When considering life insurance, it's important to understand the different types available and their benefits. Term life insurance is a popular choice, offering coverage for a specific period, but it may not be the best long-term solution. Whole life insurance, on the other hand, provides permanent coverage and a guaranteed death benefit, making it a more comprehensive option. This transition is often considered when individuals want to ensure their loved ones are protected for the long term and are looking for a more stable financial plan. Understanding when and why to switch from term to whole life insurance can help individuals make informed decisions about their future financial security.

What You'll Learn

- Cost-Effectiveness: Whole life insurance can be more affordable in the long run compared to term life

- Long-Term Coverage: Transitioning ensures lifelong protection, providing peace of mind for the future

- Flexibility: Convertible policies offer options to adjust coverage as financial needs evolve

- Tax Advantages: Whole life may offer tax benefits, making it an attractive financial tool

- Legacy Planning: Converting can help secure a financial legacy for beneficiaries

Cost-Effectiveness: Whole life insurance can be more affordable in the long run compared to term life

When considering life insurance, many people opt for term life insurance, which provides coverage for a specific period. However, there are compelling reasons to explore the option of converting to whole life insurance, especially when it comes to long-term cost-effectiveness. Whole life insurance offers a unique advantage in this regard, as it provides lifelong coverage, ensuring financial security for your loved ones even after your passing.

One of the primary benefits of whole life insurance is its guaranteed death benefit. This means that, regardless of when you pass away, your beneficiaries will receive the full death benefit amount. In contrast, term life insurance only provides coverage for a set period, typically 10, 20, or 30 years. While term life insurance is generally more affordable during the initial years, it may become significantly more expensive as you age, especially if you outlive the term period. This can result in higher premiums, making it less cost-effective in the long run.

Whole life insurance, on the other hand, offers a level of predictability and stability. The premiums for whole life insurance are calculated based on a combination of factors, including your age, health, and the desired death benefit. Once the policy is in force, the premiums remain consistent, providing a fixed cost for the entire duration of the policy. This predictability allows you to plan and budget more effectively, ensuring that your insurance coverage remains affordable over the long term.

Additionally, whole life insurance policies often include an accumulation of cash value over time. This cash value can be borrowed against or withdrawn, providing financial flexibility. It can be particularly useful if you need to access funds for major expenses, such as education costs or home improvements, without having to surrender the policy or take out a loan with potential interest charges. The cash value in whole life insurance can also grow tax-deferred, providing a valuable financial asset.

In summary, while term life insurance may be more affordable initially, whole life insurance offers a more cost-effective solution in the long term. The guaranteed death benefit, consistent premiums, and potential cash value accumulation make whole life insurance a reliable and stable choice. By considering the long-term financial implications, individuals can make an informed decision to switch from term life to whole life insurance, ensuring their loved ones' financial security and their own peace of mind.

Thieves Targeting Life Insurance: Account Number Safety

You may want to see also

Long-Term Coverage: Transitioning ensures lifelong protection, providing peace of mind for the future

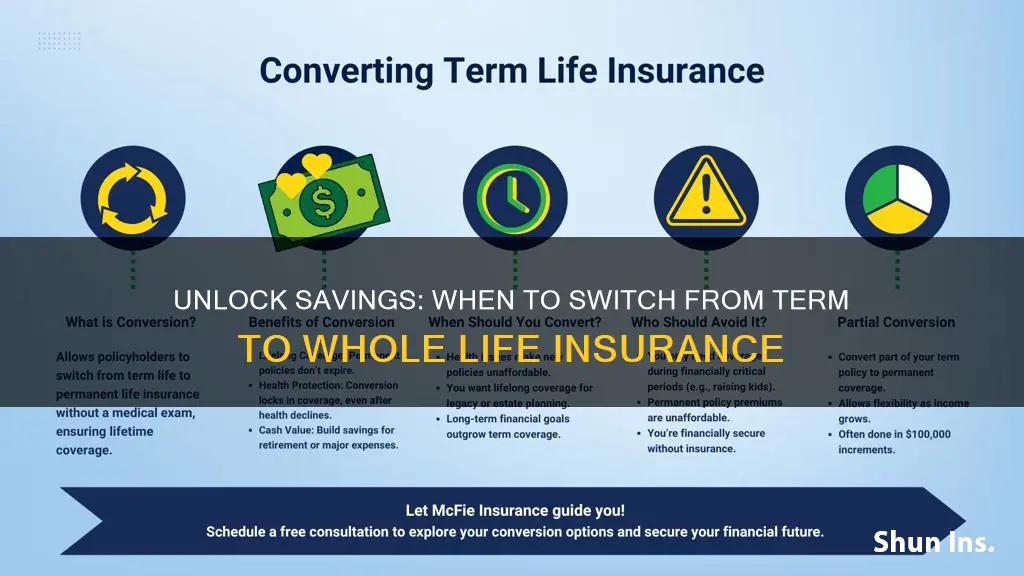

Term life insurance is a popular choice for many individuals seeking affordable coverage for a specific period, often tied to a mortgage or a child's education. However, as life circumstances evolve, so might the need for insurance. Transitioning from term life insurance to a permanent policy, such as whole life insurance, can offer long-term benefits and provide a sense of security for the future. This strategic move ensures that your loved ones are protected throughout your entire life, not just during a particular phase.

