Adjustable life insurance, also known as universal life insurance, is a type of permanent life insurance that offers greater flexibility than other types of insurance. It allows you to change features after signing up, including the premium payment and the death benefit. It also includes an interest-bearing savings component, the cash value account, which you can access while alive.

Adjustable life insurance is a good option for those who want the protection and cash value benefits of permanent life insurance but need flexibility with policy features. It is also worth considering if you want to be able to make decisions throughout the life of your policy so that it remains the best choice for you, no matter how your financial life changes.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Flexibility | Allows adjustments to premium payments, death benefit and cash value |

| Cash value | Interest-bearing savings component; can be borrowed against, withdrawn or used to pay premiums |

| Death benefit | Can be increased or decreased |

| Premium payments | Can be increased or decreased |

| Coverage | Lifelong |

| Cost | More expensive than term life insurance |

| Interest | Modest gains |

What You'll Learn

Adjustable life insurance is a type of permanent life insurance

One of the key features of adjustable life insurance is its flexibility. You can increase or decrease your premium payments as your circumstances change. For example, you can pay more during years when you're earning a lot and reduce the premium if your budget becomes restricted. Adjustable life insurance also allows you to adjust the death benefit. This can be useful if, for instance, you want a higher death benefit when your children are young and a lower payout after they become adults.

Another important aspect of adjustable life insurance is the cash value component. This is a savings-like account that earns interest over time. You can borrow against the cash value or use it to pay your premiums. The cash value grows based on market interest rates, and you can access it through a withdrawal or loan. However, if you use up all the cash value, your policy might lapse, so it's important to maintain a minimum balance.

Adjustable life insurance is a permanent policy, which means it remains in effect for your entire life as long as premiums are paid. Upon your death, your beneficiaries will receive a payout known as a death benefit. Unlike term insurance, adjustable life insurance has no end date and provides continued benefits throughout the life of the policyholder.

