Life insurance and income protection are two distinct financial products designed to safeguard individuals and their families. Life insurance provides a financial safety net for beneficiaries in the event of the insured's death, offering a lump sum payment or regular income to cover expenses and support loved ones. On the other hand, income protection insurance focuses on replacing a portion of the insured's income if they become unable to work due to illness or injury. While life insurance ensures financial security for the deceased's dependents, income protection insurance aims to maintain the insured's standard of living by providing income replacement during periods of incapacity. Understanding the differences between these two insurance types is crucial for individuals to choose the right coverage based on their specific needs and financial goals.

| Characteristics | Values |

|---|---|

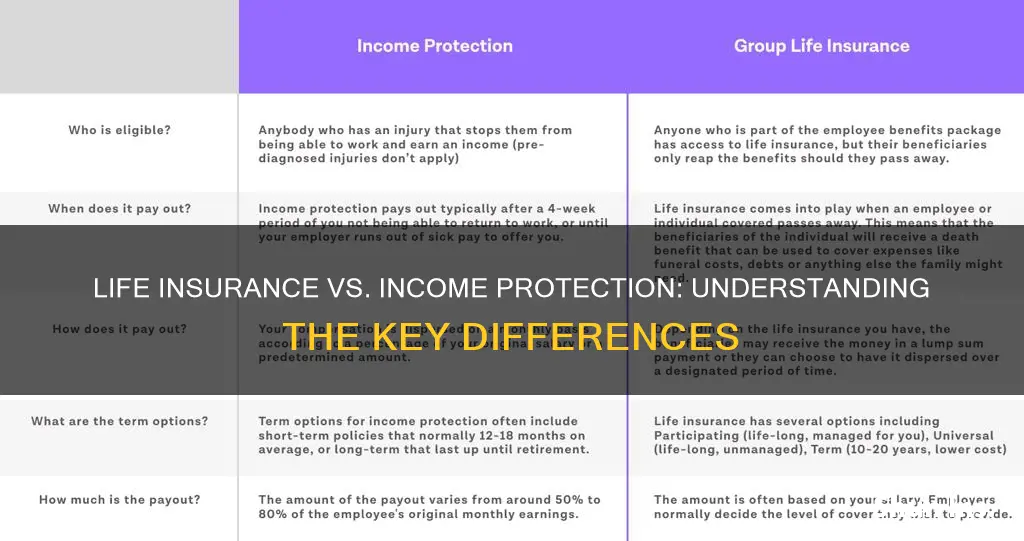

| Definition | Life insurance provides a financial benefit to beneficiaries upon the insured individual's death, while income protection ensures regular income replacement if the insured person is unable to work due to illness or injury. |

| Purpose | The primary purpose is to provide financial security to loved ones in the event of the policyholder's death. Income protection aims to replace a portion of the policyholder's income when they are unable to work. |

| Coverage | Typically covers a lump sum payment or a series of payments to beneficiaries. Income protection covers a percentage of the policyholder's pre-tax income. |

| Trigger | Activates upon the insured's death. Income protection is triggered when the policyholder becomes temporarily or permanently unable to work due to illness or injury. |

| Duration | Usually permanent, providing coverage for the policyholder's entire life. Income protection can be short-term, long-term, or permanent, depending on the policy. |

| Tax Implications | Payouts from life insurance policies are generally tax-free. Income protection benefits may be taxable, depending on the jurisdiction and policy terms. |

| Cost | Premiums are typically higher for life insurance, especially for comprehensive coverage. Income protection premiums can vary but are generally lower, as the coverage is more specific to income replacement. |

| Eligibility | Generally, anyone can purchase life insurance, but eligibility criteria may vary. Income protection policies often require a medical assessment to determine eligibility and may have age restrictions. |

| Benefits | Provides financial security and peace of mind to families. Income protection ensures financial stability and covers living expenses during periods of absence from work. |

| Types | Includes term life, whole life, universal life, and more. Income protection can be categorized as short-term, long-term, or permanent income protection. |

| Policy Customization | Life insurance policies can be tailored to specific needs, offering various coverage options and riders. Income protection policies can be customized to fit individual income requirements and preferences. |

What You'll Learn

- Coverage: Life insurance provides a lump sum, while income protection offers regular income replacement

- Trigger: Life insurance pays out upon death, income protection due to illness/injury

- Term: Permanent coverage for life, income protection typically for a defined period

- Taxation: Life insurance may be taxed, income protection often tax-free

- Cost: Income protection can be more expensive due to its comprehensive nature

Coverage: Life insurance provides a lump sum, while income protection offers regular income replacement

When it comes to financial planning, understanding the differences between various insurance products is crucial. One of the key distinctions lies in the nature of the coverage provided by life insurance and income protection.

Life insurance is a financial safety net designed to provide financial security to the beneficiaries upon the insured individual's death. It typically offers a lump sum payment, known as the death benefit, to the designated recipients. This lump sum can be a significant financial cushion, ensuring that loved ones have the necessary resources to cover expenses, pay off debts, or achieve their financial goals. The primary purpose of life insurance is to provide financial support during a challenging time, offering peace of mind and financial stability to the policyholder's family.

