When it comes to life insurance, the health rating assigned to an individual is a critical factor in determining the cost and availability of coverage. The highest health rating in life insurance is typically reserved for individuals with excellent health and low-risk profiles. This rating, often referred to as a preferred or standard plus rating, indicates that the insured individual has a very low likelihood of developing health issues that could lead to claims. These individuals are considered to be in the best possible health category, and as a result, they are offered the most competitive rates and the highest level of coverage options.

What You'll Learn

- Underwriting Criteria: Insurance companies assess health to determine eligibility and rates

- Medical History: Pre-existing conditions, surgeries, and medications impact premium costs

- Age and Gender: Younger, healthier individuals often receive lower rates

- Lifestyle Factors: Smoking, obesity, and risky hobbies can increase insurance costs

- Risk Assessment Tools: Insurance companies use algorithms to evaluate health risks and set rates

Underwriting Criteria: Insurance companies assess health to determine eligibility and rates

Underwriting is a critical process in the life insurance industry, where insurance companies evaluate the risk associated with insuring an individual. This assessment is primarily based on the applicant's health, age, lifestyle, and other relevant factors. The underwriting criteria are designed to determine the eligibility of an applicant and to set the appropriate premium rates for life insurance policies. The health of an individual is a significant determinant of the risk an insurance company is willing to take, and thus, it plays a pivotal role in the underwriting process.

Insurance companies use various methods and tools to assess health, which can vary in complexity and scope. One common approach is through a medical questionnaire or a health assessment questionnaire. These forms require applicants to disclose their medical history, current health status, medications, and any existing or past health conditions. The information provided is then analyzed to identify potential health risks and to determine the likelihood of future claims.

The underwriting process also involves a review of medical records, if available. Insurance companies may request access to an applicant's medical records, including hospital reports, lab results, and specialist consultations, to gain a more comprehensive understanding of their health. This step is crucial, especially for individuals with pre-existing conditions or those with a history of chronic illnesses, as it provides a detailed insight into their health status.

In addition to health-related factors, insurance companies also consider age as a critical underwriting criterion. Generally, younger individuals are considered lower-risk candidates for life insurance. As age increases, the risk of health-related issues and mortality tends to rise, which can impact the premium rates. Therefore, younger applicants often benefit from more favorable terms and lower premiums.

The highest health rating in life insurance is typically awarded to individuals with excellent health and a low-risk profile. This rating indicates that the applicant has a very low likelihood of developing health issues that could lead to insurance claims. As a result, they are offered the most competitive rates and terms for life insurance policies. Insurance companies may use various health rating systems, such as the Universal Underwriting Standards (UUS) or similar models, to categorize applicants based on their health and risk assessment.

Life Insurance and Chronic Illness: What's Covered?

You may want to see also

Medical History: Pre-existing conditions, surgeries, and medications impact premium costs

When it comes to life insurance, understanding the impact of your medical history is crucial, especially when it comes to determining your premium costs. The insurance company will carefully review your medical records to assess your overall health and risk profile. This assessment is a critical factor in determining the highest health rating you can achieve and, consequently, the cost of your insurance policy.

Pre-existing conditions, such as chronic illnesses or diseases, can significantly influence your insurance rates. For instance, if you have a history of heart disease, diabetes, or cancer, the insurance company will consider these as high-risk factors. These conditions often require ongoing medical management and can lead to increased healthcare costs, which are reflected in higher premium prices. The severity and stability of these conditions also play a role; a well-managed and stable condition may result in a more favorable rating, while an active or severe condition could lead to higher premiums or even a decline in coverage.

Surgeries, whether elective or non-elective, are another essential aspect of your medical history. Major surgeries, especially those related to critical illnesses, can impact your insurance rates. The type of surgery, its success, and the recovery process are all considered. For example, a successful heart bypass surgery might result in a more favorable rating, while a complex surgery with potential complications could lead to higher premiums. The time since the surgery is also a factor; a recent surgery may require a more detailed medical assessment, which can influence the premium cost.

Medications are another critical piece of the puzzle. The insurance company will review your current and past medications to understand their potential side effects and interactions. Certain medications, especially those with long-term use or those that manage chronic conditions, can impact your health rating. For instance, blood thinners or medications that manage high blood pressure may be considered favorable, as they contribute to better health management. However, medications with known side effects or those that require frequent medical monitoring might result in higher premiums.

In summary, your medical history, including pre-existing conditions, surgeries, and medications, is a comprehensive assessment of your health and risk profile. Insurance companies use this information to determine your health rating, which directly influences the cost of your life insurance policy. A thorough understanding of these factors can help individuals make informed decisions about their insurance coverage and potentially secure more favorable rates. It is always advisable to provide accurate and detailed medical information to ensure a fair and accurate assessment by the insurance provider.

Term Life Insurance: Cash Value Accumulation?

You may want to see also

Age and Gender: Younger, healthier individuals often receive lower rates

The insurance industry often uses age and gender as significant factors when determining life insurance rates. Younger, healthier individuals typically receive more favorable terms and lower premiums compared to their older or less healthy counterparts. This is primarily due to statistical data and risk assessment models used by insurance companies.