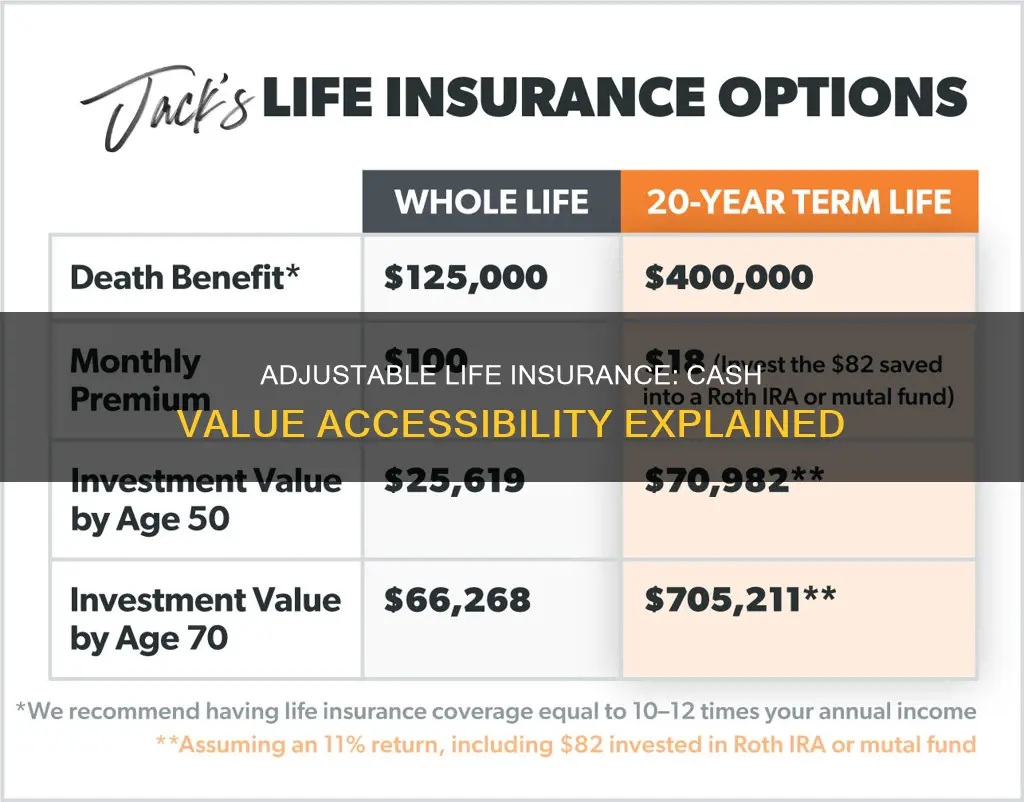

While adjustable life insurance offers flexibility, it also has some drawbacks. It is more expensive than term life insurance and requires more effort to manage. Additionally, the interest earned on the cash value account is typically modest, and you may find higher returns by investing elsewhere.

Obamacare and Life Insurance: What's Covered?

You may want to see also

It allows you to change features after signing up

Adjustable life insurance, also known as universal life insurance, is a type of permanent life insurance that allows you to change features after signing up. This flexibility is its defining feature, allowing you to adjust your insurance coverage based on changing life events. Here's what you need to know about how adjustable life insurance lets you change features:

Changing Premium Payments

Adjustable life insurance lets you change how much you pay each year. While whole life insurance locks you into a fixed monthly premium, adjustable life insurance offers flexibility. You can increase your premium payments when you're earning a lot and decrease them when your budget is restricted, such as after a job loss. This adaptability ensures that you can adjust your payments according to your financial situation.

Adjusting the Death Benefit

With adjustable life insurance, you have the option to increase or decrease the death benefit amount. For example, you might decide to increase the death benefit due to a life event, such as the birth of a child, to ensure your family has sufficient financial protection. On the other hand, if you've paid off significant debts, you might choose to lower the death benefit, as your loved ones won't need to cover those expenses in the event of your passing. It's important to note that changing the death benefit may require additional underwriting or an updated medical exam.

Modifying the Cash Value

The cash value component of adjustable life insurance, also known as the "savings component," can be adjusted by increasing or decreasing it. You can boost the cash value by increasing your premium payments. Conversely, withdrawing funds or using the cash value to pay premiums will decrease the amount. It's crucial to maintain a sufficient cash value to keep your coverage active; otherwise, your policy might lapse. The cash value earns interest, providing modest gains over time.

Customizing the Policy to Your Needs

Ultimately, adjustable life insurance allows you to customize your life insurance to meet your current and future needs. It provides the flexibility to make changes to your premium payments, death benefit, and cash value. This adaptability ensures that your life insurance policy remains relevant and suitable for your circumstances throughout your life.

By offering the ability to change features, adjustable life insurance gives you greater control over your financial planning. It's an attractive option if you want the protection and benefits of permanent life insurance but desire the flexibility to adjust the policy to align with your evolving needs and life events.

Life Insurance Klang: Protecting Your Family's Future

You may want to see also

It includes an interest-bearing savings component

Adjustable life insurance, also known as universal life insurance, includes an interest-bearing savings component called the "cash value" account. This savings component is a key feature of permanent life insurance policies, which remain in effect for the duration of the policyholder's life, provided premiums are paid. The cash value grows based on market interest rates and the return can fluctuate annually.

The cash value account offers a flexible way to save and access funds. Policyholders can borrow from the account or use it to pay premiums. This can be particularly useful if you experience a change in income, such as a job loss, as you can adjust your premium payments accordingly. Additionally, the cash value can be used to cover future premiums on the adjustable life insurance policy, ensuring continued coverage.

It's important to note that the gains from the cash value account are typically modest, and you may find higher returns by investing outside of a life insurance policy. The interest earned on the cash value is dependent on the investment portfolio it is a part of, so if the portfolio underperforms, the cash value may fail to grow or keep up with inflation. Therefore, while the cash value account offers an interest-bearing savings option, it may not be the most optimal choice for those seeking high returns.

