When it comes to long-term life insurance, finding the best policy can be a challenging task. It's important to consider several factors, such as coverage amount, policy duration, and premium costs. The ideal long-term life insurance policy should provide comprehensive coverage that aligns with your financial goals and family's needs. This type of insurance is designed to offer financial protection for your loved ones over an extended period, ensuring they are taken care of in the event of your passing. With various options available, including whole life, universal life, and term life policies, it's crucial to evaluate each type to determine which one best suits your long-term financial strategy.

What You'll Learn

- Cost-Effectiveness: Compare premiums and coverage to find the most affordable long-term plan

- Coverage Amount: Determine the necessary death benefit based on financial needs and dependents

- Policy Flexibility: Choose a plan that allows adjustments over time to meet changing circumstances

- Investment Options: Consider policies with investment components for potential long-term financial growth

- Customer Service: Evaluate the support and claims process for a positive long-term experience

Cost-Effectiveness: Compare premiums and coverage to find the most affordable long-term plan

When considering long-term life insurance, cost-effectiveness is a critical factor to evaluate. The primary goal is to find a policy that provides comprehensive coverage while being financially manageable over an extended period. Here's a guide to help you navigate this aspect:

Research and Compare Premiums: Start by researching various insurance providers and their offerings. Long-term life insurance policies can vary significantly in terms of premiums. Obtain quotes from multiple companies to get a comprehensive understanding of the market rates. Typically, the younger and healthier you are, the more affordable the premiums will be. Consider using online comparison tools to streamline this process, as these tools often aggregate data from multiple insurers, allowing you to compare premiums and coverage options side by side.

Evaluate Coverage Needs: Determine the appropriate level of coverage required. Long-term life insurance is designed to provide financial security for your beneficiaries over an extended period. Consider your financial obligations, such as mortgage payments, children's education expenses, or any other long-term commitments. Multiply these obligations by a safety factor to ensure that the policy's death benefit adequately covers these costs. Remember that the coverage amount should be sufficient to provide financial stability for your loved ones even after your passing.

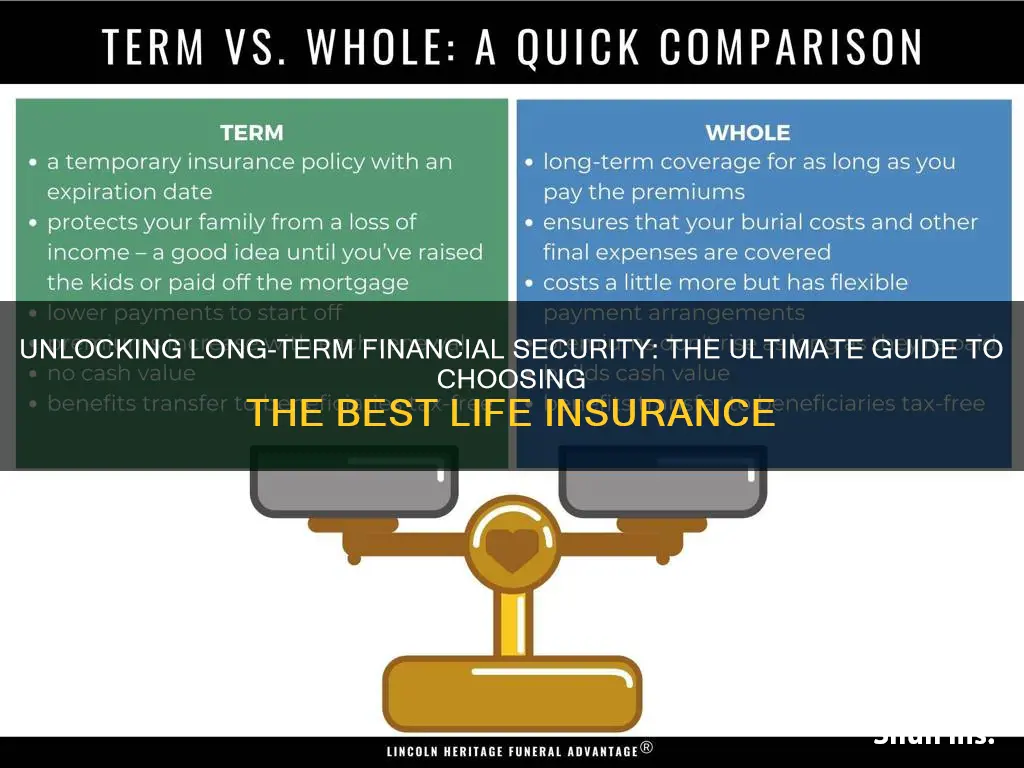

Assess Policy Types: There are different types of long-term life insurance policies, each with its own cost implications. Whole life insurance, for example, offers lifelong coverage and a cash value component, which can accumulate over time. Term life insurance, on the other hand, provides coverage for a specified period, typically 10, 20, or 30 years, and is generally more affordable during the initial years. Universal life insurance offers flexibility in premium payments and death benefits, but it can be more complex and potentially more expensive. Evaluate these options based on your financial situation and long-term goals.

