Life insurance is a crucial consideration for couples, especially those with shared financial obligations or dependents. While it's an uncomfortable topic, planning ahead can ensure financial security and peace of mind for both partners in the event of an unexpected death. Couples have the option of obtaining separate life insurance policies or a joint life insurance policy, each with its own pros and cons. Separate policies offer greater flexibility and can be tailored to individual needs, while joint policies may lower overall costs and simplify management with a single policy. Ultimately, the best option depends on the couple's unique circumstances, and consulting with a licensed insurance agent can help navigate these complex choices.

| Characteristics | Values |

|---|---|

| Number of people covered | 2 |

| Types | First-to-die, Second-to-die (or survivorship) |

| Cost | Less than two individual policies |

| Purpose | Estate planning, covering spouses who don't qualify for individual policies |

What You'll Learn

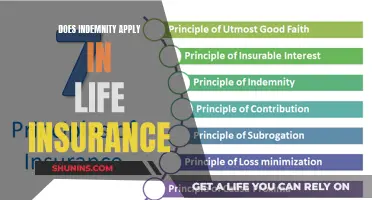

Joint vs. separate life insurance

When it comes to life insurance, couples have the option of choosing between a joint policy and separate policies. A joint life insurance policy covers two people, typically spouses, under one policy. On the other hand, separate life insurance policies allow each spouse to have their own individual policy. Both options have their own advantages and disadvantages, and the best choice depends on the couple's specific needs and preferences.

Joint Life Insurance Policies

Joint life insurance policies offer a few benefits. They can help lower overall life insurance costs for the couple, as the premium for one joint policy is generally less expensive than the combined premiums for two separate policies. Joint policies also simplify management by having only one policy to keep track of. Additionally, joint policies can be useful for estate planning and minimizing taxes. Finally, joint policies provide financial security to the surviving spouse or beneficiary in the event of a spouse's death.

However, there are also some drawbacks to joint life insurance policies. The payout structure might not fit all needs, as a second-to-die policy will only pay out after both spouses pass away. If the marriage ends, managing the joint policy can become complicated. Joint policies also offer limited flexibility compared to separate policies, as the amount and length of coverage have to be the same for each insured individual. The coverage provided by a joint policy may also be less than that of separate policies for the same premium. In a first-to-die scenario, the second spouse is no longer covered after the first spouse's death. Additionally, if one partner has health issues, the cost for the healthier spouse may be higher than if they had an individual policy.

Separate Life Insurance Policies

Separate life insurance policies offer greater flexibility and customization. Each spouse can choose from different types of policies, such as term life, whole life, or universal life insurance, and personalize the coverage amounts and lengths to suit their individual needs. Separate policies also allow each spouse to have their own coverage, unaffected by changes in marital status. This can be especially important if the marriage ends, as separate policies can be retained independently. Separate policies also allow for higher coverage amounts per individual.

However, there are some drawbacks to separate life insurance policies. They typically require managing multiple policies, which can be more time-consuming and complex. Separate policies also do not offer any potential cost savings from a combined policy. Additionally, individual underwriting might be more stringent and vary between spouses, which can affect the cost and availability of coverage.

In conclusion, the choice between joint and separate life insurance policies depends on the couple's specific needs and preferences. Joint policies can be a good option for couples looking to simplify their insurance and reduce overall costs, while separate policies offer greater flexibility and customization. It is important for couples to carefully consider their financial situation, coverage needs, and personal preferences before making a decision.

Selling Life Insurance After Bankruptcy: What You Need to Know

You may want to see also

When to get life insurance

Life insurance is a crucial step in financial planning for couples, offering peace of mind and security for the future. But when is the best time to get insured? Here are some key moments when couples should consider purchasing life insurance:

When you get married:

Life insurance is an essential part of financial planning for married couples. After tying the knot, it's a good idea to review your insurance coverage and ensure that both partners are adequately protected. Newlyweds often share financial responsibilities and goals, so updating your insurance is a priority.

When you buy a home:

Purchasing a home is a significant financial commitment, and it's crucial to ensure that your spouse can continue to cover the mortgage and other related expenses in your absence. Life insurance provides that security, giving you both peace of mind.

When you start a family:

Having children is a life-changing event, and it's essential to plan for their future financially. Life insurance can protect your family's financial stability and ensure your children's education and daily needs are met, even if something happens to one of the parents.

When your income increases:

As your career progresses and your income rises, it's a good time to re-evaluate your life insurance coverage. The policy should be sufficient to maintain your family's standard of living if something unexpected happens.

When you're young and healthy:

The cost of life insurance is generally lower when you're young and in good health. Buying life insurance early can lock in lower premiums, saving you money in the long run.

When you have other dependents:

If you have other dependents, such as ageing parents or relatives with disabilities, life insurance can ensure that they will be taken care of financially even after you're gone.

In summary, life insurance is a vital tool for couples to protect their loved ones and secure their financial future. By purchasing life insurance at key moments, such as major life events or when your circumstances change, you can ensure that you and your partner are adequately covered.

Borrowing from Life Insurance: Employer-Provided Policy Options

You may want to see also

Pros and cons of joint life insurance

Joint life insurance policies are a type of insurance that covers two people, usually spouses or domestic partners, under one policy. While it can be an attractive option for some couples, it's important to weigh the pros and cons before making a decision. Here are some of the advantages and disadvantages of joint life insurance:

Pros:

- Cost savings: Joint life insurance can often be cheaper than purchasing two separate standalone policies, as the total payout is lower. This is especially beneficial for young, dual-income families who want to ensure their financial security.

