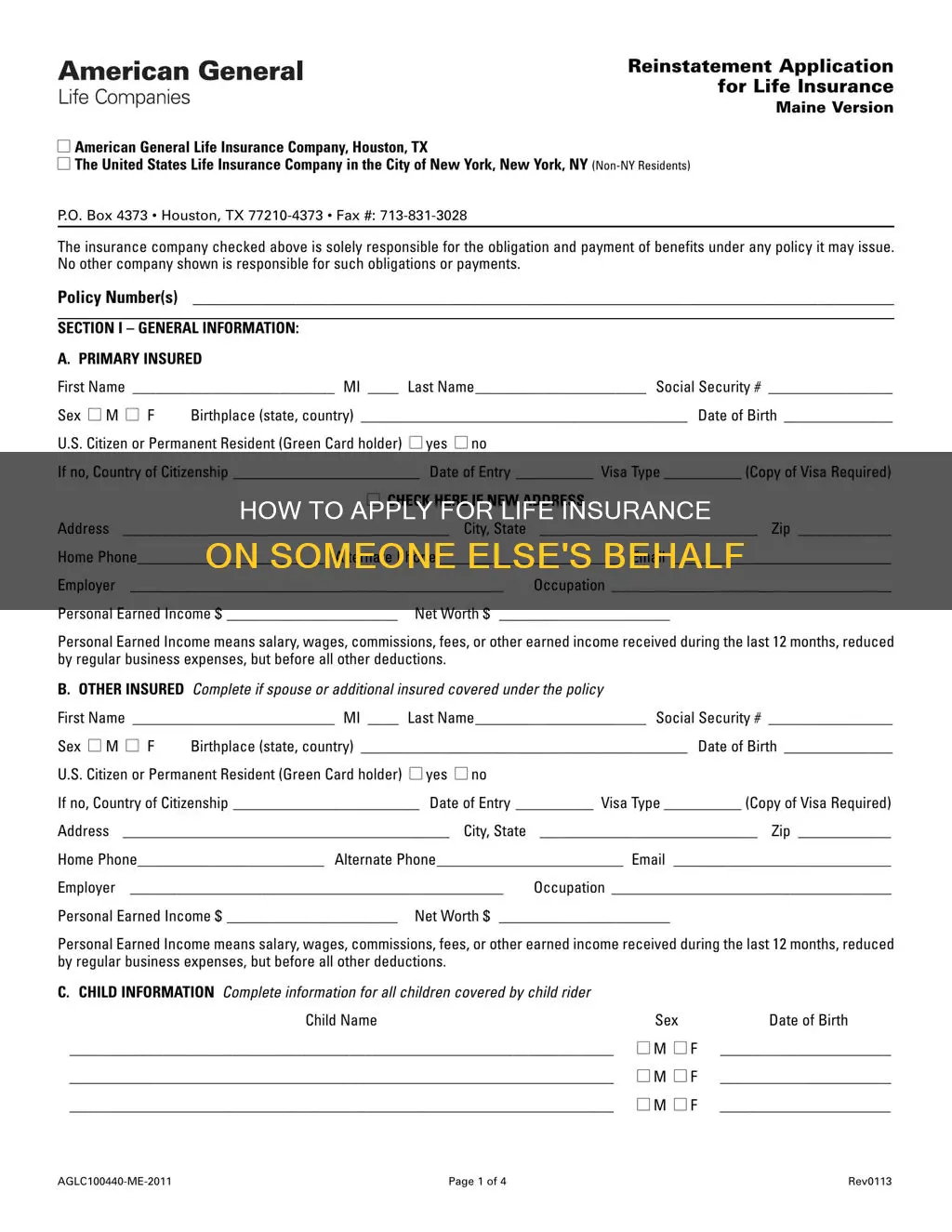

Yes, you can buy life insurance for someone else, but only if they are aware and consent to the decision. The person must be present for every step of the application process and will need to undergo a medical exam and answer application questions. To buy life insurance for another person, you must also prove insurable interest, i.e., that their death would cause you financial harm.

| Characteristics | Values |

|---|---|

| Can I apply for life insurance for someone else? | Yes |

| Do I need the consent of the insured person? | Yes |

| Do I need to prove insurable interest? | Yes |

| Who can I take out a life insurance policy on? | Spouse, former spouse, minor child, parent, business partner, key employee, grandparent, grandchild, sibling |

| What are the reasons for taking out a life insurance policy on someone else? | To manage parents' coverage as they age, to cover debt in case of a co-signer's death, to receive alimony or child support from an ex-spouse, to fund a buy-sell agreement with a business partner |

| What are the challenges of taking out a life insurance policy on someone else? | Requires a direct conversation with the insured person, may be uncomfortable to ask, may need to involve a financial advisor or life insurance agent |

What You'll Learn

Consent of the insured

- Awareness and Agreement: The insured person must be aware of and agree to the decision to purchase life insurance on their behalf. They should be informed about the process and provide explicit consent, ensuring they are comfortable with the arrangement.