For life insurance, younger people generally have a longer life expectancy, which means they are less likely to make a claim on the policy. Insurance providers consider this reduced risk and, as a result, offer lower rates to these individuals. Additionally, younger people often have fewer pre-existing health conditions or chronic illnesses, which further contributes to the lower rates.

Gender also plays a role in insurance pricing. Historically, women have tended to receive more favorable rates, especially in the past, when statistical data showed a slightly lower mortality rate for women compared to men. However, it's important to note that gender-based pricing is becoming less common as insurance companies move towards more personalized and risk-based pricing models.

The key factor here is health and lifestyle. Younger individuals who maintain a healthy lifestyle, including regular exercise, a balanced diet, and avoiding harmful habits like smoking, are more likely to receive the lowest rates. Insurance companies often use health assessments, including medical exams and lifestyle questionnaires, to determine an individual's risk profile and, consequently, their insurance premium.

In summary, younger and healthier individuals often benefit from lower life insurance rates due to their reduced risk profile. This is a direct result of statistical trends and the insurance industry's risk assessment methods. Maintaining a healthy lifestyle can significantly impact insurance rates, making it a valuable investment in both your health and your financial future.

Whole Life Insurance: Growing Value, Growing Peace of Mind

You may want to see also

Lifestyle Factors: Smoking, obesity, and risky hobbies can increase insurance costs

Lifestyle choices play a significant role in determining insurance rates, especially when it comes to life insurance. Insurance companies often consider various factors that can impact an individual's health and longevity, and these choices can have a direct influence on the cost of coverage. Here's an overview of how smoking, obesity, and risky hobbies can affect your insurance premiums:

Smoking: One of the most well-known and widely studied lifestyle factors is smoking. Insurance providers often view smokers as high-risk individuals due to the numerous health complications associated with tobacco use. Smokers are statistically more likely to develop various health issues, including lung cancer, heart disease, and respiratory problems. As a result, insurance companies may charge higher premiums for life insurance policies to account for the increased likelihood of claims. Quitting smoking can significantly improve your health and potentially lead to lower insurance rates over time.

Obesity: Excessive body weight, or obesity, is another critical factor. Obese individuals often face a higher risk of developing chronic conditions such as type 2 diabetes, high blood pressure, and cardiovascular diseases. These health issues can significantly impact life expectancy and, consequently, insurance rates. Insurance companies may consider obesity as a risk factor, especially if it is associated with other unhealthy habits or medical conditions. Maintaining a healthy weight through diet and exercise can not only improve your overall health but also potentially reduce the cost of your insurance premiums.

Risky Hobbies: Engaging in certain hobbies or activities can also influence insurance costs. Extreme sports, such as skydiving, bungee jumping, or rock climbing, are often considered risky. These hobbies can lead to higher chances of accidents and injuries, which may result in more frequent insurance claims. Insurance providers may charge additional fees or offer higher premiums to individuals who participate in these activities due to the perceived increased risk. Similarly, professions or hobbies that involve hazardous work, such as construction or firefighting, can also impact insurance rates.

It's important to note that insurance companies often use complex algorithms and risk assessment models to determine premiums. These models consider various factors, including age, gender, family medical history, and lifestyle choices, to calculate the likelihood of an individual requiring insurance payouts. By understanding these factors, individuals can make informed decisions to improve their health and potentially secure more favorable insurance rates.

Whole Life Insurance: Taxable Surrender Value?

You may want to see also

Risk Assessment Tools: Insurance companies use algorithms to evaluate health risks and set rates

