The COVID-19 pandemic has had a significant impact on the mortality rates associated with life insurance policies. The pandemic has resulted in higher mortality rates than expected, which has negatively affected the financial sustainability of life insurers. This is due to the increased number of claims being made as a result of COVID-19-related deaths. The pandemic has also highlighted the importance of having adequate life insurance coverage, as many people have realized that their current policies may not be sufficient to meet their needs in the event of their death. As a result, life insurers are facing the challenge of re-evaluating their financial sustainability and ensuring that they can honour their commitments to policyholders.

| Characteristics | Values |

|---|---|

| Impact of COVID-19 on mortality rates | COVID-19 has adversely affected mortality rates, increasing the mortality risk of life insurers. |

| Importance of understanding COVID-19's impact on mortality rates | Understanding the adverse effect of COVID-19 on mortality rates is important as higher mortality rates than expected will affect the future financial sustainability of life insurers. |

| Incorporating COVID-19 mortality risk in financial forecasting | Life insurers must incorporate COVID-19 mortality risk in their financial forecasting models to better analyse their financial sustainability. |

| COVID-19's impact on financial sustainability of life insurers | A life insurer's financial sustainability will deteriorate due to higher mortality rates than expected in the wake of COVID-19. |

| COVID-19's impact on insurance industry | The COVID-19 pandemic has posed a significant challenge to the operation of the insurance industry worldwide, causing financial losses. |