- Involvement in the Application Process: The insured person must be actively involved in the application process. This includes providing necessary information such as contact details, age, and medical history. They may also need to undergo a medical exam, answer application questions, and sign the application and relevant documents.

- Understanding of Responsibilities: It is important that the insured person understands their responsibilities related to the policy and the underwriting process. They should be clear about any requirements, such as medical exams or interviews, and their role in maintaining the policy.

- Consent for Minors: In the case of purchasing life insurance for a minor child, the consent of the child's parent, grandparent, or legal guardian is typically sufficient. However, it is important to note that the requirements may vary based on state laws and insurance company guidelines.

- Ethical Considerations: Obtaining consent is essential from an ethical standpoint. It ensures that all parties involved understand the implications of the decision and are comfortable with the arrangement. It is crucial to have open and honest conversations about the reasons for purchasing life insurance on someone else.

- Impact on Insured's Planning: Consent allows the insured person to be aware of the policy's existence and its potential impact on their own financial planning. It ensures they are informed about their maximum insurance coverage and can make necessary adjustments if needed.

In summary, consent of the insured is a critical step when buying life insurance for someone else. It protects the insured person's rights, ensures their awareness and agreement, and helps maintain ethical and legal standards in the process. By obtaining consent, all parties involved can make informed decisions and ensure a clear understanding of their roles and responsibilities.

Life Insurance: Managing Risk, Securing Future

You may want to see also

Proving insurable interest

- Spousal relationship: Since they generally share financial obligations, most spouses and life partners would have little difficulty proving insurable interest. In some cases, former spouses may also have an insurable interest if there is shared custody of children.

- Parent-child: If a parent relies on the financial support and care of an adult child, or vice versa, there is an insurable interest.

- Business relationships: An essential employee or business partner may be insured if their loss would have a significant financial impact on the company.

- Siblings or other familial relationships: There may be insurable interest in other family relationships, especially if a member of the family is providing caregiving or financial support.

- Creditor-debtor relationships: Although not common, a lender may be able to prove insurable interest in a borrower if the debt is significant and the borrower's death would affect repayment.

To prove insurable interest, a life insurance company will usually talk to the policy owner, beneficiary, and insured person. They will investigate the relationship to decide if there is an insurable interest. If an insurable interest is not found, the policy application would be denied, or the death benefit would not be paid.

It's important to note that insurable interest only needs to exist when the policy is purchased. For example, you can take out a life insurance policy on yourself and name a friend as the beneficiary. In this case, the insurable interest requirement was satisfied when the policy was initially approved.

Get Your Life Insurance License: Steps to Success

You may want to see also

Types of life insurance policies

There are two main types of life insurance plans: term or permanent. However, there are several other types of life insurance policies, each with its own unique features and benefits. Here are some of the most common types:

- Term Life Insurance: This type of policy provides coverage for a specified period, such as 10, 20, or 30 years. If the policyholder passes away during the term, the beneficiary will receive the death benefit. Term life insurance is generally more affordable, with locked-in premiums for the specified period. However, it does not offer a savings element or cash value.

- Whole Life Insurance: Whole life insurance is a permanent coverage type that lasts for the policyholder's entire life. It tends to be more expensive upfront but offers more secure benefits in the long run. Whole life insurance includes a savings component, allowing policyholders to accumulate funds over time.

- Universal Life Insurance: Universal life insurance is a permanent policy with an investment portion known as the cash value. This cash value grows in a tax-deferred account at a stable rate and offers greater flexibility, as policyholders can adjust premium payments and benefit values.

- Variable Life Insurance: This type of permanent life insurance has a cash value tied to investment accounts. The cash value can rise or fall based on the performance of these investments, offering a greater potential benefit but also higher risk and fees.

- Final Expense Insurance: This type of permanent life insurance offers a smaller death benefit payout to cover funeral costs, burial expenses, medical bills, and other end-of-life expenses. It is often more accessible to older or less healthy individuals.

- Group Life Insurance: Group life insurance is offered by employers or organizations to provide benefits for their employees or members. It can include term or whole life insurance options.