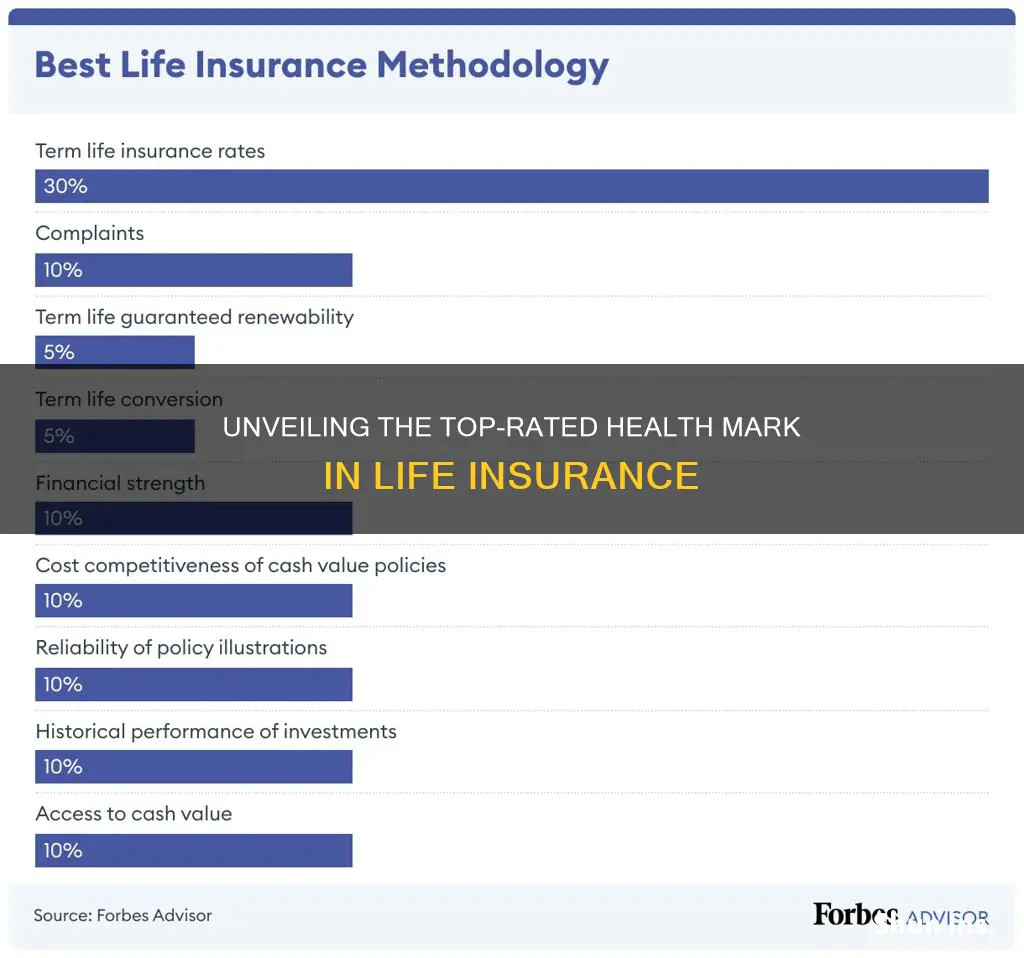

Insurance companies employ sophisticated risk assessment tools and algorithms to evaluate an individual's health and determine life insurance rates. These tools play a crucial role in the underwriting process, helping insurers make informed decisions about policy pricing and coverage. The primary goal is to assess the likelihood of an individual's death or the occurrence of a specific event, such as a critical illness, and then set appropriate insurance rates accordingly.

At the core of these risk assessment tools are complex algorithms that analyze various health-related factors. These factors can include age, gender, medical history, lifestyle choices (such as smoking or excessive alcohol consumption), family medical history, and even biometric data like blood pressure, cholesterol levels, and body mass index (BMI). By inputting this extensive data, insurance companies can run calculations and simulations to predict potential health risks.

The algorithms consider a wide range of medical conditions and their associated mortality rates. For instance, they might factor in the impact of chronic diseases like diabetes, heart disease, or cancer, as these conditions can significantly influence life expectancy and insurance risk. Additionally, lifestyle factors are given considerable weight, as they can directly contribute to an individual's overall health and longevity.

One of the key advantages of using these risk assessment tools is their ability to provide personalized risk profiles. By analyzing an individual's unique characteristics, insurers can offer tailored insurance products with specific coverage amounts and premiums. This approach ensures that the insurance rates are fair and reflective of the insured's actual health risks.

Furthermore, these tools enable insurance companies to identify high-risk individuals or groups and make informed decisions about coverage. For instance, a person with a history of smoking and high blood pressure might be considered a higher risk for life insurance, resulting in a higher premium rate. Conversely, a non-smoker with a healthy BMI and no significant medical history may be offered more competitive rates. This personalized approach allows insurers to manage their risk portfolios effectively while providing customers with appropriate coverage.

Selling Life Insurance in Florida: Strategies for Success

You may want to see also

Frequently asked questions

The highest health rating, often referred to as a "superior" or "excellent" health rating, indicates that the insured individual has a very low risk profile for the insurer. This rating is typically assigned to applicants with exceptional health, including those with no significant medical conditions, a healthy lifestyle, and a low likelihood of developing health issues that could impact their insurability.

Insurance companies use medical underwriting to assess an individual's health and determine their insurability. This process involves reviewing medical records, lab results, and sometimes even medical exams. The highest health rating is given when the insurer finds no significant health concerns or pre-existing conditions that could lead to higher insurance premiums or policy exclusions.

Individuals with the highest health rating often enjoy more favorable terms and rates on life insurance policies. They may qualify for lower premiums, higher coverage amounts, and even access to preferred rates that are typically reserved for the most insurable individuals. This rating can also make it easier to secure a policy with a reputable insurer.

While having a pre-existing condition may impact your insurability, it doesn't automatically disqualify you from achieving a high health rating. Some insurers offer special rates or policies for individuals with pre-existing conditions, especially if they can demonstrate a commitment to managing their health. However, the specific terms and rates will depend on the insurer and the nature of the condition.

To improve your chances, focus on maintaining or improving your overall health. This includes adopting a healthy diet, regular exercise, managing stress, and avoiding harmful habits like smoking. Regular health check-ups and maintaining a healthy weight can also contribute to a better health rating. Additionally, disclosing all relevant medical information accurately during the application process is essential.