Consider Additional Benefits: Some long-term life insurance policies come with additional features that may impact the overall cost. For instance, some policies offer waiver of premium benefits, which means your beneficiaries won't have to pay premiums if you become unable to do so due to illness or injury. Others may include an accelerated death benefit, allowing you to access a portion of the death benefit if you are diagnosed with a terminal illness. Assess these benefits and their associated costs to ensure they align with your needs and budget.

Review and Adjust Regularly: Long-term life insurance is a commitment that should be regularly reviewed and adjusted as your life circumstances change. Life events such as marriage, the birth of a child, or significant financial milestones may require an update to your policy. Reviewing your coverage periodically ensures that you maintain adequate protection without incurring unnecessary costs. Additionally, as you age, premiums may increase, so it's essential to stay informed about these changes.

Understanding Group Variable Life Insurance: A Comprehensive Guide

You may want to see also

Coverage Amount: Determine the necessary death benefit based on financial needs and dependents

When considering long-term life insurance, one of the most critical aspects is determining the appropriate coverage amount, often referred to as the death benefit. This figure represents the financial payout that your beneficiaries will receive upon your passing. It's a crucial decision that requires careful thought and an understanding of your unique financial situation and obligations.

The primary purpose of life insurance is to provide financial security for your loved ones, especially if you are the primary breadwinner. The coverage amount should be sufficient to cover various expenses and ensure your family's financial well-being in the long term. These expenses can include mortgage or rent payments, children's education costs, outstanding debts, and daily living expenses for your spouse or partner and any dependent children. It's essential to consider both immediate and long-term financial needs.

To determine the necessary death benefit, start by calculating your current annual expenses and multiply that by the number of years you anticipate needing financial support from the life insurance policy. For instance, if your annual expenses amount to $50,000 and you plan to provide for your family for 20 years, the initial estimate of the coverage amount would be $1 million. However, this is a simplified approach, and individual circumstances vary.

Additionally, consider the future financial obligations that may arise. For example, if you have a child who is still in elementary school, you might want to ensure that their college education is funded. You can estimate the cost of college and add it to your total coverage amount. It's also wise to account for potential future expenses, such as healthcare costs, which can be substantial, especially as you age.

Another factor to consider is the number of dependents you have. If you have multiple children or a spouse who relies on your income, you will likely need a higher coverage amount. The goal is to provide a safety net that allows your family to maintain their current standard of living and cover any unexpected costs that may arise. It's a personal decision, and consulting with a financial advisor can help you tailor the coverage amount to your specific needs.

Universal Life Insurance: A Wealth-Building Strategy?

You may want to see also

Policy Flexibility: Choose a plan that allows adjustments over time to meet changing circumstances

When considering long-term life insurance, policy flexibility is a crucial aspect to ensure your coverage remains relevant and adequate throughout your life's journey. Life insurance is a long-term commitment, and the needs of an individual or family can evolve significantly over time. Therefore, opting for a policy that offers flexibility is essential to adapt to these changes.

One way to achieve this flexibility is by choosing a term life insurance plan with convertible options. Term life insurance provides coverage for a specified period, often 10, 20, or 30 years. During this term, you can typically convert your policy to a permanent life insurance plan, such as whole life or universal life, without the need for a medical examination. This conversion privilege allows you to secure long-term coverage without the risk of being turned down due to changing health conditions. As your circumstances evolve, you can decide whether to continue with the same coverage, increase the death benefit, or adjust the policy to better suit your financial goals.

Another aspect of policy flexibility is the ability to make changes to your coverage over time. Life insurance policies often offer the option to increase or decrease the death benefit, which is the amount paid out upon your passing. This feature is particularly useful if you start with a lower coverage amount and later realize the need for more substantial protection. For instance, if you initially purchase a policy with a death benefit of $200,000 to cover immediate expenses, you can later increase it to $500,000 if your financial obligations or family's needs grow. This flexibility ensures that your insurance policy remains aligned with your evolving financial situation.

Additionally, some life insurance companies offer policy riders or add-ons that provide extra flexibility. These riders can include options like an accidental death benefit rider, which increases the payout if you die in an accident, or a waiver of premium rider, which allows you to suspend premium payments if you become disabled. By adding these riders, you can customize your policy to address specific concerns and adapt to changing life events.

In summary, when selecting long-term life insurance, prioritize policies that offer convertible terms and the ability to adjust coverage over time. This flexibility ensures that your insurance remains a reliable financial safety net, adapting to your changing needs and circumstances as you navigate through life's various stages. It empowers you to make informed decisions about your insurance, providing peace of mind and financial security for the long term.

