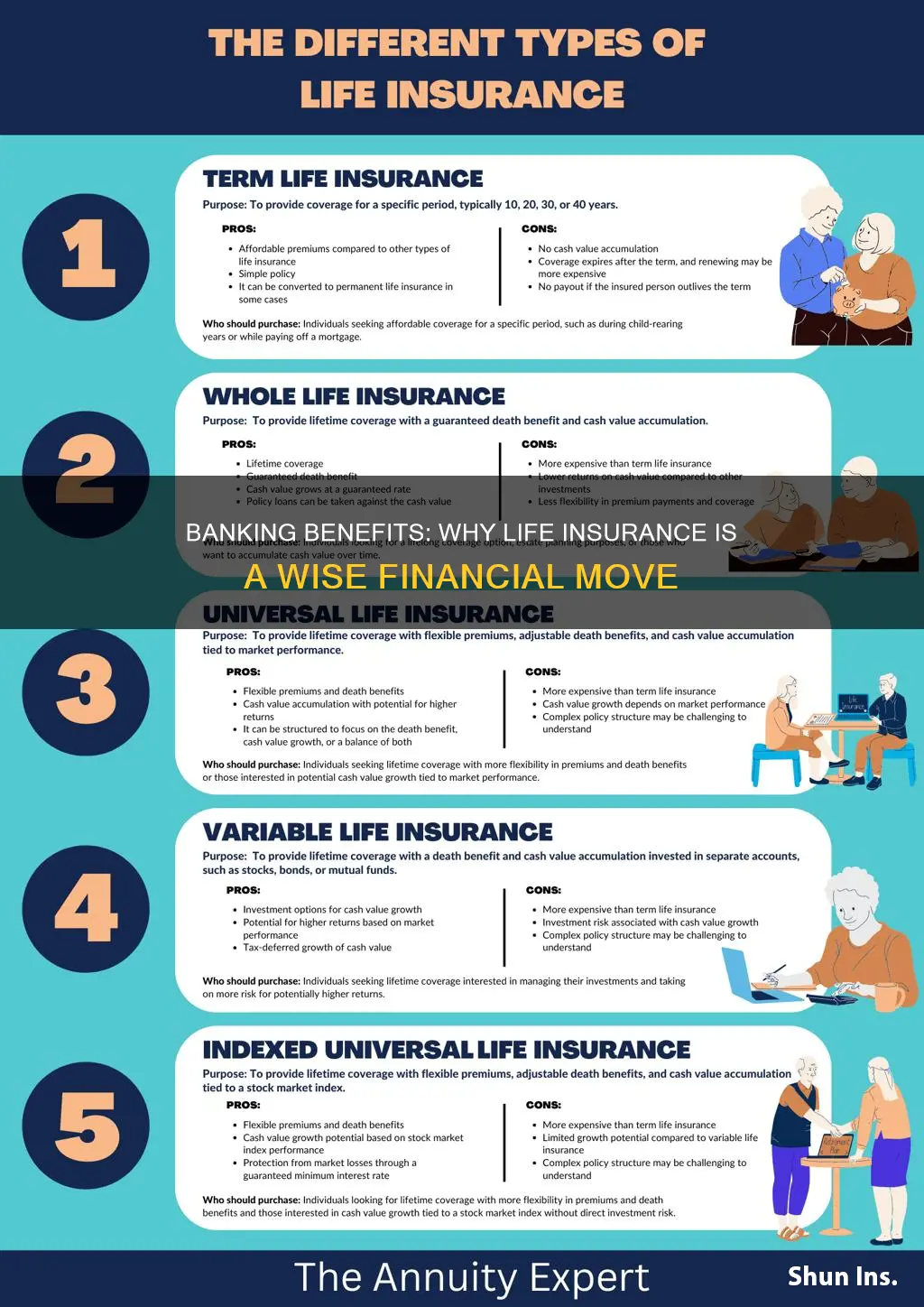

When a bank provides life insurance, it typically offers a range of coverage options tailored to the individual's needs. These policies can be term life insurance, which provides coverage for a specific period, or permanent life insurance, which offers lifelong coverage. The amount of coverage is determined by the policyholder's income, financial obligations, and the number of dependents they have. For instance, a policyholder with a large family, a mortgage, and other financial commitments might opt for a higher coverage amount to ensure their dependents can maintain their standard of living and meet their financial needs in the event of the policyholder's death.

The financial protection offered by life insurance is essential because it helps to alleviate the financial burden on the surviving family members. Without this insurance, the dependents might struggle to cover essential expenses, such as housing, utilities, and daily living costs, especially if the primary income earner is no longer present. Life insurance ensures that the dependents can maintain their lifestyle and have the financial resources to cover these expenses, providing peace of mind and security during a difficult time.