Life Insurance: Who Needs It and Why?

You may want to see also

It takes more work to plan and manage than other options

Adjustable life insurance, also known as universal life insurance, is a type of permanent life insurance that offers a lot of flexibility. This flexibility, however, comes at the cost of increased complexity in planning and management when compared to other insurance options.

Adjustable life insurance allows you to make changes to three key factors: the premium, the cash value, and the death benefit. This means that you can adjust your insurance coverage as your life circumstances change. For example, you can increase the premium when you are earning more and decrease it when you are on a restricted budget. Similarly, you can increase the death benefit in response to a life event, such as the birth of a child.

However, this flexibility requires careful planning and management. If you don't pay enough into your adjustable life insurance policy to cover the insurance costs, your future premiums will increase. If you are unable to keep up with the rising costs, your policy may lapse and you will lose coverage.

Additionally, adjustable life insurance is more expensive than temporary term life insurance policies. While the cash value does grow over time, the interest rates are typically modest, and you may earn higher returns by investing outside of a life insurance policy.

Overall, while adjustable life insurance offers a high level of flexibility, it requires more work to plan and manage than other insurance options. It is important to carefully consider your needs and financial situation before choosing this type of insurance.

Usaa Life Insurance: Understanding Exclusions and Their Impact

You may want to see also

It's also known as universal life insurance

Adjustable life insurance, also known as universal life insurance, is a type of permanent life insurance that offers flexible coverage. It allows you to make adjustments to your premium payments, death benefit, and cash value. This flexibility can be beneficial if your income varies or if you want to increase your coverage over time. Universal life insurance provides lifelong protection and lets you build a cash value that can be utilised for various purposes, such as emergencies, investments, or college tuition.

Universal life insurance stands out for its adaptability. You can choose the amount of your death benefit and how much you pay in premiums, as well as when you make those payments. This customisation can be advantageous if you have fluctuating cash flow or changing life circumstances. Additionally, the cash value component of universal life insurance earns interest, providing an opportunity for growth.

However, it's important to carefully manage your universal life insurance policy. The cash value needs to be monitored to ensure it doesn't drop too low, as this could result in higher premium payments or even a lapse in your policy. While universal life insurance offers flexibility in premium payments, you must ensure that the cash value remains sufficient to cover the cost of insurance.

Universal life insurance also differs from whole life insurance in several ways. Whole life insurance has fixed premiums and a guaranteed death benefit, whereas universal life insurance offers flexible premiums and a flexible death benefit. Additionally, the interest rate on universal life insurance is set by the insurer and can change, while whole life insurance typically offers a guaranteed rate.

In summary, adjustable life insurance, also known as universal life insurance, provides the advantage of flexibility. It allows you to customise your coverage, death benefit, and premium payments to align with your evolving needs and circumstances. However, effective management is crucial to ensure the policy remains in force and to avoid unexpected costs.

Florida's Insurance Agent Licensing: Life and Health Exclusivity

You may want to see also

Frequently asked questions

Adjustable life insurance is a type of permanent life insurance that allows you to change features of your policy after signing up, including the premium payment and the death benefit. It is also known as universal life insurance.

Adjustable life insurance allows you to make changes to the cash value, premiums, and death benefit. It offers flexibility to adjust your insurance coverage based on changing life events. The cash value component functions as a savings account, which can be borrowed against or withdrawn.

Adjustable life insurance offers the advantage of flexibility, allowing you to adjust your premium payments and death benefit over time. It also provides a savings component through the accumulation of cash value, which can be accessed while alive. However, adjustable life insurance is more expensive than term life insurance, and the interest earned on the cash value is typically modest.

You can access the cash value of your adjustable life insurance policy in several ways:

- Using the cash value to pay premiums

- Taking out a loan against the cash value

- Withdrawing money from the cash value

- Surrendering the policy to receive the cash surrender value