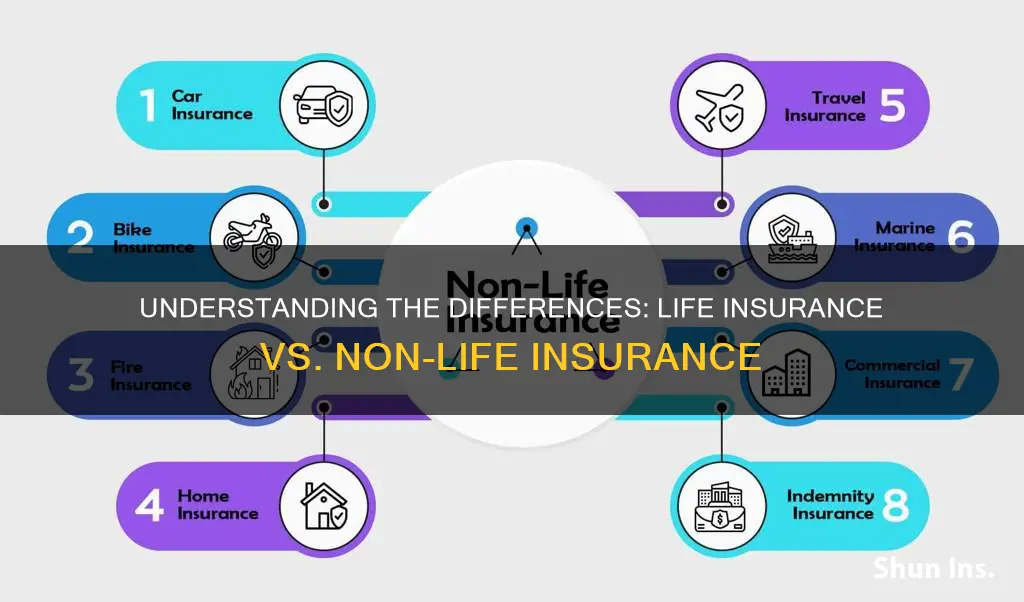

The term non-life insurance typically refers to insurance products that cover risks associated with events that can be influenced by human actions or decisions, such as property damage, liability, and health risks. These include auto insurance, homeowners insurance, and health insurance. However, when considering the broader category of insurance, it's important to note that life insurance is not a non-life insurance product. Life insurance is a specific type of insurance that provides financial protection to the beneficiaries in the event of the insured's death. It is designed to cover the financial risks associated with the insured's death, which is an event that cannot be controlled by human actions. Therefore, life insurance is a distinct category of insurance and is not considered a non-life insurance product.

What You'll Learn

- Term Life: Coverage for a set period, renewable or convertible

- Whole Life: Permanent coverage with a cash value component

- Universal Life: Flexible coverage with adjustable premiums and investment options

- Variable Life: Offers investment options and potential for higher returns

- Annuities: Income-generating contracts with guaranteed payments for life

Term Life: Coverage for a set period, renewable or convertible

Term life insurance is a type of coverage that provides financial protection for a specific period, often 10, 20, or 30 years. It is a form of life insurance that offers a straightforward and cost-effective way to secure your loved ones' financial future during a defined time frame. This type of policy is renewable, meaning it can be extended beyond the initial term if the policyholder chooses to do so, ensuring long-term protection. Additionally, term life insurance can be converted into a permanent policy, providing permanent coverage and potential cash value accumulation over time.

The key feature of term life insurance is its simplicity and predictability. It offers a fixed premium for the duration of the term, making it easier for individuals to plan and budget for their insurance needs. This type of policy is particularly beneficial for those who want to provide financial security for a specific goal, such as covering mortgage payments, funding children's education, or ensuring their family's financial stability during a particular period.

Renewability is a significant advantage of term life insurance. After the initial term expires, the policyholder has the option to renew the coverage, ensuring continuous protection. This feature is especially valuable for those who may have changing insurance needs over time, allowing them to adapt their coverage as their circumstances evolve. For example, a young family might opt for a 20-year term policy to cover their children's education, and later renew it to extend coverage as their children grow older and the family's financial obligations change.

Conversion options are another attractive aspect of term life insurance. If the policyholder decides they want permanent coverage, they can typically convert their term policy into a whole life or universal life policy. This conversion process allows individuals to lock in their current premium rates and build cash value, providing lifelong protection and potential financial benefits. It is a flexible feature that ensures policyholders can make the most of their insurance investment as their needs change.

