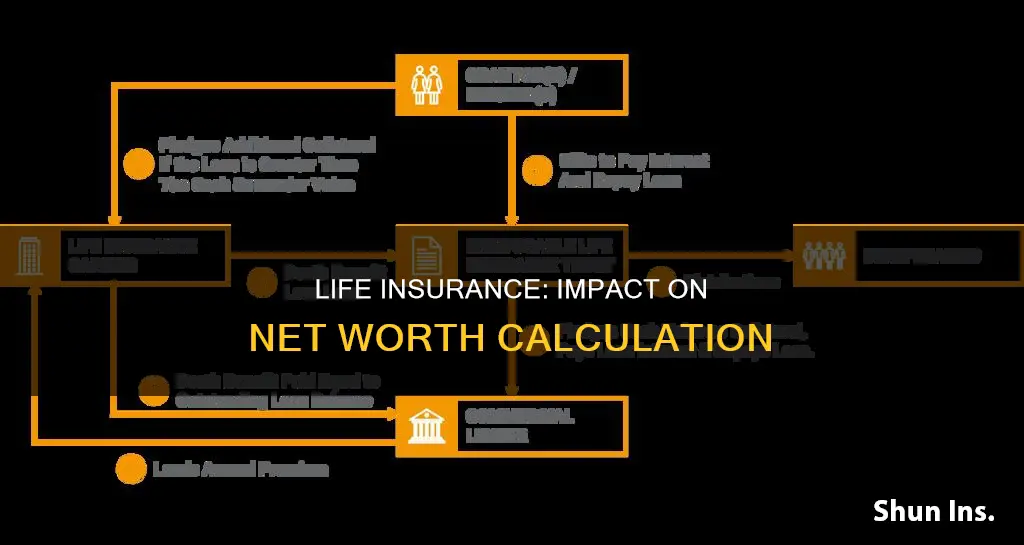

Life insurance is often purchased to provide financial stability for one's family or beneficiaries after death. While it is not considered an asset, it can still add to your net worth. Net worth is calculated by subtracting your liabilities (money owed) from your assets (things owned with monetary value). Term life insurance does not have a cash value and is not considered an asset, so it is not included in net worth calculations. However, permanent life insurance policies, such as whole life insurance, can accumulate cash value over time, which is considered an asset and included in net worth calculations.

| Characteristics | Values |

|---|---|

| Is term life insurance included in net worth calculations? | No |

| Does life insurance add to your net worth? | Yes |

| What is net worth? | The combined value of your assets minus the value of your liabilities |

| What are assets? | Liquid assets such as money in bank accounts, retirement accounts, life insurance, and other investments. Some fixed assets can also be included. |

| What are liabilities? | Money owed to another person or entity, including student loans, auto loans, personal loans, credit card debt, and mortgages. |

| What is term life insurance? | A type of life insurance that provides coverage for a specific period, typically 10-30 years. It does not accumulate cash value and has no payout after the term expires. |

| How does life insurance add to net worth? | The cash value of life insurance policies is considered an asset and is included in net worth calculations. |

What You'll Learn

Term life insurance is not an asset

Term life insurance is not considered an asset because it doesn't accumulate cash value and only lasts for a specified term. In other words, it is not an asset because you can't get value from it when you're alive. It is designed for temporary coverage and offers peace of mind and financial protection for a set amount of time, usually 10 to 30 years.

Term life insurance is a "pure" insurance policy, meaning it only pays out a death benefit to your beneficiary if you die while the policy is active. If you outlive the policy, you won't receive any money. Therefore, it doesn't fit the definition of an asset, which is something that enhances one's financial status or puts money in your pocket.

In contrast, permanent life insurance policies, such as whole life insurance and universal life insurance, are considered assets because they build cash value over time. This cash value can be accessed by the policyholder through loans or withdrawals, providing financial benefits during their lifetime.

While term life insurance is not an asset, it is still a valuable tool for protecting your assets and ensuring your family's financial security in the event of your death. It can provide immediate financial stability and comfort, making it essential for short-term financial protection.

Mortgage Brokers: Life Insurance Experts Too?

You may want to see also

Death benefit of a term life insurance policy

Term life insurance is a type of life insurance that provides a death benefit for a specified period of time, typically between 10 and 30 years. The policyholder pays a premium for this period, and if they die during the specified term, the insurance company pays out a death benefit to their chosen beneficiary or beneficiaries. This benefit is usually income tax-free and can be used to cover healthcare and funeral costs, consumer debt, mortgage debt, and other expenses.

The death benefit of a term life insurance policy is not considered an asset, as it has no cash value and does not accumulate value over time. This means that, unlike with some permanent life insurance policies, the policyholder cannot access any cash value during their lifetime. Instead, the death benefit is a lump-sum payment made to the beneficiary upon the policyholder's death. This benefit ensures that the policyholder's loved ones are financially secure and can maintain their standard of living.

When choosing a term life insurance policy, it is important to consider the length of the term and the amount of the death benefit. The term should be long enough to cover important life events, such as having children, and the death benefit should be sufficient to cover the policyholder's debts and provide financial support to their dependents.

While term life insurance does not provide a payout if the policyholder outlives the term, it is still a valuable tool for financial planning and security. By providing a death benefit, term life insurance offers peace of mind and helps protect the financial future of the policyholder's family.

Life Insurance: Reinstated, but Still Contested?

You may want to see also

Term life insurance and permanent life insurance differences

Life insurance is designed to provide financial stability for your family and beneficiaries after you die. There are two main types: term life insurance and permanent life insurance. Here are the key differences between the two:

Length of Protection

Term life insurance provides coverage for a specified time period, typically 10, 20, or 30 years. It is designed for temporary protection and lasts for a set term. The policy may be renewable, but only up to a specific age, and the premiums usually increase with each renewal. On the other hand, permanent life insurance, as the name suggests, offers long-term or lifelong coverage. It remains in force until your death, as long as you continue to pay the premiums.

