A cancer diagnosis can make it difficult to qualify for life insurance, but it's not impossible. If you're currently undergoing treatment for stage 4 cancer, your options may be limited to guaranteed issue life insurance policies, which typically have lower coverage amounts and higher premiums. These policies don't consider your health when approving your application. However, if you've been in remission for a certain period, typically ranging from one to five years, insurance companies may offer you traditional coverage. The availability and cost of life insurance depend on various factors, including the type and stage of cancer, your treatment history, age, and overall health. It's important to be completely honest about your health when applying for life insurance to ensure your family receives the intended benefits.

| Characteristics | Values |

|---|---|

| Can you get life insurance if you have stage 4 cancer? | Yes, but it is extremely difficult. You may be limited to small guaranteed-issue policies like final expense insurance, and your premiums may be nearly equal to the death benefit. |

| Factors that affect the cost of life insurance for cancer patients | Type and stage of cancer, treatment and medical history, time since diagnosis, age and other health factors |

| Life insurance options for cancer patients | Guaranteed issue life insurance, group life insurance, final expense life insurance, term and whole life insurance, life insurance without a medical exam, life insurance riders, and final expense life insurance |

| Steps to take when applying for life insurance after cancer | Get quotes from multiple life insurance companies, apply for final expense life insurance |

What You'll Learn

Life insurance for terminal cancer patients

If you have terminal cancer or stage 4 cancer, obtaining traditional life insurance will be extremely difficult. Your options may be limited to small guaranteed-issue policies like final expense insurance, and your premiums may be nearly equal to the death benefit. Final expense insurance, also known as burial insurance, is a type of whole life insurance designed to cover end-of-life expenses, such as funeral costs and medical bills.

However, if you already have a life insurance policy in place before your terminal cancer diagnosis, your coverage will continue as long as you pay your premiums, and your loved ones will receive the death benefit. It is important to note that your premiums may go up in the short term, and you may need to fill out specific forms and provide medical records and doctors' or hospital letters when making a claim.

If you are seeking to purchase a new life insurance policy after a terminal cancer diagnosis, you will likely encounter obstacles. Your options may be restricted to guaranteed issue life insurance, which does not consider your health when approving your application but offers lower coverage amounts and higher premiums.

When determining the cost of life insurance for terminal cancer patients, insurers consider various factors, including the type and stage of cancer, treatment and medical history, time since diagnosis, age, and other health factors.

It is important to carefully review the policy wording and compare quotes from multiple insurance companies to find the best coverage and rates for your specific situation. Working with an independent financial advisor or insurance broker can help you navigate the complex underwriting processes and find the most suitable policy for your needs.

Simplified Issue Life Insurance: Easy Application, Quick Approval

You may want to see also

Life insurance for cancer survivors

If you have been diagnosed with cancer, it can be challenging to qualify for a new traditional life insurance policy. However, it is not impossible. Here are some options and factors to consider when exploring life insurance as a cancer survivor:

Guaranteed Issue Life Insurance

Guaranteed issue life insurance plans do not require a medical exam or health questions, and you cannot be rejected based on pre-existing conditions like cancer. The coverage amounts are typically low (up to $25,000), and these plans usually have graded death benefits, meaning your beneficiaries may not receive the full death benefit payout if you pass away within two to three years of purchasing the policy.

Group Life Insurance

Group life insurance is often offered by employers and can come in the form of guaranteed issue. This option may be beneficial for cancer survivors because it does not penalize them for their health status. However, the coverage amounts are usually limited and based on factors such as salary, and you may lose the coverage if you leave your job.

Final Expense Life Insurance

Also known as burial or funeral insurance, final expense life insurance is designed to cover funeral costs and end-of-life expenses. Some plans include health questions, while others are guaranteed issue without health requirements. This option may be suitable for cancer survivors who want to ensure their final expenses are covered.

