When considering life insurance, it's important to understand that a doctor's exam is a snapshot of your health at a specific moment in time. Insurance companies use these exams to assess your current health status and determine your risk profile for coverage. However, life insurance policies typically require ongoing medical assessments to ensure that the insured individual's health remains stable and to adjust coverage as needed over time. Relying solely on a single doctor's exam can be misleading, as it may not account for any changes in health that could significantly impact insurance rates or eligibility. This article will explore the reasons why a doctor's exam alone is not sufficient for long-term life insurance coverage and the importance of regular medical check-ups.

What You'll Learn

- Medical Changes: Conditions can improve or worsen over time, affecting insurance eligibility

- Limited Scope: Exams focus on immediate health, not long-term risks

- Frequency: Regular check-ups may not capture sudden health issues

- Age and Lifestyle: Young, healthy individuals may need different coverage

- Pre-existing Conditions: Insurance companies may deny coverage for certain pre-existing conditions

Medical Changes: Conditions can improve or worsen over time, affecting insurance eligibility

The concept of using a doctor's examination as a one-time assessment for life insurance is flawed due to the dynamic nature of human health. Medical conditions, whether chronic or acute, can evolve and change significantly over time, often in ways that are unpredictable. This is why insurance companies require a more comprehensive understanding of an individual's health history and current state to make informed decisions about coverage.

One of the primary reasons for this is the potential for medical conditions to improve or worsen. For instance, a person diagnosed with diabetes might have managed their condition effectively through diet, exercise, and medication for years. However, factors such as stress, poor diet, or genetic predispositions can cause the condition to deteriorate, leading to complications like kidney damage or cardiovascular disease. Conversely, some conditions might resolve or become manageable with minimal intervention. A patient with a mild heart murmur, for example, might not require any treatment and could see the murmur disappear over time.

Insurance companies must consider these fluctuations in health to ensure that they provide appropriate coverage. If a policyholder's health significantly deteriorates after the initial examination, the insurance company might deny a claim or adjust the policy terms, which could be detrimental to the policyholder. Conversely, if a condition improves, the policyholder might be able to secure better coverage or even lower premiums.

To address this, insurance providers often require regular medical updates and may even conduct periodic re-examinations to assess the current health status of the policyholder. This allows them to make more accurate assessments and adjust policies accordingly. It also ensures that the insurance company is aware of any new or worsening conditions that could impact the policyholder's life expectancy and risk profile.

In summary, the use of a single doctor's examination for life insurance is insufficient due to the variable nature of health. Medical conditions can change, and these changes can have a significant impact on insurance eligibility and coverage. Therefore, insurance companies need to consider a more comprehensive and up-to-date medical history to provide fair and accurate policies.

Life Insurance After Declination: Is There Hope?

You may want to see also

Limited Scope: Exams focus on immediate health, not long-term risks

When considering life insurance, it's important to understand the limitations of a standard medical examination. While a doctor's exam can provide valuable insights into your current health status, it is designed to assess your immediate medical condition rather than predict long-term health risks. This distinction is crucial because life insurance policies typically require an assessment of an individual's overall health and longevity to determine the appropriate coverage and premium.

The scope of a typical medical exam is limited to evaluating your current physical and mental well-being. It may include a review of your medical history, a physical examination, and basic laboratory tests. This comprehensive assessment aims to identify any immediate health concerns or conditions that could impact your insurance eligibility or premium rates. However, it does not delve into the future, making it an incomplete tool for assessing long-term risks.

Long-term health risks, such as the development of chronic diseases or the impact of lifestyle choices over time, are not directly addressed in a standard exam. For instance, a doctor's visit might reveal high blood pressure or cholesterol levels, but it may not predict the progression of these conditions or their potential impact on your future health. Similarly, lifestyle factors like smoking, excessive alcohol consumption, or a sedentary lifestyle can significantly influence your long-term health, but these aspects are not always captured in a brief examination.

To ensure a comprehensive assessment for life insurance, it is essential to consider additional factors beyond a standard medical exam. This may include a review of your family medical history, a more in-depth analysis of your lifestyle choices, and a longer-term health evaluation. By incorporating these elements, you can provide a more accurate representation of your overall health and long-term risks to insurance providers, leading to more informed decision-making regarding your life insurance coverage.

Gift of Life Insurance: A Loving Legacy

You may want to see also

Frequency: Regular check-ups may not capture sudden health issues

Regular medical check-ups are an essential part of preventive healthcare, providing a comprehensive overview of an individual's health status. However, when it comes to life insurance, relying solely on these routine examinations may not be sufficient. The primary concern is that frequent check-ups might not always identify sudden or rapidly developing health issues that could significantly impact an individual's insurability.

