Yes, you can freely cancel your auto insurance in Florida at any time. However, there are a few things you should keep in mind. First, you may have to pay a cancellation fee, which can range from $20 to $50, depending on the insurer. Additionally, if you've prepaid your premium, you may be eligible for a refund. In this case, the insurer will refund the unearned portion of the premium within 30 days. It's important to note that you must maintain the required insurance coverage in Florida to avoid suspension of your driver's license and registration. Before cancelling your current insurance, make sure to have a new policy in place to avoid a gap in coverage, which could lead to higher rates in the future.

| Characteristics | Values |

|---|---|

| Can you freely cancel your auto insurance in Florida? | Yes |

| When can you cancel your auto insurance? | Any time |

| What is the cancellation process? | Contact your insurance company, pay any cancellation fees, sign the cancellation letter, receive confirmation, ask for a refund |

| How much does it cost to cancel auto insurance? | $20-$50, or 10% of the remaining policy payments |

| When should you cancel your auto insurance after selling a car? | After you've signed the vehicle's title over to the new owner and completed the final sale |

| What happens if you just stop paying for auto insurance? | Your coverage will lapse, and the insurance company will drop your policy |

| What happens if you cancel your auto insurance before your renewal date? | You may get a refund for the unused portion of any premiums you've prepaid |

| What happens if you cancel your auto insurance without getting a new policy? | Driving without insurance puts you at a higher financial and legal risk |

