AARP members can get life insurance through the AARP Life Insurance Program, which is underwritten by New York Life. The program offers term, whole, and guaranteed life insurance without a medical exam. Coverage is available in all 50 states and Washington, D.C. for members aged 50 to 80 and their spouses aged 45 to 80. AARP's offerings cater to the needs of older adults, particularly those with pre-existing conditions.

| Characteristics | Values |

|---|---|

| Provider | New York Life |

| Underwriting | AARP |

| Financial Strength Rating | A++ (Superior) by AM Best |

| Medical Exam Required | No |

| Term Life Protection Ends | At 80 |

| Sales and Customer Service Availability | Not on weekends |

| Age Range | 50-80 |

| Spouse Age Range | 45-80 |

| Coverage Options | Term, Permanent, Guaranteed Acceptance |

| Maximum Coverage | $150,000 |

| Premium Increases | No |

| Maximum Permanent Coverage | $50,000 |

| Maximum Guaranteed Acceptance Coverage | $30,000 |

| Customization | Yes |

What You'll Learn

- AARP Term Life Insurance from New York Life offers coverage up to $150,000 until the age of 80

- AARP Permanent Life Insurance from New York Life offers coverage up to $50,000 with no premium increases

- AARP Guaranteed Acceptance Life Insurance from New York Life offers coverage up to $30,000 with no premium increases

- AARP Life Insurance Options from New York Life offers customised plans to supplement retirement savings

- AARP Life Insurance is only available to members aged 50 to 80 and their spouses aged 45 to 80

AARP Term Life Insurance from New York Life offers coverage up to $150,000 until the age of 80

AARP Term Life Insurance from New York Life offers members coverage of up to $150,000 until the age of 80. This insurance can be used to help with funeral costs, rent or mortgage payments, unpaid bills, and more. It is worth noting that no medical exam is required, but health and other information is necessary. AARP members can get an instant quote and apply online or by phone.

AARP Term Life Insurance from New York Life is a great option for those looking for coverage up to $150,000. This insurance plan offers a range of benefits, including:

- Funeral cost coverage: AARP Term Life Insurance can help cover the costs of a funeral, which can be a significant expense for families.

- Rent or mortgage payments: The insurance can also assist with rent or mortgage payments, providing financial support during difficult times.

- Unpaid bills: The policy can be used to pay off any outstanding debts or unpaid bills, helping to reduce financial stress.

- No medical exam required: Members can apply without undergoing a medical exam, although health and other information is required.

AARP Term Life Insurance from New York Life is a valuable option for those seeking coverage until the age of 80. It provides financial security and peace of mind, ensuring that loved ones are taken care of in the event of the policyholder's passing. The instant quote and online or phone application process make it convenient and accessible for AARP members to obtain this valuable coverage.

Life Insurance Beneficiary: Can It Be Changed Post-Mortem?

You may want to see also

AARP Permanent Life Insurance from New York Life offers coverage up to $50,000 with no premium increases

AARP members can get permanent life insurance from New York Life Insurance Company, providing valuable whole life coverage of up to $50,000. This plan offers guaranteed rates that will never increase and lifelong coverage.

The AARP Permanent Life Insurance plan does not require a medical exam, only health and other information. Members can get an instant quote and apply online or by phone. The monthly rate will vary depending on the applicant's age, gender, and smoking status. For example, a 50-year-old non-smoking female can expect to pay $13 per month for $5,000 of coverage.

The AARP Life Insurance Program is underwritten by New York Life Insurance Company, and AARP membership is required for program eligibility. It is important to note that specific products, features, and gifts may not be available in all states or countries. New York Life Insurance Company is licensed in all 50 states and pays royalty fees to AARP for the use of its intellectual property. These fees are then used for AARP's general purposes.

AARP also offers other life insurance options, including term life insurance and guaranteed acceptance life insurance, with varying coverage amounts and eligibility requirements.

Colonial Penn: Term Life Insurance Options and Benefits

You may want to see also

AARP Guaranteed Acceptance Life Insurance from New York Life offers coverage up to $30,000 with no premium increases

AARP members can get guaranteed acceptance life insurance from New York Life Insurance Company. This insurance plan offers coverage of up to $30,000 with no premium increases. This means that once you are accepted, your rates will never increase.

The plan is available to AARP members aged 50-85 and their spouses/partners aged 45-85. Acceptance is guaranteed, and there is no medical exam or health questions required. However, there is a two-year limited benefit period, and the full coverage amount may not be available if you already have insurance with the program.

The AARP Life Insurance Program is underwritten by New York Life Insurance Company, and AARP membership is required for program eligibility. New York Life Insurance Company is licensed in all 50 states and has the highest ratings for financial strength from leading independent rating services.

If you require more than $30,000 in coverage, you can call New York Life's Customer Experience Team at (800) 247-2055, Monday to Friday, 8 a.m. to 8 p.m. ET.

Group Life Insurance: Church Employee Benefits Explored

You may want to see also

AARP Life Insurance Options from New York Life offers customised plans to supplement retirement savings

AARP Life Insurance Options from New York Life provides a range of coverage options to meet the needs of AARP members. The program offers both term and permanent life insurance plans, with coverage amounts ranging from $30,000 to $150,000. The specific products, features, and availability may vary by state or country, and New York Life pays royalty fees to AARP for the use of its intellectual property.