- Simplicity and convenience: Managing one policy instead of two can simplify the process and reduce administrative burdens.

- Estate planning: Joint life insurance can be useful for estate planning, especially for older, affluent couples. It can help minimise taxes and provide liquidity to the estate.

- Coverage for high-risk individuals: If one partner has health issues or other factors that make them difficult to insure, a joint policy can provide coverage for them at a lower cost.

Cons:

- Limited flexibility: Joint policies offer less flexibility than separate policies, as they only pay out once, after the first or second death. If a couple with a first-to-die policy splits up, the surviving partner will need to purchase a new policy, likely at a higher cost.

- Higher cost in certain cases: If one partner has health issues or other risk factors, the cost of insuring the healthier spouse may be higher than if they had an individual policy.

- Complications in case of divorce: If the marriage ends, managing the joint policy can become complicated, and it usually cannot be divided.

- Lower coverage: The coverage amount for a joint policy may be lower than that of two individual policies with the same premium.

- Limited options: Not all insurance companies offer joint life insurance, and the options for term joint life insurance are particularly scarce.

Life Insurance: A Retirement Plan?

You may want to see also

Is life insurance cheaper for married couples?

Life insurance is often cheaper for married couples, but this depends on the company offering the policy. Married couples can choose between separate life insurance policies or a joint life insurance policy. A joint life insurance policy covers both spouses, while a separate life insurance policy only covers one spouse.

A joint life insurance policy can help lower overall life insurance costs and simplify management with one policy. It can also be useful for estate planning and minimizing taxes. However, it may offer less flexibility compared to individual policies and can be complicated to manage if the marriage ends.

Separate life insurance policies allow each spouse to choose from different types of policies, such as term life, whole life, and universal life insurance. They can be tailored to individual needs and financial goals and allow for higher coverage amounts per individual. However, they typically require managing multiple policies and are more expensive than a joint policy.

When deciding between a joint or separate life insurance policy, married couples should consider their unique circumstances, coverage needs, and financial situation. Consulting with a licensed insurance agent can help navigate these options and choose the best coverage.

Life Insurance and Welfare: What's the Connection?

You may want to see also

How much life insurance do you need?

When it comes to life insurance, there is no one-size-fits-all approach. The amount of coverage you need depends on a variety of factors, including your age, income, mortgage, debts, anticipated funeral expenses, and financial goals. Here are some guidelines to help you estimate how much life insurance you and your partner may need as a couple:

- Income Replacement: It is recommended to have enough coverage to replace at least 10 years of your salary. For example, if one spouse earns $40,000 per year, a $400,000 policy would replace their income for a decade, with some extra to account for inflation.

- Mortgage and Debts: Ensure your policy includes enough coverage to pay off any outstanding debts, including mortgage, car loans, student loans, credit card debt, and personal loans. For instance, if you have a $200,000 mortgage and a $4,000 car loan, your policy should cover at least $204,000, plus additional funds to cover interest and other charges.

- Future Expenses: Consider future expenses such as raising children, their education, and daily living expenses. The cost of raising children and providing them with a good education can be significant, so it's important to factor this into your life insurance calculation.

- Final Expenses: Life insurance can also help cover funeral costs and medical bills. The younger and healthier you are, the lower your premiums are likely to be. However, older individuals can still obtain life insurance.

- Spousal Coverage: Both spouses may require life insurance coverage, even if only one is the primary breadwinner. In the event of the breadwinner's death, life insurance can provide financial security for the surviving spouse and any children.

- Joint vs. Separate Policies: Couples have the option of obtaining separate life insurance policies or a joint policy. Separate policies offer greater flexibility and can be tailored to each spouse's individual needs, but they are typically more expensive than a joint policy. Joint policies, on the other hand, may lower overall costs and simplify management with a single policy, but they offer less coverage for the same premium.

- Term vs. Permanent Life Insurance: There are two main types of life insurance: term and permanent. Term life insurance covers you for a specific period, usually 10 to 30 years, while permanent life insurance provides lifetime coverage and often includes a cash value component that can grow over time. Term life insurance is generally more affordable, making it ideal for temporary needs such as covering a mortgage or supporting children until they become financially independent. Permanent life insurance, on the other hand, is significantly more expensive but offers lifelong protection.

- Additional Considerations: Don't forget to consider other important factors, such as any shared debts, shared expenses, and future plans. If you have shared debts like a mortgage or college debt for your children, life insurance can help ensure that your spouse isn't overwhelmed by these financial obligations in the event of your death. Additionally, if you plan to expand your family or make significant purchases, such as buying a new home, your life insurance needs may change.

Get a Life Insurance License in South Carolina Easily

You may want to see also

Frequently asked questions

Joint life insurance covers two people, usually spouses, under one policy. Separate life insurance policies cover only one individual.

Joint life insurance is generally cheaper than two separate policies, and can be useful for estate planning and minimising taxes.

Joint life insurance offers less flexibility and can be complicated to manage if the marriage ends. It may also provide less coverage compared to individual policies for a similar premium.

Yes, couples in domestic partnerships are eligible for the same life insurance policies as married couples.