Whether a husband can remove their wife as a beneficiary on their life insurance policy depends on several factors, including the type of policy, the state in which it was issued, and whether the couple is divorced or planning to divorce. In most cases, the policyholder can change the beneficiary at any time, but there are some exceptions. For example, if the policyholder chooses to make the beneficiaries irrevocable, they cannot be changed or removed. Additionally, in community property states, the policyholder must receive the spouse's permission to list anyone else as the beneficiary. If the couple is divorced, the terms of the divorce may also impact the ability to remove the spouse as a beneficiary, especially if alimony or child support is involved.

| Characteristics | Values |

|---|---|

| Can a husband remove his wife as a beneficiary on life insurance? | Yes, unless the wife is named as an irrevocable beneficiary or there is a court order such as a divorce decree that obligates the husband to maintain the wife as a beneficiary. |

| Who can be a beneficiary? | section below |

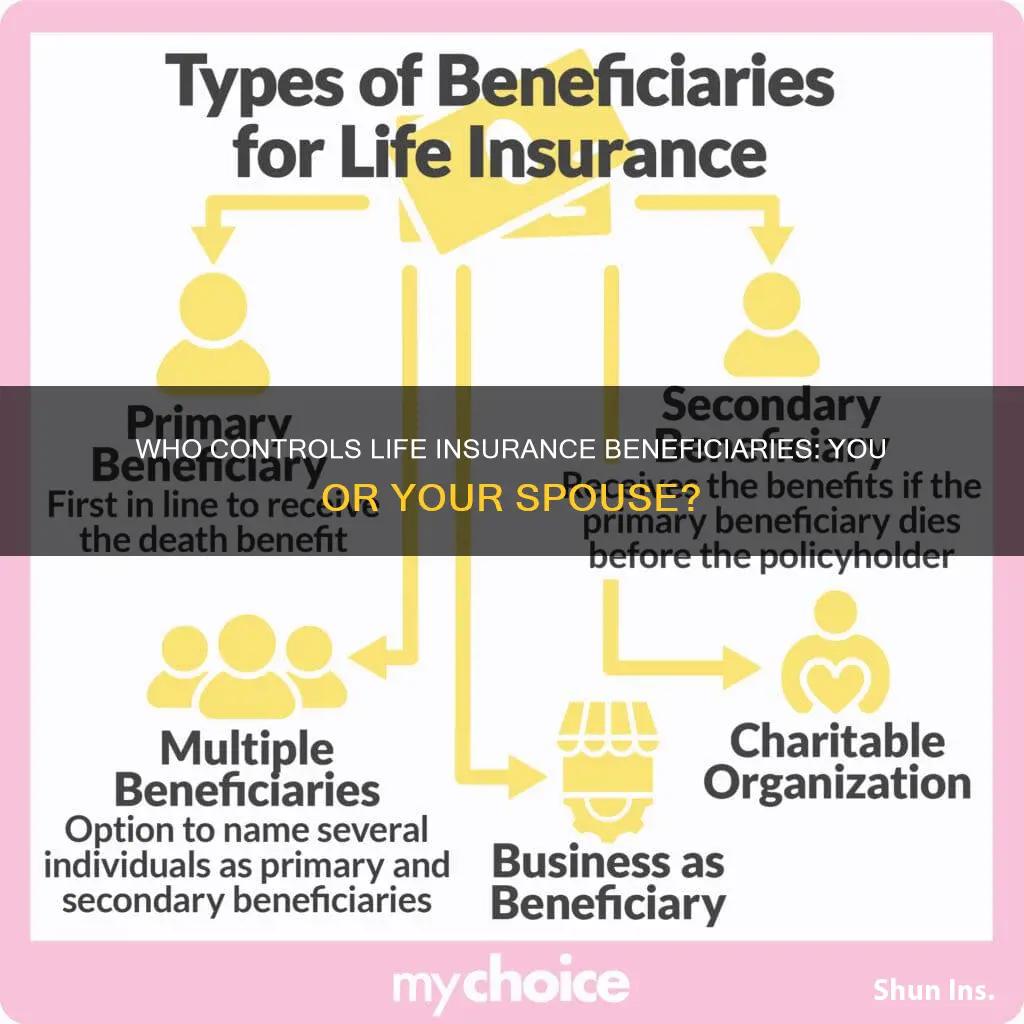

| Who typically is the primary beneficiary? | Spouse |

| Who can change the beneficiary? | The policyholder/owner |

| Who owns the policy? | The person who pays the premiums |

| Can a spouse override a beneficiary? | No, unless they live in a community property state |

| What is a community property state? | A state that considers spousessection below spouses to have equal ownership of all joint assets, including income earned during the marriage and property purchased with that income. |

| Which states are community property states? | Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin, and optionally Alaska and Tennessee |

| What happens to the life insurance policy after a divorce? | The policy will be addressed in the divorce terms and may be divided as a marital asset. |

| Can a divorce decree override a named beneficiary? | No, unless the policyholder changes the beneficiary. |

| Can a spouse be removed as a beneficiary after a divorce? | Yes, unless the spouse is receiving alimony or child support from the policyholder. |

| What happens if the insured forgets to remove their ex-spouse as the beneficiary? | It depends on state laws and the type of policy. In some states, an ex-spouse is automatically revoked as a beneficiary unless there is a written agreement to keep them as the beneficiary. |