What You'll Learn

The impact of COVID-19 on mortality rates

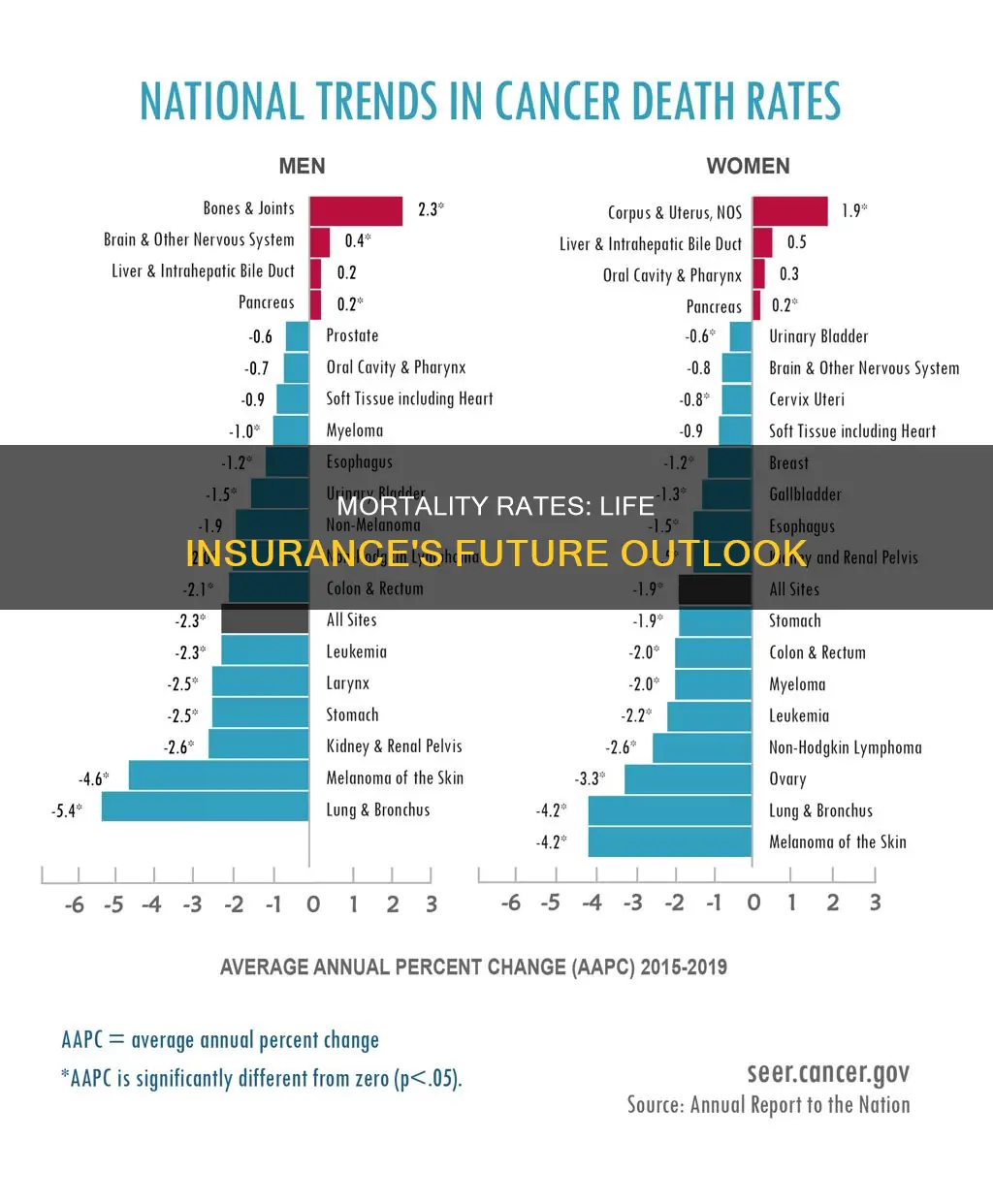

The COVID-19 pandemic has had a significant impact on mortality rates, with many countries worldwide still reporting elevated death tolls even several years after the initial outbreak. This trend is evident even when accounting for shifting population sizes and the complexities of inter-country comparisons due to varying reporting mechanisms and death classifications. The pandemic has also led to an increase in demand for life insurance policies as consumers rush to protect their loved ones.

One of the key challenges in quantifying excess mortality during the pandemic is the exceptional mortality rate of COVID-19 itself. Excess mortality refers to the number of deaths over and above the expected number, and different methods of estimation can yield very different excess mortality rates. The impact of the pandemic on excess mortality is likely to persist for several years, with potential implications for Life and Health (L&H) insurance claims and reserves.

The case fatality rate (CFR), or the number of confirmed deaths divided by the number of confirmed cases, is often discussed in the media as an indicator of the risk of death from COVID-19. However, it is important to note that the CFR does not reflect the true risk of death for an infected person, as it relies on the number of confirmed cases, and many infections go undiagnosed and untested.

The pandemic has also affected the life insurance industry in several ways, including mortality assumptions and capital requirements needed to keep providers solvent. While it is clear that mortality rates have increased since the beginning of the pandemic, the long-term effects on mortality assumptions are still uncertain. Factors related to COVID-19, such as pre-existing conditions, compromised mental health, or delayed medical care, may further impact future assumptions.

The emergence of long COVID, or lingering health problems after contracting the virus, adds further complexity to mortality assumptions. With an estimated 7.7 million to 23 million Americans affected by long COVID, the life insurance industry faces challenges in underwriting policies for individuals with these uncertain health conditions. As a result, life insurance applications have begun to include COVID-related questions, such as testing history and current diagnosis.

In summary, the COVID-19 pandemic has significantly impacted mortality rates, leading to increased demand for life insurance and uncertainty in the industry regarding mortality assumptions and underwriting processes. The long-term effects of the pandemic on mortality rates and the life insurance industry will continue to unfold in the coming years.

Shopping for Life Insurance? Compare Policies to Save

You may want to see also

The financial sustainability of life insurance companies

The COVID-19 pandemic has adversely affected mortality rates, and life insurers must understand this impact to ensure their financial sustainability. The pandemic has caused a significant challenge to the operation of the insurance industry worldwide. For example, life insurers in Australia suffered a net loss of $1.8 billion for the year ending in March 2020, compared to a profit of $759 million the previous year. The pandemic has also caused significant losses for the U.S. life insurance industry, with Prudential reporting a net loss of $2.41 billion in the second quarter of 2020, compared to a net income of $738 million in the same quarter of 2019.

To analyze their financial sustainability, life insurers must adopt an appropriate mortality model that includes the COVID-19 mortality risk. The direct effect of COVID-19 on mortality rates is reflected in the death numbers directly caused by the virus. However, under-diagnosis, limited testing, and imperfect test sensitivity in the early stages of the pandemic resulted in an undercounting of COVID-19-related deaths. Therefore, the indirect effects of the pandemic, such as the potential consequences associated with government interventions and the impact on mental and physical health, should also be considered when analyzing mortality rates.

Life insurers' financial sustainability is influenced by random mortality rates and interest rate risk. The liability of life insurers can be viewed as a function of random mortality rates, and dynamic mortality models are used to describe the three-dimensional surface of mortality by modeling age-dependent and time-dependent trends. Additionally, interest rate risk is indispensable in assessing financial sustainability, and life insurers must include both mortality and interest rate risk in their models.

In conclusion, the financial sustainability of life insurance companies is closely tied to mortality rates and interest rate risk. The COVID-19 pandemic has adversely affected mortality rates, and life insurers must incorporate the COVID-19 mortality risk into their financial sustainability models. By adopting appropriate mortality models and considering both mortality and interest rate risk, life insurance companies can better analyze and maintain their financial sustainability in the post-COVID-19 world.

