Life insurance is a crucial financial tool that provides financial security for individuals and their families. One type of life insurance that stands out for its consistent and reliable coverage is whole life insurance. This type of policy offers fixed premiums and a guaranteed death benefit for the entire lifetime of the insured individual, ensuring that beneficiaries receive a predetermined amount upon the insured's passing. The fixed nature of these payments makes whole life insurance an attractive option for those seeking long-term financial protection and peace of mind.

What You'll Learn

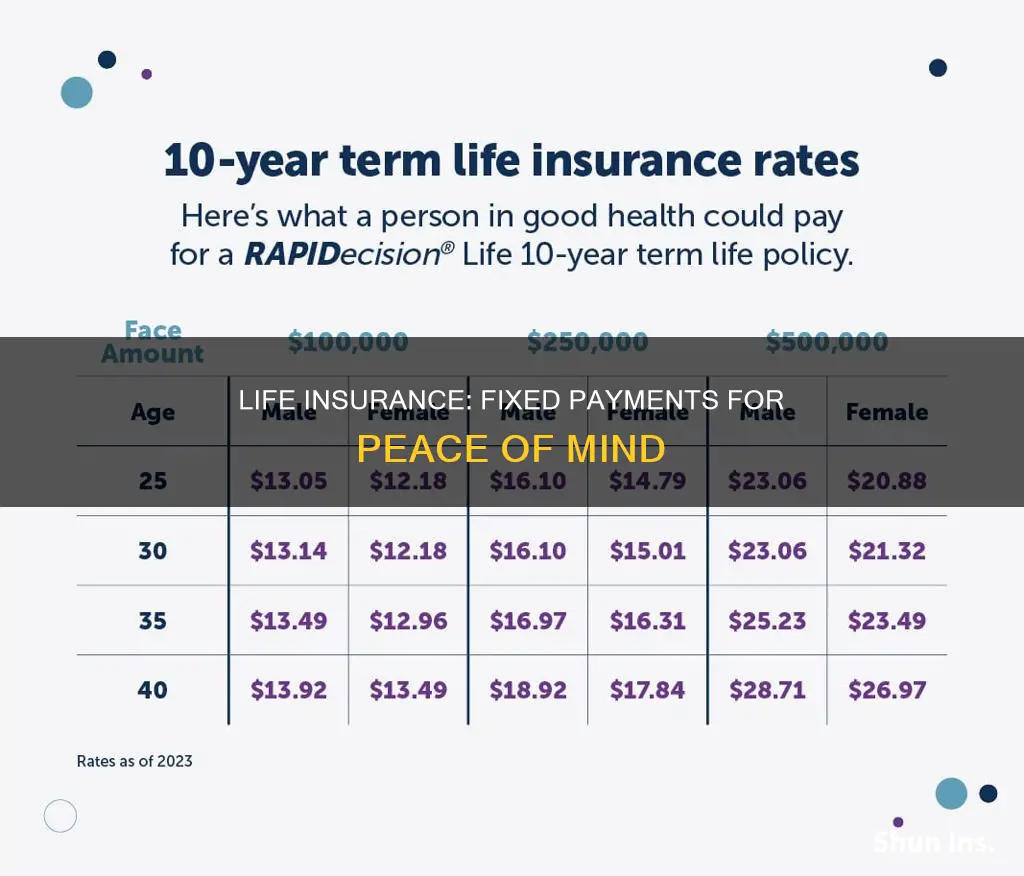

Term Life Insurance: Fixed premiums for a set period

Term life insurance is a type of coverage that provides a specific period of coverage with fixed premiums. This means that the cost of your insurance remains the same throughout the term, offering financial protection for a defined duration. It is a straightforward and affordable way to secure your loved ones' financial future during a particular time in your life, such as when you have a mortgage, children to raise, or other financial commitments.

When you purchase term life insurance, you choose the term length, which could be 10, 20, or 30 years, depending on your needs and preferences. During this period, the insurance company guarantees a death benefit if you pass away, providing a tax-free lump sum to your beneficiaries. The beauty of term life insurance is its simplicity; you pay a consistent amount each month, quarter, or year, and in return, you receive a fixed level of coverage.

One of the advantages of this type of insurance is its predictability. With fixed premiums, you can plan your finances more effectively, knowing exactly how much you will pay over the term. This predictability is especially beneficial for those on a tight budget or with limited financial resources, as it allows for better financial management and planning. Additionally, term life insurance is generally more affordable than permanent life insurance, making it an attractive option for those seeking cost-effective coverage.