What You'll Learn

Florida auto insurance cancellation fees

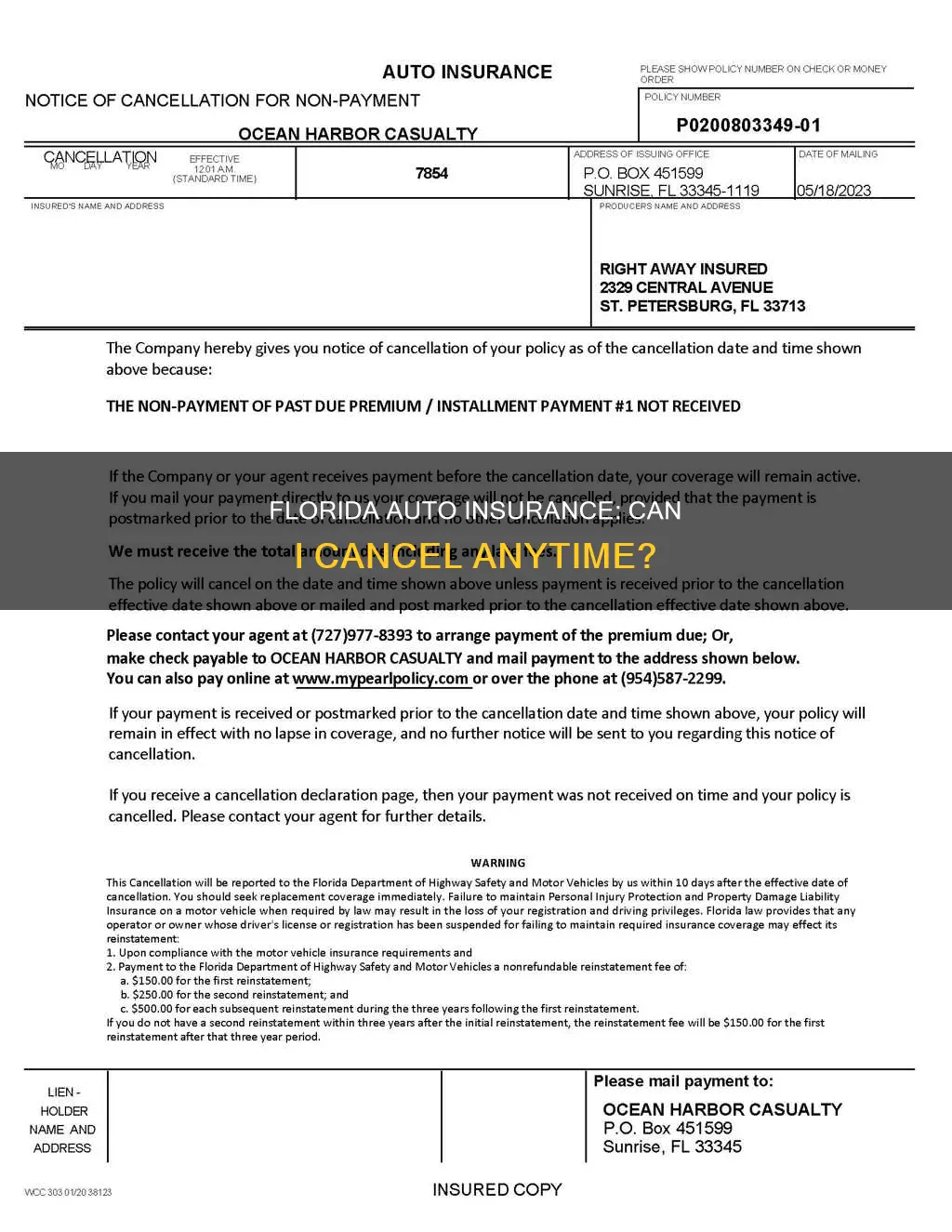

Florida law allows you to cancel your auto insurance at any time and for any reason. However, it's important to be aware of potential cancellation fees and other consequences.

When it comes to cancellation fees, the specific amount you may be charged can depend on several factors, including the terms of your insurance policy and whether you are a servicemember. Here's an outline of what you need to know:

- If you, as the insured, decide to cancel your motor vehicle insurance policy, your insurance company is required by Florida law to refund the unearned portion of your premium within 30 days of the cancellation taking effect. They are allowed to retain up to 10% of the unearned premium, and you should receive at least 90% back.

- If the insurance company cancels your policy, they must refund 100% of the unearned premium within 15 days of the cancellation taking effect.

- If you are a servicemember who cancels because you are called to active duty or transferred to a location where insurance is not required, you are entitled to a full refund of any unearned premium. You may need to provide official military orders or written verification from your commanding officer.

- In some cases, insurance companies may try to charge additional cancellation fees or penalties. It is important to carefully review your policy documentation to understand any potential fees and ensure they are correctly applied. If you believe you have been charged an incorrect cancellation fee, you can take legal action.

- To avoid suspension and reinstatement fees, you must maintain continuous insurance coverage on your vehicle. Before cancelling your insurance, surrender your license plate/tag at a Florida driver license office, motor vehicle service center, or Tax Collector's office.

Auto Insurance: Commercial Coverage Explained

You may want to see also

Cancelling before or after renewal

Yes, you can cancel your car insurance at any time in Florida, but there are a few things you should know about cancelling before or after renewal.

Cancelling Before Renewal:

If you cancel your car insurance policy before its renewal date, you may be charged a cancellation fee, and you may have to provide a letter of intent or complete a cancellation form. You may also be eligible for a partial or full refund of any advance premiums you've paid, depending on your insurer's policy. However, it's important to check with your insurer about their specific cancellation guidelines, as some may require a 30-day notice before cancellation.

Cancelling After Renewal:

If you cancel your car insurance policy after it has been renewed, you may still be charged a cancellation fee, and you may be refunded for any unused prepaid premiums. It's important to note that insurance companies typically only drop your coverage at renewal for specific reasons, such as non-payment of premiums, fraudulent activity, or a significant increase in risk.

In Florida, insurance companies are required to give at least 45 days' advance written notice of non-renewal or the renewal premium. If the policy is not being renewed, the insurer must state the reason in writing. This requirement applies if the insured has provided all the necessary information to enable the insurer to develop the renewal premium before the expiration date.

Additionally, if you cancel your car insurance, you must surrender your license plate/tag before cancelling to avoid suspension and reinstatement fees. You must also maintain the required insurance coverage throughout the registration period, or your driving privileges and license plate may be suspended for up to three years.

Vehicle Insurance Excess: What's the Deal?

You may want to see also

Reasons for cancelling

Florida requires drivers to have continuous auto insurance coverage. If you cancel your auto insurance, you may face penalties such as a suspension of your driver's license and vehicle registration, as well as a reinstatement fee of up to $500.

- Moving to a Different State: If you are relocating to another state, you will need to register your vehicle and obtain insurance in that state. It is important to maintain insurance coverage in Florida until you have completed the registration process in your new state.

- Change in Vehicle Ownership: If you no longer own the insured vehicle, you will need to cancel your existing policy. This could be due to selling the vehicle, trading it in, or experiencing a total loss.

- Switching Insurance Providers: You may find a better rate or coverage option with another insurance company. Shopping around for insurance can help you save money or find a policy that better suits your needs.

- Changes in Life Circumstances: Life events such as getting married, having a child, or retiring can impact your insurance needs. You may want to cancel your current policy and seek alternative coverage that aligns with your new life stage.