What You'll Learn

Community property states

In community property states, both spouses have an equal claim to assets and liabilities, including income earned during the marriage, property purchased with that income, and life insurance policies. In these states, the policyholder's spouse is automatically considered the beneficiary of their life insurance policy, and the policyholder must receive their spouse's permission to list anyone else.

In the event of a divorce, couples in community property states will divide their assets and debts equally, with some exceptions. Exceptions to community property include inherited assets, assets acquired before the marriage, and anything protected under a prenuptial agreement.

If a life insurance policy was purchased with community property income, the surviving spouse may file a life insurance claim for half or a portion of the policy proceeds if someone other than the spouse is listed as the beneficiary.

The community property states in the US are:

- Alaska

- California

- Florida

- Kentucky

- Nevada

- South Dakota

- Tennessee

- Washington

- Wisconsin

- These states allow spouses to choose certain assets as community property, or to opt in to community property laws.

Life Insurance and Felons: A Complex Relationship

You may want to see also

Divorce and children

Divorce can have a significant impact on life insurance policies, especially when children are involved. Here are some key considerations for divorced or divorcing parents regarding life insurance:

Child Custody and Support:

In most cases, the non-custodial parent will be required to maintain a life insurance policy for the benefit of any minor children involved. This is to ensure that the children continue to receive financial support in the event of the non-custodial parent's death. The custodial parent may also want to consider taking out a life insurance policy on their ex-spouse to protect child support and alimony payments.

Beneficiary Updates:

During a marriage, spouses often name each other as beneficiaries of their life insurance policies. However, after a divorce, each party may want to change this designation. It is essential to review and update beneficiaries to ensure that the policy aligns with the individual's wishes and the terms of the divorce agreement.

Naming Minors as Beneficiaries:

Naming minor children as direct beneficiaries of a life insurance policy is generally not recommended, as they cannot legally accept the death benefit until they reach the age of majority (18 or 21, depending on the state). Instead, consider naming a custodian or trustee, such as the other parent or a close relative, who will manage the funds on behalf of the children.

Establishing a Trust:

Another option to protect children financially is to establish a trust and name the trust as the beneficiary of the life insurance policy. This allows for greater control over how the funds are distributed and used for the benefit of the children. A trustee can be appointed to manage the funds according to the grantor's wishes.

Court-Ordered Life Insurance:

If child support, alimony, or other financial support is involved, a judge may require the paying spouse to carry a life insurance policy with the ex-spouse as the beneficiary. This ensures that financial support continues even in the event of the paying spouse's death.

Life Insurance as a Marital Asset:

Life insurance policies, especially permanent policies like whole life and universal life, may be considered marital assets during divorce proceedings. These policies accumulate cash value, which can be divided as part of the separation agreement. Term life insurance policies, on the other hand, typically do not build cash value and may be treated separately.

State-Specific Laws:

It is important to note that state laws can vary regarding life insurance and divorce. Some states have automatic revocation of beneficiary designations to ex-spouses upon divorce, while others may have different requirements for community property and the rights of spouses. Consulting with a divorce lawyer or financial advisor is crucial to understanding the specific laws and implications in your state.

Life Insurance Ratings: AM Best's Top Picks

You may want to see also

Alimony and child support

During divorce proceedings, it is essential to review the beneficiaries of life insurance policies. While most married couples have their spouses as beneficiaries, this should be changed if desired after the divorce. If there are underage children involved, it may be appropriate to keep the spouse as the beneficiary to ensure their financial protection. Additionally, if spousal or child support is being paid, the judge may require the paying spouse to maintain life insurance to protect these payments.

There are a few ways to secure alimony and child support through life insurance:

- Naming the Child as the Beneficiary: This approach ensures that the insurance proceeds go directly to the child. However, it creates a difficult and expensive problem, as the proceeds would need to be managed by a court-appointed guardian until the child reaches the age of majority.

- Naming a Custodian as the Beneficiary: This option is slightly better, as it allows the insurance proceeds to be held in a Uniform Transfers to Minors Act (UTMA) account until the child reaches a specified age, usually 21. The custodian is legally obligated to use the funds for the child's benefit, such as for their college education.