The coverage provided by term life insurance is straightforward and focused on a specific goal. It is ideal for individuals who want to protect their family during a particular life stage, such as when they are raising children or paying off a mortgage. During this time, the financial responsibilities can be significant, and having a fixed-term policy ensures that your loved ones are financially secure if something happens to you.

In summary, term life insurance offers a simple and effective solution for those seeking fixed payments for a set period. With its predictable premiums and focused coverage, it provides a valuable layer of financial protection during specific life events. By choosing the right term length, you can ensure that your loved ones are cared for, and your financial goals are met, all while maintaining a manageable and affordable insurance plan.

Unraveling the Mystery: How Long Until Life Insurance Payouts?

You may want to see also

Whole Life: Accumulates cash value with lifelong premiums

Whole life insurance is a type of permanent life insurance that offers a unique and valuable feature: it guarantees fixed payments for life. This means that once you take out a whole life policy, you will pay a set premium for the rest of your life, providing you with lifelong coverage. One of the key advantages of this type of insurance is the accumulation of cash value over time.

As you make regular premium payments, a portion of each payment goes towards building a cash reserve within the policy. This cash value grows tax-deferred, allowing it to accumulate steadily. The beauty of this feature is that it provides a financial asset that can be borrowed against or withdrawn, offering financial flexibility. Over time, the cash value can grow significantly, and you can access it for various purposes, such as funding education, starting a business, or planning for retirement.

The lifelong nature of whole life insurance ensures that your loved ones are protected even if you pass away. The death benefit, which is the amount paid out upon your passing, remains fixed and is typically equal to the total amount of premiums paid in. This provides a secure financial safety net for your family, knowing that they will receive a predetermined sum regardless of future economic conditions.

Additionally, whole life insurance offers a sense of financial stability and predictability. With fixed premiums, you can plan your finances more effectively, knowing exactly how much you will pay each year. This is particularly beneficial for long-term financial planning, allowing you to build a substantial cash reserve that can be used for various financial goals.

In summary, whole life insurance with its lifelong fixed payments and the accumulation of cash value provides a reliable and secure financial solution. It offers both protection for your loved ones and a valuable asset that can be utilized for various financial needs. Considering the long-term benefits and the peace of mind it provides, whole life insurance is an excellent choice for those seeking lifelong financial security.

Finding a Wisconsin Life Insurance Agent: The Best Options

You may want to see also

Universal Life: Flexible premiums, adjustable death benefits

Universal life insurance offers a unique and flexible approach to long-term financial protection, providing both a death benefit and an investment component. One of its key advantages is the ability to customize and adjust various aspects of the policy, including premiums and death benefits, to suit the individual's needs and circumstances.

In a universal life policy, the insured pays flexible premiums, which means the payments can vary over time. This flexibility allows policyholders to adjust their contributions based on their financial situation and goals. For instance, during the initial years, individuals might opt for higher premiums to build up a substantial cash value quickly. As they age and their financial circumstances change, they can reduce the premium payments, ensuring the policy remains affordable. This adaptability is particularly beneficial for those who experience fluctuations in income or prefer to allocate their funds according to their evolving priorities.

The death benefit in universal life insurance is adjustable, meaning it can be increased or decreased to meet changing needs. This feature is especially useful for individuals who want to ensure their loved ones are adequately protected during their lifetime and beyond. For example, a policyholder might initially set a death benefit to cover immediate family expenses and then later increase it to provide for children's education or other long-term financial goals. The ability to adjust the death benefit provides a level of control and customization that is not typically found in traditional life insurance policies.

This type of insurance also offers a valuable investment component. The premiums paid beyond the basic insurance coverage are invested by the insurance company. These investments can grow tax-deferred, providing a potential source of funds for various purposes. Over time, the cash value accumulated in the policy can be borrowed against or withdrawn, providing financial flexibility. This aspect of universal life insurance allows individuals to make the most of their premiums, potentially building a substantial savings component within the policy.

In summary, universal life insurance stands out for its flexibility in premium payments and adjustable death benefits. This type of policy empowers individuals to tailor their insurance coverage to their specific needs, ensuring they have the right level of protection and financial security. With the ability to customize and adapt, universal life insurance provides a comprehensive solution for those seeking long-term financial protection and investment opportunities.

Life Insurance and Drug Testing: Urine Sample Checks?

You may want to see also

Final Expense: Covers funeral costs with guaranteed payments

When it comes to ensuring financial security for your loved ones, considering final expense insurance can be a wise decision. This type of insurance is specifically designed to cover the costs associated with your final arrangements, providing peace of mind during a difficult time. One of the key advantages of final expense insurance is the guaranteed payment structure. Unlike some other insurance policies, final expense insurance offers fixed payments that remain the same over the life of the policy. This means that you can rely on a consistent and predictable financial commitment, ensuring that your loved ones won't have to worry about unexpected expenses when you're gone.