Whole life insurance is a type of permanent life insurance that offers lifelong coverage. It provides a guaranteed death benefit, meaning the insurance company promises to pay out a specified amount upon your passing. This feature is particularly valuable as it ensures that your family's financial needs are met regardless of life's twists and turns. Unlike term life, whole life insurance accumulates cash value over time, which can be borrowed against or withdrawn, providing financial flexibility.

The transition process typically involves reviewing your current insurance policy and assessing your evolving needs. As you age, your financial goals and responsibilities may change, and a permanent policy can adapt to these shifts. For instance, if you initially purchased term life to cover a mortgage, transitioning to whole life can provide ongoing protection for your family's long-term needs, such as education costs or retirement expenses. This shift ensures that your insurance keeps up with your life's milestones.

Making the switch also offers the advantage of long-term savings. Whole life insurance premiums are typically higher than term life but are designed to remain constant throughout your life. This predictability in pricing can be advantageous, especially when planning for the future. Additionally, the cash value accumulation in whole life policies can be a valuable asset, allowing you to build equity over time, which can be utilized for various financial goals.

In summary, transitioning from term life to whole life insurance is a strategic decision that ensures long-term coverage and provides peace of mind. It allows individuals to adapt their insurance needs as their lives progress, offering protection and financial security for the future. By making this change, you can ensure that your loved ones are safeguarded, and your financial plans are aligned with your evolving life goals.

Universal vs. Variable Life Insurance: Understanding the Key Differences

You may want to see also

Flexibility: Convertible policies offer options to adjust coverage as financial needs evolve

Convertible life insurance policies provide a unique level of flexibility that can be highly beneficial for individuals who want to adapt their insurance coverage as their financial situation changes over time. One of the key advantages of these policies is the ability to convert them from term life insurance to whole life insurance, ensuring that your coverage remains relevant and appropriate for your evolving needs.

Term life insurance is typically designed for a specific period, offering coverage for a set number of years. While it provides a straightforward and cost-effective solution for temporary needs, it may not be suitable for long-term financial planning. This is where the convertibility of policies comes into play. When you opt for a convertible policy, you gain the freedom to make adjustments as your circumstances change. For instance, if you initially purchase a term life policy to cover your children's education expenses, you can later convert it to a whole life policy to ensure a lifelong financial safety net for your family.

The flexibility offered by convertible policies allows you to start with a term life policy that suits your current financial situation and risk tolerance. As your income and assets grow, you can review and potentially increase your coverage. Over time, you might decide to convert the policy to a whole life option, which provides permanent coverage and a cash value component. This conversion can be particularly advantageous if you wish to build a substantial cash reserve within your insurance policy, offering financial security and the potential for tax-advantaged growth.

Furthermore, the ability to convert policies can be a strategic move for those who want to ensure their loved ones' financial well-being in the long term. By starting with a term life policy and later converting it, you can provide a stable financial foundation during specific life stages and then adapt the coverage to meet the evolving needs of your family. This flexibility ensures that your insurance strategy remains aligned with your financial goals and priorities.

In summary, convertible life insurance policies offer a strategic approach to insurance by providing the option to adjust coverage as your financial circumstances change. This flexibility is particularly valuable when transitioning from term life insurance to whole life insurance, allowing individuals to create a tailored financial plan that adapts to their evolving needs and provides long-term security.

Humana's Life Insurance: What You Need to Know

You may want to see also

Tax Advantages: Whole life may offer tax benefits, making it an attractive financial tool

Whole life insurance, a permanent life insurance policy, offers several tax advantages that can make it an attractive financial tool for individuals seeking long-term financial planning. One of the primary benefits is the potential for tax-deferred growth of the cash value. Unlike term life insurance, where the death benefit is paid out as a lump sum, whole life insurance provides a guaranteed death benefit and a cash value component that grows tax-deferred. This means that the cash value accumulation within the policy can grow without being subject to annual income taxes, allowing it to accumulate over time.

As the cash value grows, it can be borrowed against or withdrawn, providing access to funds without triggering immediate tax consequences. This feature is particularly useful for individuals who may need to access funds for various financial needs, such as education expenses, business investments, or retirement planning. By utilizing the cash value, policyholders can leverage their investment without incurring taxes on the growth, making it a strategic tool for long-term wealth accumulation.