Leaving Minor Life Insurance Benefits: What You Need to Know

You may want to see also

Investment Options: Consider policies with investment components for potential long-term financial growth

When exploring long-term life insurance options, it's essential to consider policies that offer investment components, providing an opportunity for financial growth over time. These types of policies, often referred to as "investment-linked life insurance" or "whole life insurance with investment features," combine the security of life coverage with the potential for wealth accumulation. Here's a detailed look at why this could be a valuable consideration:

Understanding Investment-Linked Policies:

These life insurance policies are designed to offer both a death benefit and an investment component. The investment aspect typically involves a portion of your premium being allocated to an investment fund or portfolio managed by the insurance company. This investment element can be structured in various ways, such as a guaranteed interest rate, a variable rate, or a combination of both. The goal is to provide a competitive return on your investment while ensuring the policyholder's financial security.

Benefits of Investment-Component Policies:

- Long-Term Financial Growth: The primary advantage is the potential for long-term financial growth. The investment portion of the policy can offer higher returns compared to traditional savings accounts, especially over extended periods. This growth can be particularly beneficial for those seeking to build a substantial financial nest egg for their beneficiaries.

- Flexibility and Control: Policyholders often have some level of control over their investment choices. This might include selecting from different investment options offered by the insurance company, such as stocks, bonds, or a mix of both. This flexibility allows individuals to align their investment strategy with their risk tolerance and financial goals.

- Tax Advantages: In many jurisdictions, investment-linked life insurance policies offer tax benefits. For instance, in some countries, the growth within the policy may be tax-deferred, and certain withdrawals or distributions might be tax-free, providing an attractive long-term financial strategy.

Choosing the Right Investment Policy:

When considering these policies, it's crucial to understand the specific investment options available. Some insurance companies offer a wide range of investment funds, allowing policyholders to diversify their portfolios. Others might provide a fixed-rate option, ensuring a guaranteed return but with potentially lower growth. It's advisable to review the investment performance and track record of the insurance company's investment funds to make an informed decision.

Risk Management and Diversification:

While investment-linked life insurance offers growth potential, it's essential to manage risk. Diversifying your investments across different asset classes can help mitigate potential losses. Additionally, regularly reviewing and rebalancing your investment portfolio can ensure it aligns with your long-term financial objectives.

In summary, considering investment-component policies when exploring long-term life insurance can be a strategic financial move. It provides an opportunity to grow your wealth while ensuring financial security for your loved ones. However, it's essential to carefully evaluate the investment options, understand the associated risks, and seek professional advice to make the best decision for your unique financial situation.

Life Insurance Cash Value: Is It Protected in Virginia?

You may want to see also

Customer Service: Evaluate the support and claims process for a positive long-term experience

When considering long-term life insurance, it's crucial to evaluate the customer service and support provided by the insurance company to ensure a positive and stress-free experience throughout the policy's duration. Here's a detailed look at how to assess these aspects:

Responsive and Knowledgeable Support: The best long-term life insurance providers should offer a responsive customer service team that is readily available to address policyholders' inquiries. This includes having multiple communication channels such as phone, email, and live chat. Quick response times are essential, ensuring that policyholders can get the information they need promptly. Additionally, the support staff should be knowledgeable and well-trained to handle various policy-related issues, from policy updates to claim processes. They should be able to provide accurate and clear explanations, ensuring policyholders understand their options and rights.

Efficient Claims Process: Evaluating the claims process is a critical aspect of customer service. A positive long-term experience is closely tied to a smooth and efficient claims settlement. The insurance company should have a streamlined process for filing and processing claims, ensuring that policyholders can access their benefits without unnecessary delays. This includes providing clear and concise claim forms, easily accessible online, and offering guidance to policyholders during the submission process. Quick claim resolutions, with minimal paperwork and a transparent process, will contribute to a positive customer experience.

Transparency and Communication: Effective communication is key to a positive long-term relationship. The insurance provider should maintain regular contact with policyholders, providing updates on policy changes, premium payments, and any relevant information. Transparent communication ensures that policyholders are well-informed and can make decisions accordingly. Additionally, being open and honest about policy terms, conditions, and any potential issues will build trust. Regular policy reviews and consultations can also help identify any gaps in coverage, allowing for adjustments to meet changing needs.

Customer Feedback and Improvement: A forward-thinking insurance company will actively seek customer feedback to improve their services. They should provide an easy and confidential way for policyholders to share their experiences, suggestions, and concerns. This feedback loop allows the company to identify areas of improvement, be it in customer service, policy offerings, or the overall claims process. By addressing these issues, the insurance provider can enhance customer satisfaction and create a more positive long-term experience.

In summary, evaluating the support and claims process is essential when assessing long-term life insurance. A responsive and knowledgeable customer service team, coupled with an efficient and transparent claims process, will contribute to a positive and lasting relationship with the insurance provider. Policyholders should feel supported and confident in their insurance choice, knowing that their needs are being met and their interests protected.

Who is a Claimant in Life Insurance Policies?

You may want to see also