On the other hand, income protection insurance, also known as income replacement insurance, focuses on providing financial support during the insured individual's inability to work due to illness or injury. Unlike life insurance, income protection offers regular income replacement, ensuring that the policyholder receives a steady stream of income to cover their living expenses and maintain their standard of living. This type of insurance is particularly valuable as it provides financial security when unexpected events disrupt one's ability to earn an income.

The key difference in coverage is that life insurance provides a one-time payment to beneficiaries, whereas income protection insurance offers ongoing financial support to the policyholder. Income protection is designed to bridge the gap between the insured individual's income and their outgoings during periods of absence from work, ensuring that they can maintain their financial commitments and lifestyle. This regular income replacement can be a vital aspect of financial planning, especially for those with significant financial responsibilities or a high standard of living.

In summary, while life insurance offers a lump sum to provide financial security for loved ones, income protection insurance ensures a steady income stream to support the policyholder during periods of absence from work. Understanding these differences is essential for individuals to make informed decisions about their insurance needs and ensure they have the appropriate coverage to protect themselves and their loved ones.

Whole Life Insurance: Smart Move for Young People?

You may want to see also

Trigger: Life insurance pays out upon death, income protection due to illness/injury

Life insurance and income protection are two distinct financial products designed to provide financial security, but they serve different purposes and operate in unique ways. Understanding these differences is crucial for individuals to choose the right coverage based on their specific needs and circumstances.

Life Insurance: A Financial Safety Net for the Future

Life insurance is a long-term financial strategy that offers a safety net for your loved ones in the event of your untimely death. It is a contract between you and an insurance company, where you pay regular premiums in exchange for a death benefit. This benefit is typically a lump sum amount paid out to your beneficiaries upon your passing. The primary purpose of life insurance is to provide financial support to your family, covering expenses such as mortgage payments, children's education, funeral costs, and other outstanding debts. It ensures that your loved ones are financially protected even if you are no longer around. There are various types of life insurance policies, including term life, whole life, and universal life, each with its own features and benefits.

Income Protection: Replacing Your Income During Absence

Income protection, on the other hand, is a type of insurance designed to replace a portion of your income if you are unable to work due to illness, injury, or other specified events. It is a short-term or long-term benefit that provides financial support when you can no longer earn an income. Income protection policies typically pay out a percentage of your regular income, ensuring that you have a steady stream of financial support during challenging times. This type of insurance is particularly valuable for individuals who rely on their income to meet daily expenses and maintain their standard of living. It can cover a range of situations, including short-term absences due to minor illnesses or injuries, and longer-term absences resulting from more severe health issues.

The key difference lies in the trigger for the payout. Life insurance is activated by the tragic event of death, providing financial security for your loved ones. In contrast, income protection is triggered by your inability to work, ensuring that you have a financial safety net during periods of illness or injury. Income protection policies often have waiting periods and benefit periods, during which the insurance company assesses your claim and provides the necessary financial support.

Both life insurance and income protection are essential components of a comprehensive financial plan. While life insurance focuses on providing for your family's long-term financial needs, income protection ensures that you have the means to maintain your lifestyle and cover essential expenses during short-term or long-term absences from work. It is advisable to assess your individual circumstances, including your family's financial obligations, health status, and employment situation, to determine which type of insurance or a combination of both is most suitable for your needs.

Life Insurance Payouts for Suicide: What You Need to Know

You may want to see also

Term: Permanent coverage for life, income protection typically for a defined period

Life insurance and income protection are two distinct financial products designed to safeguard individuals and their loved ones, but they serve different purposes and offer varying benefits. Understanding the difference between these two types of coverage is essential for making informed financial decisions.

Life Insurance:

Life insurance provides a financial safety net for the insured individual's beneficiaries in the event of their death. It is a long-term commitment, offering permanent coverage for the entire life of the insured person. The primary purpose is to ensure financial security for the family or dependents by providing a lump sum payment, known as a death benefit, upon the insured's passing. This benefit can be used to cover various expenses, such as mortgage payments, children's education, or everyday living costs, ensuring that the family's financial obligations are met. There are different types of life insurance, including term life and permanent life, each with its own advantages. Term life insurance provides coverage for a specified period, typically 10, 20, or 30 years, and is often more affordable. In contrast, permanent life insurance, also known as whole life or universal life, offers lifelong coverage and includes a savings component, allowing the policyholder to accumulate cash value over time.

Income Protection:

Income protection, on the other hand, is designed to replace a portion of the insured individual's income if they become unable to work due to illness or injury. This type of insurance provides temporary coverage, typically for a defined period, such as six months to two years, depending on the policy terms. The primary goal is to ensure that the insured person can maintain their standard of living and cover essential expenses during a period of incapacity. Income protection policies often have a waiting period before benefits commence, during which the insured individual must recover from the illness or injury. This waiting period can vary, but it is generally shorter than the duration of income protection benefits. The payout from an income protection policy can be used to cover daily living expenses, mortgage or rent payments, and other financial commitments, providing a sense of financial security during challenging times.