- Military Deployment: If you are a servicemember and receive orders for active duty or are transferred to a different location, you may need to cancel your existing auto insurance policy, especially if insurance is not required at your new location.

- Cost Savings: Auto insurance premiums can be expensive. If you are facing financial difficulties or looking to reduce your expenses, you may consider cancelling your current policy and exploring more affordable options.

Remember, it is important to understand the consequences of cancelling your auto insurance in Florida. Ensure that you follow the proper procedures for cancellation and maintain continuous coverage to avoid penalties and keep yourself legally compliant.

Auto Insurance: Why the Rising Rates?

You may want to see also

How to cancel

Yes, you can freely cancel your auto insurance in Florida at any time, but you may have to pay a car insurance cancellation fee of $20-$50. It is important to do some research before cancelling your insurance to ensure you don't create a gap in your coverage, which could result in higher premiums in the future.

Step 1: Research

Before cancelling your current insurance, it is recommended to line up a new policy to ensure you are always protected on the road and to avoid any gaps in coverage. Remember to activate your new policy before the old one concludes.

Step 2: Contact your current insurer

Each insurer has its own cancellation procedure. You can connect with your provider through a phone call, email, or their mobile app. While your policy documents will provide specifics, speaking with an agent can provide more clarity.

Step 3: Discuss key points

When speaking with an agent, be sure to cover the following key points:

- The step-by-step cancellation process

- Required documentation

- Potential costs or penalties

Step 4: Provide cancellation documents

Certain insurers may request a formal letter indicating your intention to cancel or a specific cancellation form. When providing these, you will typically need to include details such as your policy number, name, and desired cancellation date.

Step 5: Send proof of new insurance

If you have transitioned to a different insurance company, your former insurer might require evidence of this new coverage.

Step 6: Cancel your old insurance

With your new policy active and all documentation in place, you can now formally cancel your old insurance. Be aware that some providers might charge a cancellation fee, but you could be eligible for a refund on any prepaid premiums.

Step 7: Confirm the cancellation

Once the cancellation is processed, you should receive a confirmation letter in the mail or via email.

Step 8: Request a refund

If you paid your auto insurance rates in full, you might be entitled to a refund. Your insurance company will generally send you a pro-rated refund for the remainder of the policy term.

Step 9: Surrender your license plate

If you no longer own the vehicle, you must surrender your license plate to a Florida driver's license office, motor vehicle service center, or Tax Collector's office before cancelling your insurance to avoid suspension and reinstatement fees.

Drivetime: Gap Insurance Options

You may want to see also

Getting a refund

Yes, you can freely cancel your auto insurance in Florida, and you may be eligible for a refund if you paid your premium in advance. The refund amount will depend on how much of the premium you paid in advance and when you cancel your policy.

If you paid your full premium upfront, you will typically get a refund when you cancel your policy. If you paid monthly, you may or may not get a refund, depending on when you cancel. If you cancel your policy in the middle of the month or billing cycle, you may get a small refund for the remaining days of the month.

In Florida, if you cancel your policy, the insurer must mail the unearned portion of any premium paid within 30 days of the effective date of the cancellation. If the insurer cancels your policy, they must mail the unearned premium portion within 15 days of the effective date of the cancellation. If the unearned premium is not mailed within the applicable period, the insurer must pay the insured 8% interest on the amount due. If the unearned premium is not mailed within 45 days after the applicable period, the insured may take legal action against the insurer.

If you switch insurance companies, move out of state, or sell your car, your insurer will likely cancel your old policy and issue a refund check if you paid in advance. Note that some insurers may charge a cancellation fee.

If you make changes to your policy that reduce the cost, such as decreasing policy limits or removing a vehicle or driver, you may also be eligible for a refund.

Cheapest Teen Auto Insurance Options

You may want to see also

Frequently asked questions

Yes, you can cancel your auto insurance at any time, but you may have to pay a cancellation fee of $20-$50. It's important to do your research before cancelling to ensure you don't create a gap in your coverage.

You can cancel your auto insurance by calling your insurance company or agent, or by mailing or faxing a cancellation request. Your insurer may require a letter of intent or a completed cancellation form.

If you've prepaid your premium, you may be eligible for a full or partial refund for the unused portion.

If you stop paying for auto insurance, your coverage will lapse and the insurance company will drop your policy. You will then have to pay more to restart your policy or find a new one, and insurance companies will consider you a higher risk, which may result in higher rates.