Moreover, banks often provide life insurance as a complementary product to their existing services, such as mortgages or savings accounts. By offering life insurance, banks can enhance their customer value proposition, demonstrating their commitment to the long-term financial well-being of their clients. This approach also encourages customers to maintain their relationships with the bank, as the insurance can be linked to their existing accounts, making it a convenient and integrated part of their financial portfolio.

In summary, banks offer life insurance to provide a critical layer of financial security for their customers' dependents. This insurance ensures that the financial commitments and obligations of the policyholder are met, even in the event of their death, allowing the surviving family members to maintain their standard of living and cover essential expenses. It is a strategic product that banks provide as part of their comprehensive financial services, aiming to support the long-term financial goals and security of their clients.

Life Insurance Arbitration: What You Need to Know

You may want to see also

Debt Management: Life insurance can help pay off debts and loans, ensuring financial stability for the family

Life insurance is a powerful financial tool that can provide a safety net for families and help manage debts effectively. When an individual passes away, the life insurance policy's payout can be a crucial source of financial support for their loved ones, especially in the context of debt management. This is particularly important as it ensures that the family's financial obligations are met, providing much-needed stability during a challenging time.

The primary purpose of life insurance is often misunderstood as solely providing financial support to beneficiaries. However, it can be a strategic asset in debt management. When a person with outstanding debts dies, the remaining family members may struggle to honor those commitments, leading to potential financial strain and legal consequences. This is where life insurance steps in as a solution. The policy's death benefit can be utilized to settle debts, such as mortgages, car loans, credit card balances, and personal loans. By doing so, the insurance payout can prevent the family from incurring additional financial burdens or facing repossessions and legal issues.

For example, consider a family with a substantial mortgage and a child's college fund loan. If the primary breadwinner passes away, the remaining family members might struggle to make mortgage payments and maintain the family's standard of living. A life insurance policy with a sufficient death benefit can cover these expenses, ensuring the family's financial obligations are met. This financial security allows the family to grieve and make necessary arrangements without the added stress of managing debts.

Moreover, life insurance can be tailored to individual needs, allowing policyholders to choose the coverage amount based on their debt obligations. This customization ensures that the policy's payout is adequate to cover specific financial responsibilities. For instance, a family with a large mortgage and a child's education fund might opt for a higher death benefit to ensure these debts are fully settled. This proactive approach to debt management can provide peace of mind and financial security for the family.

In summary, life insurance is not just about providing financial support to beneficiaries; it is a strategic tool for debt management. By utilizing the death benefit from a life insurance policy, families can settle debts, maintain financial stability, and avoid the potential pitfalls of debt collection and legal issues. It empowers individuals to take control of their financial future and ensure their loved ones' well-being during challenging times.

Heart Attacks: Life Insurance Impact and Your Coverage

You may want to see also

Income Replacement: It replaces lost income, covering daily expenses and maintaining the family's standard of living

When a bank offers life insurance, it primarily focuses on a crucial aspect of financial planning: income replacement. This feature is designed to provide financial security and peace of mind for individuals and their families in the event of the policyholder's death. The primary goal is to ensure that the family can maintain their current standard of living and cover their daily expenses, even if the primary income earner is no longer present.

Income replacement through life insurance works by providing a regular payment to the beneficiaries, typically the family members, in the event of the insured individual's death. These payments are structured to mirror the deceased's income, ensuring that the family can continue to meet their essential financial obligations. This is particularly important for families with children, as it guarantees that the children's needs, such as education, healthcare, and general living expenses, can be met.

The amount of income replacement provided is carefully calculated to cover the family's essential costs, including housing, utilities, food, transportation, and other regular expenses. It is a comprehensive approach to financial planning, ensuring that the family's lifestyle remains stable and secure, even in the face of tragedy. By offering this type of coverage, banks aim to alleviate the financial burden that often accompanies the loss of a primary income earner.

Moreover, the income replacement aspect of life insurance is a powerful tool for long-term financial planning. It allows individuals to build a financial safety net that can be relied upon during unforeseen circumstances. This safety net can provide the necessary financial support to ensure that the family's long-term goals and aspirations remain on track, even if the primary breadwinner is no longer around.

In summary, income replacement through life insurance is a critical component of the financial services offered by banks. It ensures that families can maintain their financial stability and cover daily expenses, providing a sense of security and peace of mind. This feature is a testament to the comprehensive approach that banks take towards financial planning, aiming to protect and support individuals and their families in various life stages and circumstances.

Group Term Life Insurance: Taxable Gross Income?

You may want to see also

Long-Term Savings: Some policies offer investment components, helping build long-term wealth and savings

Long-term savings are a crucial aspect of financial planning, and life insurance can play a significant role in helping individuals achieve their financial goals. Many life insurance policies offer investment components, which can be a powerful tool for building long-term wealth and savings. These investment options are designed to grow your money over time, providing a secure and structured way to save for the future.

