Life expectancy is a crucial factor in retirement planning and financial decision-making, including the calculation of life insurance premiums. While it is challenging to predict life expectancy accurately, various tools and data sources are available to help individuals and insurance companies estimate this important metric. Federal agency databases, such as the Social Security Administration and the Centers for Disease Control and Prevention (CDC), provide life expectancy estimates based on gender, national averages, and other factors. However, these estimates may not consider personal factors such as health, lifestyle, and family history, which can significantly impact life expectancy. To address this, online life expectancy calculators have been developed, integrating data from multiple sources and considering individual characteristics to provide more holistic estimates. Understanding life expectancy is essential for financial planning, including insurance decisions, retirement savings goals, and Social Security benefits.

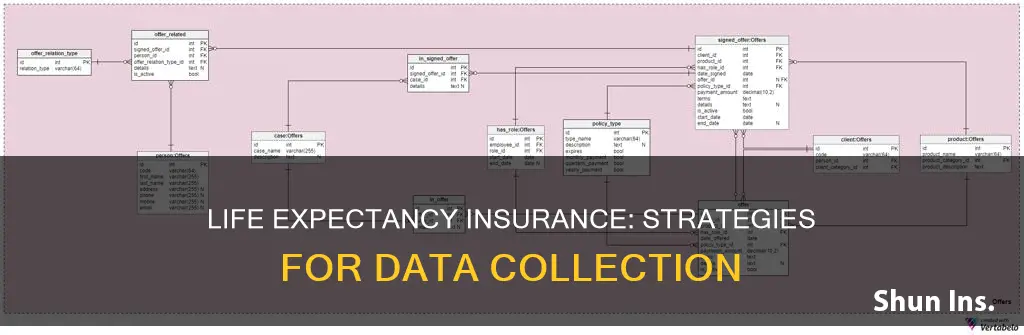

| Characteristics | Values |

|---|---|

| Data Type | High-volume, high-velocity and/or high-variety information assets |

| Data Collection | Prescription history, motor vehicle records, electronic health records, financial records, professional licenses |

| Data Analysis | Predictive analytics, machine learning, Internet of Things |

| Data Use | Underwriting standards, verifying information, understanding consumer behaviour, understanding risks, pricing policies, designing products |

| Data Sources | MIB insurance database, mortality tables, online calculators |

| Data Protection | Compliance with industry standards, laws and regulations, e.g. Fair Credit Reporting Act, California Consumer Privacy Act, California Privacy Rights Act |

What You'll Learn

Using mortality tables to calculate life expectancy

Life tables have been a key tool for actuaries for around 200 years, and they are the basis for calculating life expectancy. The process involves taking a large group, or "cohort", of individuals born on the same day and recording the number of individuals alive at each birthday (age x) and the number dying during the following year. The ratio of these is the probability of dying at age x, usually denoted by q(x).

In practice, such "cohort life tables" are rarely used, as individuals would have to be followed for up to 100 years, and the resulting table would reflect historical conditions that may no longer apply. Instead, actuaries generally work with a period, or current, life table. This summarises the mortality experience of persons of all ages in a short period, typically one or three years. The death probabilities q(x) for every age x are computed, often using census information gathered at regular intervals.

A period life table is based on the mortality experience of a population during a relatively short period. For example, the 2021 period life table for the Social Security area population was used in the 2024 Trustees Report. This table presents the period life expectancy at a given age as the average remaining number of years expected prior to death for a person at that exact age, using the mortality rates for 2021 over the course of their remaining life.

The national life tables are published annually and cover a consecutive three-year period to help reduce the effect of annual fluctuations in the number of deaths caused by seasonal events such as winter flu. These tables give period life expectancies, which are defined as:

> "The average number of additional years a person can be expected to live for if he or she experiences the age-specific mortality rates of the given area and time period for the rest of his or her life."

The life table starts with 100,000 simultaneous births (l0). The life table population is then calculated by multiplying 100,000 (l0) by the mortality rate between age 0 and 1 years (q0) to give the number of deaths at age 0 years (d0). The number of deaths between age 0 and 1 years (d0) is then subtracted from 100,000 (l0) to give the number of people surviving to age 1 year (l1). This process continues through the life table until we close the national life tables at age 110 years.

Life expectancy tables are based on actual mortality experience collected from sources such as life insurance companies and the Social Security Administration. These tables show the average probability of death by a certain age. It's important to note that the LE data provided is not necessarily indicative of life expectancy, and the insured may live longer than indicated by the table.

Becoming a Top Life Insurance Agent: Strategies for Success

You may want to see also

Prescription history

In the US, life insurance companies can access prescription records with the applicant's consent. This consent is given when the applicant signs their application and a Health Insurance Portability and Accountability Act (HIPAA) form. Without this consent, insurers cannot view prescription records – applicants' health information is protected by HIPAA.