The key distinction lies in the duration of coverage. Life insurance offers permanent protection, ensuring financial security for the entire life of the insured individual, while income protection is designed for a specific period, typically associated with a temporary loss of income due to illness or injury. Understanding these differences is crucial when evaluating one's insurance needs and choosing the appropriate coverage to protect oneself and one's loved ones.

Variable Whole Life Insurance: What You Need to Know

You may want to see also

Taxation: Life insurance may be taxed, income protection often tax-free

When it comes to the tax implications of life insurance and income protection, there are some key differences to understand. Firstly, life insurance can be subject to taxation, especially in certain jurisdictions. This is because life insurance policies often provide a financial benefit upon the death of the insured individual, which can be considered an asset or a form of income. As such, the proceeds from a life insurance policy may be taxed as income or even as a capital gain, depending on the tax laws in your country. For example, in some countries, the payout from a life insurance policy may be subject to income tax, and the recipient may have to declare this amount as part of their taxable income for that year.

On the other hand, income protection insurance is generally designed to provide tax-free benefits. Income protection policies are structured to replace a portion of the insured individual's income if they become unable to work due to illness or injury. The primary purpose of these policies is to provide financial security and ensure that the insured person can maintain their standard of living during periods of absence from work. Since income protection benefits are typically paid out directly to the insured individual, they are often treated as personal income and are not subject to the same tax rules as life insurance payouts. This means that the recipient can usually claim these benefits as tax-free income, providing a valuable financial safety net without the tax implications associated with life insurance.

The tax treatment of these insurance products can vary depending on the specific policy and the jurisdiction. It is essential to consult with a financial advisor or tax professional to understand the tax implications in your region. They can provide tailored advice based on your circumstances, ensuring that you make informed decisions regarding your insurance coverage and its tax consequences.

In summary, while life insurance may be taxed as income or a capital gain, income protection insurance is generally designed to provide tax-free benefits, offering financial security without the same tax implications. Understanding these differences is crucial when evaluating insurance options and their potential impact on your financial affairs.

Life Insurance Money: Taxable Income in Connecticut?

You may want to see also

Cost: Income protection can be more expensive due to its comprehensive nature

Income protection insurance is often more costly compared to life insurance, and this price difference can be attributed to the comprehensive coverage it offers. While life insurance primarily focuses on providing financial security to beneficiaries in the event of the insured's death, income protection takes a broader approach. It aims to replace a portion of the insured's income if they become unable to work due to illness or injury. This extended coverage means that income protection policies typically include a wider range of benefits, such as covering various medical conditions, accidents, and even mental health issues, which can significantly increase the overall cost.

The comprehensive nature of income protection is designed to provide financial support during a challenging period, ensuring that the insured individual can maintain their standard of living and cover essential expenses. This level of coverage often involves more complex policy structures, with various benefits and potential waiting periods, which can contribute to higher premiums. Additionally, the longer-term nature of income protection, which may last for years or even decades, further influences the cost, as insurers need to account for the extended period of potential claims.

In contrast, life insurance policies are generally more straightforward, focusing on a single event (death) and offering a lump sum payment to beneficiaries. This simplicity in coverage and the shorter-term nature of life insurance policies can result in lower premiums compared to income protection. However, it's important to note that the cost of income protection can vary depending on individual circumstances, the level of coverage chosen, and the insurer's rates.

When considering the financial implications, it's essential to understand that income protection is a more specialized form of insurance, catering to the specific need of income replacement. This specialization, combined with the comprehensive benefits, justifies the higher cost. Prospective policyholders should carefully evaluate their financial situation, risk tolerance, and long-term goals to determine the most suitable insurance coverage, balancing the need for comprehensive protection with the associated costs.

Cancelling Globe Life Insurance: Are Refunds Possible?

You may want to see also

Frequently asked questions

Life insurance is a financial safety net that provides a monetary benefit to the policyholder's beneficiaries upon their death. It is designed to offer financial security to the family or dependents by covering expenses such as funeral costs, mortgage payments, or daily living expenses.

Income protection insurance is a type of insurance that replaces a portion of the policyholder's income if they become unable to work due to illness or injury. It focuses on providing financial support during the period of disability, ensuring that the individual can maintain their standard of living and cover essential expenses.

Income protection insurance is particularly important if you have financial commitments or dependents that rely on your regular income. It is recommended for individuals who want to ensure that their income is protected in the event of an unforeseen illness or injury that prevents them from working. This type of insurance can provide peace of mind and financial stability during challenging times.

Yes, it is possible and often beneficial to have both types of insurance. Life insurance provides coverage for the eventuality of death, while income protection insurance safeguards your income if you become unable to work. Having both policies can offer comprehensive financial protection and ensure that your loved ones and financial goals are secured.