Other types of life insurance include credit life insurance, which helps loved ones pay off large debts like mortgages or car loans, and simplified issue life insurance, which involves a health questionnaire instead of a medical exam for quicker approval.

Cancer and Term Life Insurance: Does Level Death Benefit?

You may want to see also

Financial assessment

When considering life insurance, it is important to assess your financial situation and goals. This involves evaluating your income, expenses, debts, and future plans to ensure that your loved ones will be financially protected in the event of your death.

Income and Expenses

Start by calculating your current income and expenses. This includes salaries, investments, and any other sources of income, as well as fixed expenses such as rent or mortgage, utilities, groceries, and other regular costs.

Debts and Obligations

In addition to regular expenses, it is crucial to consider any outstanding debts and long-term financial obligations. This includes credit card debt, student loans, mortgages, and expected future costs such as college tuition for children or grandchildren.

Future Financial Goals

Life insurance can also help secure your family's future financial goals. This may include funding for your children's education, supporting a spouse's retirement, or ensuring the continuation of a family business.

Calculating Coverage Amount

The amount of life insurance coverage needed will depend on your unique financial situation. Online calculators and financial professionals can help estimate the required coverage based on factors such as age, marital status, income, debts, and future goals.

Types of Life Insurance

There are different types of life insurance policies available, including term life insurance and whole life insurance. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years, and is generally more affordable. Whole life insurance lasts for the policyholder's entire life and includes an investment component, allowing cash value to accumulate over time.

Shopping for Quotes

It is recommended to shop around for quotes from multiple insurance carriers to find the best price and terms. The same type of coverage can vary in price between different companies, and certain pre-existing health conditions may impact the rate offered.

Additional Considerations

When purchasing life insurance, it is essential to consider the financial impact on your loved ones. This includes not only the immediate financial obligations but also any future expenses they may incur. By assessing your financial situation and goals, you can ensure that your life insurance coverage adequately protects your family's financial well-being.

U.S. Life Insurance: Who Gets the Payout?

You may want to see also

Tax implications

There are several tax implications to consider when purchasing life insurance for someone else. Firstly, it is important to understand the concept of "insurable interest". This means that the policyholder would suffer a financial loss if the insured family member died. Proving insurable interest is crucial when taking out a life insurance policy on someone else, as it demonstrates that their death would have an adverse financial impact on you. Most immediate family members naturally have an insurable interest in each other, but it is still essential to provide proof and demonstrate the financial loss that would occur in the event of the insured's death.

Another tax consideration is the consent of the insured. This is a legal requirement to protect individuals from unwanted policies taken out by estranged family members or other entities. Without the consent of the insured and their presence during the application process, you will not be able to take out a policy on them.

When purchasing life insurance for someone else, it is also important to consider the type of policy being sold. For example, selling a term life insurance policy often results in minimal tax consequences since it lacks a cash value component. On the other hand, permanent policies such as whole life, universal life, or variable life policies may have cash values, potentially making them subject to taxation upon sale.

Additionally, the ownership of the policy matters for tax purposes. Policies owned by individuals are treated differently from those owned by trusts or corporations. In some cases, selling your life insurance policy can generate taxable income in the form of gains, which are subject to income tax and can result in a significant tax liability. However, there are also tax-exempt scenarios to consider. For instance, if the insured is terminally or chronically ill, a portion or all of the proceeds from the sale might be tax-free. Similarly, if the policy qualifies as a "viatical settlement" due to the insured's life expectancy, a tax exemption could apply.

Furthermore, taxation on the sale of a life insurance policy typically falls under capital gains tax rules, and it is categorized as either ordinary income or capital gain, depending on factors such as policy type, ownership, and duration of ownership. Accurate reporting of the sale is essential to avoid potential penalties, and Form 1099-R and Form 1040 Schedule D are commonly used for this purpose.

Finally, it is worth noting that for large policies, life insurance can lead to estate taxes. Consulting a tax professional is highly recommended to ensure compliance with tax laws and to optimize the financial outcome.

Understanding Your Life Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

Yes, the person being insured must provide consent and be involved in the application process. They will have to go through the underwriting process, which involves answering questions and, in most cases, taking a life insurance medical exam. The insured will also have to sign the application. The exception to this rule is if you’re buying life insurance for a child.

Insurable interest means the policyholder would suffer a financial loss if the insured family member died. Without insurable interest, the policy could be considered void or even illegal. It’s typically not a hard requirement to meet, as most immediate family members naturally have an insurable interest in each other.

You can buy life insurance for a variety of people, including your spouse, business partner, parents, children, grandchildren, and former spouse.