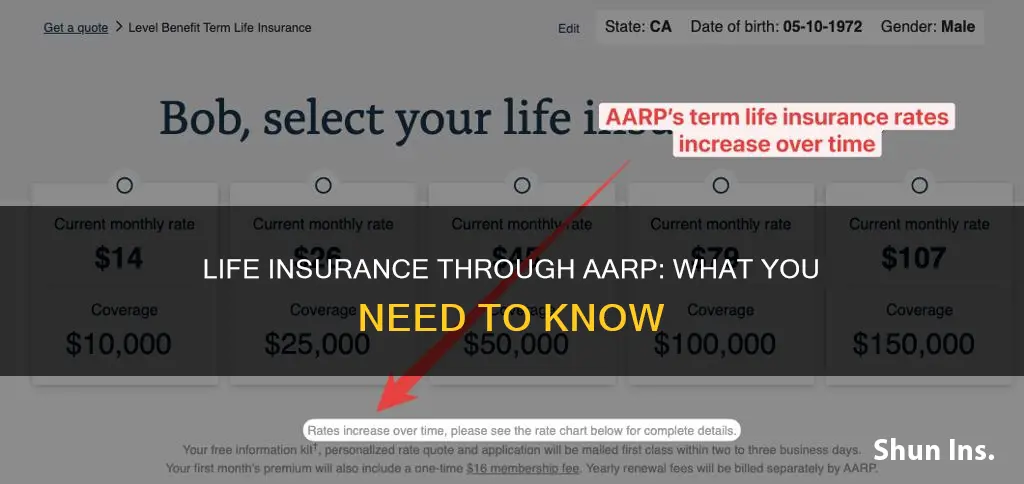

The term life insurance option provides coverage up to $150,000, which ends at age 80. This option can help with funeral costs, rent or mortgage payments, unpaid bills, and more. There is no medical exam required, but health and other information are necessary for application.

The permanent life insurance option offers up to $50,000 in coverage with no premium increases. This plan provides life-long coverage, and members can lock in guaranteed rates that will never increase. Similar to the term life option, there is no medical exam, but health and other information are required.

AARP Life Insurance Options from New York Life provides flexibility and peace of mind for members by offering customised plans tailored to their retirement savings needs. These plans can help ensure financial protection and security for loved ones, covering expenses such as funeral costs, outstanding debts, and ongoing living costs.

To learn more about AARP Life Insurance Options from New York Life, members can visit the official website or contact New York Life directly at 1-800-865-7927.

American Legion: Life Insurance Benefits and Coverage

You may want to see also

AARP Life Insurance is only available to members aged 50 to 80 and their spouses aged 45 to 80

AARP life insurance is available to members aged 50 to 80 and their spouses aged 45 to 80. The program offers term, whole, and guaranteed life insurance without a medical exam.

AARP life insurance is underwritten by New York Life, which has high ratings for financial strength. This ensures the company can comfortably meet its policy obligations. AARP members can get an instant quote and apply online or by phone.

AARP offers three policies for members aged 50 and above: term life insurance, permanent life insurance, and guaranteed acceptance life insurance. Term life insurance provides coverage for a set amount of time and can help beneficiaries manage expenses such as funeral costs, unpaid bills, and other financial obligations after the policyholder's passing. Coverage ranges from $10,000 to $150,000 for members aged 50 to 74 and their spouses aged 45 to 74. Coverage lasts until the policyholder turns 80, and to continue coverage, the policyholder can exchange their term life policy for a permanent life policy.

Permanent life insurance is a type of insurance that spans the entire lifetime of the policyholder and grows in cash value over time, provided policy premiums are paid on time. AARP's permanent life insurance policy offers coverage of $5,000 to $50,000 for members aged 50 to 80 and spouses aged 45 to 80. According to the website, premiums are locked for life, and no medical exam is required, but a health questionnaire must be completed.

AARP also offers a second whole life policy called Guaranteed Acceptance. Coverage is guaranteed for members aged 50 to 80 and their partners aged 45 to 80, with no medical exam or health questionnaire required. The maximum amount is $25,000, and payouts are limited for the first two years. Beneficiaries will not receive a full death benefit if the policyholder dies during that time.

Health Insurance and Life Alert: What's Covered?

You may want to see also

Frequently asked questions

AARP life insurance is tailored for members aged 50 to 80. It provides term, permanent, and guaranteed acceptance policies. Each offers coverage options that don’t require a medical exam.

AARP offers three policies for members aged 50 and above: term life, permanent life, and guaranteed acceptance life insurance.

Term life insurance provides coverage for a set amount of time and can help beneficiaries manage expenses such as funeral costs, unpaid bills, and other financial obligations after the policyholder's passing.

Whole life insurance is a type of permanent life insurance that spans your entire lifetime and grows in cash value over time, provided policy premiums are paid on time. AARP's permanent life insurance policy offers coverage of $5,000 to $50,000 for members aged 50 to 80 and their spouses aged 45 to 80.

AARP members can get a free quote and purchase life insurance directly through the AARP website or by speaking with a licensed New York Life agent.