Benefits

Term life insurance offers short-term death benefit protection, and your beneficiaries receive a lump-sum payout if you pass away during the coverage term. Some term policies include flexible features, such as early benefit access if you become terminally ill or premium assistance if you become disabled. Permanent life insurance, on the other hand, provides long-term death benefit protection and additional features. One of the most notable benefits is the opportunity to build cash value. This accumulated cash value can be accessed to cover unexpected emergencies, college tuition, or retirement expenses.

Cost

Term life insurance is generally cheaper than permanent life insurance. The premiums for term coverage are locked in for the selected period, but they increase if you choose to renew. Permanent life insurance, specifically whole life coverage, usually has higher premiums that are locked in at the time of purchase and do not increase over time. While term life insurance may be more affordable initially, permanent life insurance may prove to be a better value in the long run due to its stability and the potential to build cash value.

Suitability

Term life insurance is suitable if you need short-term coverage, have a limited budget, or anticipate changes in your needs or circumstances. It is also a good option if you have other financial assets to leave as an inheritance. Permanent life insurance is ideal if you require long-term financial protection, want to create an inheritance for your heirs, seek a tax-advantaged way to save for future expenses, or prefer stable premiums.

Life Insurance: Passing Outside of the Estate?

You may want to see also

How term life insurance works

Term life insurance is a simple and pure form of life insurance. It is a contract between the policy owner and an insurance company. The owner agrees to pay a premium for a specific term, usually between 10 and 30 years, and in return, the insurance company promises to pay a death benefit to the beneficiaries upon the insured person's death. The death benefit is usually income tax-free unless the premiums are paid with pre-tax dollars.

There is an application process for term life insurance, which includes a medical exam to evaluate the applicant's health, as well as questions about their occupation, lifestyle, and other factors that may affect the cost of the premiums. Certain hobbies, such as scuba diving, and dangerous occupations, such as working on an oil rig, may result in higher rates.

When taking out a term life insurance policy, it is important to choose an appropriate term length. If you have children, it is recommended to choose a term that will last until they are out of the house and have completed their education. Longer terms are generally more expensive, but it is usually more cost-effective to opt for a longer term as it is easier to get insurance while you are younger and in good health.

Term life insurance policies have no cash value and do not provide a payout after the term expires. The only value is the death benefit. Most term policies are "level premium", meaning that the monthly premium stays the same for the entire term.

There are different types of term life insurance policies available, including:

- Level premium: The simplest and most common type, where the premium stays the same for the entire term.

- Yearly renewable term: Covers the policyholder for one year at a time, with the option to renew without a medical exam, but at a higher cost.

- Return of premium: Pays back all or a portion of the premiums if the policyholder lives to the end of the term, but the premiums are significantly higher.

- Guaranteed issue: These policies do not require a medical exam and only ask a few simple health questions. However, the premiums are much higher as the insurance company assumes the policyholder is a risky prospect.

Some term life insurance policies also offer convertibility, which allows the policyholder to change their term insurance into a permanent whole life policy without a medical exam. This can be useful if the policyholder develops a serious health problem or wants the asset-building cash value component of a whole life policy.

Zurich Life Insurance: Is It Worth the Investment?

You may want to see also

Calculating your net worth

Net worth is the value of all your assets minus the total of your liabilities. In other words, it is what you own minus what you owe. Net worth can be an indicator of your financial health. Ideally, your net worth should grow over time as you save more and pay down debts.

Identify your assets:

Assets include everything you own, such as cash in your bank accounts, real estate, investments, and items with a clear market value like cars, jewellery, and art. Some assets, like your home, are considered fixed assets, while others, like cash and stocks, are considered liquid assets.

Calculate the total value of your assets:

Add up the value of all your assets to get a total.

Identify your liabilities:

Liabilities are your outstanding debts, including any remaining balances on your mortgage, car loan, credit card debt, student loans, back taxes, and any other money owed.

Calculate the total value of your liabilities:

Add up the value of all your liabilities to get a total.

Subtract your liabilities from your assets:

Use the following formula:

ASSETS – LIABILITIES = NET WORTH

By calculating your net worth, you can gain a better understanding of your financial position and make more informed decisions about saving, investing, and paying off debts.

It is worth noting that term life insurance is not considered an asset when calculating net worth, as it does not accumulate cash value. However, permanent life insurance policies with a cash value component can be considered an asset.

Wealthy Estate Planning: Life Insurance and Tax Avoidance

You may want to see also

Frequently asked questions

No, term life insurance is not included in net worth calculations. Term life insurance is designed to provide coverage for a set period, usually 10 to 30 years, and it does not accumulate cash value. Only permanent life insurance policies with a cash value component are considered assets and included in net worth calculations.

Term life insurance provides coverage for a specified term or period and does not accumulate cash value. It is designed to be simple and cost-effective, offering peace of mind and financial protection for your loved ones in the event of your death during the policy term. On the other hand, permanent life insurance, such as whole life or universal life insurance, offers lifelong coverage and includes a cash value component that grows over time. This cash value is considered an asset and, thus, impacts your net worth.

Life insurance is an important component of your financial plan, providing financial stability for your family or beneficiaries after your death. While the primary benefit of life insurance, the death benefit, is not considered an asset, certain types of life insurance policies with a cash value component can be counted as assets. These assets contribute to your net worth and can be used for liquidity and estate planning. Additionally, life insurance can help protect your wealth and facilitate the transfer of assets to your heirs.