Health conditions often progress without noticeable symptoms, especially in the early stages. For instance, cardiovascular diseases like hypertension or high cholesterol may not present any obvious warning signs until a critical event occurs. Similarly, certain types of cancer can develop silently, and by the time they are detected through routine screenings, they might have already progressed to an advanced stage. In such cases, life insurance companies might consider the individual as high-risk, potentially leading to higher premiums or even denial of coverage.

The frequency of medical check-ups is designed to monitor and manage chronic conditions and detect any deviations from the norm. While these visits are crucial for maintaining overall health, they might not always be able to predict or prevent sudden health crises. For example, a person with a family history of heart disease might have normal blood pressure and cholesterol levels during their regular check-up, but a sudden cardiac event could still occur, leaving them vulnerable to insurance complications.

To address this issue, life insurance providers often require additional assessments, such as medical exams, lab tests, and even consultations with specialists, especially for individuals with pre-existing conditions or those with a family history of certain diseases. These extra measures help insurers make more informed decisions about coverage and risk assessment. It is also advisable for individuals to maintain a consistent and transparent medical record, ensuring that any new or worsening health issues are promptly reported to their insurance provider.

In summary, while regular check-ups are vital for maintaining health, they might not always reveal sudden or rapidly progressing health problems. Life insurance companies, therefore, often require more comprehensive assessments to ensure accurate risk evaluation. Being proactive in managing one's health and staying informed about insurance requirements can help individuals navigate the complexities of obtaining life insurance coverage.

Universal Life Insurance Loans: Taxable or Not?

You may want to see also

Age and Lifestyle: Young, healthy individuals may need different coverage

When considering life insurance, it's important to understand that the needs of a young, healthy individual can vary significantly from those of an older person with a different lifestyle. Age and lifestyle play a crucial role in determining the type and extent of coverage required. Young, healthy individuals often have a lower risk profile for life insurance companies, which means they may qualify for more favorable rates and terms. However, this doesn't mean that a standard medical examination is sufficient for their insurance needs.

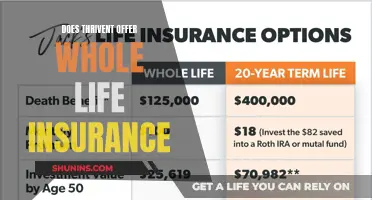

For young adults, life insurance is often more about planning for the future and protecting loved ones than about covering immediate health risks. Term life insurance, which provides coverage for a specified period, is a popular choice for young people. This type of policy is typically more affordable and can be tailored to their specific needs, such as covering mortgage payments, student loans, or providing financial support for dependents. The key advantage is that young individuals have a longer lifespan, reducing the likelihood of claiming the policy early.

Medical examinations for life insurance often focus on identifying pre-existing conditions or health risks that could lead to increased premiums or policy exclusions. Young, healthy individuals may not have significant health concerns, but they still need to be aware of the potential impact of lifestyle choices. For instance, hobbies like skydiving or extreme sports can be considered high-risk activities and may affect insurance rates. Additionally, lifestyle factors such as smoking, excessive alcohol consumption, or a sedentary lifestyle can also influence the insurance company's assessment.

Given the lower risk profile, young individuals might be advised to opt for a simpler medical examination process. However, this doesn't mean they should skip the evaluation altogether. Instead, they should focus on disclosing relevant health information accurately. This includes any pre-existing conditions, family medical history, and lifestyle choices. By providing honest and detailed information, young adults can ensure they receive the appropriate coverage without unnecessary complications.

In summary, young, healthy individuals should approach life insurance with a strategic mindset. They can benefit from the lower rates and flexibility of term life insurance. While a standard medical examination may not be as critical, they should still be prepared to provide accurate health information. Understanding the impact of lifestyle choices and being proactive in managing their health can contribute to a smoother insurance application process and ensure they have the right coverage in place for the future.

Life and Health Insurance Exam: Tough Test?

You may want to see also

Pre-existing Conditions: Insurance companies may deny coverage for certain pre-existing conditions

When it comes to life insurance, pre-existing conditions can significantly impact your ability to secure coverage. Insurance companies often view these conditions as high-risk factors, and as a result, they may deny or limit coverage for individuals with certain pre-existing health issues. This is a critical aspect of understanding why a doctor's examination alone might not be sufficient for obtaining comprehensive life insurance.

