Voluntary life insurance through an employer is a financial benefit that provides employees and their families with an additional layer of security. This type of insurance is typically offered as a voluntary benefit, meaning employees can choose to enroll in it or not, depending on their personal needs and preferences. It is an essential component of a comprehensive benefits package, offering financial protection in the event of the insured's death. This insurance policy is designed to provide a tax-free death benefit to the policyholder's beneficiaries, which can be used to cover various expenses, such as mortgage payments, children's education, or outstanding debts. Understanding the details and benefits of this insurance can help employees make informed decisions about their financial well-being.

What You'll Learn

- Definition: Voluntary life insurance is a voluntary benefit offered by employers, providing coverage for employees and their families

- Benefits: It offers financial protection and peace of mind, ensuring loved ones are cared for in the event of the insured's death

- Eligibility: Employees can typically enroll in voluntary life insurance plans, often with the option to increase coverage amounts

- Cost: Premiums are usually deducted from employees' paychecks, making it convenient and affordable

- Flexibility: Employees can choose coverage amounts and terms, allowing for personalized protection tailored to their needs

Definition: Voluntary life insurance is a voluntary benefit offered by employers, providing coverage for employees and their families

Voluntary life insurance is a valuable financial benefit that employers can offer to their employees as part of a comprehensive benefits package. It is a voluntary benefit, meaning it is not mandatory for employees to purchase, but it is made available to them as an option. This type of insurance provides financial protection and peace of mind for employees and their families in the event of the employee's death.

When an employer offers voluntary life insurance, they typically partner with an insurance company to provide the coverage. The insurance policy is designed to pay out a death benefit to the employee's designated beneficiaries upon their passing. This benefit can be a significant financial safety net for the employee's loved ones, helping them cover expenses and maintain their standard of living during a difficult time.