In summary, term life insurance offers a set period of coverage with the option to renew or convert, providing a flexible and cost-effective solution for life insurance needs. Its simplicity, renewability, and conversion options make it an excellent choice for individuals seeking a straightforward way to secure their family's financial future during a defined time frame. By understanding the features of term life insurance, individuals can make informed decisions about their insurance coverage and ensure they have the right protection in place.

Cigna Life Insurance: Depression History and Rejection Risk

You may want to see also

Whole Life: Permanent coverage with a cash value component

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which offers coverage for a specified period, whole life insurance offers lifelong protection. This means that as long as the premiums are paid, the policyholder will have coverage until their passing. One of the key features of whole life insurance is its cash value component.

The cash value of a whole life policy is a significant benefit that accumulates over time. It is essentially the investment component of the policy, allowing the policyholder to build a savings account within the insurance contract. Each premium payment made goes towards both the insurance coverage and the cash value. The cash value grows tax-deferred, meaning it can accumulate without being taxed until it is withdrawn. This feature makes whole life insurance an attractive option for those seeking long-term financial security and a way to build wealth.

As the policyholder, you can access the cash value in several ways. You can take out loans against the cash value, providing a source of funds for various purposes. Additionally, you can surrender the policy for its cash value if you no longer need the coverage. This flexibility is particularly useful for those who may want to access funds for education expenses, business ventures, or other significant financial commitments.

The cash value of whole life insurance also grows at a guaranteed rate, which is typically higher than the interest rates offered by traditional savings accounts. This ensures that the policyholder's money is growing and accumulating value over time. As the policy matures, the cash value can be used to pay for future expenses or even provide a financial safety net for the policyholder and their beneficiaries.

In summary, whole life insurance with its cash value component offers a unique and valuable aspect to the insurance market. It provides permanent coverage, ensuring financial protection for the entire life of the insured. The cash value accumulation allows policyholders to build a savings account, access funds, and grow their wealth over time, making it a comprehensive and attractive financial product.

Understanding Life Insurance Principals: Who is the Principal?

You may want to see also

Universal Life: Flexible coverage with adjustable premiums and investment options

Universal life insurance offers a unique and flexible approach to coverage, providing policyholders with a range of benefits that set it apart from traditional life insurance policies. One of its key advantages is the ability to customize and adjust various aspects of the policy, making it a versatile choice for individuals seeking tailored financial protection.

In the context of non-life insurance, which typically refers to insurance that covers risks other than death, universal life insurance stands out as a comprehensive solution. It is not just a non-life insurance product but a type of permanent life insurance that offers both death benefit coverage and an investment component. This dual nature makes it a versatile tool for financial planning. Policyholders can choose to allocate a portion of their premiums to investment options, allowing their money to grow over time. This investment aspect is a significant differentiator, as it provides the opportunity to potentially accumulate wealth while also ensuring a financial safety net.

The flexibility of universal life insurance is evident in its adjustable premiums. Policyholders have the freedom to increase or decrease their monthly or annual payments based on their financial circumstances. This adaptability is particularly beneficial for those who experience changes in income or financial goals over time. For instance, a young professional might opt for lower premiums during their initial years of career growth, knowing that they can adjust the payments later as their earnings stabilize. This flexibility ensures that the insurance policy remains relevant and affordable throughout the policyholder's life.

Additionally, the investment options associated with universal life insurance provide a strategic advantage. Policyholders can choose from various investment vehicles, such as stocks, bonds, or mutual funds, to grow their policy's cash value. This feature allows individuals to potentially earn higher returns compared to traditional savings accounts, providing an incentive to save and invest for the future. The investment strategy can be tailored to the policyholder's risk tolerance and financial objectives, ensuring a personalized approach to wealth accumulation.

In summary, universal life insurance is a powerful tool that goes beyond the scope of non-life insurance. Its flexibility in premium adjustments and investment options makes it a comprehensive and adaptable choice for individuals seeking both financial protection and wealth-building opportunities. By offering a unique blend of death benefit coverage and investment growth, universal life insurance provides a unique and valuable solution in the realm of personal finance.

Gerber Life Insurance: Does It Have an Expiry Date?

You may want to see also

Variable Life: Offers investment options and potential for higher returns

Variable life insurance is a type of permanent life insurance that offers a unique combination of insurance protection and investment opportunities. Unlike traditional term life insurance, which provides coverage for a specified period, variable life insurance allows policyholders to invest a portion of their premium payments in various investment options. This feature sets it apart from non-life insurance, which primarily focuses on providing financial protection against specific risks, such as death or injury.

One of the key advantages of variable life insurance is the potential for higher returns on investment. Policyholders can choose from a range of investment options, including stocks, bonds, and mutual funds, which are managed by the insurance company or an external investment manager. These investment options offer the possibility of outperforming traditional fixed-income investments, providing policyholders with the opportunity to grow their money over time. The investment aspect of variable life insurance allows individuals to potentially increase their wealth while also ensuring their loved ones are financially protected in the event of their passing.