Cancer Insurance

In addition to life insurance, cancer insurance can help cover the expensive costs associated with a cancer diagnosis and treatment. Aflac, for example, offers cancer insurance that provides policyholders with lump-sum cash benefits to be used for various expenses.

Factors Affecting the Cost of Life Insurance for Cancer Survivors

When determining the cost of life insurance for cancer survivors, insurers consider various factors:

- Type and stage of cancer: Insurers classify cancers based on the risk they pose, taking into account the aggressiveness of the cancer and the severity of the disease.

- Treatment history: The type and duration of treatment, such as chemotherapy, radiation, surgery, or immunotherapy, and the cancer's response to treatment will be considered.

- Diagnosis duration: The length of time since diagnosis impacts eligibility and premiums, with longer periods of remission resulting in lower premiums.

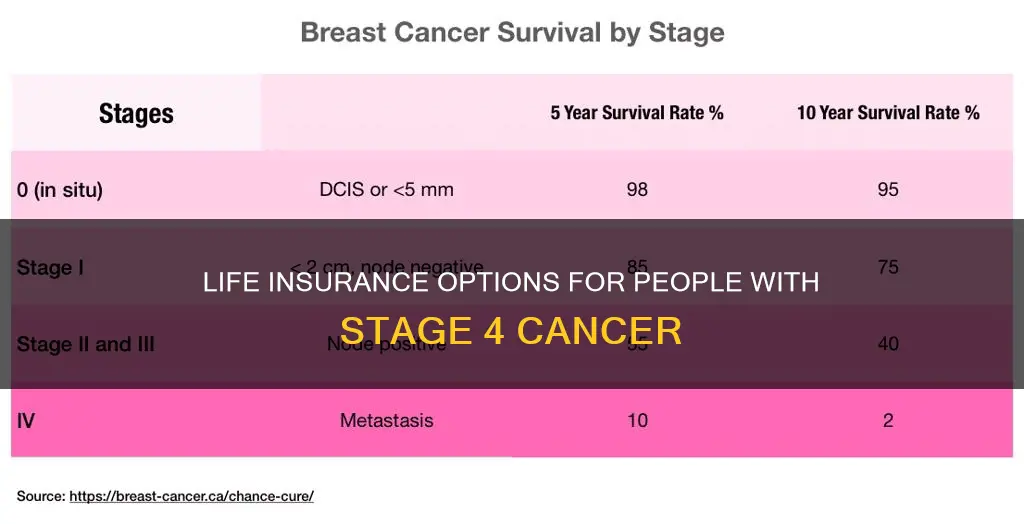

- Prognosis and survival rate: Insurers use statistical data on survival rates and long-term outcomes for different types of cancer.

- Specific cancer-related factors: For example, a Gleason score for prostate cancer.

- Other factors: Age, overall health, family medical history, tobacco usage, and lifestyle choices can also influence the cost of life insurance.

Tips for Cancer Survivors:

- Compare quotes from multiple insurers to find the best coverage and rates.

- Be honest about your health and disclose your cancer history when applying for life insurance. Nondisclosure may result in denial of coverage or benefits.

- Consult an independent financial advisor or insurance broker to help you navigate your options and find the right coverage for your situation.

Understanding Life Insurance: Free Look Period Explained

You may want to see also

Life insurance for those with a family history of cancer

A family history of cancer will likely increase your life insurance rates. The amount of this increase depends on your family's medical history. Insurance companies will want to know:

- The number of relatives diagnosed and how you were related to them.

- The age at which your relative(s) was diagnosed. If they were diagnosed at an older age, this will likely have a lower impact on your rates than if they were young.

If you have a family history of cancer but have not had a diagnosis yourself, there is no specific life insurance policy that is more recommended than another. However, traditional life insurance policies, which require you to disclose your family medical history, may result in higher rates and affect your eligibility.

Tips for Buying Life Insurance with a Family History of Cancer

- Work with an experienced independent life insurance agent, particularly one who specialises in impaired risk underwriting.

- Improve your overall health by eating healthily and exercising.