The guaranteed payments aspect of final expense insurance is particularly beneficial for several reasons. Firstly, it provides financial protection for your beneficiaries, who may be dealing with grief and other emotional challenges during a difficult period. By having a fixed payment, they can focus on honoring your memory without the added stress of unexpected costs. Secondly, the guaranteed nature of these payments offers long-term financial security. As you age, your insurance premiums may increase, but with final expense insurance, the payments remain stable, providing consistent coverage throughout your life.

Final expense insurance is tailored to cover the specific costs associated with end-of-life services, such as funeral expenses, burial or cremation costs, and any other related fees. These expenses can vary widely, and having insurance that guarantees coverage can prevent financial strain on your family. It's important to note that final expense insurance is not just for the elderly; it can be beneficial for individuals of all ages. By securing this type of insurance, you ensure that your final wishes are respected and that your loved ones are financially protected, regardless of your age or health status.

When considering final expense insurance, it's advisable to research and compare different providers to find the best fit for your needs. Look for companies with a strong financial standing and a history of reliable service. Additionally, understand the terms and conditions of the policy, including any exclusions or limitations, to make an informed decision. Remember, the goal is to provide financial security and peace of mind, so choose a policy that aligns with your specific requirements.

In summary, final expense insurance with guaranteed payments is a valuable tool for ensuring that your final wishes are honored and your loved ones are financially protected. By offering fixed payments, this type of insurance provides stability and predictability, allowing your beneficiaries to focus on remembering you rather than worrying about expenses. It is a thoughtful consideration that can bring comfort to both you and your family during challenging times.

Insuring Another Person's Life: Is It Possible?

You may want to see also

Long-Term Care: Provides coverage for extended care needs

Long-term care insurance is a crucial financial tool designed to provide coverage for extended periods of care that individuals may need as they age. This type of insurance is specifically tailored to address the financial challenges associated with long-term care services, which can be both costly and often required for an extended duration. The primary goal of long-term care insurance is to offer financial protection and peace of mind to individuals and their families, ensuring that they are prepared for the potential expenses that may arise during their later years.

As people age, they may encounter various health issues and medical conditions that require ongoing care and support. This can include assistance with daily activities, such as bathing, dressing, and eating, as well as more specialized medical services. Long-term care insurance steps in to cover these expenses, providing a safety net for individuals who may require extended periods of care. It ensures that the financial burden of long-term care does not become a significant stressor for the individual or their family.

The coverage provided by long-term care insurance typically includes a range of services, such as skilled nursing care, assisted living, and in-home care. It can also cover the costs of adult day care, hospice care, and even some home modifications to accommodate the individual's needs. This comprehensive coverage ensures that individuals have access to the necessary support and services they require, promoting independence and quality of life.

One of the key advantages of long-term care insurance is the predictability of costs. Unlike some other insurance products, long-term care insurance offers fixed payments for life. This means that once an individual purchases the policy, they can rest assured that their premiums will remain the same throughout their lifetime, providing consistent financial protection. This predictability is particularly valuable for those planning for the future, as it allows them to budget and manage their finances effectively.

When considering long-term care insurance, it is essential to evaluate your specific needs and preferences. There are various policy options available, including traditional long-term care insurance, hybrid policies that combine long-term care with other types of insurance, and annuities with long-term care riders. Each option has its own benefits and considerations, so consulting with a financial advisor or insurance professional can help you make an informed decision. They can guide you through the process, ensuring you choose a policy that aligns with your goals and provides the necessary coverage for your extended care needs.

Term Life Insurance: Canceling Your Policy Safely and Smartly

You may want to see also

Frequently asked questions

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you pay your premiums. It offers a guaranteed death benefit and a fixed premium that remains the same for the life of the policy. This means your monthly, quarterly, or annual payments will be the same, providing financial security and peace of mind for your loved ones.

In life insurance, a fixed payment structure means that the premiums you pay will not change over time. This is in contrast to term life insurance, where premiums may vary based on age and other factors. With fixed payments, you can budget accurately and know exactly how much you'll pay each period. This predictability is especially valuable for long-term financial planning.

While fixed payments offer stability, they may also mean higher overall costs compared to variable policies. Fixed-payment life insurance policies typically have higher upfront costs and may not offer the same level of flexibility as other types of coverage. Additionally, if you outlive the expected lifespan, you might not get a return on your investment. It's essential to consider your financial goals and consult with an insurance advisor to determine the best fit for your needs.