When considering long-term savings, it's essential to explore the various investment options available within life insurance policies. These investment components often include a range of investment funds, portfolios, or accounts that are professionally managed by financial experts. By investing in these options, policyholders can benefit from the potential for long-term growth and the diversification of their savings.

The investment aspect of life insurance policies typically offers a way to accumulate wealth over an extended period. It provides an opportunity to make tax-efficient savings, as the growth within the policy may be tax-deferred or even tax-free, depending on the jurisdiction and the specific policy features. This tax advantage can be particularly beneficial for long-term savings, allowing your money to grow faster and potentially accumulate a more substantial value over time.

Additionally, the investment components of life insurance policies often come with various risk management tools. These may include the ability to adjust the investment strategy, such as rebalancing or changing asset allocations, to suit the policyholder's risk tolerance and financial objectives. Such flexibility ensures that individuals can actively manage their long-term savings and make adjustments as their financial situation evolves.

By incorporating investment options into life insurance policies, banks and financial institutions provide a comprehensive solution for individuals seeking long-term savings. This approach allows people to combine the security and benefits of life insurance with the potential for wealth accumulation, making it an attractive and strategic choice for those looking to build a secure financial future.

Understanding Third-Party Designation for Life Insurance

You may want to see also

Peace of Mind: Offering life insurance gives customers peace of mind, knowing their loved ones are protected

Offering life insurance is a strategic move by banks for several reasons, and at its core, it provides customers with a sense of security and peace of mind. When individuals purchase life insurance through their bank, they are not just buying a financial product; they are investing in the well-being of their loved ones. This is particularly important in today's fast-paced world, where financial stability is a top priority for many families. By offering life insurance, banks address a fundamental human need: the need to protect one's family and ensure their financial future is secure.

The primary benefit of life insurance is the financial protection it provides to the policyholder's beneficiaries. In the event of the insured individual's death, the life insurance policy pays out a lump sum or regular income to the designated beneficiaries. This financial safety net can cover various expenses, such as mortgage payments, children's education, daily living costs, and even future financial goals. Knowing that their family's financial needs will be met in their absence can significantly reduce stress and anxiety for the policyholder, allowing them to focus on living their lives to the fullest.

Moreover, life insurance offers a sense of long-term financial planning. It encourages individuals to think about their future and the future of their loved ones. By taking out a policy, customers actively participate in creating a financial safety net, which can provide stability and security for generations to come. This proactive approach to financial planning can be a powerful tool for banks to build trust and loyalty with their customers, as it demonstrates a commitment to their financial well-being.

For banks, offering life insurance is a way to diversify their product portfolio and provide comprehensive financial solutions to their customers. It allows banks to cater to a wide range of financial needs, from basic banking services to more specialized products. By integrating life insurance into their offerings, banks can enhance customer satisfaction and loyalty, as they are providing a holistic approach to financial management. This can lead to increased customer retention and a competitive edge in the market.

In summary, the peace of mind that comes with offering life insurance is a powerful incentive for both customers and banks. Customers gain the reassurance that their loved ones will be financially protected, while banks establish themselves as trusted financial partners. This symbiotic relationship highlights the importance of financial security in modern society and demonstrates how banks can play a vital role in safeguarding the financial future of their customers.

Whole Life Insurance Options for Seniors Over 60

You may want to see also

Frequently asked questions

Banks offer life insurance as a way to provide financial security and peace of mind to their customers. It is a valuable product that can help individuals and their families manage financial risks associated with premature death. By offering life insurance, banks can build long-term relationships with customers, ensuring a steady stream of revenue and fostering customer loyalty.

When customers buy life insurance through their bank, they often benefit from competitive rates and convenient payment options. Banks can offer group life insurance policies, which typically provide coverage at lower costs compared to individual plans. Additionally, customers can set up automatic payments from their bank accounts, making the process seamless and efficient.

Having life insurance through a bank offers several advantages. Firstly, it provides a one-stop solution for customers' financial needs, allowing them to manage multiple financial products in one place. Secondly, banks often have dedicated financial advisors who can offer personalized advice and ensure customers make informed decisions. This personalized approach can lead to better coverage and more suitable policies.

Yes, banks often provide incentives to customers who purchase life insurance. These incentives may include discounts on other financial products, such as reduced interest rates on loans or lower fees on banking services. Some banks also offer loyalty rewards or cashback programs tied to life insurance premiums, providing additional value to customers.

Life insurance purchased through a bank can be an essential component of a comprehensive financial plan. It helps in protecting assets, covering funeral expenses, paying off debts, and providing financial support to dependents. By offering life insurance, banks enable customers to create a safety net for their loved ones and ensure financial stability even in the event of their passing.