It is uncommon for an applicant to be denied life insurance solely on the basis of their prescription history. Working with a licensed life insurance professional can help applicants understand how their prescriptions may affect their rates.

Life Insurance: Divorce Asset or Liability in Wisconsin?

You may want to see also

Motor vehicle records

MVRs offer a wealth of information about an individual's driving history, including speeding tickets, accidents, and driving under the influence (DUI) violations. This data is not only relevant to car insurance rates but also plays a significant role in life insurance pricing. By analysing MVRs, insurance companies can predict an individual's overall risk of dying, not just from car accidents but from any cause. For example, studies have shown that people with serious driving violations have a substantially higher death rate than those with clean driving records.

To streamline the evaluation process, LexisNexis offers a Standard Violation Code service. This service utilises a uniform violation reporting structure, enabling customers to process new and renewal business more efficiently. Additionally, LexisNexis combines MVR data with other publicly available information, such as prescription records, to create a comprehensive software tool for assessing life insurance applicants. The tool generates a score for each applicant, which life insurance companies can then use to help price policies.

It is worth noting that MVRs are just one piece of the puzzle in life insurance data collection. Insurance companies gather data from various other sources, including prescription history, electronic health records, financial records, and professional licenses. All of this information helps insurers make informed decisions about policy pricing and underwriting standards, ensuring that they can accurately assess an individual's overall health and risk profile.

Life Insurance Replacement: Indiana's Definition and Rules Explained

You may want to see also

Electronic health records

EHRs are a lower-cost alternative to traditional data sources such as blood and urine samples and attending physician statements (APS). They are positioned to create widespread value across the insurance industry by facilitating superior risk assessment and speeding up operations.

Life insurance companies collect EHR data from various sources to create underwriting standards and verify information shared on customer applications. This data includes prescription history, motor vehicle records, and financial records. EHRs can be used to better understand an applicant's overall health and risk to the insurance company, as well as to make decisions about the products they offer.

In terms of data privacy, insurance companies follow relevant regulations to ensure that data is used fairly and accurately. They also take steps to minimise privacy concerns for consumers, managing sensitive data in the same way they would handle any other type of health or financial data.

Overall, EHRs are a valuable tool for the insurance industry, providing a comprehensive medical risk profile that can be leveraged to evaluate an applicant's health and issue an insurance policy.

Maximizing Cash Value Life Insurance: Strategies for Success

You may want to see also

Financial records

One of the first places to look is the deceased's personal records, including files, safe deposit boxes, and address books. If you find the names of insurance agents, brokers, or financial advisers, you can contact them to see if they kept their own records. Bank and credit card statements might also show premium payments to a life insurance company.

It is also worth checking the departed's tax returns, as a tax form and supplemental filings could show interest income from a permanent life insurance policy with cash value. Income tax returns may also show interest paid on any loans if the deceased borrowed against their life insurance policy. If the deceased had a universal life insurance policy, the life insurance company may have sent notices on the status of the policy, dividends, or cash value amounts, which could be found in their mail or email.

If you are the executor of the deceased's estate, you can also request paper statements from their bank if you have power of attorney. This will allow you to see who premiums were paid to if you don't have access to their online bank account.

In addition to personal financial records, there are also public financial records that can be searched. The National Association of Insurance Commissioners (NAIC) provides access to financial statements, and some states have online tools to search for unclaimed property, which can include life insurance proceeds. For example, FLTreasureHunt.gov in Florida allows users to search for unclaimed property.

Another way to search for financial records related to life insurance is to look for a financial connection, such as an accountant, financial planner, or insurance agent who may have knowledge of or access to a copy of the policy.

Finally, there are professional search services that can be paid to search for unclaimed life insurance policies, such as the Medical Information Bureau (MIB) database, which stores information related to medical conditions and risk factors for life insurance companies.

Statins and Life Insurance: Blood Test Impact

You may want to see also

Frequently asked questions

A valuation mortality table is a statistical chart used by insurance companies to calculate the death rate for people at different ages. It shows the death rate at any given age, based on the number of deaths that occur for every thousand individuals of that age.

Insurance companies use big data to improve their products and services, speed up operations, and make decisions faster. They collect data from various sources, including prescription history, motor vehicle records, and electronic health records. This data helps them to better understand consumer behaviour and risks, and to underwrite policies more accurately.

Life insurance companies use a variety of factors to determine life expectancy, including age, gender, use of tobacco products, and current health. They also use mortality tables, which show the average probability of death by a certain age, to help them set insurance premiums and payouts.

Actual life expectancy refers to the average number of years a person is expected to live, based on statistical data and mortality rates. Projected life expectancy is an estimate of an individual's life expectancy based on specific information provided by that person, such as lifestyle choices and health status.