Pre-existing conditions refer to any health issues or diseases that an individual has before applying for life insurance. These can include chronic illnesses like diabetes, heart disease, cancer, or even mental health disorders. Insurance providers carefully assess these conditions because they can influence the insured person's longevity and future healthcare costs. For instance, someone with a history of heart disease may be considered a higher risk for insurance companies, as they might require frequent medical attention and could have a reduced life expectancy.

The process of obtaining life insurance with pre-existing conditions is more complex. Insurance companies typically require a thorough medical examination and review of the applicant's medical history. This is where the challenge arises; a single doctor's exam might not provide the comprehensive insight needed. While a doctor's assessment is essential, it may not cover all the necessary details about an individual's health, especially for those with long-term or complex conditions.

In such cases, insurance companies may request additional medical information, including lab results, medical records, and sometimes even a consultation with a specialist. This extra layer of scrutiny ensures that the insurance provider has a more accurate understanding of the applicant's health status. For individuals with pre-existing conditions, this process can be lengthy and may require patience and cooperation with multiple medical professionals.

Despite the challenges, it is important to remember that having a pre-existing condition doesn't automatically disqualify you from life insurance. Many insurance companies offer specialized policies for individuals with health issues, often at higher premiums. The key is to be transparent about your medical history and work closely with insurance providers to find suitable coverage. With the right information and a comprehensive medical assessment, individuals with pre-existing conditions can still secure life insurance that meets their needs.

Smokers' Life Insurance: Is It Possible?

You may want to see also

Frequently asked questions

Doctor's exams are typically conducted for a specific health assessment or to diagnose a particular condition. These exams may not provide a comprehensive view of your long-term health, which is crucial for life insurance companies to assess risk. Life insurance policies often require a more thorough understanding of an individual's overall health history and current medical condition.

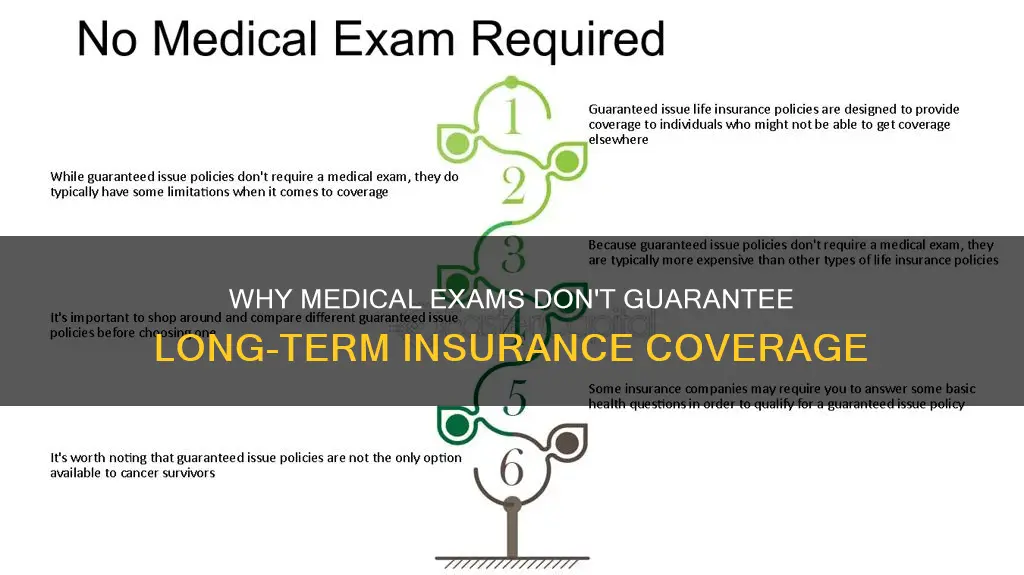

In some cases, a simple medical examination by your doctor might be sufficient if you are considered a preferred or standard risk. However, for individuals with pre-existing health conditions or those seeking higher coverage amounts, life insurance companies often require more extensive medical evaluations, including additional tests and a review of medical records.

You can explore options like simplified issue life insurance or no-medical-exam life insurance. Simplified issue policies may require basic health information and a limited medical exam, while no-exam policies rely on a health questionnaire and other factors to determine eligibility. These alternatives can be suitable for individuals with minor health concerns or those who prefer a quicker application process.

Life insurance companies often consider a range of factors, including age, gender, smoking status, family medical history, lifestyle choices (e.g., diet, exercise), and occupation. They may also review your medical records, lab test results, and other health-related data to make an informed decision about your insurance eligibility and premium rates.

Yes, there are several steps you can take. Maintaining a healthy lifestyle, managing pre-existing conditions, and providing accurate and detailed health information during the application process can significantly improve your chances. Additionally, choosing a life insurance policy with a higher coverage amount might require a more comprehensive medical evaluation.