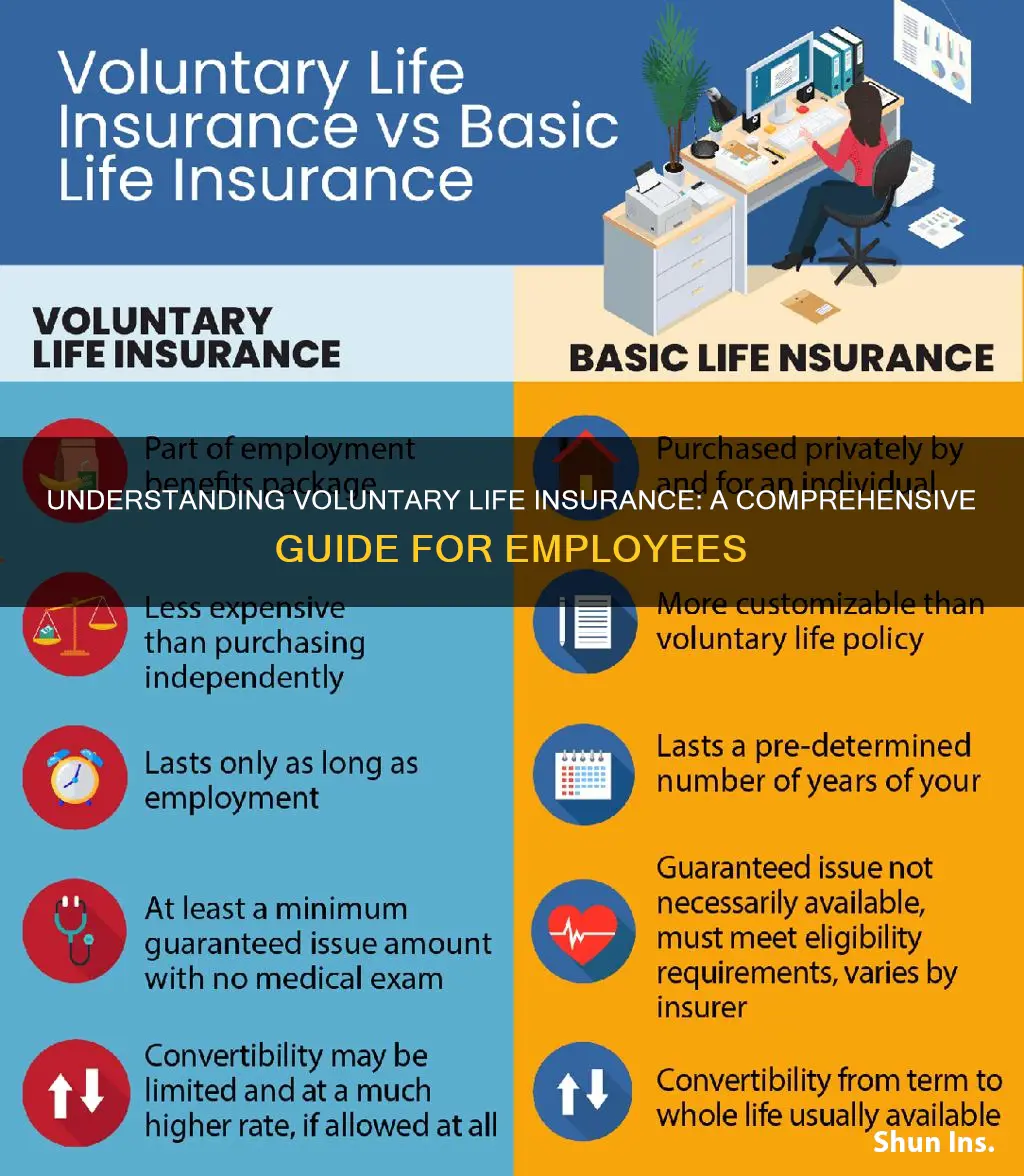

The coverage amount and terms of voluntary life insurance can vary. Employers often provide a basic level of coverage as a standard benefit, which employees can choose to accept or decline. In some cases, employees may have the option to increase their coverage by paying additional premiums, allowing them to customize the policy to their specific needs and preferences. This flexibility ensures that employees can choose a level of protection that aligns with their financial goals and family circumstances.

Voluntary life insurance is an attractive benefit for employees as it offers financial security without the need for extensive research or decision-making. It is often more affordable compared to individual life insurance policies, making it accessible to a broader range of employees. Additionally, having life insurance through an employer can provide a sense of stability and reassurance, knowing that their family's well-being is protected even if they are no longer working.

In summary, voluntary life insurance is a voluntary benefit that employers offer to provide financial protection for employees and their families. It is a convenient and often cost-effective way for employees to secure life insurance coverage, ensuring that their loved ones are cared for in the event of their passing. This benefit can be a valuable addition to any employee's benefits package, offering both financial security and peace of mind.

Life Insurance Exam in Georgia: How Many Questions?

You may want to see also

Benefits: It offers financial protection and peace of mind, ensuring loved ones are cared for in the event of the insured's death

Voluntary life insurance through an employer is a valuable benefit that provides financial security and peace of mind to employees and their families. This type of insurance is offered as an additional option alongside other benefits packages, allowing employees to voluntarily choose to purchase it. It is a voluntary arrangement, meaning employees can decide whether or not to enroll, often at a discounted rate due to the employer's group purchasing power.

The primary benefit of this insurance is the financial protection it provides to the policyholder's loved ones in the event of their death. In the unfortunate circumstance of the insured's passing, the policy pays out a death benefit, which can be a significant financial cushion for the family. This benefit can cover various expenses, including mortgage payments, children's education, daily living costs, and other financial obligations, ensuring that the family's financial stability is maintained even after the insured's death.

Peace of mind is another crucial advantage. Knowing that one's family is financially protected in the event of an unexpected death can significantly reduce stress and anxiety. This type of insurance provides a safety net, allowing individuals to focus on their work, personal relationships, and overall well-being without constantly worrying about financial security. It empowers individuals to take control of their future and that of their loved ones.

Furthermore, voluntary life insurance through an employer often offers customizable options. Policyholders can choose the coverage amount based on their specific needs and financial goals. This flexibility ensures that the insurance policy is tailored to individual circumstances, providing the most appropriate level of protection. Additionally, some policies may offer additional benefits, such as accelerated death benefits, which can provide financial support if the insured is diagnosed with a terminal illness, allowing them to spend more time with their loved ones.

In summary, voluntary life insurance through an employer is a valuable benefit that provides financial protection and peace of mind. It ensures that loved ones are cared for financially in the event of the insured's death, covering essential expenses and providing a safety net. With customizable options and the potential for additional benefits, this type of insurance is a wise choice for employees who want to secure their family's future and gain peace of mind.

Lincoln Heritage Life Insurance: Drug Testing Policy Explained

You may want to see also

Eligibility: Employees can typically enroll in voluntary life insurance plans, often with the option to increase coverage amounts

Voluntary life insurance through employers is a valuable benefit that many companies offer to their employees. This type of insurance provides financial protection for the employee's beneficiaries in the event of their death. It is a voluntary plan, meaning employees can choose to participate, and it is often offered alongside group life insurance provided by the employer. One of the key advantages is the convenience and ease of enrollment, as it is typically integrated into the employee's benefits package.

Eligibility for voluntary life insurance is generally straightforward. Most employers make this benefit accessible to all current employees, allowing them to secure their loved ones' financial future. The process is usually simple: employees can review the available options, select the desired coverage, and enroll during the specified enrollment period, which is often an annual event or may occur at other times, such as when a new employee joins the company. During this period, employees can choose their preferred coverage amount, which is a significant advantage over other insurance products.

The coverage amount is a critical aspect of voluntary life insurance. Employees can typically choose the level of protection they desire, often with the option to increase the coverage. This flexibility ensures that individuals can tailor the plan to their specific needs and financial circumstances. For instance, an employee might opt for a higher coverage amount if they have a large family or significant financial responsibilities, ensuring their loved ones are adequately protected.