- Don't use tobacco. Life insurance quotes for smokers are typically much higher.

- Avoid risky hobbies like mountain climbing, skydiving and scuba diving, as these will factor into your quotes and result in higher rates.

- Keep a clean driving and criminal record. DUIs, arrests and criminal convictions may affect your rate or even disqualify you from coverage.

Life Insurance and Child Support: Can It Be Garnished?

You may want to see also

Life insurance riders for cancer patients

If you already have life insurance and are then diagnosed with cancer, your coverage will not be affected. Your existing policy will remain in effect as long as premiums are paid, so it's crucial to stay on top of your payments.

However, if you are looking to buy a new life insurance policy and have been diagnosed with cancer, either recently or in the past, you will likely encounter some obstacles. If your diagnosis occurred in the last five years, you may find that your rates are significantly higher for traditional term and whole life insurance policies, or your application may simply be rejected.

If you already have life insurance, you might want to check if you have a rider that can help with cancer-related expenses. Common riders include critical illness riders or accelerated death benefit riders. These can be valuable for individuals with cancer, as they provide financial support for medical costs and/or living expenses during a critical illness.

- Critical illness rider: This rider provides financial support for medical costs and/or living expenses during a critical illness. It can help cover expenses such as treatment, travel for treatment, or loss of income due to the illness.

- Accelerated death benefit (ADB) rider: Also called a terminal illness rider, this rider allows you to receive a portion of the death benefit while still alive if you are diagnosed with a qualifying terminal illness. There may be a cap on the amount you can access, and the funds you use will be deducted from the death benefit when you pass away.

- Chronic or critical illness rider: This is a specific type of accelerated death benefit rider that allows you to access your death benefit if you meet certain requirements related to chronic or critical illnesses, as defined in your policy. The funds you use will be deducted from your death benefit.

- Return of premium rider: This rider allows you to receive a refund of the premiums you have paid if you cancel your policy or reach the end of the policy term.

- Waiver of premium rider: If you become disabled or unable to work due to cancer or another illness, this rider will waive your future premium payments.

- Disability income rider: This rider provides a monthly income if you become disabled due to cancer or another illness and are unable to work.

- Long-term care rider: If you require long-term care due to cancer or another illness, this rider will provide benefits to help cover the costs of care.

It's important to carefully review the terms and conditions of any life insurance policy and riders you are considering to ensure that you understand the coverage and limitations.

Selling Life Insurance Part-Time: Is It Possible?

You may want to see also

Final expense life insurance

Final expense insurance offers competitive, fixed premiums that do not change over time. It also allows the insured to build cash value, which can be used to borrow against or as a non-forfeiture benefit. Additionally, most final expense plans do not require a physical exam, only a brief health questionnaire.

While final expense life insurance can provide peace of mind and financial security for your loved ones, it's important to remember that it may not be suitable for everyone. If you are independently wealthy or have enough set aside in savings, you may not need this type of insurance. Additionally, if you are over the age of 85, in hospice care, or currently hospitalized, you may not be eligible for this type of coverage.

When considering final expense life insurance, it's important to shop around and compare quotes from multiple providers to ensure you get the best coverage and most affordable rates. It's also crucial to be honest about your medical history when applying for this type of insurance, as withholding information could result in the denial of a claim.

Unpaid Life Insurance: Strategies to Sell and Gain Peace

You may want to see also

Frequently asked questions

Individuals with stage 4 cancer may find it extremely difficult to obtain traditional life insurance. You may be limited to small guaranteed-issue policies like final expense insurance, and your premiums may be nearly equal to the death benefit.

Insurers take into account various factors when assessing your application, including the type and stage of cancer, your treatment and medical history, the time since your diagnosis, your age, and other health factors.

Final expense insurance, also known as burial insurance, is an option for those with pre-existing conditions like stage 4 cancer. It provides a generally low amount of coverage to help with funeral costs and medical expenses. Additionally, no-exam life insurance options are available but may come with lower coverage amounts and higher premiums.