Finding Cash Value in Life Insurance: A Step-by-Step Guide

You may want to see also

The direct and indirect effects of the pandemic on mortality

The COVID-19 pandemic has had a direct impact on mortality rates, with the number of deaths directly caused by the virus exceeding those reported in official statistics. This has resulted in a negative impact on the financial sustainability of life insurers. However, the pandemic has also had indirect effects on mortality, which are challenging to quantify. These indirect effects can be both positive and negative.

On the one hand, the pandemic may have indirectly increased mortality due to factors such as delays or avoidance of medical care for serious existing illnesses, increased substance use and suicidal ideation, and crowded emergency departments. On the other hand, stay-at-home orders and reduced social contacts may have led to a decrease in mortality from other infectious diseases and improved mental health for some individuals.

Overall, the pandemic's direct and indirect effects on mortality are complex and vary across different populations and age groups. Further research is needed to fully understand the impact of the pandemic on mortality and to inform public health policies and interventions.

Farm Bureau Life Insurance: Accelerated Payment Options Explained

You may want to see also

The importance of adopting an appropriate mortality model

To mitigate these losses and maintain financial sustainability, life insurers must adopt appropriate mortality models that account for the direct and indirect effects of the pandemic on mortality rates. This involves understanding the excess death rates caused by COVID-19 and incorporating this data into their mortality models. By doing so, life insurers can more accurately forecast their financial sustainability and make informed decisions to protect their financial position.

The adoption of an appropriate mortality model is crucial for life insurers to effectively manage their risks and ensure they have sufficient reserves to cover claims. It also enables them to set competitive premium rates that reflect the true risk of their policyholders. Without an appropriate mortality model, life insurers may underestimate the risks they are taking on, leading to financial instability and potential insolvency.

Furthermore, an appropriate mortality model can help life insurers identify trends and make strategic decisions. For example, during the COVID-19 pandemic, life insurers may have noticed an increase in claims related to mental health issues or specific age groups. By analyzing the data through an appropriate mortality model, they can identify these trends and develop targeted products or services to meet the changing needs of their customers.

In conclusion, the adoption of an appropriate mortality model is vital for life insurers to manage their risks effectively, ensure financial sustainability, set competitive premium rates, and make strategic decisions based on accurate data and trends. By incorporating factors such as the direct and indirect effects of pandemics, life insurers can enhance the accuracy of their mortality models and make more informed decisions to protect their financial position and better serve their customers.

Life Insurance and Financial Aid: What's the Connection?

You may want to see also

The role of government interventions during the pandemic

The COVID-19 pandemic has had a significant impact on mortality rates, with excess mortality varying across different states and countries. Government interventions played a crucial role in mitigating the impact of the pandemic on mortality rates, and their effectiveness depended on various factors, including the availability of health insurance coverage.

During the pandemic, people with health insurance coverage were more likely to receive the necessary care for COVID-19 and non-COVID-19 ailments. This is evident in the United States, where the lack of health insurance coverage was associated with higher excess mortality rates, even when controlling for other factors such as vaccination rates and the age distribution of the state. The findings suggest that states with relatively low health insurance coverage rates experienced more excess deaths. This indicates the important role of government interventions in ensuring access to health insurance coverage to protect populations during periods of high excess mortality.

The Biden-Harris Administration in the United States, for example, implemented policies to increase health insurance coverage, which helped reduce the uninsurance rate among 18-64-year-olds. These policies included expanded premium tax credits, which made it more affordable for people to purchase health insurance. Additionally, the American Rescue Plan provided consumers with access to quality, affordable health care coverage through marketplaces. These interventions not only reduced financial barriers to health care but also contributed to better health outcomes and improved treatment of chronic conditions.

However, the impact of government interventions during the pandemic on mortality rates is complex and influenced by various factors. For instance, the effectiveness of interventions such as lockdowns and social distancing measures in reducing infection rates and mortality varied across different countries and regions. Additionally, the availability of health care resources, such as hospital beds and intensive care units, played a crucial role in the ability of health systems to manage the influx of patients during the pandemic.

Overall, government interventions during the pandemic had a significant impact on mortality rates. Ensuring access to health insurance coverage and affordable health care were key factors in mitigating the impact of the pandemic on excess mortality. However, the effectiveness of interventions varied across different regions, and the complex interplay of social, economic, and health care factors influenced the overall impact on mortality rates.

Canceling Americo Life Insurance: A Step-by-Step Guide

You may want to see also