Additionally, the death benefit paid out upon the insured's passing is generally tax-free. When a whole life insurance policyholder dies, the death benefit is typically paid out to the designated beneficiaries, and this amount is not subject to income tax. This tax-free nature of the death benefit can be advantageous, especially for families or beneficiaries who may rely on the proceeds for financial security.

Furthermore, the tax advantages of whole life insurance extend to the investment component. The cash value, which is invested in a separate account, can earn dividends, and these dividends may be reinvested or withdrawn tax-free. This allows policyholders to benefit from compound growth, where the earnings on the investment are reinvested, potentially leading to significant tax-advantaged growth over time.

In summary, whole life insurance provides tax advantages through tax-deferred growth of cash value, tax-free access to funds, and the potential for tax-free investment returns. These benefits make it a compelling financial tool for individuals seeking to optimize their long-term financial planning and wealth accumulation strategies. Understanding these tax advantages can be crucial when considering a switch from term life insurance to whole life, as it highlights the potential for long-term financial gains and security.

Understanding the Basics: Minimum Duration of Life Insurance Policies

You may want to see also

Legacy Planning: Converting can help secure a financial legacy for beneficiaries

Converting from term life insurance to whole life insurance can be a strategic move in legacy planning, offering a more comprehensive approach to securing financial assets for your beneficiaries. Here's why this conversion is a valuable consideration:

Long-Term Financial Security: Whole life insurance provides permanent coverage, ensuring that your beneficiaries receive a death benefit regardless of when you pass away. This is in contrast to term life insurance, which offers coverage for a specific period. By converting, you create a long-term financial safety net, allowing your loved ones to have a steady income or a lump sum amount to cover various expenses and future needs. This is especially crucial if you have dependents or specific financial goals that require long-term funding.

Building a Financial Legacy: The death benefit from a whole life insurance policy can be an excellent tool to create a financial legacy. You can choose to invest a portion of the policy's value, allowing it to grow over time. This investment component can provide a substantial sum for your beneficiaries, enabling them to achieve their financial aspirations, such as purchasing a home, funding education, or starting a business. With proper investment strategies, the conversion can result in a valuable asset that contributes to your family's long-term financial well-being.

Flexibility and Customization: Whole life insurance offers flexibility in policy customization. You can tailor the coverage amount and premium payments to your specific needs and financial situation. This flexibility ensures that the policy aligns with your legacy planning goals. For instance, you might opt for a higher coverage amount to provide more financial security or adjust the premium payments to fit your budget. This customization can make the conversion more accessible and beneficial for your overall financial strategy.

Tax Advantages: Whole life insurance policies can offer tax benefits, providing an additional incentive for conversion. The cash value accumulation within the policy can grow tax-deferred, allowing it to accumulate over time. This growth can be a valuable asset, especially if you have other investment options. Additionally, the death benefit received by beneficiaries is generally tax-free, ensuring that the entire amount goes towards their financial needs.

Peace of Mind: Converting to whole life insurance provides peace of mind, knowing that your beneficiaries are financially protected. This conversion can be a strategic decision, especially if you have a long-term financial plan and want to ensure that your loved ones are taken care of. By taking this step, you demonstrate your commitment to their future, offering a sense of security and stability.

In summary, converting term life insurance to whole life insurance is a strategic legacy planning move. It provides long-term financial security, builds a valuable financial legacy, offers flexibility, and includes tax advantages. By making this conversion, you can ensure that your beneficiaries receive the support they need and contribute to their financial well-being, even after your passing. It is a thoughtful decision that can have a significant impact on the financial future of your loved ones.

NFL's Life Insurance: Protecting Athletes' Legacy

You may want to see also

Frequently asked questions

Whole life insurance offers permanent coverage, providing a fixed death benefit for the entire life of the insured, whereas term life insurance is designed for a specific period. The main advantage of whole life is that it has a cash value component, which can be borrowed against or withdrawn, offering financial flexibility and a guaranteed death benefit. This can be beneficial if you want long-term financial security and the potential for investment growth.

The decision to change from term to whole life insurance depends on your personal financial goals and circumstances. Typically, people consider this transition when they have achieved financial stability, have a growing family, or when they want to ensure their loved ones are protected for the long term. It's often a good idea to review your insurance needs periodically, especially when major life events occur, such as getting married, having children, or purchasing a home.

Yes, certain financial milestones can prompt the consideration of whole life insurance. For instance, if you've built up a substantial amount of debt, have a large family with ongoing expenses, or want to ensure your children's education costs are covered, whole life insurance can provide a reliable safety net. Additionally, if you've outgrown your term policy and want to ensure your coverage remains adequate, switching to whole life can be a strategic move.

Converting to whole life insurance early can have several advantages. Firstly, you'll lock in a guaranteed premium rate for life, protecting you from future rate increases. Secondly, the cash value accumulation in whole life policies can provide a source of funds for various financial needs, such as retirement planning or funding education expenses. Early conversion also ensures that your loved ones will have coverage for an extended period, providing long-term financial security.