It is important to note that the eligibility criteria for increasing coverage amounts may vary. Some employers might offer a standard maximum coverage limit, while others may allow employees to exceed this limit based on specific conditions or medical assessments. This flexibility ensures that employees can find a plan that suits their individual requirements.

In summary, voluntary life insurance through employers is a convenient and accessible way for employees to secure financial protection for their families. With eligibility open to all current employees, the process of enrolling is simple, and the coverage amount can be customized to individual needs. This benefit is a valuable addition to any employee's benefits package, providing peace of mind and financial security.

Life Mortgage Insurance: Disability Coverage?

You may want to see also

Cost: Premiums are usually deducted from employees' paychecks, making it convenient and affordable

Voluntary life insurance through employers is a convenient and cost-effective way for employees to secure financial protection for their loved ones. One of the key advantages of this type of insurance is the ease of access and affordability it offers.

When an employer offers voluntary life insurance as part of their benefits package, the premium payments are typically deducted directly from the employee's paycheck. This streamlined process ensures that the cost of the insurance is conveniently integrated into the employee's regular financial obligations. By having the premium automatically deducted, employees can rest assured that their insurance coverage remains active without the hassle of remembering to make payments.

The affordability of this arrangement is further enhanced by the fact that premiums are often calculated based on the employee's salary or a percentage of their income. This means that the cost of the insurance is proportional to the employee's earnings, making it a manageable expense for most individuals. As a result, voluntary life insurance through employers provides a practical solution for those who may not have the financial means to purchase individual life insurance policies.

Additionally, the convenience of automatic deductions encourages employees to take advantage of this benefit. With the insurance premium seamlessly integrated into their payroll, employees are more likely to maintain their coverage over time, ensuring that their families are protected in the event of their passing. This aspect of convenience and affordability is a significant factor in the success of voluntary life insurance programs offered by employers.

In summary, the cost-effectiveness of voluntary life insurance through employers is evident in the automatic payroll deductions, which make it accessible and affordable for employees. This approach simplifies the process of securing life insurance, allowing employees to provide financial security for their loved ones without incurring additional financial burdens.

Life Insurance for the Honorably Discharged: What You Need to Know

You may want to see also

Flexibility: Employees can choose coverage amounts and terms, allowing for personalized protection tailored to their needs

Voluntary life insurance offered through employers provides employees with the flexibility to customize their coverage, ensuring it aligns with their unique financial and personal circumstances. This type of insurance is a valuable benefit, as it empowers individuals to take control of their financial security and make informed decisions about their future.

One of the key advantages is the ability to choose the coverage amount. Employees can assess their financial obligations, such as mortgage payments, children's education costs, or other long-term commitments, and select a policy that provides adequate financial protection. For instance, someone with a substantial mortgage might opt for a higher coverage amount to ensure their family can maintain their standard of living in the event of their passing. Conversely, a person with fewer financial ties may choose a lower coverage amount, opting for a more modest level of protection.

Additionally, employees have the freedom to decide on the insurance term, which is the duration for which the policy is in effect. This flexibility allows individuals to match the term to their specific needs. For example, a young professional might opt for a 10-year term to cover a critical period, such as the time it takes to pay off a student loan or save for a down payment on a house. As they progress in their career and their financial situation changes, they can adjust the term accordingly. Longer-term options, such as 20-year or 30-year terms, are also available, providing extended coverage for those who wish to ensure their family's financial security over an extended period.

The personalized nature of voluntary life insurance through employers allows employees to make informed decisions based on their life stage, financial goals, and risk tolerance. This flexibility ensures that the insurance policy becomes a tailored solution, providing peace of mind and financial security without unnecessary complexity. By offering this option, employers demonstrate their commitment to employee well-being and financial health, fostering a positive and supportive work environment.

Life Insurance Payouts: When to Expect Proceeds

You may want to see also

Frequently asked questions

Voluntary life insurance is a type of life insurance policy that employees can choose to purchase through their employer's benefits package. It is typically offered as an additional benefit to employees, allowing them to protect their loved ones financially in the event of their passing. This type of insurance is often more affordable compared to individual policies because employers often negotiate group rates with insurance companies.

When an employer offers voluntary life insurance, they usually provide a range of coverage options with different benefit amounts. Employees can select the amount of coverage they desire, which is often based on their income, family size, and other factors. The employer may also contribute to the premium, making it more cost-effective for the employee. The policy is typically administered through payroll deductions, where a portion of the premium is automatically deducted from the employee's paycheck and paid to the insurance company.

Yes, there are several benefits to enrolling in voluntary life insurance through your employer. Firstly, it is convenient as the policy is often set up and managed through your payroll, requiring minimal effort from you. Secondly, group policies often have lower administrative costs, which can result in more competitive rates. Additionally, some employers may offer additional perks or discounts as part of the package. This type of coverage can provide peace of mind, knowing that your family's financial well-being is protected even if you were to pass away during your working years.