When considering variable life insurance, it's important to understand the investment risks involved. The value of the investments can fluctuate, and there is a chance that the policyholder may experience losses. However, this risk is carefully managed by the insurance company, which typically offers a range of investment options with different risk levels. Policyholders can choose their investment strategy based on their risk tolerance and financial goals, allowing for a personalized approach to insurance and investment.

The flexibility of variable life insurance is another appealing feature. Policyholders can adjust their investment strategy over time, making changes as their financial situation or goals evolve. This adaptability is particularly beneficial for those who want to optimize their investment returns while maintaining the insurance coverage they need. Additionally, variable life insurance policies often provide a guaranteed death benefit, ensuring that the insured's beneficiaries receive a specified amount upon their passing, regardless of the investment performance.

In summary, variable life insurance stands out as a unique form of insurance that combines insurance protection with investment opportunities. It offers policyholders the potential for higher returns through various investment options while providing a guaranteed death benefit. This type of insurance is an attractive choice for individuals seeking to manage their finances effectively, grow their wealth, and ensure financial security for their loved ones. Understanding the investment aspects and risks associated with variable life insurance is essential for making informed decisions in the world of personal finance.

Life Expectancy Insurance: Strategies for Data Collection

You may want to see also

Annuities: Income-generating contracts with guaranteed payments for life

Annuities are a type of financial product that can be considered a unique form of insurance, but they are not classified as non-life insurance. Non-life insurance, also known as general insurance, typically covers risks and uncertainties associated with events that can occur during a person's lifetime, such as accidents, health issues, or property damage. On the other hand, annuities are a form of financial contract that provides a steady stream of income over a specified period or for the rest of the annuitant's life.

Annuities are designed to offer financial security and stability, especially for retirees or individuals seeking a reliable income source. When you purchase an annuity, you essentially make a series of payments to an insurance company or financial institution, and in return, they guarantee a series of payments to you. These payments can be made as a lump sum, a fixed amount at regular intervals, or a combination of both. The key feature is the guarantee of income for life, ensuring that you have a steady financial stream regardless of market fluctuations or economic downturns.

The concept of annuities can be traced back to ancient Rome, where they were used to provide financial security for individuals. Over time, they have evolved into a popular retirement planning tool. Annuities are particularly attractive to retirees because they offer a predictable income stream, which can be crucial for maintaining a comfortable standard of living during retirement. The guaranteed payments ensure that retirees have a reliable source of funds to cover their expenses and achieve their financial goals.

There are different types of annuities, including fixed annuities, variable annuities, and indexed annuities, each with its own set of features and risks. Fixed annuities offer a consistent rate of return, while variable annuities provide investment options that can grow over time. Indexed annuities are linked to specific market indices, offering potential for higher returns. The choice of annuity depends on an individual's financial goals, risk tolerance, and retirement plans.

In summary, annuities are income-generating contracts that provide guaranteed payments for life, making them a valuable financial tool for retirement planning. While they are not classified as non-life insurance, they offer a unique form of financial security and stability, ensuring a steady income stream for individuals during their retirement years. Understanding the different types of annuities and their features can help individuals make informed decisions about their retirement savings and income strategies.

Understanding Cash Value Life Insurance Liquidity: A Comprehensive Guide

You may want to see also

Frequently asked questions

Life insurance provides coverage for a specific period, typically until the insured individual's death, and pays out a death benefit to the policyholder or beneficiaries. Non-life insurance, also known as general insurance, covers various risks and losses other than death, such as property damage, liability, health, and motor vehicle accidents.

Non-life insurance refers to a category of insurance that focuses on insuring against various risks and perils that can affect an individual, business, or property. This includes insurance for health, motor vehicles, property, liability, and other specified risks. It is a broad term encompassing multiple insurance types.

Non-life insurance policies typically involve an agreement between the insured party and an insurance company. The insured party pays a premium, and in return, the insurance company promises to compensate the insured for specified losses or damages as outlined in the policy. This can include financial protection against accidents, natural disasters, theft, or other unforeseen events.

Common types of non-life insurance include health insurance, motor vehicle insurance, property insurance (such as home or business insurance), liability insurance, and professional indemnity insurance. Each type is designed to address specific risks and provide financial protection in different areas of life and business.

Yes, health insurance is a type of non-life insurance. It provides coverage for medical expenses, treatments, and other healthcare-related costs. Health insurance policies can be individual or group-based and offer financial protection against unexpected medical bills and help manage healthcare costs.