- Designating the Ex-Spouse or the Child's Other Parent as the Beneficiary: Many couples choose this option, even during separation or divorce, to ensure that their children continue to receive financial support. While the surviving ex-spouse has a moral duty to use the funds as per the separation agreement, there are potential downsides, including exposure to creditors and bankruptcy.

- Elimination of Windfall: To prevent a windfall, a decreasing schedule of required policy proceeds can be implemented, depending on the child's age. This allows the paying spouse some flexibility in naming other beneficiaries as the child approaches the age of emancipation.

- Life Insurance to Secure Alimony Payments: Life insurance can also be used to secure alimony payments by providing a substitute for the alimony payments the surviving ex-spouse would have received.

It is important to note that the specific laws and considerations may vary from state to state. Consulting with a family law attorney or a life insurance attorney can help individuals navigate these complex issues and make informed decisions about their life insurance policies during or after a divorce.

Smoking After Life Insurance: Impact on Your Policy

You may want to see also

Irrevocable beneficiaries

An irrevocable beneficiary is a person or entity designated by the policyholder to receive the assets from their life insurance policy. The status of an irrevocable beneficiary is more ironclad than that of a revocable beneficiary, whose rights to the policy can be denied or amended. The irrevocable beneficiary's rights are locked in and they cannot be removed or changed without their consent.

When setting up a life insurance policy, the policyholder can choose who will receive the payout, known as the death benefit, in the event of their death. The policyholder may designate either a revocable or an irrevocable beneficiary. A revocable beneficiary can be changed at any time by the policyholder without the consent of the currently named beneficiary. However, an irrevocable beneficiary cannot be removed from the policy without their consent. They must sign off on any changes, forfeiting their rights to the proceeds.

The primary disadvantage of having an irrevocable beneficiary is inflexibility. The policyholder cannot make any changes without the beneficiary's consent. Therefore, it is critical to understand the financial and legal implications before designating an irrevocable beneficiary.

Covid Shots and Life Insurance: What's the Verdict?

You may want to see also

Court-ordered life insurance

There are nine common mistakes made during divorce proceedings regarding life insurance:

- Ignoring a court-ordered mandate to buy life insurance

- Purchasing the wrong type of life insurance policy

- Purchasing the wrong face amount for your policy

- Forgetting to inspect the fine print on your contract

- Not getting legal advice about life insurance for your divorce

- Not accounting for possible pitfalls

- Not considering no-exam life insurance

- Forgetting to update your existing life insurance policy

- Not working with an independent life insurance agent

In community property states, the policyholder's spouse is automatically considered the beneficiary. In these states, the policyholder must receive the spouse's permission to list anyone else as the beneficiary. However, if you don't live in a community property state, the policyholder can name someone else, such as a friend or family member, as the beneficiary.

Divorce doesn't automatically invalidate or adjust a life insurance policy. If you want to update a beneficiary or alter the amount of insurance coverage, you'll need to contact the insurer.

If you have a permanent life insurance policy with a cash value, this is considered a financial asset and could be divided between spouses during a divorce. In this case, it may make sense to cash out the policy and divide the cash value. Alternatively, you could negotiate keeping the policy, but you may be required to keep your spouse as the beneficiary.

If you depend on your spouse's income, you'll likely receive alimony support following a divorce. To protect this income, consider getting a life insurance policy on your former spouse. You'll need their consent to do this, but in some cases, the court can order your spouse to get life insurance.

If you receive child support payments following a divorce, you should consider getting life insurance on your former spouse to protect this income. You'll also need your ex-spouse's consent to set this up.

Graded Life Insurance: Understanding the Policy and Its Benefits

You may want to see also

Frequently asked questions

Yes, a husband can remove his wife as a beneficiary on life insurance, but it depends on a few factors. If the husband and wife are getting divorced and there are no children involved, the husband can change the beneficiary by contacting the insurance company. However, if the husband has to pay alimony or child support due to the divorce, he may be required to keep his wife as the beneficiary.

In community property states, the policyholder must receive the spouse's permission to list anyone else as the beneficiary. The spouse is automatically considered the beneficiary unless they indicate otherwise. If the husband removes his wife as the beneficiary in a community property state, she will still be entitled to half of the death benefit.

In some states, beneficiary designations to ex-spouses are automatically revoked upon divorce. However, this can depend on the terms of the divorce and the specific state laws. If the husband is required to pay alimony or child support, he may have to keep his ex-wife as the beneficiary.

Adding a child as a beneficiary is possible, but it is not recommended if the child is a minor. In most states, a person must be 18 or older to receive a life insurance death benefit. If the husband wants to add his child as a beneficiary, it is important to appoint a custodian or create a trust to manage the insurance payout.